Europe Fillings And Toppings Market Size (2024-2030)

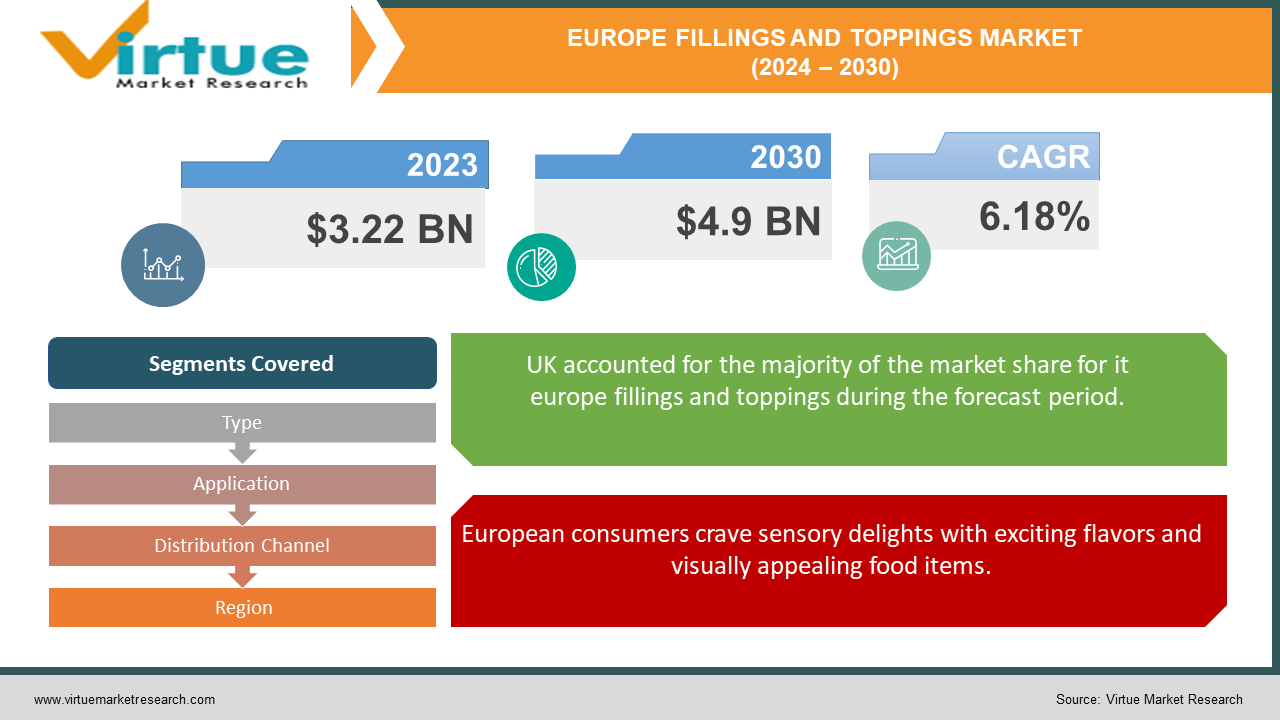

The Europe Fillings And Toppings Market was valued at USD 3.22 billion in 2023 and is projected to reach a market size of USD 4.9 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6.18%.

The European Fillings and Toppings Market is a powerhouse, leading the global scene thanks to established food cultures in countries like France and Germany. Consumers in Europe have a sweet tooth, driving demand for exciting flavor combinations and visually appealing treats. This trend is fueled by the rise of home baking and the popularity of customized desserts. The convenience food sector is another growth engine, relying on these ingredients to add variety to their offerings.

Key Market Insights:

The trend is amplified by the rise of home baking, with fruits and nuts being the most widely used type at over 50% of the market share due to their versatility in pastries, desserts, and yogurts. Convenience food is another major driver, relying on fillings and toppings for variety.

However, the market faces the challenge of balancing indulgence with health. While consumers seek exciting flavor profiles, there's a growing focus on healthy lifestyles. This translates to a demand for lower sugar and fat content in fillings and toppings. Manufacturers must navigate this by creating innovative products.

The Europe Fillings And Toppings Market Drivers:

European consumers crave sensory delights with exciting flavors and visually appealing food items.

European consumers are increasingly seeking out multi-sensorial flavor experiences that tantalize their taste buds and create a visually stunning presentation. This translates to a demand for innovative fillings and toppings that boast unique flavor profiles and eye-catching colors. Imagine pastries bursting with vibrant fruit fillings or cupcakes adorned with creatively colored sprinkles. This focus on aesthetics is further fueled by the rise of social media, where people share pictures of their culinary creations.

The rise of home baking and customization fuels the demand for a wider variety of fillings and toppings.

