Europe Flavored Water Market Size (2024-2030)

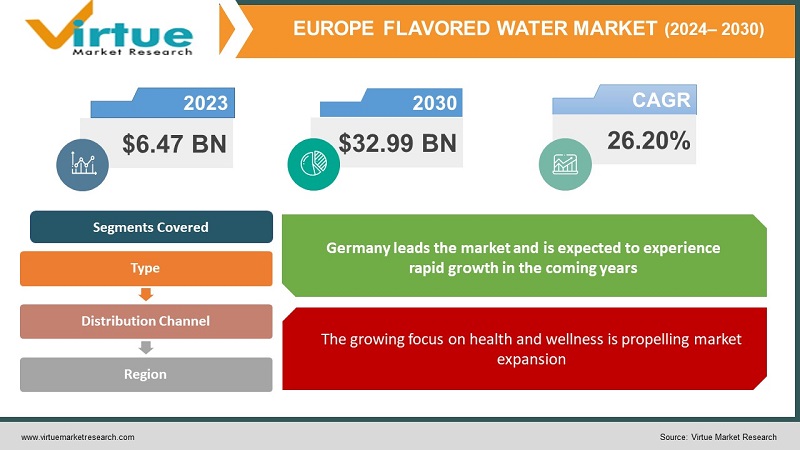

The Europe Flavored Water Market was valued at USD 6.47 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 32.99 billion by 2030, growing at a CAGR of 26.20%.

Flavored water serves as a nutritious substitute for sugary beverages, attracting individuals who desire hydration with enhanced taste. The market is experiencing a surge in the introduction of new flavors, catering to diverse consumer preferences and presenting a broad spectrum of options. Additionally, convenient packaging designed for on-the-go consumption enhances the market's attractiveness by aligning with the fast-paced lifestyles of consumers.

Key Market Insights:

- The factors fueling the growing demand for flavored and functional water include an aging demographic, increasing obesity rates, heightened urbanization, and a rise in disposable income that allows consumers to invest in premium products.

- Additionally, evolving consumer tastes and preferences, along with shifting lifestyles, play a significant role in this trend.

Europe Flavored Water Market Drivers:

The growing focus on health and wellness is propelling market expansion.

In the European market, the increasing emphasis on health and wellness is making flavored and functional waters increasingly prominent among consumers. Both inorganic and organic strategies are being employed by various established water brands from other regions to expand into European countries. A notable example is Coca-Cola's entry into this sector through its acquisition of the energy brand Glaceau, along with its fortified beverage line, Vitaminwater. Companies are leveraging innovative marketing strategies to highlight the health benefits of flavored and functional water. The compound annual growth rate (CAGR) is being driven by consumer preference for flavorful and healthy alternatives to sugary beverages. Additionally, adolescents are consuming energy drinks and other functional beverages, believing they enhance performance, stamina, and alertness. The demand for quick energy boosts is also propelling interest in energy drinks, influenced by unpredictable work schedules and an increase in social activities. Health-conscious consumers are gravitating toward nutritious and sugar-free options due to a growing awareness of the importance of an active lifestyle and the rising prevalence of lifestyle-related diseases.

Moreover, sales of flavored and functional water have been significantly influenced by promotions and advertising since their inception. Both businesses and consumers recognize that functional beverages are effectively distributed through supermarket and hypermarket retail channels. Private labels and international brands supply the flavored and functional water available in these stores. Supermarkets and hypermarkets have become the preferred retail formats for European consumers due to their competitive pricing and convenient one-stop shopping experiences. These formats appeal to residents and those with modern lifestyles because of the negotiating power, dynamism, and strategic locations they offer. Additionally, canned flavored and functional waters, including energy drinks, enjoy a higher market penetration rate due to their availability in various retail locations and their suitability for on-the-go consumption. These factors have significantly contributed to the growth of the flavored and functional water industry in Europe, thus driving revenue in this market segment.

Europe Flavored Water Market Restraints and Challenges:

Rising environmental awareness poses challenges to market growth.

Bottled flavored water contributes to plastic waste, raising environmental concerns. The increasing focus on sustainability, along with heightened awareness of plastic pollution, may affect consumer preferences and encourage the adoption of more eco-friendly alternatives.

