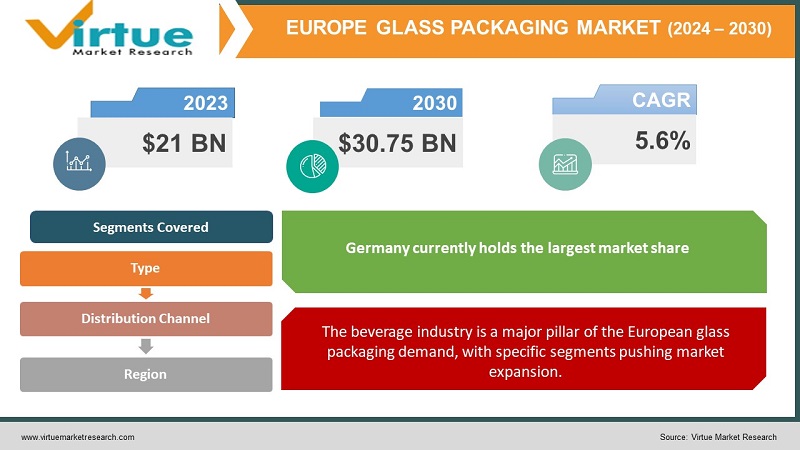

Europe glass Packaging Market Size (2024-2030)

Europe glass Packaging Market was valued at USD 21 Billion in 2023 and is projected to reach a market size of USD 30.75 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

Glass is renowned for its inert nature. It doesn't interact with the contents it holds, safeguarding product integrity, flavors, and aromas. This quality is critical for food, beverages, pharmaceuticals, and sensitive cosmetics. Glass possesses the unique potential to be infinitely recycled without compromising quality. This aligns with Europe's strong emphasis on circular economies and environmentally conscious practices. Glass packaging offers unmatched visual appeal. From elegant wine bottles to sleek perfume vials, it conveys a sense of quality and tradition that plastic alternatives struggle to replicate. Glass has built a reputation for trustworthiness over centuries. Consumers perceive glass-packaged products as safe, pure, and more likely to contain high-quality ingredients. The European glass packaging industry is continually investing in innovation, improving production efficiency, developing lighter-weight containers, and exploring creative designs.

Key Market Insights:

Because of its inert nature, glass doesn't interact with the objects it holds. This is essential for maintaining the flavor of food and drink as well as the safety of medications and cosmetics. Glass is thought to be of superior quality and elegance. It is also infinitely recyclable, which appeals to European consumers who care about the environment as much as brands. Glass packaging allows firms to create a distinctive visual presence on shelves and solidify their identity through the use of distinctive shapes, colors, and embossing. Growing consciousness about the environmental effects of packaging forces brands to prioritize recyclable materials like glass. This fits in with the circular economic objectives of the European Union. Glass is becoming a more popular packaging option due to growing concerns about plastic pollution, particularly in the food and beverage industry. Glass facilitates the expansion of premium beverage markets where packaging is crucial to the overall experience of the product, such as craft beer, artisan spirits, and premium sodas. The need for upscale-appearing glass packaging that upholds the indulgence element is driven by the growing self-care market and the focus on premium ingredients. A rising segment of European consumers is willing to pay extra for products packaged in glass because they believe it to be a symbol of quality and environmental conscience. Producers are working on methods to make glass packaging that is lighter and thinner without sacrificing strength. This lessens the environmental impact and cost of transportation.

Europe Glass Packaging Market Drivers:

Sustainability concerns have risen to the forefront of consumer consciousness, and the European Union has implemented ambitious targets for recycling and minimizing environmental impact.

