Europe Food and Beverage Metal Cans Market Size (2024-2030)

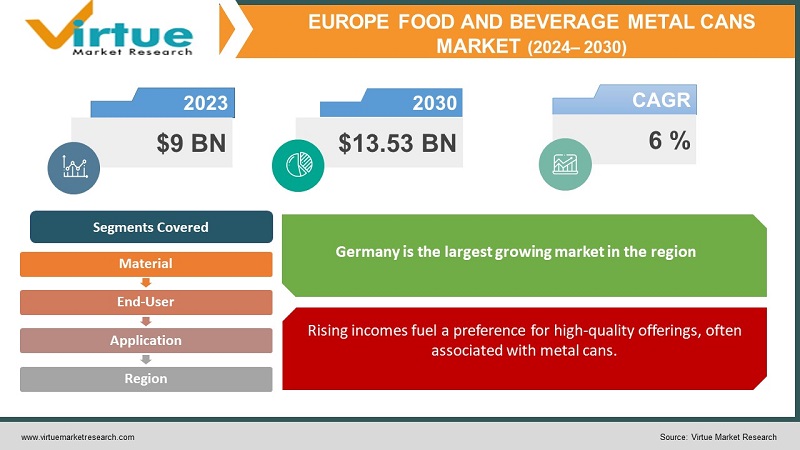

The European food and beverage metal cans market was valued at USD 9 billion in 2023 and is projected to reach a market size of USD 13.53 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

Convenience reigns supreme in the European food and beverage market. These lightweight, portable, and easy-to-open containers are a perfect fit for our busy lives and the rise of on-the-go consumption. Growing disposable incomes also drive demand for premium products, often found in metal cans. Additionally, their high recyclability resonates with environmentally conscious consumers. Aluminum dominates the market, catering to both convenience and sustainability. It's favored over steel, which primarily serves larger containers in food service applications. Beverages are the leading application, but food is experiencing faster growth, indicating a shift in preferences.

Key Market Insights:

Busy lives and the on-the-go trend have raised the demand for metal cans. Their lightweight, portable, and easy-to-open nature makes them ideal for the fast-paced world. Not only that, but rising disposable incomes are fueling a desire for premium products, often found in these recyclable metal containers. Their eco-friendliness further attracts environmentally conscious consumers. Aluminum reigns supreme, offering both convenience and sustainability. It's the preferred choice over steel, which is primarily used for larger containers in food service. While beverages currently hold the largest market share, the food segment is experiencing a remarkable growth spurt, indicating a shift in preferences. Competition is fierce among industry giants, who constantly innovate and expand their reach. However, challenges remain. Rising raw material costs, competition from other materials like plastic and glass, and stringent regulations on waste management need to be addressed. Despite these hurdles, the future of metal cans looks bright. Convenience, rising incomes, and sustainability concerns are expected to continue driving growth. However, adapting to evolving regulations and consumer preferences will be crucial for maintaining momentum and ensuring a healthy future for these versatile and eco-friendly containers.

Europe Food and Beverage Metal Cans Market Drivers:

On-the-go lifestyles demand easily portable and consumable products, making metal cans ideal.

Dual income has become the new norm. This has created hectic schedules. The on-the-go lifestyle demands products that are easy to carry and consume. Metal cans excel in this aspect with their lightweight, portable, and easily openable design, making them ideal for busy consumers.

Rising incomes fuel a preference for high-quality offerings, often associated with metal cans.

Urbanization has caused a lot of changes in the economy of Europe. Rising disposable incomes are leading to a preference for premium products, and metal cans are often associated with high-quality offerings. Their sleek design and diverse printing capabilities enhance the brand image and appeal to consumers willing to pay more.

Eco-conscious consumers favor metal cans' high recyclability and alignment with circular economy initiatives.

Environmentally conscious consumers are increasingly drawn to eco-friendly packaging options. Metal cans boast high recyclability rates, with over 70% of them being recycled in Europe. This aligns with the growing focus on sustainability and circular economy initiatives.

Lighter cans, extended shelf life, and even smart features keep metal cans competitive.

Manufacturers are constantly developing innovative metal cans with improved functionality and features. This includes lightweight materials for reduced material usage, improved barrier properties for extended shelf life, and even smart packaging with interactive features.

Improved printing and production processes enhance appeal and efficiency, driving market growth.

Advancements in printing technologies allow for eye-catching designs and personalized branding, making metal cans more appealing to consumers. Additionally, improvements in production processes enhance efficiency and reduce costs, further contributing to market growth.