The home baking trend is experiencing a surge in popularity, driven by a desire for fresh, personalized baked goods. Consumers are no longer satisfied with mass-produced options; they crave the customization and satisfaction that comes from creating their desserts. This trend fuels the demand for a wider variety of fillings and toppings, allowing home bakers to experiment with different flavor combinations and textures. From classic favorites like chocolate and cream to trendy options like salted caramel and exotic fruits, a diverse selection caters to every baking enthusiast's creativity.

Convenience food relies on easy integration of fillings and toppings into existing production lines.

The fast-paced lifestyle of modern Europeans has led to a booming convenience food sector. These pre-made meals and snacks rely heavily on fillings and toppings to add taste and variety to their offerings. Manufacturers are constantly innovating to develop easy-to-use and integrated solutions that can be incorporated into existing production lines. Think frozen yogurt parfaits with a variety of fruit and nut toppings or pre-made pancake mixes bundled with delicious syrup flavors.

A shift towards healthier lifestyles is driving demand for fillings and toppings with lower sugar and fat content.

While indulgence remains a key driver, European consumers are becoming increasingly health conscious. This shift in focus translates to a demand for fillings and toppings with lower sugar and fat content. Manufacturers are responding to this trend by exploring alternative sweeteners, incorporating healthy fats like nuts and seeds, and creating sugar-reduced options that still deliver a satisfying flavor experience. This allows consumers to enjoy their favorite treats without compromising on their well-being.

The Europe Fillings And Toppings Market Restraints and Challenges:

The European Fillings and Toppings Market, although a leader, faces challenges that can curb its growth. Europeans are increasingly aware of the link between sugary, fatty fillings and toppings, often laden with artificial ingredients, and health problems like obesity and diabetes. This translates to a decline in demand for traditional options that are high in sugar and fat.

Another challenge is the unpredictable nature of raw material prices. When raw material prices rise, it can squeeze profit margins for manufacturers. They may be forced to raise their prices, potentially leading to sticker shock for consumers and impacting purchasing decisions.

The European Fillings and Toppings Market is also becoming increasingly competitive. New players are entering the scene, all vying for a slice of the pie alongside established brands. This fierce competition can lead to price wars, putting pressure on manufacturers to differentiate themselves. The market needs to be responsive to these evolving preferences by offering inclusive options that cater to these dietary restrictions. By remaining flexible and innovative, the European Fillings and Toppings Market can navigate these challenges and continue to thrive.

The Europe Fillings And Toppings Market Opportunities:

The European Fillings and Toppings Market isn't just holding its own, it's brimming with exciting opportunities. Discerning consumers are driving a trend towards premiumization, willing to pay more for high-quality, gourmet options. Imagine luxurious fillings boasting organic fruits, single-origin chocolate, or artisanal nuts. This indulgence can be balanced with functionality. The growing demand for healthy eating presents an opportunity to create fillings and toppings with added benefits. Think incorporating probiotics, prebiotics, or protein powders to cater to health-conscious consumers who crave a treat without sacrificing well-being. Furthermore, the rise of home baking and the emphasis on unique flavor profiles open doors for customization. Imagine DIY solutions or kits with interchangeable flavors, empowering consumers to create their own personalized dessert experiences. Sustainability is another key to unlocking market potential. Manufacturers who embrace eco-friendly practices and source ingredients responsibly will resonate with environmentally conscious European consumers. Finally, there's a whole world of flavor waiting to be explored. European palates are adventurous, so manufacturers can capitalize on this by developing exciting new profiles inspired by global cuisines or incorporating unusual ingredients. From exotic fruits and spices to botanicals, the possibilities are endless, catering to consumers who crave a taste sensation beyond the ordinary.

EUROPE FILLINGS AND TOPPINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.18% |

|

Segments Covered |

By Type, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

ADM, Barry Callebaut, Tate & Lyle, AGRANA Beteiligungs-AG, Associated British Foods, Cargill, AAK AB, Zentis GmbH & Co. KG |

Europe Fillings And Toppings Market Segmentation: By Type:

-

Creams

-

Fruits and Nuts

-

Fondants

-

Sprinkles

-

Syrups

-

Pastes and Variegates

Creams are the dominant segment in the European Fillings and Toppings Market due to their extensive use in pastries and various desserts. However, fruits and nuts are expected to be the fastest-growing segment, driven by the rising demand for healthy and versatile topping options. This trend is fueled by consumers' growing interest in home baking and creating visually appealing treats.

Europe Fillings And Toppings Market Segmentation: By Application:

-

Bakery Products

-

Confectionery Products

-

Dairy Products

-

Frozen Products

Bakery Products hold the dominant share in the European Fillings and Toppings Market due to their extensive use in various baked goods. However, Frozen Products are expected to be the fastest-growing segment, driven by the rising popularity of convenience foods.

Europe Fillings And Toppings Market Segmentation: By Distribution Channel:

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Industrial Customers

Supermarkets and hypermarkets reign supreme in the European Fillings and Toppings Market's distribution channels, catering to everyday consumer needs. However, specialty stores are the rising stars, experiencing the fastest growth. These stores cater to passionate home bakers and niche markets with a wider variety of unique and innovative fillings and toppings, capitalizing on the trend towards customization and premiumization.

