Europe Fruit Beer Market Size (2024-2030)

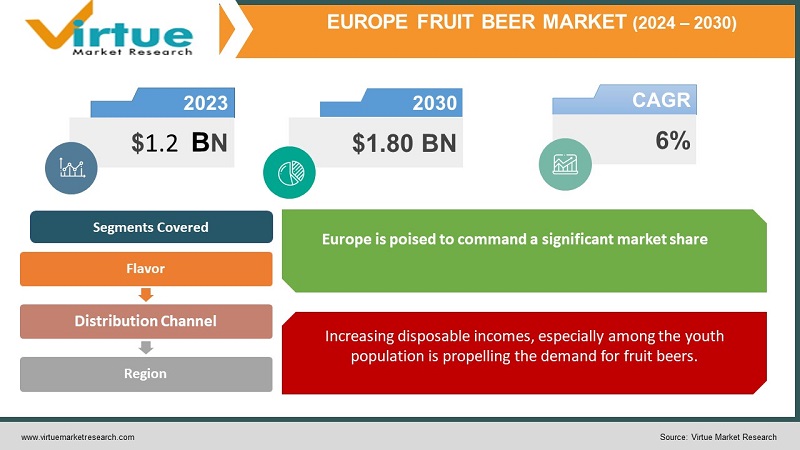

The Europe Fruit Beer Market was valued at USD 1.2 Billion and is projected to reach a market size of USD 1.80 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Fruit beer is made by fermented fruits like peach, berries as a substitute to grains. The low alcohol by volume (ABV) ratio of fruit beer is increasing its popularity, especially among health-conscious consumers. The consumption of low alcohol fruit beer does not affect the kidneys and liver and does not lead to intoxication. These health benefits of low-alcohol fruit beer will help in increasing its demand among consumers. This will have a positive impact on the growth of the fruit beer market.

Key Market Insights:

Some factors in the market growth include the rising demand towards non-alcoholic beverages and health awareness regarding fruit beer in the region. An increasing demand towards non-alcoholic beverages has been witnessed in the region, due to the rising population who prefer no or low alcoholic drinks. As per the German Association of Brewers (DBB), 1,500 breweries of Germany manufacture between 400 to 500 ranges of alcohol-free beer. Germany is reported to have an alcohol-free lifestyle.

The consumption of 0% of alcohol brands in Germany is around 11 million from aged 14 years and older drank non-alcoholic beer. This, in turn, results in the emerging demand for fruit beer in the region. Fruit beer was invented by Belgian brewers to provide flavor. In Europe, the manufacturers mostly use raspberry and cherries for tarty and sharp flavor.

Europe Fruit Beer Market Drivers:

Increasing awareness towards alcohol free beer is increasing the market drive for fruit beers.

A shift in consumer preferences towards low or alcohol-free beer has transpired due to heightened awareness. To meet the escalating demand for low or alcohol-free beer, market players within the fruit beer sector have introduced alcohol-free beverages featuring a variety of flavors. In June 2021, industry giants like Anheuser-Busch InBev and Heineken launched non-alcoholic beverages in India, posing competition to beverage manufacturers such as The Coca Cola Company and PepsiCo Inc., both in traditional retail outlets and restaurants.

Increasing disposable incomes, especially among the youth population is propelling the demand for fruit beers.

The rise in the disposable incomes and the increasing purchasing power per person is a major factor boosting the demand and augmenting market expansion for fruit beers. This when coupled with the awareness for non-alcoholic drinks act as a good substitute for alcoholic beverages and is causing a major upturn in the global as well as regional fruit beer market.

Europe Fruit Beer Market Restraints and Challenges:

Consumers' growing awareness of the detrimental impacts of alcohol consumption, propelled by numerous campaigns, has instilled a belief that fruit beers carry similar risks. This perception stands as a notable impediment to the expansion of the market. Additionally, the prevalent existence of counterfeit products within established markets like craft beer and low-alcohol beer is anticipated to obstruct the overall growth of the market.

The latest developments in nonalcoholic beverage trends encompass advancements, production challenges, and the nutritional and other impacts of diverse nonalcoholic beverages, such as fruit beer. Pertinent subjects covered include traditional non-alcoholic beverages, issues pertaining to labeling and safety in production, and the consumption of functional compounds in specific applications. This serves as a crucial resource for agricultural scientists, technologists, mechanics, nutritionists, chemists, and professionals within the food and beverage industry.

