Europe Fish Feed Market Size (2024-2030)

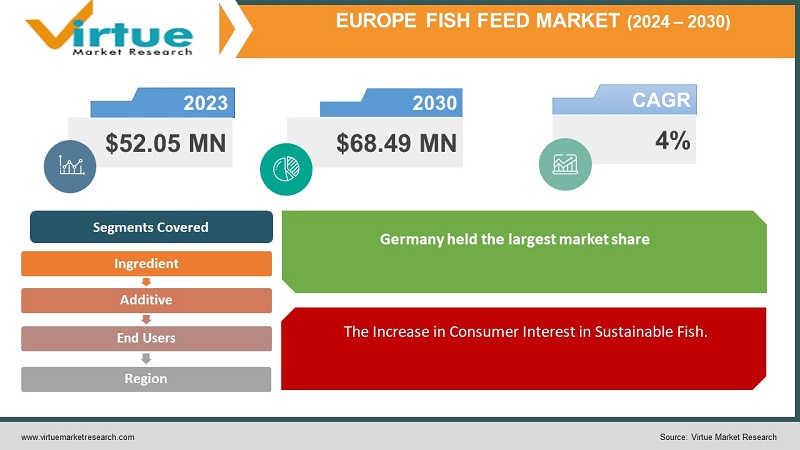

The European Fish Feed Market was valued at USD 52.05 million and is projected to reach a market size of USD 68.49 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4% between 2024 and 2030.

Fish feed plays a crucial 74role in contemporary commercial aquaculture by giving farmed fish the well-balanced nutrients they require. The concentrated and steady nutrition that the feeds, which come in pellet or granule form, give allows the fish to grow to their maximum capacity and feed effectively. Traditionally, fishmeal and fishing oil have been two of the most crucial components. There are two primary themes in the development of dry pelleted fish meals thus far. Enhancing digestibility and fine-tuning the nutritional balance are two main themes to better meet the needs of various fish species at different stages of development. Enhancing the ingredients' sustainability is the second kind. The primary means of doing this is finding more sustainable ingredient sources, especially to lessen the reliance on fish oil and fishmeal. Enhancing feeding effectiveness contributes to sustainability as well. Population increase, growing incomes, and fast urbanization are the main drivers of the European fish feed business, which is further helped by the robust expansion of fish production and more effective delivery networks. According to observers like the Food and Agriculture Organization of the United Nations, aquaculture must fill the void left by the inability to sustainably expand the yield from wild catch.

Key Market Insights:

Though it has grown modestly overall, the European fish feed business is changing due to a greater emphasis on sustainability and innovation. The industry's main trends include a move toward sustainable methods, with fish feed manufacturers spearheading initiatives to provide environmentally friendly substitutes. This means that the usage of plant-based proteins, such as soybean meal, has increased significantly. Additionally, research into other protein sources, including insect-based feed and fish scraps, is still ongoing. Additionally, the development of sophisticated aquaculture systems such as offshore fish farms and recirculating aquaculture systems (RAS) calls for the use of specific feeds to maintain fish health, growth rates, and effective nutrient conversion. Fish feed that upholds these ideals is becoming more and more necessary as consumer preferences change and there is a growing need for seafood that is supplied ethically and healthily. Potential price swings brought on by the hefty price of conventional fishmeal and fish oil are still a cause for concern, though. Despite these obstacles, the European fish feed business is growing to meet industry expectations; innovation and sustainability are major forces behind the development of solutions that satisfy consumers who care about the environment as well as fish.

Europe Fish Feed Market Drivers:

Increasing the Volume of Fish Feed Needed for European Aquaculture Growth.

The aquaculture sector in Europe is expanding rapidly as a sustainable means of satisfying the growing demand for seafood, especially in light of the depletion of wild fish supplies. Fish farming, often known as aquaculture, has become a major part of seafood production in the European Union. An increasingly important link in the region's seafood supply chain is aquaculture, which has the potential to reduce strain on wild fish populations. Fish feed is becoming more and more necessary to feed farmed fish as the aquaculture industry grows to satisfy rising customer demand. This increase in demand highlights how important fish feed manufacturers are to the long-term viability of the European aquaculture sector, guaranteeing a steady supply of premium seafood while reducing environmental

impact.

The Increase in Consumer Interest in Sustainable Fish.

The environmental effects of the dietary choices that European consumers make are gaining more and more attention, especially when it comes to seafood. The demand for sustainable seafood products has significantly increased throughout the region as a result of this increased awareness. To satisfy this rising customer demand, fish farmers are aggressively adopting sustainable aquaculture techniques. This move toward sustainability includes not only farming practices but also the components of fish feed. Fish feed manufactured from sustainable materials is in higher demand as consumers prefer goods that share their ideals of ethical sourcing and environmental responsibility. Aquaculture is changing as a result of customer demand for sustainability, which is pushing producers to use more environmentally friendly supply chain procedures. As a result, the focus on sustainability in the seafood business is stimulating innovation and investment in sustainable aquaculture solutions, as well as positive transformation within the sector.

