Europe Fast Food Market Size (2024-2030)

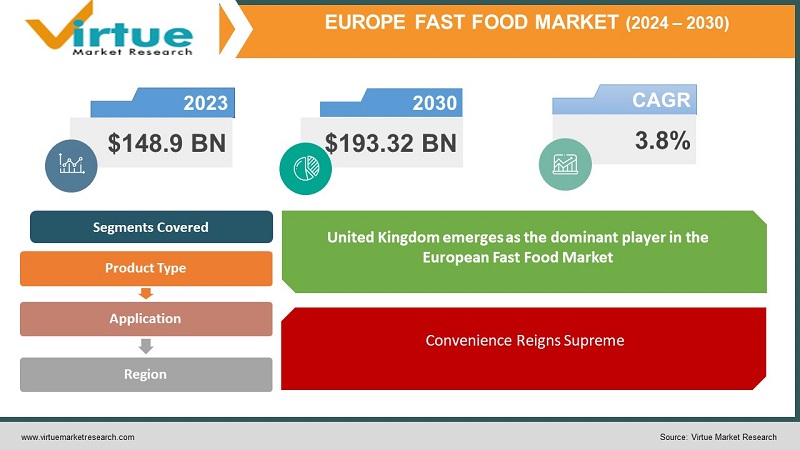

The Europe fast food market was valued at $148.9 billion in 2023 and is expected to grow to $193.32 billion by 2030. From 2024 to 2030, the market is predicted to grow at an average annual rate of 3.8%.

Download Free Sample Report Now

Key Market Insights:

- Online food delivery sales in Europe are projected to skyrocket to a value of USD 34.05 billion by 2025, fuelled by the increasing popularity of mobile ordering and delivery platforms, providing a significant boost to fast food chains.

- The European Fast Food Market is witnessing a rise in technology adoption, with 60% of consumers in Europe utilizing mobile apps for restaurant ordering or delivery by 2023, indicating a growing preference for convenient dining solutions.

- Fast food chains are recognizing the importance of catering to evolving preferences, with the introduction of plant-based options experiencing significant growth. The European plant-based meat market is projected to reach a value of USD 4.67 billion by 2027, reflecting changing consumer tastes.

- However, the European fast-food industry is facing labor shortages, which could impact operational efficiency, leading to longer wait times, and potentially even restaurant closures, posing challenges to the sector's growth.

Unlock Market Insights: Get A FREE Sample Report Today!

Europe Fast Food Market Drivers

Convenience Reigns Supreme:

Fast-paced lives across Europe create a strong demand for convenient and readily available food options. Fast food chains perfectly cater to this need by offering a wide variety of menu items quickly and efficiently. Whether it's grabbing a burger on a lunch break or ordering dinner after a long workday, convenience remains a key driver for consumers.

Urbanization and Rising Disposable Income:

The trend of urbanization across Europe is creating clusters of potential customers for fast food chains. This, coupled with rising disposable income, particularly in developing European economies, empowers consumers to spend more on dining out, including fast food options. This increased spending power allows them to indulge in convenient and familiar fast food meals more frequently.

Evolving Palates and Menu Innovation:

Consumer preferences in Europe are shifting towards a wider variety of cuisines and flavors. Fast food chains are recognizing this trend and constantly innovating their menus to cater to these evolving palates. This includes introducing new menu items inspired by global flavors, offering vegetarian and vegan options, and catering to specific dietary needs.

Digital Revolution - Delivery and Online Ordering:

The rise of online ordering and food delivery services is significantly influencing the European Fast Food Market. Many consumers, especially younger generations, prefer the ease of ordering food online and having it delivered directly to their doorstep. Fast food chains are actively investing in these platforms to ensure a seamless digital experience for their customers.

Healthier Options Emerge:

A growing health-conscious consumer base in Europe is prompting a shift within the fast food industry. Fast food chains are recognizing this trend and including healthier options on their menus. This could involve offering salads, grilled items, and portion control options alongside traditional fast food fare. This allows health-conscious consumers to indulge in fast food occasionally without compromising their dietary goals.

Fast Food Market Restraints and Challenges

Sustainability Concerns can be a challenge for market growth:

Environmental consciousness is rising across Europe, and the fast food industry is under scrutiny for its contribution to waste generation through packaging and food production methods. Consumers are increasingly demanding sustainable practices from companies, including the use of recyclable packaging and sourcing ingredients ethically. Failure to address these concerns could lead to a decline in consumer loyalty.

Labor Shortages and Operational Efficiency can hinder the market growth:

The European fast-food industry, like many sectors, is facing labor shortages. This can negatively impact operational efficiency, leading to longer wait times, reduced service quality, and potentially even restaurant closures. Finding innovative strategies to attract and retain employees, such as offering competitive wages and benefits, will be crucial for smooth operations.