Europe Fruit Beer Market Opportunities:

The growing market demand for alcohol-free beer and heightened awareness regarding the inherent health advantages linked to fruit beer are anticipated to propel the product's expansion. Furthermore, the rising appeal of fruit beer as an occasional beverage among women is expected to nurture market growth in the forthcoming years.

EUROPE FRUIT BEER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Flavor, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, France, Spain, Germany, Italy, Rest of Europe |

|

Key Companies Profiled |

Alphabet Brewing Co., Carlsberg Breweries A/S, Anheuser-Busch InBev, Jubel Ltd., Heineken N.V., Mahou San Miguel , St Peter's Brewery Co. Ltd, Siren Craft Brew., Warsteiner Brauerei Haus Cramer KG, Krombacher International GmbH |

Europe Fruit Beer Market Segmentation:

Europe Fruit Beer Market Segmentation: By Flavor

- Peach

- Raspberry

- Plums

- Apricot

- Cherry

- Apple

- Blueberry

- Others

The raspberry segment secured the largest market share at 29.9% in 2023. This particular fruit beer variant is anticipated to maintain its status as a preferred choice among consumers, primarily attributed to the outstanding nutritional advantages offered by raspberries, encompassing low-calorie content and a rich concentration of fiber, vitamins, and minerals. Additionally, the exceptional flavor profile of raspberries is poised to attract consumers, further bolstering the popularity of products within this segment.

Cherry-flavored products are projected to exhibit the swiftest Compound Annual Growth Rate (CAGR) at 5.1% throughout the forecast period, driven by the widespread appeal of this fruit flavor, particularly among female consumers. Furthermore, the escalating demand for soured flavored beer among consumers is expected to contribute favorably to the growth trajectory of cherry-flavored products in the forthcoming years.

Europe Fruit Beer Market Segmentation: By Distribution Channel

- Departmental Stores

- Bars and Restaurants

- Supermarkets

- Specialty Stores

- Online Retailers

The substantial growth of the segment is notably influenced by the increasing number of restaurants and cafés. Factors such as evolving demographics, a burgeoning young consumer base, and the availability of diverse beer options contribute significantly to the on-trade distribution of fruit beer. The proliferation of microbreweries and breweries, fueled by the rising trend of socializing at pubs, bars, and liquor lounges among the youth demographic, is anticipated to further boost fruit beer sales through on-trade channels.

In supermarkets and hypermarkets, flavors like raspberry, cherry, mango, and grape are progressively occupying shelf space, responding to the escalating demand for alcohol-free beer among health-conscious consumers. The heightened product visibility in these retail outlets is a key driver for the sales of fruit drinks in the off-trade channel. Raspberries, rich in essential minerals, particularly potassium, play a pivotal role in ensuring proper heart function and regulating blood pressure. The omega-3 fatty acids found in raspberries also contribute to preventing stroke and heart disease.

The online distribution channel is poised for significant growth during the forecast period, propelled by the increasing number of online shoppers and a growing emphasis among regional players to enhance their online presence. This presents an opportune avenue for fruit beer manufacturers to establish a robust online presence, reaching their target audience effectively. Additionally, online retailers' provision of discounts further supports the upward trajectory of product sales.

Europe Fruit Beer Market Segmentation - By Region:

- UK

- France

- Spain

- Germany

- Italy

- Rest of Europe

Europe is poised to command a significant market share, accounting for 38.2% of the global fruit beer market. The European fruit beer landscape is particularly advantageous, benefiting from the emergence of numerous domestic microbreweries. Prominent players in this region include BrewDog, Mikkeller, Omnipollo, Cloudwater Brew Co., and Lervig Aktiebryggeri, among others. The prevalence of a substantial number of microbreweries and a growing demand for alcohol-free beverages among consumers in countries like France and the U.K. are expected to act as favorable catalysts for regional industry growth. The European tradition of highly valuing and supporting the beer-making industry is anticipated to create opportunities for new players to invest domestically.

Fruit beer has experienced a surge in popularity, spreading from Belgium to various corners of the globe in recent years. Recognized for being less taxing on the human body compared to traditional beer products, these fruit drinks are seldom associated with harm to the liver or kidneys. The health benefits offered by fruit beer, combined with its appealing fruit aroma and taste characteristics, are likely to drive consumer purchasing decisions for such fruit drinks in the forthcoming years.