Europe Fish Feed Market Restraints and Challenges:

Even with its focus on sustainability, the European fish feed sector faces several obstacles that prevent it from expanding as planned. The region's total need for fish feed is severely constrained by the stagnating expansion of European aquaculture. Furthermore, finding inexpensive, high-quality raw materials is still a difficult task, made worse by worries about the volatile cost of conventional fishmeal and the scarcity of substitute protein sources. Complicating conditions for farmers are stricter restrictions that control feed mix and environmental impact. These limitations highlight the need for ongoing innovation in the creation of affordable and sustainable feed compositions. The European fish feed industry can effectively traverse the complex market landscape and secure a lucrative and sustainable future for the aquaculture sector in the region by tackling these problems and promoting innovations in feed technology.

Europe Fish Feed Market Opportunities:

Businesses that can meet important industry and consumer expectations will find great potential in the European fish feed sector. The demand for creative fish feed solutions is high due to the increased emphasis on sustainable aquaculture methods. Creating scalable and affordable methods of producing plant-based proteins and insect-based feed components is part of this. In addition, the emergence of sophisticated aquaculture systems such as RAS necessitates customized feeds, creating a market for businesses capable of creating these diets. European fish feed companies might potentially secure long-term growth by tapping into new markets and meeting the changing needs of fish farmers, as well as ecologically concerned customers.

EUROPE FISH FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Ingredient, additive, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, UK, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Skretting (Nutreco), BioMar Group, Cargill Aqua Nutrition (EWOS), Alltech Coppens, Aller Aqua Group |

Europe Fish Feed Market Segmentation:

Europe Fish Feed Market Segmentation By Ingredient

- Corn

- Soybean

- Fish Oil

- Fish Meal

- Additives

- Other Ingredients

The Europe Fish Feed Market is Segmented by Ingredient, Fish oil held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Since fish oil gives fish energy and helps them absorb nutrients, it has long been a mainstay in fish feed. Its abundance of omega-3 fatty acids is also important for fish health, growth, and reproduction. Fish oil was the go-to option because alternate sources of protein and fat were either hard to come by or not very cost-effective. However, evolving patterns in the European fish feed industry point to a slow erosion of its hegemony. The significance of fish oil has been reevaluated due to concerns about sustainability brought on by overfishing and unstable pricing dynamics. As such, there's been a spike in the market's investigation and acceptance of sustainable substitutes, like plant-based oils. Fish oil may still hold a sizable portion of the market today, but as the industry shifts to more affordable and sustainable feed formulations, its dominance is predicted to decline. This change is indicative of a larger commitment to environmental stewardship and shows how the European Fish Feed Market is evolving to become a more resilient and sustainable industry.

Europe Fish Feed Market Segmentation By Additive:

- Vitamins

- Antibiotics

- Amino Acids

- Antioxidants

- Feed Acidifiers

- Feed Enzymes

- Other Additives

The European fish Feed Market is Segmented by Additive, Vitamins held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Vitamins are the most common additives in the European fish feed market because they are essential for maintaining the best possible health, growth, and immune system performance in farmed fish. Like any other animal, fish need a well-balanced diet full of vital elements to survive, and vitamins are an important component of this. Every vitamin has a distinct purpose that is essential to fish health, ranging from immune system support to bone and vision development. Furthermore, fish feed compositions' restricted natural vitamin sources require the direct inclusion of vitamins to guarantee fish get the necessary concentrations of every essential nutrient. In the end, this focused supplementation boosts production and profitability in fish farms by improving overall efficiency and helping to improve fish health. Even while vitamins dominate the additives market, it's important to recognize the value of other additives as well, such as probiotics, minerals, and antioxidants, each of which has a special function in promoting fish health and enhancing aquaculture production methods in Europe. The fact that vitamins are so widely used in the European fish feed market highlights their critical role in preserving fish welfare and promoting sustainability.

Europe Fish Feed Market Segmentation By End Users :

- Fish

- Molluscs

- Crustaceans

The European fish Feed Market is Segmented by End Users, Fish held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The "End User" segmentation of the European fish feed market serves a variety of aquaculture operations. The "Fish" segment is the main participant, while mollusks (shellfish) and crustaceans (shrimp, prawns) have their segments. The emphasis on finfish (salmon, trout, carp, etc.) is because these species are consumed more frequently in Europe than shellfish and crustaceans. The need for fish feed in this market is also driven by the larger-scale operations of finfish farms. Finfish continues to rule the market despite the contributions of mollusks and crustaceans because of established consumer preferences and higher production quantities.

