Europe Food Packaging Market Size (2024-2030)

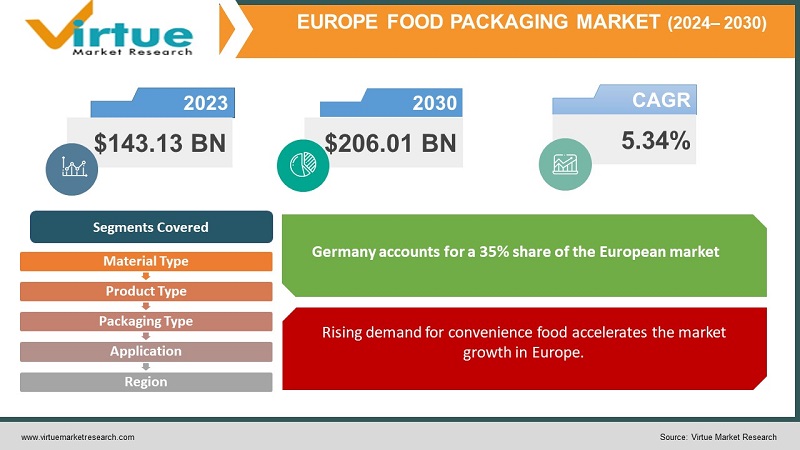

Europe's Food Packaging Market was valued at USD 143.13 billion in 2023 and is projected to reach a market size of USD 206.01 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.34%.

Food packaging is the process of packaging food to protect it from contamination, spoilage, spoilage, and pests during storage, transportation, and retail sales. It also protects food from moisture, light, pressure, heat, disease, etc. It protects from various external factors such as. Increasing consumer demand for packaging products due to changing cultures and changing lifestyles is one of the key drivers of the market. The packaging industry has evolved because it can provide significant benefits such as product protection, convenience, and mobility, all of which have contributed to its expansion around the world. The continuous efforts of major companies to provide such packaging and the use of smart packaging technology have increased the growth of the global market.

Key Market Insights:

The food packaging market in Europe is influenced by many factors, including the increase in urban population and changing consumption patterns due to rapid change, especially in developing countries. Additionally, the strong demand for frozen food due to the increasing workforce and expansion of the retail market will increase the demand for European packaging products in the future. In addition, factors such as increasing disposable income due to population growth and the small number of households also positively affected the European packaging products market. Increased shelf life is expected to accelerate the growth of the European packaging market. The food packaging industry in Europe is expected to increase food consumption due to increasing urban populations, increasing the popularity of individual packaging. The European food packaging industry is driven by factors such as demand from RTC and RTE food end users, automation, and changes in product safety regulations taken by various government agencies such as FDI. As people's awareness of environmental pollution and global warming increases, more and more people dislike green food packaging machines. This had a huge impact on the growth of the European packaging industry.

Europe is the world's second-largest food packaging market due to the region's developed food processing industry. Europe's single trade policy allows free trade in the region, which is expected to increase exports and therefore contribute to the growth of the European packaging industry.

Food Packaging Market Drivers:

Rising demand for convenience food accelerates the market growth in Europe.

Convenience foods are widely used because they are portable, have a long shelf life, and are ready for consumption. These include a variety of products such as snacks, frozen foods, snacks, desserts, and beverages. These items generally require less preparation and are served hot in ready-to-eat containers. Increasing demand for ready-made snacks due to sedentary lifestyles is expected to increase the demand for ready-made foods, leading to the growth of the market. In addition, the increase in disposable income per capita and the increase in the number of workers accelerated economic growth.

Nowadays, the demand for fast food is increasing due to the lifestyle of consumers. This high demand has made it easier for food manufacturers to produce products that have better nutritional value and do not harm the body. Going forward, the demand for convenience foods will increase which in turn results in increasing demand for packaging, thus supporting the growth of this sector.

The rise in demand for edible packaging fuels the market growth.

Increasing concerns about packaging waste and its environmental impacts are increasing the demand for edible packaging. Over the past decade, traditional food packaging has resulted in more waste and landfill space. Recycling rates of plastic materials are still very low. According to the Organization for Economic Co-operation and Development (OECD), plastic pollution is increasing due to a lack of waste management and recycling. Only 9% of plastic waste in the European region is recycled and 27% is not managed appropriately. These factors relate to the demand for food packaging and its contribution to market growth.

Food Packaging Market Restraints and Challenges:

Maintaining quality and Standardization provides a challenge to market growth.

Maintaining consistency in quality and standardization of Food Packaging can be difficult due to differences between material and processing. Ensure batch-to-batch consistency and compatibility requirements, especially for companies sourcing from multiple suppliers or regions.

The volatility in material prices brings a challenge to market growth.

