Europe Gluten-Free Prepared Food Market Size (2024-2030)

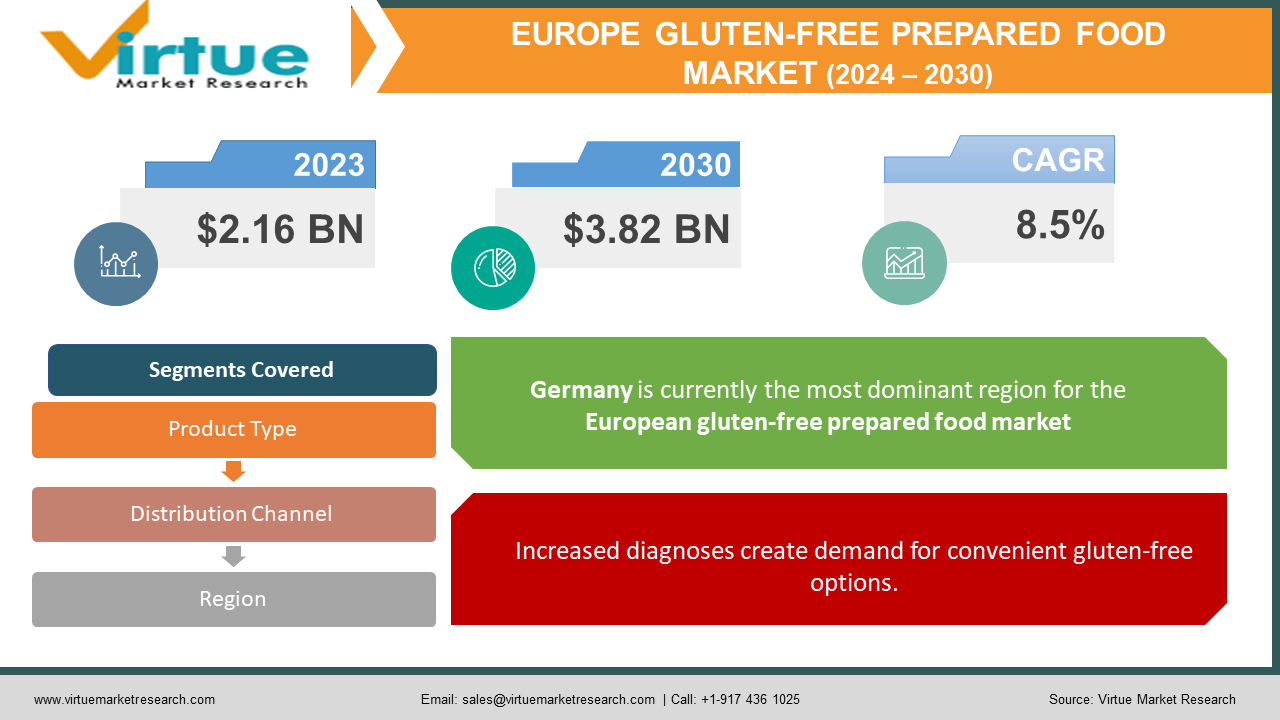

The European gluten-free prepared food market was valued at USD 2.16 billion in 2023 and is projected to reach a market size of USD 3.82 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

Certain grains, including wheat, barley, rye, and triticale, contain the protein gluten. It holds food together and gives it a stretchy texture, much like a binder. A frequent raw material composition found in gluten-free goods includes corn, rice, soy, cassava, and potato. In typical goods, these substances take the place of grains like wheat, rye, and barley, which contain gluten. The European market for gluten-free prepared foods is flourishing, driven by several key factors. Firstly, the rising prevalence of celiac disease and gluten intolerance has created a significant demand for alternative food options. Secondly, increasing disposable income allows consumers to spend more on premium and healthy food products, including gluten-free options. Finally, growing awareness of healthy eating habits fuels the market as consumers seek the convenient and healthy choices that gluten-free prepared foods often provide.