Europe Fish Feed Market Segmentation By Region:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

The European fish Feed Market is Segmented by Region, Germany held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Given its thriving aquaculture sector, which drives significant domestic demand for fish feed, especially for freshwater species like carp and trout, Germany's dominance in the European fish feed market makes sense. Furthermore, Germany's location in central Europe provides strategic access to important markets around the continent, which may allow German manufacturers of fish feed to cater to a wide range of clientele. The German fish feed market is renowned for using cutting-edge technologies and for producing feed formulas that are both high-quality and maybe more effective. Even though Germany is probably at the top of the market, it's important to take into account other major players, such as the Nordic and Southern European countries, who also have robust aquaculture businesses. A thorough analysis of regional market share comparisons would shed further light on Germany's dominant position in the European fish feed industry. All things considered, Germany's diverse strengths place it in a strong position to influence the dynamics and innovation of the industry.

COVID-19 Impact Analysis on the Europe Fish Feed Market:

The COVID-19 pandemic significantly affected supply chains, demand, labor, and market trends in the aquaculture industry, which in turn created substantial disruptions in the European fish feed market. Lockdowns and other limitations made it difficult to move the raw materials needed to produce fish feed, which led to shortages and price swings. Fish consumption declined as a result of reduced demand brought on by restaurant closures and economic uncertainty, which also reduced the need for fish feed. Production capacity was further hampered by social distancing policies and illness-related labor shortages. Furthermore, the pandemic highlighted the fragility of intricate supply chains, which may eventually lead to a change in sourcing practices toward more regional and sustainable ones. The market is expected to gradually revive with the restaurant industry's recovery and increased customer confidence, but it is unclear how COVID-19 will affect consumer behavior and aquaculture practices in the long run. Resilience and adaptation are probably going to be important variables determining how the European fish feed business develops in the future.

Latest Trends/ Developments:

Though overall growth has been flat in recent years, there have been major shifts in the European fish feed business. One of the main trends influencing the market is the increased focus on sustainability, which is demonstrated by the rise in demand for fish feed derived from sustainable sources like soy and insect protein, which are plant-based proteins. Furthermore, the advent of novel farming techniques such as offshore fish farms and recirculating aquaculture systems (RAS) need customized feeds that are adapted to specific environmental circumstances. This is encouraging the investigation of substitute protein sources, especially considering the ongoing price volatility of conventional feed ingredients such as fishmeal and fish oil. Consolidation has an impact on market dynamics as well, with significant firms like Skretting and Bio Mar controlling the market and consistently innovating to meet changing industry demands. Although the COVID-19 pandemic initially caused market disruption, there are indications of recovery, since restaurant demand for seafood is increasing. However, it is unclear how this will affect consumer behavior in the long run. Producers must navigate an ever-changing landscape that presents both possibilities and challenges as the market adjusts to new aquaculture practices and places a greater emphasis on sustainability.

Key players:

- Skretting (Nutreco)

- BioMar Group

- Cargill Aqua Nutrition (EWOS)

- Alltech Coppens

- Aller Aqua Group

Chapter 1. Europe Fish Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Fish Feed – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Fish Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Fish Feed - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Fish Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Fish Feed Market– By Ingredient

6.1. Introduction/Key Findings

6.2. Corn

6.3. Soybean

6.4. Fish Oil

6.5. Fish Meal

6.6. Additives

6.7. Other Ingredients

6.8. Y-O-Y Growth trend Analysis By Ingredient

6.9. Absolute $ Opportunity Analysis By Ingredient , 2024-2030

Chapter 7. Europe Fish Feed Market– By Additive

7.1. Introduction/Key Findings

7.2 Vitamins

7.3. Antibiotics

7.4. Amino Acids

7.5. Antioxidants

7.6. Feed Acidifiers

7.7. Feed Enzymes

7.8. Other Additives

7.9. Y-O-Y Growth trend Analysis By Additive

7.10. Absolute $ Opportunity Analysis By Additive , 2024-2030

Chapter 8. Europe Fish Feed Market– By End-user

8.1. Introduction/Key Findings

8.2. Fish

8.3. Molluscs

8.4. Crustaceans

8.5. Y-O-Y Growth trend Analysis End-user

8.6. Absolute $ Opportunity Analysis End-user , 2024-2030

Chapter 9. Europe Fish Feed Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Ingredient

9.1.3. By Additive

9.1.4. By End-user

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Fish Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Skretting (Nutreco)

10.2. BioMar Group

10.3. Cargill Aqua Nutrition (EWOS)

10.4. Alltech Coppens

10.5. Aller Aqua Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Fish Feed market is expected to grow at a 4% CAGR through 2030.

The Europe Fish Feed market is expected to reach USD 68.49 million by 2030.

The Fish Oil sector drives the Europe market.

By 2023, the Europe Fish Feed market is expected to be valued at USD 52.05 million.

The UK dominates the Europe Fish Feed market