One of the most compelling features of glass is its infinite recyclability without diminishing quality. Existing glass can be repurposed into new bottles and jars with virtually no loss in structural integrity. Europe boasts well-established recycling programs for glass, creating a strong circular economy for this packaging material. Glass is renowned for its inert nature. It doesn't leach chemicals into its contents, ensuring food and beverage safety, a major concern for consumers. This quality also protects the flavor and integrity of the products within. The European Union sets strict packaging sustainability targets. Its "Circular Economy Package" calls for 75% of packaging waste to be recycled by 2030. Glass, owing to its recyclability, positions itself well for companies looking to comply with regulations and reduce their environmental footprint. Leading food, beverage, cosmetics, and pharmaceutical companies are transitioning to more sustainable packaging solutions. Glass has become a natural choice due to its alignment with both consumer sentiment and regulatory requirements. The development of lightweight yet strong glass containers reduces material use, further bolstering the environmental benefits and lowering transportation costs. The recyclability and environmentally responsible image of glass translate into a strong marketing value proposition, allowing brands to communicate their commitment to sustainability. In certain market segments, glass packaging's association with sustainability aligns with a 'premium' product image, particularly for organic, artisanal, or luxury goods.

The beverage industry is a major pillar of the European glass packaging demand, with specific segments pushing market expansion.

Beer has a long-standing history of being packaged in glass bottles throughout Europe. It remains a preferred packaging choice due to its ability to protect beer from light, maintain carbonation, and avoid flavor interaction. Premium spirits, especially craft distillations of gin, vodka, and bespoke liquors, are driving increased demand for glass packaging. Glass reinforces brand identity and a sense of quality for discerning consumers. Europe is seeing a surge in innovative non-alcoholic beverages, from sparkling waters to infused botanical drinks, and health-conscious juice blends. Glass packaging offers safe storage and visual appeal on the shelf, attracting attention in this competitive segment. For specific wine styles, glass bottles remain the gold standard. Preserving tradition and highlighting the wine's hues are important factors, ensuring the continuing demand for glass packaging in this sector. The diversity of beverage products encourages innovation in glass bottle shapes and sizes. Sleek, eye-catching designs elevate packaging appeal for a variety of brands. To meet rising demand, glass manufacturers are modernizing production capacity and streamlining processes with automation and smart technologies. Reduced material usage in glass packaging aligns with sustainability aims in beverage transportation, optimizing supply chains and reducing carbon emissions. Glass packaging’s reputation for safety resonates with the growing consumer focus on healthy beverages, giving brands using glass a potential marketing edge.

Europe Glass Packaging Market Restraints and Challenges:

Price volatility of key raw materials such as soda ash, silica sand, and recycled glass (cullet) can affect production costs and result in unstable glass packaging prices.

Prices of essential raw materials like soda ash, silica sand, and recycled glass (cullet) can be volatile, impacting manufacturing costs and leading to price instability for glass packaging. Glass production necessitates energy-intensive processes like melting furnaces. Rising energy costs, particularly in the current climate of fluctuating fuel prices, create a significant burden on manufacturers and increase end-product prices. Plastics, metal, and even innovative composites offer cost advantages at times. This puts pressure on glass packaging to maintain its competitiveness, especially in price-sensitive market segments. While inherently recyclable, glass manufacturing has a substantial carbon footprint compared to some alternative materials. Concerns about climate change motivate brand owners and consumers to seek out packaging options with a lower environmental impact. The relative weight of glass packaging increases transportation costs and its associated carbon emissions. Lightweighting technology addresses this to some extent, but it remains a factor when compared to ultra-lightweight plastic or cardboard alternatives. True sustainability in glass packaging requires a robust closed-loop system for the collection and recycling of used glass back into manufacturing. While strong in some regions, inconsistencies across Europe hinder overall effectiveness.

Europe Glass Packaging Market Opportunities:

Glass continues to reign supreme in conveying a sense of quality and luxury, particularly in segments such as alcoholic beverages, gourmet food, and high-end cosmetics. Consumers are willing to pay more for products packaged in glass due to their perceived value and aesthetic appeal. In crowded markets, premium glass bottles and jars help brands stand out on shelves and reinforce a high-quality positioning. Unique shapes, textures, and colors can enhance brand storytelling and product appeal. The elegance and tactile quality of glass packaging aligns well with gifting and celebratory occasions, offering significant expansion opportunities. Glass's inherent recyclability, when supported by a robust collection infrastructure, is a significant selling point for environmentally conscious consumers and brand owners. The push towards a circular economy favors glass packaging. Consumers increasingly seek products with sustainable packaging. Clear communication about the recyclability and recycled content used in glass packaging becomes a powerful marketing tool. European glass manufacturers can tap into the growing "zero-waste" movement by exploring refillable packaging solutions and collaborations with retailers offering refill programs.