Key Market Insights:

The European gluten-free prepared food market is experiencing significant growth, driven by several key factors. Firstly, rising awareness and diagnosis of celiac disease and gluten intolerance have created a substantial consumer base seeking alternative food options. Secondly, increasing disposable income allows consumers to splurge on premium and healthy food products, including gluten-free prepared meals. Finally, growing health consciousness fuels the market as consumers actively seek convenient and healthy choices, which gluten-free prepared foods often provide. While bakery products dominate the market, other categories like pasta, snacks, and frozen meals are also gaining traction. Supermarkets remain the primary distribution channel, but online retailers are showing promising growth potential. Geographically, Germany leads the market, followed by other European nations. Looking ahead, the market is expected to continue its upward trajectory due to factors like expanding product variety, rising awareness of gluten-free options, and the increasing popularity of online grocery shopping. However, challenges like higher price points, limited product availability in certain regions, and consumer perceptions regarding taste and texture need to be addressed for sustained growth. Overall, the European gluten-free prepared food market presents a significant opportunity for manufacturers and retailers to cater to the growing demand for convenient and healthy gluten-free options.

Europe Gluten-Free Prepared Food Market Drivers:

Increased diagnoses create demand for convenient gluten-free options.

The small intestine is harmed by the long-term immunological and digestive illness known as celiac disease. Foods containing gluten, a protein present in wheat, rye, and barley, cause it to occur. The immune system targets your tissues when you eat gluten, which harms your digestive tract. Your body cannot absorb nutrients from meals as a result of this. Increased awareness and diagnosis of celiac disease and gluten intolerance have created a substantial population segment requiring gluten-free alternatives. This drives demand for readily available and conveniently prepared food options.

Consumers are willing to spend more on premium and healthy gluten-free meals.

Over the years, there have been many changes in the economy because of urbanization. Consumers in Europe are witnessing a rise in disposable income, allowing them to spend more on premium and healthy food products, including gluten-free prepared meals. This willingness to pay for specialized dietary options fuels market growth.

Consumers seek convenient and healthy choices, often perceived in gluten-free prepared foods.

There have been many health and wellness trends that have gained prominence. A greater percentage of the population has started to incorporate healthy food into their diet. A growing focus on healthy eating habits is prompting consumers to seek convenient and healthy alternatives. Gluten-free prepared foods are often perceived as healthier choices, further propelling market demand.

Manufacturers offer a wider range of delicious and convenient gluten-free options.

Manufacturers are continuously innovating and expanding their product offerings, providing consumers with a wider range of delicious and convenient gluten-free options. This increased variety caters to diverse dietary needs and preferences, attracting a larger consumer base.

Online platforms provide easy access to a wider selection of gluten-free prepared foods.

The growing popularity of online grocery shopping platforms provides convenient access to a wider selection of gluten-free prepared foods, especially for consumers in regions with limited physical store availability. This ease of access further facilitates market growth.

Europe Gluten-Free Prepared Food Market Restraints and Challenges:

The European gluten-free prepared food market enjoys significant growth but faces challenges that need addressing. While rising diagnoses of celiac disease and gluten intolerance, increasing disposable income, and growing health consciousness fuel demand, several factors hinder further expansion. The higher price point of gluten-free products compared to conventional options can deter budget-conscious consumers. Additionally, limited product availability, particularly in remote regions, restricts access for certain segments of the population. Furthermore, some consumers perceive gluten-free products as lacking taste and texture, discouraging them from trying or regularly consuming them. Stringent regulations governing labeling, claims, and ingredients for gluten-free products can add complexity and cost, potentially hindering innovation and market expansion. Additionally, the increasing presence of private-label gluten-free options offered by retailers intensifies competition, impacting established brands. Limited awareness about celiac disease, gluten intolerance, and the benefits of gluten-free options, along with misinformation and misconceptions, further challenges market growth. Addressing these restraints through innovative product development, improved affordability, increased consumer education, and effective marketing strategies is crucial for sustained growth and wider adoption of gluten-free prepared foods in Europe.

