Europe Flexible Packaging Market Size (2024-2030)

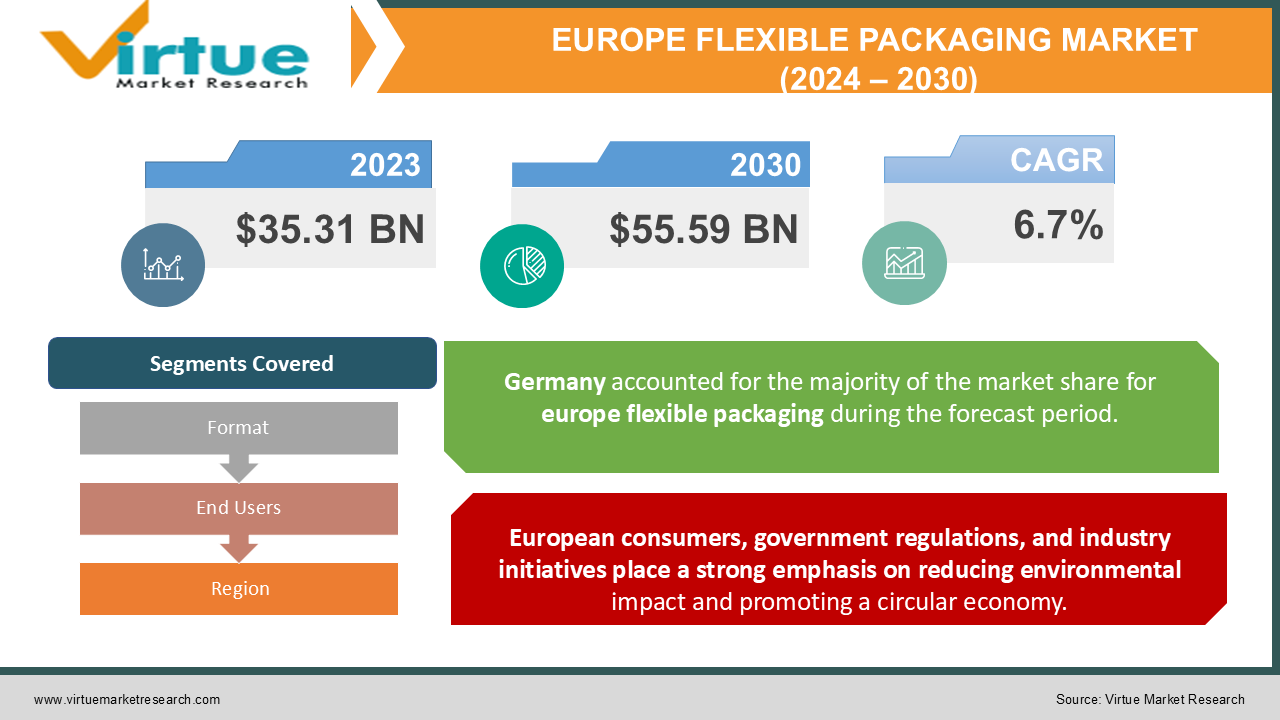

The Europe Flexible Packaging Market was valued at USD 35.31 Billion in 2023 and is projected to reach a market size of USD 55.59 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.7%.

The European flexible packaging market enjoys healthy growth, driven by its usage in food packaging (the largest segment) and significant opportunities in pharmaceuticals, cosmetics, and other sectors. Multi-layered laminates combining various plastics and sometimes aluminum are widely used. Increasingly, the focus is turning towards mono-material structures for improved recyclability. The industry is under intense pressure to innovate with sustainable solutions, addressing recyclability concerns and moving towards circular models. The market includes large multinationals, specialized converters, and smaller regional players, catering to varying needs and niche applications. The rise of e-commerce and smaller retail formats favor lightweight, space-efficient packaging. Consumer desire for convenience drives demand for single-serve, portable formats. Flexible packaging with active or intelligent attributes aids in extending the lifespan of fresh and perishable foods, reducing wastage. Specialized flexible packaging solutions are increasing due to strict regulations governing medicine packaging, storage, and tamper-evidence. Busy lifestyles and an increase in the on-the-go consumption of snacks and beverages directly benefit the growth of flexible packaging. While facing challenges, the demand for more eco-friendly flexible packaging strongly influences innovation and research efforts within the sector. The single-use nature of most flexible packaging is under intense scrutiny. Developing effective recycling systems, designing for recyclability, and incorporating recycled content are major challenges the industry is navigating.

