Europe Green Tea Market Size (2024-2030)

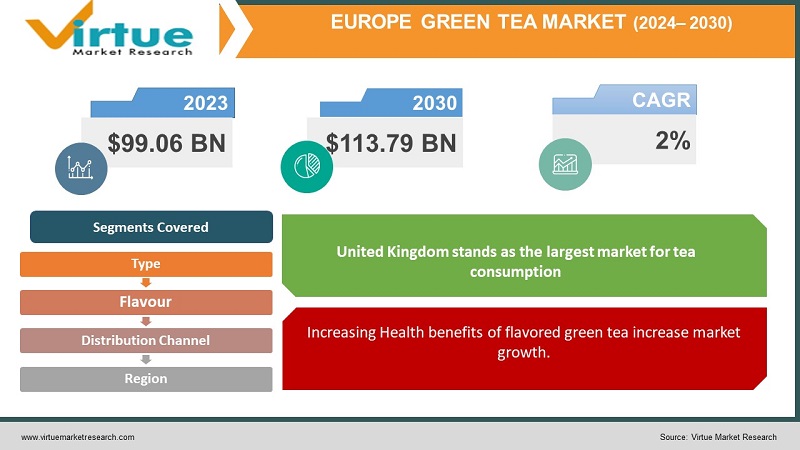

The Europe Green Tea Market was valued at USD 99.06 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 113.79 billion by 2030, growing at a CAGR of 2%.

Green tea is derived from the Camellia sinensis plant, utilizing its leaf buds and dried leaves in the process. The preparation involves pan-frying and steaming these components before drying them. Renowned for its potential health benefits, green tea is recognized for its positive effects on conditions like depression and various forms of cancer, including lung, liver, colon, and gastric cancers, among others.

Key Market Insights:

In contemporary times, individuals in both developed and developing regions have heightened their focus on health consciousness. Green tea, extracted from the leaves and buds of the Camellia sinensis plant, stands distinct from other teas due to its avoidance of withering and oxidation processes during production. Its consumption is associated with a range of health benefits, including cancer prevention, mitigation of liver cirrhosis, management of obesity and blood pressure, and combating various chronic diseases. Notably, its weight loss properties are attributed to bioactive compounds like caffeine and polyphenols, which facilitate the breakdown of fat cells and their release into the circulatory system, bolstering its demand. However, the cost of green tea remains relatively high due to its selective use of specific parts of the tea plant, exclusively utilizing fresh buds and leaves. Unlike black tea, green tea leaves are not subjected to fermentation and oxidation processes. In the competitive green tea market, industry leaders are innovating with novel flavors and aromas, expanding consumer options. This diversification may further encourage consumers to incorporate green tea products into their daily routines for convenient health benefits.

Europe Green Tea Market Drivers:

Increasing Health benefits of flavored green tea increase market growth.

In recent times, consumers in both developed and developing regions have displayed a heightened awareness of health concerns. Derived from the leaves and buds of the Camellia sinensis plant, green tea stands out for its omission of withering and oxidation processes during production. Its consumption is linked to the prevention of various ailments such as cancer, liver cirrhosis, obesity, and hypertension, among others. Additionally, green tea aids in weight loss due to its bioactive components, including caffeine and polyphenols, which facilitate the breakdown of fat cells and their subsequent release into the circulatory system, thus bolstering demand. The combination of green tea with lemon presents several health benefits, given its anti-inflammatory and antimicrobial properties. Aloe Vera green tea purportedly contains essential nutrients like amino acids, vitamins, minerals, polysaccharides, and enzymes. Cinnamon-infused green tea assists in combating stomach and digestive issues, enhancing digestion efficiency and nutrient absorption. Basil green tea is known to enhance memory function and alleviate anxiety. Rich in phytonutrients and antioxidants, Tulsi green tea aids in protecting the body against free radicals. Similarly, jasmine tea, typically derived from green tea leaves, offers comparable health advantages to green tea.

Europe Green Tea Market Restraints and Challenges:

Increasing trends in coffee consumption can hamper the market growth.