Europe Food and Beverage Metal Cans Market Restraints and Challenges:

The European food and beverage metal cans market, while promising, faces its share of hurdles. Rising costs of aluminum and steel, the main ingredients, can squeeze profits and impact consumer prices. The competition from plastic and glass, often cheaper and offering transparency for some products, is fierce. Stringent regulations, though favoring metal cans due to their recyclability, also add complexity and cost through stricter safety standards and end-of-life responsibilities. Some consumers perceive metal cans as less convenient than pouches or Tetra Paks, especially on the go. While offering good shelf life for many items, they might not be ideal for perishables like fruits or dairy, where plastic or glass excel. Limited reusability, compared to the growing preference for reusable packaging, presents another challenge. Additionally, regional variations in regulations, preferences, and economic factors demand flexible strategies from manufacturers. Despite these challenges, the future of metal cans is not bleak. By understanding these obstacles and actively addressing them, manufacturers can pave the way for continued success in the European market, capitalizing on the convenience, premiumization, and sustainability advantages metal cans offer.

Europe Food and Beverage Metal Cans Market Opportunities:

Europe's food and beverage metal cans market brims with potential. Convenience reigns supreme, and metal cans' portability and ease of use perfectly answer the call. Rising disposable incomes unlock opportunities for premium products, where metal cans shine with their high-quality image and diverse printing options. Sustainability is being emphasized, and metal cans' impressive recyclability and alignment with circular economies make them a clear winner. Innovation fuels differentiation, with lighter cans, extended shelf life, and even smart features setting them apart. Technological advancements enhance appeal with eye-catching designs and personalized branding while boosting production efficiency and lowering costs. Evolving regulations favoring sustainable alternatives like metal cans create fertile ground for expansion. Shifting consumer preferences towards health and wellness aligns perfectly with metal cans' convenient single-serve formats and excellent food preservation. Regional growth in Eastern Europe and urbanization across the continent present exciting opportunities for metal cans as the preferred packaging solution. Niche markets like craft beer and premium coffee offer additional avenues for growth, catering to specific customer demands. By strategically leveraging these trends and tackling challenges head-on, manufacturers can unlock the full potential of this promising European market.

EUROPE FOOD AND BEVERAGE METAL CAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Material, end user, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Ajinomoto Co., Inc., Koninklijke DSM N.V., Kerry Group PLC, Tate & Lyle PLC, AngelYeast Co., Ltd., Cargill Incorporated, Givaudan, Lesaffre Group, ADM, Symrise |

Europe Food and Beverage Metal Cans Market Segmentation:

Europe Food and Beverage Metal Cans Market Segmentation: By Material:

- Aluminum cans

- Steel cans

In the European food & beverage metal can market, aluminum reigns supreme, holding the dominant position with a 70% market share. Its lightweight properties, recyclability, and cost-effectiveness make it the preferred choice for manufacturers. However, the fastest-growing segment is steel cans, experiencing a surge in demand. The 304/L grade is highly sought-after because of its ability to withstand oxidation and corrosion. It can also withstand the strong chemicals needed to maintain the cleanliness of the production facilities.

Europe Food and Beverage Metal Cans Market Segmentation: By End-User:

In the European food and beverage metal cans market, retail reigns supreme, holding the largest share (70%) of the end-user segment. Supermarkets, convenience stores, and other retail outlets drive this dominance due to the convenience and impulse purchases associated with metal cans. However, food service is experiencing a faster growth rate, currently at 30% of the market. This trend reflects the increasing popularity of on-the-go consumption and the demand for convenient food options in restaurants, cafes, and other establishments. Both segments present significant opportunities for metal can manufacturers, with retail offering a stable base and food service promising exciting growth potential.

Europe Food and Beverage Metal Cans Market Segmentation: By Application:

- Beverage cans

- Food cans

Within the European food and beverage metal cans market, beverages hold the dominant position with around 60% of the market share. This segment thrives due to its association with convenience, particularly for carbonated drinks, energy drinks, and alcoholic beverages. However, food cans are the fastest-growing segment, experiencing a surge in popularity for packaged vegetables, fruits, soups, and pet food. This trend reflects changing consumer preferences for convenient, single-serve options, and metal cans are perfectly positioned to capitalize on this shift.

Europe Food and Beverage Metal Cans Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany is the largest growing market in the region, driven by a high disposable income and a strong economy. Beverages remain the largest application, with demand for energy drinks and soft drinks. This is a technologically advanced market with a strong focus on sustainable packaging solutions. Metal cans are gaining traction due to their recyclability and extended shelf life The United Kingdom is the fastest-growing, with a rapidly growing population and increasing demand for convenience foods. Premium metal cans for beverages and high-end food products offer potential for growth. Food and beverage applications are both experiencing growth, with potential for further expansion in the food segment. Metal cans are seen as a hygienic and convenient option for packaging food and beverages. The government's focus on promoting local manufacturing and improving infrastructure further strengthens the market potential for metal cans.