Customer perceptions are limiting market growth.

Concerns about artificial flavors, sweeteners, and additives lead some consumers to perceive flavored water as less healthy or natural than plain water. This belief may deter health-conscious individuals from pursuing flavored water options.

High pricing limits market growth.

Flavored water is often priced higher than plain water, which can restrict its adoption, especially in price-sensitive markets. Consumers may be reluctant to pay a premium for flavored water when they can easily add flavor to regular water at a lower cost or opt for other more affordable beverage choices.

Europe Flavored Water Market Opportunities:

Product development that introduces new offerings attracts customers, contributing to market growth.

Product innovation, including the launch of new flavors, functional additives, and distinctive formulations, creates opportunities to attract and engage customers. By leveraging evolving consumer preferences and introducing unique offerings, companies can differentiate themselves from the competition.

Collaboration with Food Service Providers creates opportunities.

Collaborating with restaurants, cafes, and food service providers to include flavored water on their beverage menus enhances visibility and consumption. Partnerships with hospitality establishments can help build brand awareness and facilitate the introduction of new products.

Eco-friendly packaging creates more opportunities.

The increasing focus on eco-friendly packaging presents opportunities for flavored water companies to adopt sustainable alternatives. Brands that prioritize environmentally responsible practices and materials can gain a competitive edge by attracting environmentally conscious consumers.

EUROPE FLAVORED WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

26.20% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

The Coca-Cola Company, PepsiCo Inc., Groupe Danone, Sunny Delight Beverages Company, New York Spring Water, Kraft Foods, Nestle SA., Balance Water Company, Aquafina FlavorSplash, Cargill Inc. |

Europe Flavored Water Market Segmentation:

Europe Flavored Water Market Segmentation By Type:

- Still Flavored Water

- Sparkling Flavored Water

The sparkling flavored water segment currently holds the largest revenue share and is projected to continue expanding in the coming years. The rising demand for flavored bubbly and fizzy hydration products is expected to drive this segment's growth, as consumers increasingly favor sparkling options for their taste, effervescence, and health benefits. Notable brands, such as Nestlé Pure Life, offer a variety of zero-calorie and zero-sweetener flavored options in different fruit varieties.

Key players are responding to the evolving preferences of health-conscious consumers by launching new products. Conversely, the still flavored water segment is expected to experience the fastest compound annual growth rate (CAGR) during the forecast years. The availability of a diverse range of still water products enriched with minerals, antioxidants, vitamins, and caffeine is likely to boost this segment's growth. Additionally, concerns regarding the impact of sparkling drinks on bone mineral density and dental health are driving many consumers toward still alternatives.

The growing availability of still variants infused with various fruits, such as watermelon, blueberry, blackberry, lemon, mango, pomegranate, and mandarin orange, is further increasing the consumption of these products.

Europe Flavored Water Market Segmentation By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Specialist Stores

- Others

The sparkling flavored water segment currently holds the largest revenue share and is projected to continue expanding in the coming years. The rising demand for flavored bubbly and fizzy hydration products is expected to drive this segment's growth, as consumers increasingly favor sparkling options for their taste, effervescence, and health benefits. Notable brands, such as Nestlé Pure Life, offer a variety of zero-calorie and zero-sweetener flavored options in different fruit varieties.

Key players are responding to the evolving preferences of health-conscious consumers by launching new products. Such innovations are anticipated to further enhance segment growth throughout the forecast period.

Conversely, the still flavored water segment is expected to experience the fastest compound annual growth rate (CAGR) during the forecast years. The availability of a diverse range of still water products enriched with minerals, antioxidants, vitamins, and caffeine is likely to boost this segment's growth. Additionally, concerns regarding the impact of sparkling drinks on bone mineral density and dental health are driving many consumers toward still alternatives.

The growing availability of still variants infused with various fruits, such as watermelon, blueberry, blackberry, lemon, mango, pomegranate, and mandarin orange, is further increasing the consumption of these products.