Despite the potential benefits of green tea, global coffee consumption is on the rise, with over 2.25 billion cups consumed daily. The availability of various flavors in coffee is attracting more people towards it, potentially hindering the growth of the green tea market.

Europe Green Tea Market Opportunities:

Increasing Demand for Herbal Tea

In the country, the demand for green tea and herbal tea is experiencing rapid growth, propelled by aggressive marketing efforts and campaigns highlighting the health advantages of tea consumption. Tea consumption is associated with enhanced blood flow in the body, as it widens key arteries and reduces the risk of clot formation, thus lowering the likelihood of heart attacks. Additionally, tea exhibits a strong capacity to absorb oxygen radicals within the human body, aiding in the neutralization of harmful free radicals. These health-promoting properties drive the increasing demand for tea in the country. Furthermore, tea's popularity is steadily rising within the food services sector. Herbal tea, in particular, is recognized for its potential to bolster the immune system. The preference for herbal tea is growing as many consumers view it as a medicinal aid capable of improving digestive health.

EUROPE GREEN TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2% |

|

Segments Covered |

By Type, Flavor, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany , France , Italy , Spain , Rest Of Europe |

|

Key Companies Profiled |

Nestle, AriZona Beverage Co., Associated British Foods plc, Dilmah Ceylon Tea Company PLC, Kirin Holdings Company, Unilever, Tata Global Beverages |

Europe Green Tea Market Segmentation:

Europe Green Tea Market Segmentation By Type:

- Green Tea Bags

- Green Tea Instant Mixes

- Iced Green Tea

- Loose Leaf

- Others

The dominant segment in the European green tea market is the green tea bag segment. These tea bags are thin, porous pouches filled with green tea leaves. They are designed to be opened and emptied, allowing consumers or tea brewers to utilize the full-leaf tea within. Typically, green tea bags are constructed from materials such as filter paper, food-grade plastic, or silk cotton.

The concept of instant tea was developed in the 1930s, although it was not widely sold until the late 1950s. Instant green tea gained popularity with the introduction of innovative products to the market. After brewing and liquefying the tea, it undergoes concentration and drying processes to form a powder. The nutritional content of instant green tea mix is purportedly equivalent to that of traditionally brewed green tea. Furthermore, instant green tea mix dissolves rapidly in liquid and leaves no residue.

Iced green tea offers a refreshing option during hot weather, along with potential health benefits. Unflavored iced green tea is calorie-free, whereas sweetened versions typically contain fewer calories than soft drinks or juices. When loose-leaf tea is steeped in liquid, the tea leaves have ample space to absorb water and expand, facilitating the extraction of a wide range of vitamins, minerals, flavors, and aromas.

Additionally, green tea is available in capsules or as a dietary supplement.

Europe Green Tea Market Segmentation By Flavour:

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Basil

- Others

Lemon green tea boasts a rich content of antioxidants, flavonoids, and other phytonutrients, which are known to combat various diseases, including cancer. Additionally, it is available in the refreshing form of iced lemon green tea. The addition of fresh lemon juice not only enhances its taste but also augments its medicinal properties. Aloe vera, renowned for its medicinal attributes, aids in boosting immunity and improving skin elasticity, making it more supple and smooth.

Green tea and cinnamon are valued for their flavor profiles and health-enhancing properties. The warm and sweet aromas of cinnamon complement the richness of green tea's flavor. Vanilla, widely used as a flavoring agent in desserts and beverages, such as vanilla ice cream, milkshakes, and smoothies, remains immensely popular among consumers across the European region.

Basil green tea is consumed for its memory-sharpening and anxiety-reducing qualities attributed to basil. The blend of rich antioxidants in green tea with natural flavors serves to elevate energy levels and promote digestion. Furthermore, jasmine-flavored green tea offers the same health benefits as traditional green tea, along with a delightful, aromatic twist.

Europe Green Tea Market Segmentation By Distribution Channel:

- Hypermarket/Supermarket

- Specialist Retailers

- Convenience Stores

- Online Retailers

- Other Distribution Channels

The segment of supermarkets and hypermarkets is projected to maintain a prominent position in the Europe green tea market. These self-service retail outlets offer a wide array of green tea products, ranging from green tea mixes to iced green tea, and various flavors such as basil, tulsi, honey, and lemon. These products are strategically arranged in organized sections and shelves within the stores to attract customers effectively.