EUROPE GLASS PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Owens-Illinois, Ardagh Group, Verallia, Vidrala, Stoelzle Glass Group, Saverglass, Wiegand-Glas |

Europe Glass Packaging Market Segmentation:

Europe Glass Packaging Market Segmentation: By Type -

- Bottles

- Jars

- Vials

- Ampoules

Bottles: 55% (The dominant type due to extensive beverage industry applications) From miniature sample bottles to large wine or spirit bottles, the range is vast to meet the needs of various industries. Bottles serve as a canvas for unique shapes, embossed logos, and eye-catching labels, contributing to product differentiation. Jars: 30% (Highly versatile for various food products and cosmetics) Options for both easy scooping (spreads, honey) and controlled dispensing (pickles, olives) increase their versatility. Essential for many food products to ensure quality control and consumer trust. Vials: 8% (Critical for pharmaceutical and medical uses) must meet rigorous pharmaceutical standards, often using Type I borosilicate glass for superior chemical resistance. Specialized manufacturing processes to maintain sterility and product purity for injectable or sensitive medications. Ampoules: 4% (Specialized for single-use dosages) Designed for one-time doses, typically sealed by melting the glass, maximizing precision and avoiding contamination risks. Break easily at the neck for access to contents, a vital safety measure in medical settings.

Europe Glass Packaging Market Segmentation: By Distribution Channel -

- Beverages

- Food

- Pharmaceuticals

- Cosmetics & Personal Care

Beverages: Glass caters to a wide range of products- wine bottles with varying colors and shapes, diverse spirit bottles, and the iconic brown beer bottle. The market is seeing innovations in lightweight, recycled content glass, and decorative techniques to address both environmental and premium segment demands. Food: Glass preserves the taste and quality of food products, ranging from sauces and spreads to gourmet oils and pickled goods. The food segment demands a variety of jars, bottles, and closures to accommodate the vast range of specialized products within the market. The shift towards healthier and minimally processed foods benefits glass packaging, perceived as safer and more natural. Pharmaceuticals: The inertness and stability of glass are paramount for storing medicines and sensitive substances. Borosilicate glass offers superior resistance for specific applications. The pharmaceutical industry operates under strict regulations. Glass's long history of safe use and compliance standards builds a strong trust factor. Vials, ampoules, and glass bottles ensure accurate dosages, minimal product interaction, and tamper-proof solutions critical for pharmaceuticals. Cosmetics & Personal Care: Unique shapes, colors, and luxurious finishes of glass containers help cosmetics companies differentiate themselves and enhance brand storytelling. Consumers increasingly seek "safe" cosmetic products, making glass an ideal packaging solution to communicate purity and cater to specific allergies or sensitivities. The industry benefits from flexibility in glass packaging design, allowing smaller, niche brands to create distinctive products, often with a focus on sustainability.

Europe Glass Packaging Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany: Home to major glass packaging manufacturers, Germany contributes significantly to production and technological innovation within the European market. A sizeable beer industry and growing consumer interest in non-alcoholic beverages drive substantial demand for glass bottles. France: World-renowned wine regions create an enormous need for glass bottles. Sustainability is a key focus even within traditional sectors, fueling the use of recycled glass in production. France is recognized globally for its cosmetics and perfumes. Premium products in this sector frequently utilize elegant glass packaging. Italy: Italy is known for olive oils, pasta sauces, balsamic vinegar, and of course, wines. Glass is favored to protect and showcase these quality products. Italian brands favor sophisticated and distinctive glass packaging for product differentiation and strong on-shelf appeal. UK: The UK exhibits diverse consumption patterns with demand for glass across beverages, food, and a growing cosmetics industry. The rise of craft breweries, small-batch spirits, and gourmet food producers creates opportunities for bespoke and premium glass packaging solutions. Spain: A major producer of wine, olive oil, and processed foods, generating demand for a variety of glass packaging solutions. Growth in organic and health-oriented food segments aligns well with glass packaging, emphasizing purity and natural preservation methods. Rest of Europe: Economies in Poland and other Eastern European nations are seeing increased demand for packaged goods as living standards improve, opening up new markets for glass packaging. Sweden, Denmark, and neighboring countries spearhead eco-conscious consumer behavior, driving the use of glass packaging due to its recyclability and emphasis on closed-loop systems. Western Europe collectively holds the largest share of the glass packaging market within the continent. The "Rest of Europe" segment, with its diversity, is poised for strong growth potential within the glass packaging market.