Key Market Insights:

The European flexible packaging market exhibits robust growth fueled by demand from numerous end-use sectors. This growth outpaces traditional rigid packaging options. A strong focus on sustainability within the industry drives innovation towards recyclable, reduced-material, and bio-based flexible packaging solutions. Shifting consumer lifestyles, smaller households, and an emphasis on convenience and portability favor the adaptability of flexible packaging. Digital printing, smart packaging technologies, and advancements in barrier properties are expanding the capabilities of flexible packaging. The booming processed and convenience food industry in Europe relies heavily on flexible packaging for its functionality, efficiency, and shelf appeal. Growth in snacking culture, busy lifestyles, and demand for smaller portion sizes increase demand for pouches, sachets, and other portable packaging formats. The rise of online shopping creates a need for lightweight, protective, and shippable packaging solutions – benefits offered by various flexible formats. While facing scrutiny, flexible packaging is evolving to become more eco-friendly through recyclability, compostability, and reduced material usage.

Europe Flexible Packaging Market Drivers:

Fast-paced modern living, particularly in urban areas, favors convenient food solutions. Pre-packaged, ready-to-eat meals, snacks, and processed foods align perfectly with this need.

Longer working hours, commuting times, and packed schedules have become the norm, particularly in urbanized areas of Europe. This leaves limited time for traditional meal preparation. The increase in single-person households and smaller family units means less time and motivation for elaborate cooking for smaller quantities. For many consumers, leisure time and pursuits outside the kitchen are gaining more significance, leaving less desire to spend hours on food preparation. Processed and pre-prepared foods offer a solution to the time crunch. Quick heat-and-eat meals, ready-made salads, and packaged snacks cater to those seeking instant food options. Supermarkets and grocery stores with their extensive aisles of readily available packaged foods make them both easy to access and often offer economical choices. Flexible packaging is ideal for creating individual servings, snack-sized packs, and formats optimized for consumption ease - think squeeze pouches for fruit purees or single-serve meals. The printable surface of flexible packaging plays a vital role in attracting consumers. Brands use vibrant graphics, emphasize health claims, and use packaging to convey product information on the go.

European consumers, government regulations, and industry initiatives place a strong emphasis on reducing environmental impact and promoting a circular economy.

The European flexible packaging market finds itself at a crossroads. While its versatility and convenience drive its popularity, historical sustainability concerns regarding plastic waste and limited recyclability have cast a shadow. However, this very pressure has become a powerful driver for innovation, pushing the industry towards eco-conscious solutions and a transformation towards a circular economy. Negative public perceptions of plastic pollution and environmental concerns surrounding flexible packaging waste have spurred action. European Union (EU) directives and national regulations addressing plastic waste management and promoting recyclability play a significant role. While flexible packaging often uses less material than rigid alternatives, the challenge lies in discarded, non-recycled packaging ending up in landfills or polluting oceans. The complexity of multi-material laminates in some flexible packaging formats further complicates recycling efforts. The concept of a circular economy where materials are kept in use for as long as possible and waste is minimized, is becoming a guiding principle. In this context, flexible packaging manufacturers are rethinking their approach throughout the lifecycle, from material selection to design and post-consumer practices. A major push towards mono-material structures – made from a single type of plastic – is replacing complex multi-layer laminates. This simplifies recycling processes and increases recyclability rates.

Europe Flexible Packaging Market Restraints and Challenges:

Flexible packaging is often closely associated with the larger issue of plastic waste. Images of polluted oceans and overflowing landfills have tarnished the image of plastics, influencing consumer sentiment

Flexible packaging is often closely associated with the larger issue of plastic waste. Images of polluted oceans and overflowing landfills have tarnished the image of plastics, influencing consumer sentiment. Not all plastic-based flexible packaging is created equal. While some types lack viable recycling streams, painting the entire category with a broad brush misses the innovations and efforts being made toward sustainable solutions. Flexible packaging is frequently associated with single-serve, disposable products, reinforcing the image of wastefulness. This challenges the positive environmental role flexible packaging can play through efficient resource use and product protection. Environmentally conscious consumers may actively avoid products packed in flexible packaging materials traditionally considered non-recyclable, particularly for non-essential items. Some consumer goods companies might be hesitant to fully embrace flexible packaging solutions due to potential negative brand associations in the eyes of eco-conscious consumers. Growing societal focus on plastic waste drives stricter government regulations, potentially restricting certain materials or imposing more stringent recycling mandates. While some types of flexible packaging are recyclable, the reality is that adequate recycling infrastructure and collection systems are not universally available across Europe.