Rising Costs and Profit Margin Squeeze can be a challenge for market growth:

The European fast food industry is grappling with rising costs for ingredients, labor, and energy. While some chains can pass on these cost increases to consumers through menu price hikes, it can lead to decreased customer satisfaction. Balancing cost management with maintaining competitive pricing will be a delicate act for fast food businesses in 2023.

Technological Disruption and Keeping Up with Trends:

The fast food industry needs to embrace technological advancements to stay competitive. This includes exploring automation for tasks such as food preparation and order fulfillment, as well as utilizing technology to enhance customer experience through loyalty programs and personalized offerings. Failure to adapt to these trends could leave fast food chains lagging behind competitors.

Fast Food Market Opportunities

Personalization and Customization: Consumers crave unique and personalized experiences. Fast food chains can capitalize on this by offering customizable options, allowing customers to tailor their meals to their specific preferences and dietary needs. This could involve features like "build-your-own" bowls, offering a variety of sauces and toppings, or catering to specific dietary restrictions through menu customization options.

Technology-Driven Enhancements: Embracing technology can revolutionize the fast food experience. This includes utilizing mobile apps for convenient ordering and payment, implementing self-service kiosks to reduce wait times, and offering loyalty programs with personalized rewards. Additionally, exploring food preparation automation and delivery drone technology can enhance efficiency and customer satisfaction.

Embracing Plant-Based and Alternative Protein Options: The growing demand for plant-based and alternative protein options presents a significant opportunity for the European fast food market. Collaborating with food tech companies and introducing innovative vegetarian and vegan options can attract a wider customer base and cater to evolving dietary preferences.

Sustainability: A Competitive Advantage: Sustainability is no longer just a trend; it's a consumer expectation. Fast food chains that implement environmentally friendly practices, such as using recyclable packaging, minimizing food waste, and sourcing ingredients sustainably, can gain a competitive edge. Highlighting these efforts can resonate well with environmentally conscious consumers.

Experiential Dining and Unique Concepts: Fast food isn't just about grabbing a quick bite anymore. Consumers are looking for immersive and engaging dining experiences. Fast food chains can capitalize on this by creating unique restaurant concepts with innovative themes, offering entertainment options, or providing interactive dining experiences for families.

EUROPE FAST FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.8% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Wendy’s International, Inc., Domino’s Pizza, Inc., Mcdonald’s Corporation, Restaurant brands international, Inc., Yum! Brands, Inc., Inspire Brands, Inc., Hardee's Restaurants LLC, Firehouse Restaurant Group, Inc., Focus Brands LLC , Subway |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

Europe Fast Food Market Segmentation Analysis

Europe Fast Food Market Segmentation: By Product Type

- Pizza/Pasta

- Burger/Sandwich

- Chicken

- Asia/Latin American Food

- Seafood and Others

The Burger/Sandwich segment dominates the European Fast Food Market, buoyed by several key factors. First and foremost is its versatility and familiarity, offering consumers a customizable option that caters to diverse taste preferences. With an array of toppings and sauces available, burgers and sandwiches provide a quick snack or a satisfying meal, appealing to a broad spectrum of diners. Moreover, the strong brand recognition enjoyed by major chains such as McDonald's and Burger King instills a sense of trust and reliability among consumers. Coupled with their affordability, burgers and sandwiches remain accessible to a wide demographic, ensuring their continued popularity.

In addition to their versatility and brand recognition, the convenience and speed of service offered by fast food chains play a pivotal role in driving consumer preference. With busy lifestyles becoming increasingly common, the ability to quickly prepare and serve burgers and sandwiches is a major draw for diners seeking a convenient dining option. While alternative segments like Chicken and Asian/Latin American cuisine are experiencing growth, the enduring appeal of burgers and sandwiches—rooted in their versatility, affordability, and convenience—solidifies their position as the leading product type in the European Fast Food Market..

Europe Fast Food Market Segmentation: By Application

- Food-Service Restaurants

- Quick Service Restaurants

- Caterings

- Others

The Quick Service Restaurants (QSRs) segment stands out as the leading end user in the European Fast Food Market, owing to its emphasis on convenience, speed, and affordability. These establishments, renowned for their self-service ordering systems, minimal table service, and rapid turnover of meals, align perfectly with the fast-paced lifestyles prevalent across Europe. QSRs serve as go-to dining options for individuals, families, and young adults seeking quick and hassle-free meals amidst their busy schedules.

