Europe Dried Fruits Market Size (2024-2030)

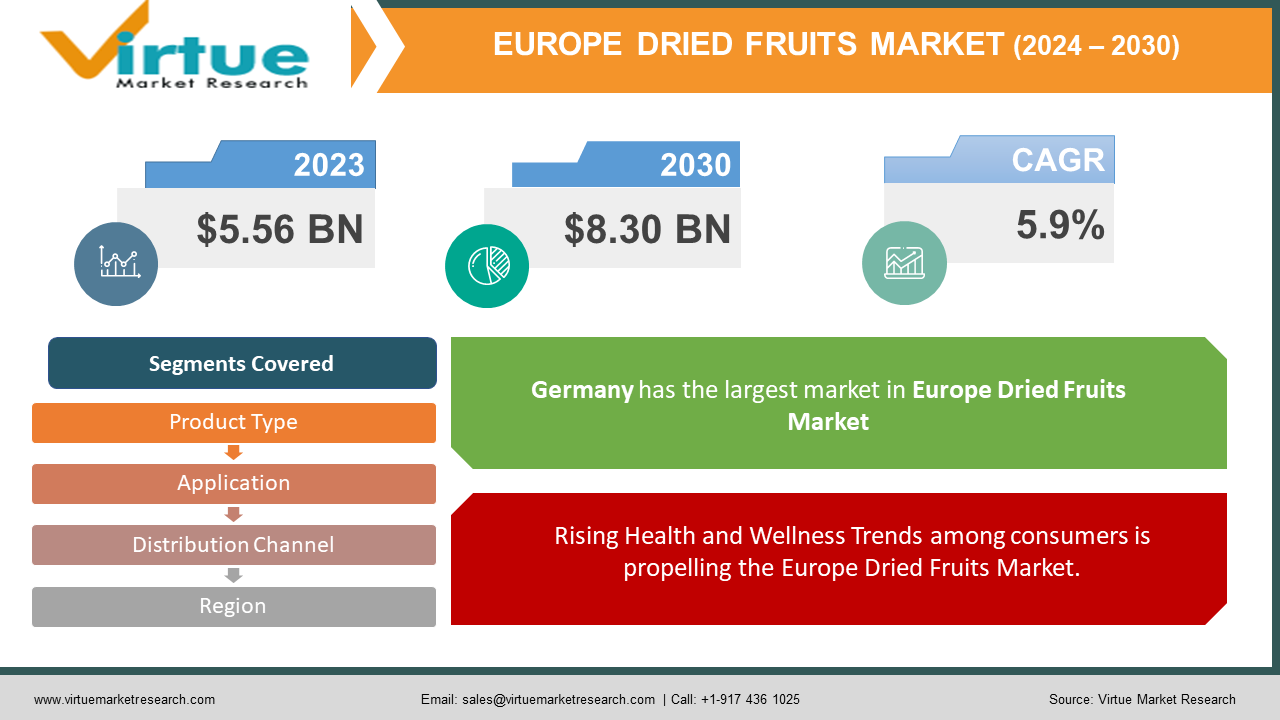

The Europe Dried Fruits Market was valued at USD 5.56 Billion in 2023 and is projected to reach a market size of USD 8.30 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Market Overview:

The Europe dried fruits market represents a thriving and diverse industry shaped by evolving consumer preferences for healthy and convenient snacking options. With a growing emphasis on natural and nutritious food choices, dried fruits have gained substantial traction, positioned as wholesome alternatives to processed snacks. This market encompasses a wide array of dried fruits such as raisins, apricots, dates, figs, and berries, catering to varied taste preferences. Factors driving market growth include the rising awareness of the health benefits associated with dried fruits, their longer shelf life, and the versatility they offer in culinary applications, ranging from baking to snacking. Additionally, the trend towards clean-label products and sustainable sourcing practices further propels the expansion of the Europe dried fruits market, reflecting a consumer inclination towards healthier, environmentally conscious food options.