Europe Flavored Water Market Segmentation- by region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Europe holds a substantial share of the global market for flavored and functional waters. Natural flavored and naturally carbonated waters, rich in minerals, appeal particularly to health-conscious consumers. The flavors in these drinks are often derived from natural fruit extracts. Sales are robust in several countries, including Germany, the U.K., Italy, Spain, and France, where these products are frequently served alongside meals in restaurants.

Germany leads the market and is expected to experience rapid growth in the coming years. Consumers looking to stay hydrated while meeting their daily nutritional needs often gravitate toward functional waters enriched with nutrients. The visually appealing packaging, characterized by elegant labels and distinctive bottle shapes, helps these products stand out on store shelves. Additionally, the demand for flavorful and healthy alternatives to sugary beverages is driving the market for flavored and functional water in Germany.

The Coca-Cola Company’s Glacéau Vitaminwater brand has made its entrance into the German market after gaining popularity internationally. The initial focus is on Hamburg, with plans to expand into Munich, Cologne, Berlin, and beyond. German consumers tend to prioritize the quality of functional waters over price, indicating that well-known brands are perceived to offer higher quality than private label options, likely resulting in stronger sales for these established brands.

COVID-19 Pandemic: Impact Analysis

The market experienced significant growth during the COVID-19 pandemic, driven by heightened health concerns that increased demand for flavored hydration products fortified with minerals and vitamins. This trend was particularly pronounced among health-conscious consumers with mid- to high-income levels.

Latest Trends/ Developments:

March 2022: PepsiCo introduced Gatorade Fit, a new electrolyte beverage aimed at fitness enthusiasts that contains no added sugar, artificial flavors, sweeteners, or colors. The company claims that the drink contains antioxidants, vitamins A and C, along with electrolytes derived from watermelon and sea salt.

Key Players:

These are top 10 players in the Europe Flavored Water Market :-

- The Coca-Cola Company

- PepsiCo Inc.

- Groupe Danone

- Sunny Delight Beverages Company

- New York Spring Water

- Kraft Foods

- Nestle SA.

- Balance Water Company

- Aquafina FlavorSplash

- Cargill Inc.

Chapter 1. EUROPE FLAVORED WATER MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. EUROPE FLAVORED WATER MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. EUROPE FLAVORED WATER MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. EUROPE FLAVORED WATER MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. EUROPE FLAVORED WATER MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. EUROPE FLAVORED WATER MARKET – By Types

6.1. Introduction/Key Findings

6.2. Still Flavored Water

6.3. Sparkling Flavored Water

6.4. Y-O-Y Growth trend Analysis By Types

6.5. Absolute $ Opportunity Analysis By Types , 2024-2030

Chapter 7. EUROPE FLAVORED WATER MARKET – By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3. Convenience Stores

7.4. Online Stores

7.5. Specialist Stores

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. EUROPE FLAVORED WATER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Distribution Channel

8.1.3. By Types

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. EUROPE FLAVORED WATER MARKET – Company Profiles – (Overview, Product Types Portfolio, Financials, Strategies & Development

9.1. The Coca-Cola Company

9.2. PepsiCo Inc.

9.3. Groupe Danone

9.4. Sunny Delight Beverages Company

9.5. New York Spring Water

9.6. Kraft Foods

9.7. Nestle SA.

9.8. Balance Water Company

9.9. Aquafina FlavorSplash

9.10. Cargill Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

In the European market, the increasing emphasis on health and wellness is making flavored and functional waters increasingly prominent among consumers. Both inorganic and organic strategies are being employed by various established water brands from other regions to expand into European countries

The top players operating in the Europe Flavored Water Market are - The Coca-Cola Company, PepsiCo Inc., Groupe Danone, Sunny Delight Beverages Company, New York Spring Water, Kraft Foods, Nestle SA., Balance Water Company, Aquafina FlavorSplash, Cargill Inc.

The market experienced significant growth during the COVID-19 pandemic, driven by heightened health concerns that increased demand for flavored hydration products fortified with minerals and vitamins

March 2022: PepsiCo introduced Gatorade Fit, a new electrolyte beverage aimed at fitness enthusiasts that contains no added sugar, artificial flavors, sweeteners, or colors.

Germany leads the market and is expected to experience rapid growth in the coming years.