Several factors contribute to the dominance of QSRs in the European fast food landscape. Firstly, their inherent convenience and familiarity make them a popular choice among consumers looking for a quick bite without compromising on taste or quality. Moreover, QSRs prioritize affordability, offering cost-effective meal options that cater to a broad spectrum of consumers, including those on tighter budgets. Additionally, the integration of online ordering and delivery platforms further enhances the appeal of QSRs, allowing customers to conveniently enjoy their favorite fast food items from the comfort of their homes or workplaces. While Food-Service Restaurants offer a different dining experience with sit-down service and potentially higher prices, the unparalleled focus on speed, affordability, and convenience solidifies QSRs as the top choice in the European Fast Food Market among end users.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Europe Fast Food Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom emerges as the dominant player in the European Fast Food Market, primarily owing to several key factors that underscore its market leadership. Firstly, the UK boasts a mature Quick Service Restaurant (QSR) industry, characterized by a rich history and the presence of well-established brands. This extensive network of QSR outlets provides consumers with a diverse array of fast food options, contributing to the market's substantial size compared to other European nations.

Moreover, the UK exhibits a remarkable level of consumer demand for fast food and convenient dining solutions. Brits have demonstrated a strong inclination towards utilizing delivery services and frequenting QSR establishments, highlighting their preference for quick and hassle-free meal options.

Additionally, the UK's large population base further bolsters its position as the leading country in the European Fast Food Market in terms of market size. With a sizable populace driving demand for fast food offerings, the UK stands out as a significant market player, surpassing contenders like Germany and France. While growth potential may vary across regions, the UK's combination of a mature QSR industry, robust consumer demand, and substantial population size solidifies its prominence in the European fast food landscape.

COVID-19 Impact Analysis on the Europe Fast Food Market:

The COVID-19 pandemic caused a temporary disruption to the European Fast Food Market. Lockdowns and restrictions on dine-in services led to a decline in sales as in-person traffic plummeted. Additionally, supply chain disruptions impacted ingredient availability and potentially increased costs.

However, the market exhibited resilience and witnessed a rebound. The rise of online ordering and delivery platforms proved to be a lifeline for fast food chains during lockdowns. Consumers, confined to their homes, increasingly relied on these convenient options to satisfy their fast food cravings. Additionally, the reopening of restaurants with safety measures in place, coupled with a growing desire for normalcy post-lockdowns, fueled a revival of dine-in experiences.

The long-term impact of COVID-19 on the European Fast Food Market is expected to be minimal. The market is likely to maintain its pre-pandemic growth trajectory, potentially even surpassing it. The increased adoption of online ordering and delivery is expected to remain a permanent fixture, offering a lasting benefit to the market. Furthermore, a renewed focus on hygiene and safety measures within fast food establishments can instill consumer confidence and encourage continued patronage.

Latest Trends/ Developments:

- In April 2023, Fast food restaurant chain Burger King has partnered with the delivery management platform Bringg to increase its customer delivery experience.

Key Players:

- Wendy’s International, Inc.

- Domino’s Pizza, Inc.

- Mcdonald’s Corporation

- Restaurant brands international, Inc.

- Yum! Brands, Inc.

- Inspire Brands, Inc.

- Hardee's Restaurants LLC

- Firehouse Restaurant Group, Inc.

- Focus Brands LLC

- Subway

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Europe Fast Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Fast Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Fast Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Fast Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Fast Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Fast Food Market– By Product Type

6.1. Introduction/Key Findings

6.2. Pizza/Pasta

6.3. Burger/Sandwich

6.4. Chicken

6.5. Asia/Latin American Food

6.6. Seafood and Others

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Fast Food Market– By Application

7.1. Introduction/Key Findings

7.2 Food-Service Restaurants

7.3. Quick Service Restaurants

7.4. Caterings

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Fast Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Fast Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Wendy’s International, Inc.

9.2. Domino’s Pizza, Inc.

9.3. Mcdonald’s Corporation

9.4. Restaurant brands international, Inc.

9.5. Yum! Brands, Inc.

9.6. Inspire Brands, Inc.

9.7. Hardee's Restaurants LLC

9.8. Firehouse Restaurant Group, Inc.

9.9. Focus Brands LLC

9.10. Subway

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Fast Food Market was valued at USD 148.9 billion and is projected to reach a market size of USD 198.32 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.8%.

Convenience, Urbanization and Rising Disposable Income, Menu Innovation, Digital Revolution, and Healthier Options are propelling the global Fast Food industry.

Based on Product Type, the Europe Fast Food Market is segmented into Pizza/Pasta, Burger/Sandwich, Chicken, Asia/Latin American Food, Seafood, and Others.

UK is the most dominant region for the Europe Fast Food Market.

Wendy’s International, Inc., Domino’s Pizza, Inc., Mcdonald’s Corporation, Restaurant brands international, Inc., Yum! Brands, Inc., Inspire Brands, Inc., Hardee's Restaurants LLC, Firehouse Restaurant Group, Inc., Focus Brands LLC, and Subway are the key players operating in the Europe Fast Food Market.