Europe Food Packaging prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Sustainability and Environmental Impact restrains market growth.

The increasing demand for food packaging has led to concerns about their material sustainability and environmental impact. Maintaining sustainable practices and supporting local communities are key challenges facing the Food Packaging industry.

Food Packaging Market Opportunities:

Consumers place greater value on freshness and long shelf life. This is driving demand for smart packaging that can monitor temperature, detect spoilage, and extend product life. Innovations such as variable air volume and anti-inflammatory medications are beneficial, reducing food waste and increasing customer satisfaction.

Individual packaging with QR codes and augmented reality has benefited people. Smart labels that track product origin and performance are gaining traction, providing transparency and building trust. Additionally, the business cycle provides the opportunity to reuse and recycle packaging, further supporting sustainability.

Environmental concerns are driving the use of recyclable, biodegradable, and compostable materials. While paper, bioplastics, and recycled materials attract attention, innovations such as renewable and recyclable materials are also emerging. Consumers are willing to pay a premium for environmentally friendly packaging, creating a profitable market segment.

Busy lifestyles and urbanization have created the need for single-serve, grab-and-go packages. This includes reusable bags, microwavable trays, and containers. Additionally, the e-commerce market for food is growing and there is a need for packaging that can withstand transportation and handle the product.

EUROPE FOOD PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.34% |

|

Segments Covered |

By Product Type, Packaging type, material type, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK , Germany, France, Italy, Spain , rest of Europe |

|

Key Companies Profiled |

O-I Glass, Inc. , ALPLA , ProAmpac , CANPACK , Tetra Laval International, Stora Enso, KM Packaging Services Ltd., Smurfit Kappa, Amcor, Ardagh Group |

Functional Food Market Segmentation:

Functional Food Market Segmentation by Material Type

- Plastics

- Paper and Paperboard

- Glass

- Metal

- Wood

- Others

In 2023, based on Material Type, plastics account for the 40% share of the European market. The plastic used in packaging is the most popular material due to its properties such as flexibility, lightness, cost-effectiveness, and breakage resistance. It also provides good protection against food spoilage. Most plastic resins used in packaging can be recycled. Both flexible and rigid packaging offer innovation opportunities. For example, modified air packaging (MAP) helps preserve the freshness of foods and extend the shelf life of products by slowing spoilage. Increasing water consumption has led to increased demand for plastic, which can be beneficial to the growing economy.

Functional Food Market Segmentation by Product Type

- Flexible

- Rigid

- Semi-Rigid

In 2023, based on the Product Type segment, Flexible accounts for more than 60% share of the European market. It is in high demand due to the use of technology and the constant development of new solutions for packaging needs. Simple packaging uses less material than containers and requires less energy to manufacture the packaging. Increasing demand for packaging to provide better nutritional quality and taste will accelerate the growth of this segment.

Functional Food Market Segmentation by Packaging Type

- Bags & Pouches

- Films & Wraps

- Stick packs & Sachets

- Bottles & Jars

- Boxes & Cartons

- Others

In 2023, based on the Packaging Type segment, Bags and pouches account for more than 30% share of the European market. The bag is lightweight, and easy to reseal and transport, making them preferable in the food packaging industry. In addition, modern flexographic printing methods used in bags and pouches also help the development of this segment.

Functional Food Market Segmentation by Application

- Bakery & Confectionery

- Fruits & Vegetables

- Dairy Products

- Meat

- Others

In 2023, based on the Application segment, Bakery & Confectionary account for more than 35% share of the European market. This section is mainly used for sweets and confectionery, including chewing gum, croissants, savory pastries, candies, candies and chocolates. Consuming more of these food items will lead to economic growth. Additionally, increasing demand for gluten-free alternatives has triggered the growth of this segment.

|

35% |

Functional Food Market Segmentation: Country Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest Of Europe

In 2023, based on Country, Germany accounts for a 35% share of the European market. Germany is Europe's economic powerhouse leading in sustainability solutions, embracing bioplastics and recycled content.

On the other hand, the United Kingdom has shown higher CAGR in recent times and is expected to witness significant growth in the forecasting period. Convenience is king in the UK, with flexible pouches and single-serve packaging dominating. E-commerce food sales are booming, driving demand for sturdy and sustainable packaging solutions.

France stands third in the queue followed by Italy, Spain, and the Rest of Europe.

COVID-19 Impact Analysis on the Europe Food Packaging Market:

As the European Government categorizes the food industry as an essential service during the pandemic, its impact is relatively on a smaller scale compared to the manufacturing industry. Companies specializing in flexible packaging, especially those doing business such as food packaging, risen during the pandemic period. There are many factors affecting the global food packaging industry, including changes in consumer demand patterns, government measures, and inventory that are increasing the demand for food packaging. Additionally, increasing concerns about food safety during the pandemic have led to significant changes in consumer preferences, with more food packaging options emerging in emerging economies such as India. In addition, the rise of e-commerce stores during the pandemic strengthened home-cooked food sales and the demand for conveniently packaged food.