Key Market Insights:

- Within the UK, the majority of imported quantities are consumed, with minimal re-exports, totaling an estimated consumption of nearly 5 thousand tonnes. The prominent varieties are dried mangoes and tamarinds, with the latter being specific and favored by the Indian and Pakistani diaspora.

- Notably, the UK market distinguishes itself by favoring the carabao mango variety from the Philippines over other European markets' preferences for different mango varieties. Additionally, while most European importers source dried bananas from Ecuador, the UK prefers larger quantities from Uganda and the Philippines.

- The market expects a shift towards no-added-sugar dried tropical fruits, although the COVID-19 pandemic led to increased imports of sweetened varieties due to higher home consumption of indulgent products. Sweetened dried tropical fruit cubes are also commonly used in muesli breakfast cereals.

Europe Dried Fruits Market Drivers:

Rising Health and Wellness Trends among consumers is propelling the Europe Dried Fruits Market.

The increasing emphasis on health-conscious consumption habits has propelled the demand for dried fruits in Europe. Consumers are increasingly drawn to these products due to their perceived health benefits. Dried fruits are naturally rich in essential vitamins, minerals, antioxidants, and dietary fiber, making them an attractive option for individuals seeking nutritious snacks. With a growing focus on maintaining a balanced diet and overall wellness, dried fruits are favored as wholesome alternatives to processed snacks, contributing to the market's growth.

Convenience and Versatility offered by dry fruits drives their popularity, attracting more consumers.

Dried fruits offer convenience and versatility in various culinary applications, driving their popularity. They are easily portable, have an extended shelf life, and maintain their nutritional value, making them ideal for on-the-go consumption. Moreover, they serve as versatile ingredients in cooking, baking, and snacking, enhancing the flavor profile and nutritional value of various dishes. This versatility appeals to consumers looking for convenient yet nutritious options, further boosting the demand for dried fruits across Europe.

Europe Dried Fruits Market Restraints and Challenges:

Price Volatility and Sourcing Concerns is the biggest challenge in dried fruits market of Europe.

The market often contends with price fluctuations due to factors like climate changes affecting crop yields, transportation costs, and geopolitical issues impacting trade routes. Dried fruits heavily rely on specific climatic conditions for cultivation, and any irregularities or extreme weather events can disrupt production, leading to supply shortages and increased prices. Additionally, ensuring a consistent supply of high-quality dried fruits while maintaining fair pricing becomes challenging, especially when sourcing from regions prone to political instability or facing logistical challenges.

Quality Control and Shelf Life Maintenance is crucial in maintaining the dried fruits industry.

Maintaining the quality and extending the shelf life of dried fruits pose considerable challenges. While the dehydration process preserves fruits, ensuring they retain their nutritional value, flavor, color, and texture demands careful handling and storage. Factors such as improper storage conditions, exposure to moisture, or inadequate packaging can degrade the quality of dried fruits, affecting their appeal to consumers. Striking a balance between cost-effective packaging methods and preserving the fruits' quality over an extended period presents an ongoing challenge for manufacturers and suppliers in the European market. Moreover, meeting stringent quality standards and compliance regulations adds complexity to the supply chain, requiring rigorous monitoring and quality control measures.

Europe Dried Fruits Market Opportunities:

The Europe dried fruits market presents promising opportunities driven by evolving consumer preferences for healthy and natural snacking choices. With a growing focus on clean-label products and sustainable sourcing, there's an increasing demand for organic and responsibly sourced dried fruits. Moreover, the rising awareness of the health benefits associated with dried fruits, including their rich nutrient content and versatility in various culinary applications, offers avenues for innovation. Companies can capitalize on these opportunities by introducing innovative packaging solutions that enhance shelf life, expanding product lines to include unique fruit blends, and leveraging e-commerce platforms to reach a broader consumer base seeking convenient and nutritious snacking options.

