Europe Electric Vehicle Market Size (2024-2030)

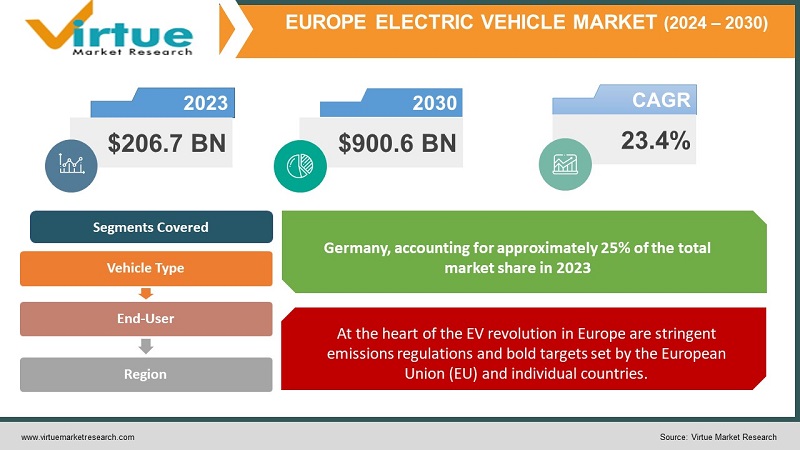

The Europe Electric Vehicle Market is valued at USD 206.7 Billion and is projected to reach a market size of USD 900.6 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 23.4%.

Europe is witnessing an electrifying shift in automotive trends. EV sales have soared in recent years, surpassing even the optimistic expectations of many industry analysts. Ambitious government targets for emissions reductions, generous subsidies, and a looming ban on the sale of new internal combustion engine (ICE) vehicles propel the EV market forward. Rapid advancements in battery technology, improved range, and the expansion of charging networks are overcoming traditional barriers to adoption. Environmental consciousness, lower operating costs, and the sheer desirability of cutting-edge EVs are converting more and more European drivers. Major automakers are now heavily invested in the EV revolution, pouring billions into research and offering a wider selection of electric models than ever before. Fully electric vehicles, powered solely by batteries, hold a growing share of the market and are the primary focus of government incentives in many countries.

Key Market Insights:

With about 80% of new cars sold being electric by 2023, Norway is leading the way in EV adoption. Among the countries with high EV adoption rates are the Netherlands, Germany, Denmark, Sweden, and Denmark.

With almost 75% of the market, the passenger car industry dominates the European EV market. The commercial vehicle segment, which comprises trucks and vans, is seeing a rise in demand for electrification, particularly in areas with stringent emission regulations. By 2027, there will be over 3 million public charging stations throughout Europe.

The cost of electric car batteries should have decreased by 20% by 2027.

By 2025, it is anticipated that the average range of electric vehicles will have increased by 25%.

By 2030, the European Union wants at least 30 million zero-emission cars on the road.

Germany is predicted to account for 20% of the European market for electric vehicles by 2027. France's projected growth rate is 24.5% CAGR for the projection period. The UK is expected to see a CAGR of 21.8% between 2022 and 2027. Italy is predicted to account for 10% of Europe's EV market share by 2027. Throughout the projected period, Spain is anticipated to grow at a compound annual growth rate of 23.1%.

Europe Electric Vehicle Market Drivers:

At the heart of the EV revolution in Europe are stringent emissions regulations and bold targets set by the European Union (EU) and individual countries.

Policies like the EU's "Fit for 55" plan, aiming for significant reductions in greenhouse gas emissions, mandate a shift towards zero-emission vehicles. Generous subsidies, tax breaks, and purchase incentives for EVs at both national and regional levels significantly reduce the upfront cost of ownership, making them more competitive with traditional vehicles. Priority lanes, access to restricted urban zones, free or discounted parking and charging, and exemptions from various tolls and fees all add to the attractiveness of EV ownership in many European cities. Government procurement policies, stricter emission regulations for public transport, and corporate fleets transitioning to EVs create a significant and consistent demand stream within the market. Automakers face a clear imperative to invest heavily in EV development, expand electric model ranges, and ramp up production capacity to meet both regulatory requirements and evolving consumer demand. Substantial government investment is being directed towards expanding public charging networks and incentivizing workplace and home charger installation. Building reliable infrastructure is crucial to address range anxiety.

Growing climate awareness and a desire for sustainable transportation solutions are driving many European consumers to consider EVs as a conscious choice.