COVID-19 Impact Analysis on the European Food and Beverage Metal Cans Market:

COVID-19 sent shockwaves through the European food and beverage metal can market, leaving a trail of both challenges and unexpected opportunities. Initial lockdowns triggered panic buying, spiking demand for canned goods and straining production. Disrupted supply chains added to the chaos, causing temporary shortages. Yet, amidst the initial turbulence, silver linings emerged. Restaurant closures and limited dining options fueled the demand for packaged food and beverages, playing right into the metal can's strength. The hygiene concerns surrounding the pandemic further boosted their popularity, positioning them as safe and reliable packaging options. Moreover, the growing awareness of sustainability during this period solidified metal cans' position as an eco-friendly choice due to their recyclability. While the market has stabilized after the initial surge, demand remains slightly higher than pre-pandemic levels. Interestingly, the food segment continues to outpace beverages, reflecting a shift towards convenient, single-serve options. Recognizing this trend, manufacturers are innovating with lightweight cans, improved printing, and even smart packaging to stay ahead of the curve. Additionally, stricter regulations on plastic waste and growing support for circular economies further solidify metal cans' position as a sustainable alternative. In conclusion, while COVID-19 undoubtedly impacted the European metal cans market, the long-term outlook remains positive, driven by convenience, hygiene, sustainability, and regulatory changes. Adapting to evolving consumer preferences and navigating the changing regulatory landscape will be crucial for manufacturers to thrive in this dynamic market.

Latest Trends/ Developments:

Europe's metal can market has been prioritizing sustainability, with manufacturers pirouetting towards lightweight designs, bio-based coatings, and closed-loop recycling systems. Consumers, the ever-demanding audience, call for smaller, single-serve acts, premium aesthetics, and even interactive experiences through smart packaging. Technology steps onto the stage with smart factories, 3D printing, and digital printing, shaping the future of metal cans. Regulatory applause echoes for their sustainable performance, as stricter plastic waste rules and circular economy initiatives give them a standing ovation. Eastern Europe's economic rise and developing markets' growing incomes offer exciting opportunities while staying attuned to these trends ensures manufacturers remain the leading performers in this dynamic market.

Key Players:

- Ajinomoto Co., Inc.

- Koninklijke DSM N.V.

- Kerry Group PLC

- Tate & Lyle PLC

- AngelYeast Co., Ltd.

- Cargill Incorporated

- Givaudan

- Lesaffre Group

- ADM

- Symrise

Chapter 1. Europe Food and Beverage Metal Cans Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Food and Beverage Metal Cans Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Food and Beverage Metal Cans Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Food and Beverage Metal Cans Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Food and Beverage Metal Cans Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Food and Beverage Metal Cans Market– By Material

6.1. Introduction/Key Findings

6.2 Aluminum cans

6.3. Steel cans

6.4. Y-O-Y Growth trend Analysis By Material

6.5. Absolute $ Opportunity Analysis By Material , 2024-2030

Chapter 7. Europe Food and Beverage Metal Cans Market– By Application

7.1. Introduction/Key Findings

7.2 Beverage cans

7.3. Food cans

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Food and Beverage Metal Cans Market– By End-User

8.1. Introduction/Key Findings

8.2. Retail

8.3. Foodservice

8.4. Y-O-Y Growth trend Analysis End-User

8.5. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 9. Europe Food and Beverage Metal Cans Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Material

9.1.3. By Application

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Food and Beverage Metal Cans Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Ajinomoto Co., Inc.

10.2. Koninklijke DSM N.V.

10.3. Kerry Group PLC

10.4. Tate & Lyle PLC

10.5. AngelYeast Co., Ltd.

10.6. Cargill Incorporated

10.7. Givaudan

10.8. Lesaffre Group

10.9. ADM

10.10. Symrise

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European food and beverage metal cans market was valued at USD 9 billion in 2023 and is projected to reach a market size of USD 13.53 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

On-the-go lifestyles, rising income, high recyclability, features, appeal, and efficiency are the main drivers

Based on application, the market is divided into beverage cans and food cans

The most dominant region for the European food and beverage metal can market is Germany

Ball Corporation, Ardagh Group, Crown Holdings, Silgan Holdings, Can-Pack, Massilly Holdings, CCL Container, Toy Seikan Group Holdings, Universal Can Corporation, Kingcan Holdings, and Muller and Bauer are the major players.