Europe Flexible Packaging Market Opportunities:

Rising demand for fresh, minimally processed food aligns with the opportunity to develop flexible packaging that protects and preserves without compromising the 'natural' appeal. Shipping fresh products requires packaging with the right barrier properties to prevent spoilage in transit and maintain quality until delivery. Developments in digital printing techniques enable vibrant colors, photorealistic imagery, and custom branding for flexible packaging, making it an effective marketing tool. Embedding technologies into flexible packaging expands functionality, enhances consumer interaction, and provides insights to brands. Time-temperature indicators or sensors that detect potential spoilage can improve quality control, increase consumer confidence, and potentially reduce food waste. Integrating features that make flexible packaging difficult to replicate helps combat counterfeit products, crucial for high-value goods and pharmaceuticals. The pharmaceutical industry requires packaging solutions offering exceptional barrier properties, tamper-evidence, and stability to protect medications and ensure safety. Multi-layer films, high-grade laminates, and formats like blister packs or pouches designed for single doses are crucial in pharmaceutical packaging. Europe's aging population increases the need for accessible and convenient pharmaceutical packaging formats that seniors can easily open and handle.

EUROPE FLEXIBLE PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Format, end users, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, UK, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Berry Global, Amcor, Constantia Flexibles , Mondi Group, Coveris, Wipak, Clondalkin Flexoplast |

Europe Flexible Packaging Market Segmentation:

Europe Flexible Packaging Market Segmentation: By Format -

- Pouches

- Bags

- Films and Wraps

- Liners

Pouches (45%): The workhorse format due to its versatility and adaptability. Boast excellent shelf presence and consumer convenience. They are widely used for snacks, dry foods, pet food, and increasingly for liquid products. Offer controlled dispensing of liquids, sauces, purees, and semi-solid products. Popular for baby food, beverages, and household products. Bags (20%): Simple, cost-effective, and used across various industries. Cost-effective solutions for numerous products. Think poly bags for bakery or produce items. Side folds allow for greater volume and stability, ideal for bulkier products. Films and Wraps (25%): Essential for both individual product wrapping and as components of laminates. They are used to wrap individual products or bundle items together, often for food and consumer goods. Highly elastic film wrapped tightly around products or pallets for securing and protecting them during transport. Liners (5%): Specialized applications with reliable share. Large flexible liners for storing and transporting dry bulk goods (chemicals, grains, etc.). Fit within drums or barrels to contain liquids, semi-solids, or hazardous materials.

Europe Flexible Packaging Market Segmentation: By End Use -

- Food and Beverage

- Pharmaceuticals and Healthcare

- Personal Care and Cosmetics

- Industrial and Chemical

Food and Beverage (55%): The cornerstone of the flexible packaging market. The wide array of food and beverage products drives enormous demand for flexible packaging. Simple films for overwrapping to multi-layer barrier packaging for extended shelf-life – this industry requires it all. Pharmaceuticals and Healthcare (15%): Strict requirements drive specialized solutions. Flexible packaging for this industry prioritizes barrier properties for product protection, stability, and tamper-evidence. Regulations heavily influence design choices. The aging population increases the demand for accessible and user-friendly medication packaging. Personal Care and Cosmetics (10%): Diverse formats for various product types. Branding, aesthetics, and functionality play a significant role alongside product protection. Pouches, sachets, tubes, and even shrink sleeves find ample use in this industry. Travel-friendly and sample-size packaging fuelled by trial and portability. Emphasis on dispensing solutions (pumps, spouts) for controlled product use. Industrial and Chemical (10%): Heavy-duty and protective packaging needs. This segment demands tough, protective, and often highly specialized flexible packaging. Heavy-duty sacks for raw materials, agricultural products, or construction materials. Packaging for chemicals or potentially hazardous substances requiring specific barrier properties. Growth in specific industrial sectors drives demand for tailored packaging.