While not the first, Tesla played a pivotal role in shifting the perception of EVs from niche products to desirable, high-performance vehicles. Rapid technological advancements in batteries, drivetrain efficiency, and overall vehicle design are steadily overcoming past hurdles. Modern EVs offer greater range, faster charging times, and performance that rivals or exceeds traditional gasoline vehicles. Mainstream automakers are now fully engaged in the EV market, offering consumers a wide array of electric SUVs, sedans, and hatchbacks catering to diverse tastes and needs. Driving an EV is increasingly gaining a "green status" appeal. This shift, particularly amongst early adopters and trendsetters, influences wider segments of the population. Consumer attitudes and technological progress work in tandem to move EVs from a niche segment toward becoming the dominant choice in the new vehicle market. Greater range and an expanding charging infrastructure alleviate concerns, making EVs a practical alternative for daily commutes and longer journeys.

Europe Electric Vehicle Market Restraints and Challenges:

While EV costs are steadily declining, a significant upfront price difference persists between many EVs and their conventional internal combustion engine (ICE) counterparts. This can be a barrier for potential adopters. While EVs boast lower operational costs (fuel, maintenance), the initial acquisition cost can skew the TCO calculation, especially across shorter ownership periods. This requires greater awareness of long-term benefits. The battery pack remains one of the most expensive EV components. Though ongoing improvements in battery technology are driving down costs, they still contribute significantly to overall EV prices. While expanding, public charging infrastructure still lags behind the needs of the growing EV market. The uneven distribution of chargers across Europe remains a concern. The increased demand for electricity grids due to the widespread adoption of EVs necessitates significant upgrades and smart grid management to avoid strain.

Europe Electric Vehicle Market Opportunities:

Growth in workplace charging, incentives for home charger installation, and integration of charging into new residential and commercial developments are addressing charging convenience. The rollout of ultra-fast charging stations along major travel corridors and in urban hubs aims to minimize charging times, making EVs more viable for longer journeys. Ongoing research and development into battery chemistries, cell design, and manufacturing processes promise to increase energy density, reduce cost per kilowatt-hour, and extend EV range. Ongoing research and development into battery chemistries, cell design, and manufacturing processes promise to increase energy density, reduce cost per kilowatt-hour, and extend EV range. Exploring sustainable end-of-life scenarios for EV batteries, including repurposing for stationary energy storage or recycling to recover critical materials, enhances the long-term outlook for supply chains. Growing environmental awareness, particularly amongst younger generations, fuels a greater interest in EVs as a sustainable transportation choice. As the range of newer EV models improves and charging infrastructure becomes more widespread, one of the major barriers to consumer adoption is diminishing. While early EVs focused on the luxury segment, automakers now offer a diversifying range of models across price points, bringing EVs within reach of a broader consumer base.

EUROPE ELECTRIC VEHICLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.4% |

|

Segments Covered |

By Vehicle Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Volkswagen Group, Stellantis, Renault Group, BMW Group , Mercedes-Benz Group, Hyundai-Kia, Tesla, Rivian, Polestar |

Europe Electric Vehicle Market Segmentation-

Europe Electric Vehicle Market Segmentation: By Vehicle Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Fuel Cell Electric Vehicles (FCEVs)

BEVs typically hold the largest share of the European EV market. While the exact percentage may vary by country and year, estimates often dominate the 60-70% range of EV sales. BEVs cater to drivers seeking the most environmentally conscious option. Advancements in battery technology have expanded the range of many BEV models. BEVs often qualify for the most generous subsidies or tax breaks. Automakers are offering a wider variety of BEVs across different sizes, styles, and price points.

While PHEVs offer flexibility, the tide in Europe is decisively shifting towards BEVs as the fastest-growing segment. Regulations, incentives, and ICE vehicle phase-outs heavily favor BEVs as the true zero-emissions option. Expanding public charging networks and faster charging capabilities are making BEVs a more practical choice for a wider range of drivers. Ongoing improvements in battery energy density, range, and cost are significantly improving the BEV value proposition. As BEVs become more mainstream, range anxiety diminishes, and the appeal of the quiet, powerful driving experience grows.

Europe Electric Vehicle Market Segmentation: By End-User -

- Passenger Vehicles

- Commercial Vehicles

The passenger vehicle segment comprises the vast majority of the current European EV market. This includes personal cars of various sizes, from compact EVs to luxury electric SUVs. Automakers now offer EVs across a wider range of price points and vehicle types, increasing their appeal to a broader consumer base. Heightened environmental awareness and a desire for lower operating costs are motivating some consumers to switch to EVs for their transportation.

While starting from a lower base, the commercial electric vehicle segment is projected to witness some of the fastest growth within the European EV landscape. A focus on cleaner public transportation and air quality in urban areas is driving strong adoption of electric buses. E-commerce growth, predictable delivery routes, and corporate sustainability goals fuel the electrification of commercial fleets. While still in earlier development stages, medium and heavy-duty electric trucks hold potential for longer-haul and logistics applications as technology and infrastructure mature.