Europe Fillings And Toppings Market Segmentation: Regional Analysis:

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

Renowned for its rich baking traditions, the UK boasts a significant market share. Consumers here favor classic fillings like jams, custards, and cream, while also embracing new flavor trends. The rise of home baking and afternoon tea culture further drives demand for high-quality fillings and toppings.

Known for its chocolate expertise and love for pastries, Germany is a major player in the market. Here, there's a strong preference for traditional fillings like fruit compotes, poppy seeds, and quark (a fresh cheese). However, there's also a growing interest in healthier options with lower sugar content.

Eastern and Central Europe contribute a significant share of the market with their unique dessert traditions. Local fruits, nuts, and spices play a prominent role in fillings and toppings. This region also shows potential for growth due to its developing economies and expanding consumer spending.

COVID-19 Impact Analysis on the European Fillings And Toppings Market:

The COVID-19 pandemic undoubtedly shook the European Fillings and Toppings Market, bringing both challenges and unexpected opportunities. Lockdowns and restrictions disrupted supply chains, causing shortages and price hikes for key ingredients. Additionally, the closure of restaurants and cafes significantly reduced demand for these products used in commercially prepared desserts. With a heightened focus on health during this time, some consumers may have also curtailed their indulgence in sugary treats.

However, the pandemic also presented some silver linings. The rise of home baking as people stayed home more saw a surge in demand for household fillings and toppings for creating homemade treats. This trend, coupled with the e-commerce boom, benefitted online retailers who catered to home bakers and consumers seeking convenient purchasing options. Furthermore, the pandemic heightened awareness of health and well-being, potentially leading to a future rise in demand for fillings and toppings with immunity-boosting ingredients like fruits rich in vitamins.

Latest Trends/ Developments:

The European Fillings and Toppings Market is abuzz with exciting new developments. In response to a growing focus on environmental responsibility, manufacturers are prioritizing sustainability throughout the supply chain. This translates to eco-friendly ingredients, sustainable sourcing practices, and recyclable packaging solutions.

The health and wellness trend continues to be a major driver, with a specific emphasis on reduced sugar and fat content. Manufacturers are getting creative, using alternative sweeteners and incorporating healthy fats like avocado or nut butter, all while ensuring a delicious taste experience.

Another intriguing trend is the rise of functional fillings and toppings. These innovative products cater to health-conscious consumers by offering additional benefits like protein for athletes, probiotics for gut health, or prebiotics to aid digestion. Finally, European consumers' adventurous palates continue to be a source of inspiration. Manufacturers are developing exciting new flavor profiles that explore global influences, incorporating ethnic ingredients, spices, and even botanical extracts. Imagine fillings boasting flavors like matcha, yuzu, or rose water, taking taste buds on a delightful world tour.

Key Players:

-

ADM

-

Barry Callebaut

-

Tate & Lyle

-

AGRANA Beteiligungs-AG

-

Associated British Foods

-

Cargill

-

AAK AB

-

Zentis GmbH & Co. KG

Chapter 1. Europe Fillings And Toppings Market Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Fillings And Toppings Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Fillings And Toppings Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Fillings And Toppings Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Fillings And Toppings Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Fillings And Toppings Market– By Type

6.1. Introduction/Key Findings

6.2. Creams

6.3. Fruits and Nuts

6.4. Fondants

6.5. Sprinkles

6.6. Syrups

6.7. Pastes and Variegates

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Europe Fillings And Toppings Market– By Application

7.1. Introduction/Key Findings

7.2 Bakery Products

7.3. Confectionery Products

7.4. Dairy Products

7.5. Frozen Products

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Fillings And Toppings Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Specialty Stores

8.4. Industrial Customers

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Fillings And Toppings Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Fillings And Toppings Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. ADM

10.2. Barry Callebaut

10.3. Tate & Lyle

10.4. AGRANA Beteiligungs-AG

10.5. Associated British Foods

10.6. Cargill

10.7. AAK AB

10.8. Zentis GmbH & Co. KG

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Fillings And Toppings Market was valued at USD 3.22 billion in 2023 and is projected to reach a market size of USD 4.9 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6.18%.

Craving for Sensory Delights, DIY Dessert Dreams, Convenience Reigns Supreme, Balancing Indulgence with Wellness

Supermarkets and Hypermarkets, Specialty Stores, Industrial Customers.

Western Europe, encompassing countries like France, Germany, and the UK, is likely the most dominant region in the European Fillings and Toppings Market due to its rich baking traditions and established food cultures.

ADM, Barry Callebaut, Tate & Lyle, AGRANA Beteiligungs-AG, Associated British Foods, Cargill, AAK AB, Zentis GmbH & Co. KG.