Europe Gluten-Free Prepared Food Market Opportunities:

The European gluten-free prepared food market brims with exciting growth opportunities. Innovation in product development, offering delicious and diverse options across categories, can attract new consumers and cater to varied dietary needs. Additionally, expanding distribution channels through online platforms and partnerships with restaurants can increase accessibility and convenience. Targeting specific demographics like children, athletes, and health-conscious individuals with tailored marketing and product lines can unlock new market potential. Addressing price sensitivity through cost-effective production and offering value packages can make these products more accessible. Furthermore, incorporating sustainable and ethically sourced ingredients resonates with environmentally conscious consumers and enhances brand image. Exploring export opportunities to regions with rising demand and leveraging technology through e-commerce platforms and social media marketing can further propel market growth. By capitalizing on these opportunities and addressing existing challenges, stakeholders can ensure the European gluten-free prepared food market thrives and caters to the evolving needs of health-conscious consumers.

EUROPE GLUTEN-FREE PREPARED FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Free by Glutino, General Mills, Conagra Brands, Bob's Red Mill, Amy's Kitchen, Genius Foods, Golden West Specialty Foods, Kraft-Heinz Company, Dr. Schär, Schar Gluten-Free, Orgran |

Europe Gluten-Free Prepared Food Market Segmentation:

Europe Gluten-Free Prepared Food Market Segmentation: By Product Type:

- Bakery products

- Pasta & noodles

- Snacks

- Frozen meals

- Other products

The bakery products segment dominates the European Gluten-Free Prepared Food Market, accounting for over 50% of the market share. This dominance is driven by the high demand for gluten-free bread and baked goods. However, the snack segment is experiencing the fastest growth due to the increasing popularity of convenient and on-the-go food options, with consumers seeking gluten-free alternatives to traditional snacks.

Europe Gluten-Free Prepared Food Market Segmentation: By Distribution Channel:

- Supermarkets

- Hypermarkets

- Convenience stores

- Online retailers

- Other channels

The most dominant segment in the European Gluten-Free Prepared Food Market by distribution channel is supermarkets, holding over 60% of the market share. These stores offer a wide variety of gluten-free options, making them a convenient one-stop shop for consumers. Meanwhile, the online retail segment is experiencing the fastest growth due to increasing consumer preference for online shopping and a wider product selection compared to physical stores.

Europe Gluten-Free Prepared Food Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany is the largest market. This is an established market with a high prevalence of celiac disease and a strong focus on healthy living, offering fertile ground for the continued growth of the gluten-free prepared food market. Rising disposable income, increasing urbanization, and growing health consciousness are expected to drive market expansion in these countries, paving the way for the wider adoption of gluten-free prepared foods. This confluence of factors fuels a significant demand for gluten-free prepared foods. With rising awareness, growing disposable income, and initiatives promoting healthy eating, the United Kingdom is the fastest-growing, presenting substantial market potential. In response to this demand, UK producers and merchants are launching gluten-free goods in a range of categories, such as bread, pasta, snacks, and prepared meals. The UK government's campaigns to encourage a balanced diet and assist those with dietary needs have also contributed to the country's gluten-free market's rapid expansion. Other countries like Italy, France, and Spain demonstrate promising potential, due to increasing awareness and a growing demand for gluten-free options, particularly in urban areas. This trend is expected to continue as disposable income and urbanization rise.