COVID-19 Pandemic: Impact Analysis

The Europe fruit beer market faced a nuanced impact from the disruptions caused by the COVID-19 pandemic. Supply chain interruptions and challenges in accessing raw materials initially hindered market growth. However, amidst these challenges, positive trends emerged. The heightened focus on health and well-being during the pandemic led consumers to seek healthier alternatives, positioning fruit beers as a favorable choice. The surge in online shopping, a notable trend during lockdowns, expanded the market's reach and offered consumers a wider selection of options. As people spent more time at home, the appeal of fruit beers as unique and flavorful beverages for home entertainment grew. Furthermore, the challenges prompted innovation and adaptation within the industry, fostering resilience and potential for new product developments and marketing strategies. The fruit beer market demonstrated adaptability in response to changing consumer behaviors and market dynamics influenced by the pandemic.

Latest Trends/ Developments:

- Sustaining a noteworthy presence in the market is expected to hinge significantly on substantial investments in research and development by manufacturers. Consequently, industry participants are projected to augment expenditures towards the exploration of exotic flavors, including dragon fruit, Chinese bayberry, passion fruit, and black carrot. In recent years, consumers have increasingly allocated their spending towards exotic fruits and their derivatives, driven by the exceptional nutritional properties, notably high vitamin C and dietary fiber content. As a result, fruit beer enterprises are poised to leverage these exotic flavors to formulate finished products catering to such discerning consumers in the imminent future.

Key Players:

- Alphabet Brewing Co.

- Carlsberg Breweries A/S

- Anheuser-Busch InBev

- Jubel Ltd.

- Heineken N.V.

- Mahou San Miguel

- St Peter's Brewery Co. Ltd

- Siren Craft Brew.

- Warsteiner Brauerei Haus Cramer KG

- Krombacher International GmbH

Chapter 1. Europe Fruit Beer Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Flavor of Material s

1.5. Secondary Flavor of Material s

Chapter 2. Europe Fruit Beer Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Fruit Beer Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Fruit Beer Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Fruit Beer Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Fruit Beer Market– By Flavor

6.1. Introduction/Key Findings

6.2. Peach

6.3. Raspberry

6.4. Plums

6.5. Apricot

6.6. Cherry

6.7. Apple

6.8. Blueberry

6.9. Others

6.10. Y-O-Y Growth trend Analysis By Flavor

6.11. Absolute $ Opportunity Analysis By Flavor , 2024-2030

Chapter 7. Europe Fruit Beer Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Departmental Stores

7.3. Bars and Restaurants

7.4. Supermarkets

7.5. Specialty Stores

7.6. Online Retailers

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Fruit Beer Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Flavor of Material

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Fruit Beer Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Alphabet Brewing Co.

9.2. Carlsberg Breweries A/S

9.3. Anheuser-Busch InBev

9.4. zubel Ltd.

9.5. Heineken N.V.

9.6. Mahou San Miguel

9.7. St Peter's Brewery Co. Ltd

9.8. Siren Craft Brew.

9.9. Warsteiner Brauerei Haus Cramer KG

9.10. Krombacher International GmbH

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Fruit beer is made by fermented fruits like peach, berries as a substitute to grains.The low alcohol by volume (ABV) ratio of fruit beer is increasing its popularity, especially among health conscious consumers.

The top players operating in the Europe Fruit Beer Market are - Alphabet Brewing Co, Carlsberg Breweries A/S,Anheuser-Busch InBev, Jubel Ltd, Heineken N.V., Mahou San Miguel, St Peter's Brewery Co. Ltd., Siren Craft Brew., Warsteiner Brauerei Haus Cramer KG, Krombacher International GmbH

Covid-19 has a mixed impact on the Europe fruit beer market. As the supply chain was interrupted, the effect on raw materials also hindered the market growth. But due to covid people are focusing more on their health and better lifestyles.

The growing market demand for alcohol-free beer and heightened awareness regarding the inherent health advantages linked to fruit beer are anticipated to propel the product's expansion.

The prevalence of a substantial number of microbreweries and a growing demand for alcohol-free beverages among consumers in countries like France and the U.K. are expected to act as favorable catalysts for regional industry growth.