Convenience stores, on the other hand, are characterized by their compact size and limited area compared to hypermarkets and supermarkets. While they may offer a smaller selection of green tea products, they cater to the needs of customers in convenient locations.

The increased use of mobile phones, computers, and laptops has fueled the growth of digital channels, both in terms of reach and transaction volume.

Furthermore, green tea distribution extends to other retail channels such as grocery stores, specialty stores, and food services. These retailers offer a diverse range of products from various national and local brands, available in different packaging formats such as glass and premium plastics, catering to the preferences of a wide consumer base.

Europe Green Tea Market Segmentation- by Region

- Spain

- United Kingdom

- France

- Germany

- Italy

- Rest of Europe

The United Kingdom stands as the largest market for tea consumption. Evolving lifestyles among individuals have led to a growing emphasis on herbal tea, with a considerable portion of the population favoring it over-caffeinated variants. The notable nutritive value and fat-burning attributes inherent in green tea contribute substantially to the expansion of the tea market. This increasing demand for tea empowers manufacturers to introduce a diverse range of natural and infused tea flavors tailored to the preferences of health-conscious consumers.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a favorable impact on the green tea market. Amidst the global health crisis, there has been a notable shift towards the consumption of healthier and organic products. Green tea, renowned for its beneficial properties, has emerged as a preferred choice for consumers seeking to boost immunity and facilitate weight loss during these uncertain times.

Latest Trends/ Developments:

- In September 2022, JDE Peet's, a company headquartered in the Netherlands, disclosed its intention to acquire the French tea company Les 2 Marmottes for an undisclosed amount. This strategic move aims to expand JDE Peet's portfolio of tea brands, as stated by JAB Holding. Furthermore, JDE Peet's has assured that Les 2 Marmottes, based in Haute-Savoie, France, will retain its independence and all 90 employees.

Key Players:

These are the top players in the Europe Green Tea Market: -

- Nestle

- AriZona Beverage Co.

- Associated British Foods plc

- Dilmah Ceylon Tea Company PLC

- Kirin Holdings Company

- Unilever

- Tata Global Beverages

Chapter 1. Europe Green Tea Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Green Tea Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Green Tea Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Green Tea Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Green Tea Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Green Tea Market– By Type

6.1. Introduction/Key Findings

6.2 Green Tea Bags

6.3. Green Tea Instant Mixes

6.4. Iced Green Tea

6.5. Loose Leaf

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Green Tea Market– By Flavour

7.1. Introduction/Key Findings

7.2 Lemon

7.3. Aloe Vera

7.4. Cinnamon

7.5. Vanilla

7.6. Basil

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Flavour

7.9. Absolute $ Opportunity Analysis By Flavour , 2024-2030

Chapter 8. Europe Green Tea Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Hypermarket/Supermarket

8.3. Specialist Retailers

8.4. Convenience Stores

8.5. Online Retailers

8.6. Other Distribution Channels

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Green Tea Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Flavour

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Green Tea Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestle

10.2. AriZona Beverage Co.

10.3. Associated British Foods plc

10.4. Dilmah Ceylon Tea Company PLC

10.5. Kirin Holdings Company

10.6. Unilever

10.7. Tata Global Beverages

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The demand for green tea and herbal tea is experiencing rapid growth, propelled by aggressive marketing efforts and campaigns highlighting the health advantages of tea consumption

The top players operating in the Europe Green Tea Market are -Nestle, AriZona Beverage Co., Associated British Foods plc, and Dilmah Ceylon Tea Company PLC.

The COVID-19 pandemic has had a favorable impact on the green tea market. Amidst the global health crisis, there has been a notable shift towards the consumption of healthier and organic products.

. In November 2021, Unilever announced its agreement for the sale of ekaterra, a global tea company, to CVC Capital Partners Fund VIII, in a transaction devoid of debt and cash.

The United Kingdom stands as the largest and fastest-growing market for tea consumption.