EUROPE DRIED FRUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Bergin Fruit and Nut Company, Sunsweet Growers Inc., Paradise Fruits Solutions GmbH & Co., Traina Foods, Del Monte Foods, Inc., Sun-Maid Growers of California, Ocean Spray Cranberries, Inc., Royal Nut Company, Graceland Fruit, Inc., The Wonderful Company |

Europe Dried Fruits Market Segmentation:

Europe Dried Fruits Market Segmentation: By Product Type

- Raisins

- Apricots

- Dates

- Figs

- Berries

- Others

Among the various product types in the Europe dried fruits market, raisins typically represent the largest segment holding market share of 38% in 2023. Raisins' dominance is attributed to their widespread use across multiple applications in the food industry, such as bakery, confectionery, and snacks. Raisins are versatile and widely incorporated into various recipes and food products due to their natural sweetness, texture, and extended shelf life. Additionally, their relatively lower price point compared to some other dried fruits makes them more accessible and preferred in both commercial food processing and household consumption, contributing significantly to their status as the largest segment in the European market. The berries segment, including cranberries, blueberries, and goji berries, has emerged as the fastest-growing product type in the Europe dried fruits market expected to grow at a CAGR of 7.9%. This growth is attributed to several factors, including the rising consumer awareness of the health benefits associated with berries. Dried berries are rich in antioxidants, vitamins, and fiber, appealing to health-conscious consumers seeking nutritious and convenient snacking options. Additionally, the versatility of dried berries in various applications, from being used in cereals and baked goods to inclusion in trail mixes and salads, has expanded their market reach.

Europe Dried Fruits Market Segmentation: By Distribution Channel

- Supermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

In the Europe dried fruits market, the largest segment by distribution channel is the Supermarkets category having market share of 57% in 2023. These retail outlets offer a wide variety of dried fruits to consumers, benefitting from their extensive reach, convenience, and consumer trust. Supermarkets and hypermarkets have a vast presence across European regions, providing shoppers with diverse options under one roof. Their ability to stock multiple brands, offer promotional deals, ensure product visibility, and provide a one-stop shopping experience attracts a significant portion of consumers seeking dried fruits. The consistent foot traffic and strategic placement within communities contribute to the prominence of supermarkets and hypermarkets as the primary distribution channel for dried fruits in Europe. In the Europe dried fruits market, the online retail segment stands out as the fastest growing distribution channel. This growth is primarily propelled by the increasing digitalization of commerce and changing consumer shopping habits. The convenience, accessibility, and wide product variety offered by online platforms have attracted a larger consumer base seeking healthier and convenient snacking options. Additionally, the COVID-19 pandemic accelerated the shift towards online shopping as lockdowns and restrictions led consumers to explore e-commerce for their grocery needs.

Europe Dried Fruits Market Segmentation: By Application

- Snacks

- Baking & Confectionery

- Breakfast Cereals

- Desserts

- Others

Among the applications in the Europe dried fruits market, the largest segment is often Snacks having market share of 40% in 2023. This dominance stems from the increasing consumer inclination toward healthier snack alternatives. Dried fruits offer a compelling solution as they are naturally sweet, portable, and packed with nutrients, making them an ideal choice for on-the-go snacking. The shift in consumer preferences towards convenient yet nutritious snacking options aligns perfectly with the qualities of dried fruits, driving their significant usage as a go-to snack. Moreover, the versatility of dried fruits allows them to be used in various snack formats like mixed fruit packs, single-serve portions, or incorporated into trail mixes, catering to diverse consumer tastes and preferences for convenient, healthier snacking alternatives. The fastest-growing segment by application in the Europe dried fruits market is also Snacks category. This surge is primarily attributed to the evolving consumer lifestyle characterized by on-the-go eating habits and a rising preference for healthier snacking options. Dried fruits, being convenient, portable, and inherently nutritious, perfectly align with this trend. The emphasis on healthier snacking choices due to increased health awareness and the demand for natural, preservative-free alternatives drives the growth of dried fruits in the snack category.

Europe Dried Fruits Market Segmentation: Regional Analysis:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

In the Europe Dried Fruits Market, Germany stands as the largest having market share of 37% in 2023. This prominence is primarily attributed to Germany's robust economy and strong consumer demand for healthy and convenient food options. The country's emphasis on quality, technological advancements in food processing, and a well-established distribution network contribute significantly to its leading position in the dried fruits market within Europe. Spain emerges as the fastest-growing area expected to grow at a rate of 9.2%. This growth can be attributed to several factors, including increased consumer preference for healthy and natural snack options, rising demand for dried fruits due to their nutritional benefits, expanding retail distribution channels, and the country's favorable climate for fruit cultivation. Spain's robust agricultural practices and focus on quality production contribute significantly to the accelerated growth of the dried fruits market within the region.