Latest Trends/ Developments:

Innovations in packaging provide opportunities for business growth. Packaging plays an important role in maintaining food quality, ensuring food safety, and extending shelf life. Plastic packaging is very important for the recognition of new products. Among the plastic packaging types, the most used plastic packaging material today is plastic stretch film. The transition to environmentally friendly packaging and innovations in plastic packaging are shaping the direction of this market. This innovation includes various packaging options such as smart packaging, packaging, nanocomposites, food/biodegradable packaging, and various packaging designs.

The Food and Agriculture Organization of the United Nations said innovation and technological advances in the food industry have led to rapid improvements in food safety. These technologies include food processing, manufacturing, and packaging, which provide improved tools for monitoring, identifying foodborne pathogens, and detecting contamination. Therefore, progress in innovation has led to a high demand for new packaging; this demand expanded and emerged as an important model for the growth of the industry.

Key Players:

- O-I Glass, Inc.

- ALPLA

- ProAmpac

- CANPACK

- Tetra Laval International

- Stora Enso

- KM Packaging Services Ltd.

- Smurfit Kappa

- Amcor

- Ardagh Group

- In August 2022, Amcor Plc acquired a flexible packaging plant in the Czech Republic with advanced specialized equipment in various industries. This strategic position enables the company to expand its capacity to meet the high demand and customer growth across the European flexible packaging network.

- In June 2022, Ardagh Metal Packaging is expanding its production facility in La Ciotat, France in response to growing demand for beverage cans from new and existing customers for long-term partnerships in South West Europe and the Middle East. This expansion will help the company reduce its CO2 imports and can work to reduce the consumption of premium aluminum by recycling at all stages of the production process.

- In April 2022, Mondi announced the launch of new solutions specific to the food industry at Anuga FoodTec in Cologne, Germany. The launch of two new packaging trays provides the brand with new recyclable materials to help reduce food waste.

Chapter 1. Europe Food Packaging Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Food Packaging Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Food Packaging Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Food Packaging Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Food Packaging Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Food Packaging Market – By Product Type

6.1. Introduction/Key Findings

6.2. Flexible

6.3. Rigid

6.4. Semi-Rigid

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Food Packaging Market – By Material Type

7.1. Introduction/Key Findings

7.2 Plastics

7.3. Paper and Paperboard

7.4. Glass

7.5. Metal

7.6. Wood

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Material Type

7.9. Absolute $ Opportunity Analysis By Material Type , 2024-2030

Chapter 8. Europe Food Packaging Market – By Packaging Type

8.1. Introduction/Key Findings

8.2 Bags & Pouches

8.3. Films & Wraps

8.4. Stick packs & Sachets

8.5. Bottles & Jars

8.6. Boxes & Cartons

8.7. Others

8.8. Y-O-Y Growth trend Analysis Packaging Type

8.9. Absolute $ Opportunity Analysis Packaging Type , 2024-2030

Chapter 9. Europe Food Packaging Market – By Application

9.1. Introduction/Key Findings

9.2 Bakery & Confectionery

9.3. Fruits & Vegetables

9.4. Dairy Products

9.5. Meat

9.6. Others

9.7. Y-O-Y Growth trend Analysis Application

9.8. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 10. Europe Food Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Europe

10.1.1. By Country

10.1.1.1. U.K.

10.1.1.2. Germany

10.1.1.3. France

10.1.1.4. Italy

10.1.1.5. Spain

10.1.1.6. Rest of Europe

10.1.2. By Packaging Type

10.1.3. By product type

10.1.4. By Material Type

10.1.5. Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Europe Food Packaging Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

11.1 O-I Glass, Inc.

11.2. ALPLA

11.3. ProAmpac

11.4. CANPACK

11.5. Tetra Laval International

11.6. Stora Enso

11.7. KM Packaging Services Ltd.

11.8. Smurfit Kappa

11.9. Amcor

11.10. Ardagh Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Europe's Food Packaging Market was valued at USD 143.13 billion in 2023 and is projected to reach a market size of USD 206.01 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.34%.

The segments under the Europe Food Packaging Market based on Material Type are Plastics, Paper and Paperboard, Glass, Metal, Wood, and Others.

Germany is dominant in Europe's Food Packaging Market

Stora Enso, KM Packaging Services Ltd., Smurfit Kappa, Amcor, Ardagh Group, etc

As the European Government categorizes the food industry as an essential service during the pandemic, its impact is relatively on a smaller scale compared to the manufacturing industry. Companies specializing in flexible packaging, especially those doing business such as food packaging, risen during the pandemic period