Europe Electric Vehicle Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany, accounting for approximately 25% of the total market share in 2023. Germany's position as a major automotive manufacturing hub, combined with supportive government policies and the ambitious goals of traditional automakers, makes it a driving force in the EV market. To encourage the use of electric vehicles, the German government has put supportive measures in place, such as tax breaks, buying incentives, and investments in infrastructure for charging them. Furthermore, the nation's strong emphasis on sustainability and renewable energy is in line with the expansion of the EV market, attracting EV providers and manufacturers.

The fastest-growing region in the European EV market is the Rest of Europe category, which includes countries like Norway, Sweden, and the Netherlands. These regions are witnessing significant growth due to stringent emission regulations, strong consumer demand for sustainable transportation solutions, and a well-developed charging infrastructure.

COVID-19 Impact Analysis on the Europe Electric Vehicle Market:

Border closures, factory lockdowns, and transportation restrictions hampered the smooth flow of raw materials, equipment, and finished diamond substrates. Diamond substrate manufacturers faced operational challenges, including workforce disruptions and limited access to critical resources, leading to production slowdowns. The overall economic downturn and a pause in capital expenditure by many companies cast a shadow over near-term market prospects. The pandemic highlighted the critical need for advanced medical equipment used in diagnostics, treatment, and monitoring. This segment, which can benefit from diamond-based components due to their biocompatibility and radiation resistance, witnessed a surge in demand. The pandemic underscored the importance of collaboration between research institutions, diamond substrate manufacturers, and device designers to accelerate innovation and overcome technical hurdles.

Latest Trends/ Developments:

EVs with bidirectional charging capability can not only draw power from the grid but also feed energy back during peak demand periods. This turns them into distributed energy storage assets, stabilizing the grid and potentially opening up revenue streams for EV owners. Greater customization of vehicle settings, driving modes, energy management, and even in-car entertainment tailored to individual user preferences. The rise of EV-integrated ADAS with features like automated lane keeping, advanced cruise control, and self-parking is transforming the driving experience. Online car configuration, remote sales processes, and digital platforms are changing how consumers interact with car brands and dealerships, particularly for direct-to-consumer EV startups. While the early focus was on premium EVs, we're witnessing a surge in mid-priced, more accessible models entering the market, targeting mainstream buyers.

Key Players:

- Volkswagen Group

- Stellantis

- Renault Group

- BMW Group

- Mercedes-Benz Group

- Hyundai-Kia

- Tesla

- Rivian

- Polestar

Chapter 1. Europe Electric Vehicle Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Electric Vehicle Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Electric Vehicle Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Electric Vehicle Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Electric Vehicle Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Electric Vehicle Market– By Vehicle Type

6.1. Introduction/Key Findings

6.2. Battery Electric Vehicles (BEVs)

6.3. Plug-in Hybrid Electric Vehicles (PHEVs)

6.4. Hybrid Electric Vehicles (HEVs)

6.5. Fuel Cell Electric Vehicles (FCEVs)

6.6. Y-O-Y Growth trend Analysis By Vehicle Type

6.7. Absolute $ Opportunity Analysis By Vehicle Type , 2024-2030

Chapter 7. Europe Electric Vehicle Market– By End-User

7.1. Introduction/Key Findings

7.2 Passenger Vehicles

7.3. Commercial Vehicles

7.4. Y-O-Y Growth trend Analysis By End-User

7.5. Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Europe Electric Vehicle Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Vehicle Type

8.1.3. By End-User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Electric Vehicle Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Volkswagen Group

9.2. Stellantis

9.3. Renault Group

9.4. BMW Group

9.5. Mercedes-Benz Group

9.6. Hyundai-Kia

9.7. Tesla

9.8. Rivian

9.9. Polestar

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The EU has implemented stringent targets for reducing CO2 emissions from vehicles, creating a powerful incentive for automakers to electrify their fleets

While EVs typically have lower running costs, factors like potential battery replacement down the line need to be communicated to consumers for a realistic assessment of total ownership costs.

Volkswagen Group, Stellantis, Renault Group, BMW Group, Mercedes-Benz Group, Hyundai-Kia, Tesla, Rivian, Polestar.

Germany currently holds the largest market share, estimated at around 25%.

The fastest-growing region in the European EV market is the Rest of Europe category, which includes countries like Norway, Sweden, and the Netherlands. These regions are witnessing significant growth due to stringent emission regulations, strong consumer demand for sustainable transportation solutions, and a well-developed charging infrastructure