Europe Flexible Packaging Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany (25%): Strong manufacturing base, extensive use in processed foods. Emphasis on barrier properties, precise printing, and high-performance packaging aligns with its strong engineering reputation. Proactive in developing recyclable and eco-conscious flexible packaging solutions. France (15%): A major manufacturing hub with a large, processed food sector drives significant demand for flexible packaging. Consumers are drawn to premium and aesthetically pleasing packaging, with innovation in both design and materials. Navigating packaging regulations and focusing on sustainability shape innovation within the French market. Italy (12%): Significant food industry, a major driver for packaging innovation. The abundance of food and beverage manufacturers translates to a vast need for flexible packaging solutions. Known for design excellence, Italian packaging often prioritizes visual appeal alongside functionality. UK (10%): Mature market, with evolving demands for convenience and sustainable solutions. Flexible packaging use is widespread across various sectors, contributing to a mature market structure. Changing consumer preferences, demands for on-the-go pack formats, and sustainability concerns impact packaging choices. Spain (8%): Food and beverage packaging needs to expand with economic growth. Growth in convenience foods, snacks, and beverages creates increasing demand for flexible packaging. Significant fruit and vegetable production generates a need for packaging solutions focusing on freshness and extended shelf-life. Rest of Europe (30%): A mix of established markets and those with high growth potential. Developing nations in Eastern Europe show strong potential, driven by economic progress and changes in retail landscapes.

COVID-19 Impact Analysis on the Europe Flexible Packaging Market:

Initial lockdowns, factory closures, and border restrictions created supply chain bottlenecks. This led to delays in raw material sourcing and impacted production schedules, particularly for converters relying on global imports. Illness, quarantine measures, and worker hesitation caused temporary labor shortages. This impacted flexible packaging manufacturing capabilities. The surge in demand for certain packaging types combined with supply chain disruptions created volatility in the pricing of raw materials like polymers. Panic buying and stockpiling behaviors early in the pandemic temporarily skewed buying patterns, putting pressure on inventory management for specific product categories. Lockdowns and social distancing measures fueled a surge in online shopping—this increased demand for flexible packaging suitable for shipping and handling of consumer goods. Heightened awareness about hygiene and safety boosted the use of flexible packaging. It was seen as a way to protect products, minimize contamination, and provide tamper-evidence. Shifts towards increased at-home cooking and stockpiling drove up demand for flexible packaging solutions for food products. This includes packaging with extended shelf-life capabilities.

Latest Trends/ Developments:

The focus is shifting from mere recyclability towards designing packaging with its entire lifecycle in mind. This is driven by stricter regulations and growing consumer preference for eco-conscious choices. Replacing complex multi-layer laminates with recyclable mono-material structures (using a single polymer type) is an area of significant innovation and investment. Brands, driven by sustainability targets, are increasing their demand for flexible packaging incorporating recycled materials (post-consumer or post-industrial waste). Research into renewable resources like starches and biopolymers continues. Compostable options, where suitable infrastructure exists, are gaining interest, particularly for specific food packaging applications. The rise of smart, connected packaging is transforming how flexible packaging interacts with consumers and supply chains.

Key Players:

- Berry Global

- Amcor

- Constantia Flexibles

- Mondi Group

- Coveris

- Wipak

- Clondalkin Flexoplast

Chapter 1. Europe Flexible Packaging Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Flexible Packaging Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Flexible Packaging Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Flexible Packaging Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Flexible Packaging Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Flexible Packaging Market– By Format

6.1. Introduction/Key Findings

6.2. Pouches

6.3. Bags

6.4. Films and Wraps

6.5. Liners

6.6. Y-O-Y Growth trend Analysis By Format

6.7. Absolute $ Opportunity Analysis By Format, 2024-2030

Chapter 7. Europe Flexible Packaging Market– By End Use

7.1. Introduction/Key Findings

7.2 Food and Beverage

7.3. Pharmaceuticals and Healthcare

7.4. Personal Care and Cosmetics

7.5. Industrial and Chemical

7.6. Y-O-Y Growth trend Analysis By End Use

7.7. Absolute $ Opportunity Analysis By End Use , 2024-2030

Chapter 8. Europe Flexible Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Format

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Flexible Packaging Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Berry Global

9.2. Amcor

9.3. Constantia Flexibles

9.4. Mondi Group

9.5. Coveris

9.6. Wipak

9.7. Clondalkin Flexoplast

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Hectic modern lifestyles, especially in urban areas, prioritize convenience. Pre-packaged and ready-to-eat foods aligned with this need heavily rely on flexible packaging.

Despite its many advantages, flexible packaging significantly contributes to plastic waste. Limited recyclability of multi-layered materials and reliance on single-use formats often lead to landfill disposal or environmental pollution.

Berry Global, Amcor, Constantia Flexibles, Mondi Group, Coveris

Wipak.

Germany currently holds the largest market share, estimated at around 25%.

Several nations in Eastern Europe, like Poland, Hungary, and others, are experiencing economic expansion. This growth translates into increasing disposable incomes and evolving consumption patterns, fueling the demand for packaged goods.