COVID-19 Impact Analysis on the European Gluten-Free Prepared Food Market:

The COVID-19 pandemic impacted the European gluten-free prepared food market in both positive and negative ways. Initial challenges included supply chain disruptions, shifting consumer behavior towards essential goods, and the closure of restaurants, impacting market growth. However, the pandemic also presented opportunities. Increased focus on health and immunity potentially drove some consumers towards gluten-free options, while the rise of e-commerce provided convenient access to these products. Additionally, with more people cooking at home, demand for versatile and convenient options like baking mixes and frozen meals is likely to increase. Overall, while the initial disruptions were temporary, the long-term impact of COVID-19 is still unfolding. Growing health consciousness and online grocery shopping are expected to be positive drivers in the post-pandemic landscape. The market is expected to continue its growth trajectory, albeit at a potentially slower pace, with manufacturers and retailers needing to adapt to the evolving consumer landscape through online presence, product innovation, and effective marketing strategies.

Latest Trends/ Developments:

The European gluten-free prepared food market is buzzing with exciting trends and developments. Consumers are increasingly seeking plant-based and clean-label products, prompting the development of innovative options using natural ingredients like legumes and ancient grains. Additionally, product variety is expanding to include new categories like breakfast cereals and snacks, with a focus on improved taste, texture, and nutritional value.

Furthermore, the demand for functional and fortified products enriched with vitamins, minerals, and probiotics is rising, catering to the desire for convenient and healthy options. Personalization and customization are also gaining traction, allowing consumers to tailor their gluten-free meals to specific needs and preferences.

Sustainability and ethical sourcing are becoming increasingly important factors, with consumers demanding products made with responsible practices and ethically sourced ingredients. Private label brands are also intensifying competition, influencing pricing and brand strategies.

Technology plays a vital role through online platforms and mobile applications facilitating sales, direct-to-consumer options, and personalized customer engagement. Finally, as the European market matures, manufacturers are exploring export opportunities to regions with rising demand for gluten-free products, presenting significant growth potential for the future. By embracing these trends and developments, stakeholders can ensure continued success in this dynamic and evolving market.

Key Players:

- Free by Glutino

- General Mills

- Conagra Brands

- Bob's Red Mill

- Amy's Kitchen

- Genius Foods

- Golden West Specialty Foods

- Kraft-Heinz Company

- Dr. Schär

- Schar Gluten-Free

- Orgran

Chapter 1. Europe Gluten-Free Prepared Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type of Material s

1.5. Secondary Product Type of Material s

Chapter 2. Europe Gluten-Free Prepared Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Gluten-Free Prepared Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Gluten-Free Prepared Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Gluten-Free Prepared Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Gluten-Free Prepared Food Market– By Product Type

6.1. Introduction/Key Findings

6.2. Bakery products

6.3. Pasta & noodles

6.4. Snacks

6.5. Frozen meals

6.6. Other products

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Gluten-Free Prepared Food Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3. Convenience Stores

7.4. Specialty Stores

7.5. Online Retail Stores

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Gluten-Free Prepared Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Gluten-Free Prepared Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Free by Glutino

9.2. General Mills

9.3. Conagra Brands

9.4. Bob's Red Mill

9.5. Amy's Kitchen

9.6. Genius Foods

9.7. Golden West Specialty Foods

9.8. Kraft-Heinz Company

9.9. Dr. Schär

9.10. Schar Gluten-Free

9.11. Orgran

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European gluten-free prepared food market was valued at USD 2.16 billion in 2023 and is projected to reach a market size of USD 3.82 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

Increased diagnoses of celiac disease, the willingness of consumers to spend more on premium and healthy gluten-free prepared meals, convenient and healthy choices, a wider range of delicious and convenient gluten-free options, and online platforms are the main drivers of the European gluten-free prepared foods market.

Based on distribution channels, the market is divided into supermarkets, hypermarkets, convenience stores, online retailers, and other channels

Germany is currently the most dominant region for the European gluten-free prepared food market, followed by France, Italy, Spain, and the United Kingdom

Free by Glutino, General Mills, Conagra Brands, Bob's Red Mill, Amy's Kitchen, Genius Foods, Golden West Specialty Foods, Kraft-Heinz Company, Dr. Schär, Schar Gluten-Free, and Orgran are the major players