COVID-19 Impact Analysis on the Europe Glass Packaging Market:

Lockdown measures across Europe disrupted the production and transportation of glass packaging materials. Raw material shortages and border restrictions created bottlenecks, impacting delivery schedules and raising concerns about meeting existing demand. As physical stores shuttered, online shopping surged. While initially posing challenges for safe and secure delivery of glass packaging, it ultimately presented a long-term growth opportunity for the industry. The critical need for medicines and diagnostics during the pandemic propelled demand for glass vials, ampoules, and bottles used in pharmaceutical packaging. The inert properties and chemical stability of glass proved advantageous for storing and transporting sensitive medical products. Heightened concerns about hygiene and food safety led to a rise in demand for glass packaging for food products perceived as safer and more sustainable compared to some plastic alternatives. Consumers gravitated towards glass jars for food items like jams, sauces, and pickled vegetables. The e-commerce boom necessitated advancements in protective packaging solutions for glass. Manufacturers developed innovative cushioning materials and shipping methods to ensure the safe delivery of glass containers to online shoppers. The experience of the pandemic is likely to fuel long-term growth in the glass packaging used for pharmaceuticals and food products. Consumers may continue to prioritize hygiene, safety, and quality, favoring glass over some plastic alternatives.

Latest Trends/ Developments:

The European Union's strong focus on the circular economy translates directly to the glass packaging sector. Manufacturers prioritize designing for recyclability, increasing recycled glass content (cullet) in their products, and actively engaging in value chain collaborations for efficient collection systems. Eco-conscious consumers demand sustainable packaging solutions. Glass, with its inherent recyclability, gains favor when its lifecycle is communicated transparently and supported by a robust recycling infrastructure. Technological advancements enable the production of lighter glass containers while maintaining their strength. This reduces material usage, lowers transportation costs, and decreases the overall carbon footprint associated with glass packaging. Glass continues to reign supreme in conveying a sense of premiumness and quality. Expect innovations in textures, unique embossed designs, and custom shapes to elevate brand positioning and stand out on shelves, especially within the cosmetics, spirits, and gourmet food segments.

Key Players:

- Owens-Illinois

- Ardagh Group

- Verallia

- Vidrala

- Stoelzle Glass Group

- Saverglass

- Wiegand-Glas

Chapter 1. Europe Glass Packaging Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Glass Packaging Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Glass Packaging Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Glass Packaging Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Glass Packaging Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Glass Packaging Market– By Type

6.1. Introduction/Key Findings

6.2. Bottles

6.3. Jars

6.4. Vials

6.5. Ampoules

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Glass Packaging Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Beverages

7.3. Food

7.4. Pharmaceuticals

7.5. Cosmetics & Personal Care

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Glass Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Glass Packaging Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Owens-Illinois

9.2. Ardagh Group

9.3. Verallia

9.4. Vidrala

9.5. Stoelzle Glass Group

9.6. Saverglass

9.7. Wiegand-Glas

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The EU's ambitious goals regarding circular models and waste reduction directly benefit glass packaging due to its inherent recyclability and potential for closed-loop systems.

Glass manufacturing is an energy-intensive process, particularly the melting furnaces. Fluctuations in energy prices, particularly with the current energy crisis in Europe, create significant cost pressures for manufacturers.

Owens-Illinois, Ardagh Group, Verallia, Vidrala, Stoelzle Glass Group

Saverglass, Wiegand-Glas.

Germany currently holds the largest market share, estimated at around 22%.

. Countries within Eastern Europe, such as Poland, Hungary, the Czech Republic, and others, are seeing significant economic growth and rising disposable incomes. As living standards improve, there's increased demand for consumer goods, including food and beverages often packaged in glass.