COVID-19 Impact Analysis on the Europe Dried Fruits Market:

The COVID-19 pandemic brought both challenges and opportunities to the Europe dried fruits market. Initially, disruptions in supply chains and logistics, coupled with uncertainties in trade regulations, affected the availability of dried fruits. However, as consumers increasingly sought healthier and shelf-stable food options during lockdowns, the demand for dried fruits surged. This shift towards at-home cooking and snacking habits drove market growth, highlighting the perceived health benefits and longer shelf life of dried fruits. Additionally, the emphasis on boosting immunity and maintaining overall health during the pandemic further bolstered the market as dried fruits are recognized for their nutritional value. While the market faced short-term disruptions, the sustained demand for healthier snack alternatives and a shift towards online retail channels indicate resilience and potential for growth in the Europe dried fruits sector.

Latest Trends/ Developments:

A prevailing trend in the Europe dried fruits market is the increasing emphasis on sustainable and ethical sourcing practices. Consumers are becoming more conscious of the environmental impact and ethical considerations related to food production. This trend has led to a growing demand for dried fruits sourced through sustainable farming methods, such as organic cultivation and fair trade practices. Companies are responding by highlighting their commitment to ethical sourcing, transparent supply chains, and environmentally friendly production processes. Consumers are showing a preference for products that align with their values, driving the trend towards sustainably sourced dried fruits.

A significant development in the Europe dried fruits market is the increasing focus on product diversification and innovative blends. Companies are introducing a variety of dried fruit blends that combine different fruits or mix dried fruits with nuts, seeds, or chocolate to offer unique snacking experiences. These blends cater to consumer preferences for convenience, taste variety, and nutritional value in a single product. Moreover, this development aligns with the demand for healthier snacking alternatives, providing consumers with flavorful options while meeting their nutritional needs. The introduction of these innovative blends reflects a response to evolving consumer tastes and preferences in the dried fruits market.

Key Players:

- Bergin Fruit and Nut Company

- Sunsweet Growers Inc.

- Paradise Fruits Solutions GmbH & Co.

- Traina Foods

- Del Monte Foods, Inc.

- Sun-Maid Growers of California

- Ocean Spray Cranberries, Inc.

- Royal Nut Company

- Graceland Fruit, Inc.

- The Wonderful Company

Chapter 1. Europe Dried Fruits Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Dried Fruits Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Dried Fruits Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Dried Fruits Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Dried Fruits Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Dried Fruits Market– By Product Type

6.1. Introduction/Key Findings

6.2. Raisins

6.3. Apricots

6.4. Dates

6.5. Figs

6.6. Berries

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Dried Fruits Market– By Application

7.1. Introduction/Key Findings

7.2 Snacks

7.3. Baking & Confectionery

7.4. Breakfast Cereals

7.5. Desserts

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Dried Fruits Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Specialty Stores

8.4. Convenience Stores

8.5. Online Retail

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 9. Europe Dried Fruits Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Application

9.1.3. By Product Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Dried Fruits Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bergin Fruit and Nut Company

10.2. Sunsweet Growers Inc.

10.3. Paradise Fruits Solutions GmbH & Co.

10.4. Traina Foods

10.5. Del Monte Foods, Inc.

10.6. Sun-Maid Growers of California

10.7. Ocean Spray Cranberries, Inc.

10.8. Royal Nut Company

10.9. Graceland Fruit, Inc.

10.10. The Wonderful Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Dried Fruits Market was valued at USD 5.56 Billion in 2023 and is projected to reach a market size of USD 8.30 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Rising Health and Wellness Trends among consumers along with Convenience and Versatility offered by dry fruits are the main drivers propelling the Europe Dried Fruits Market.

Based on application, the Europe Dried Fruits Market is segmented into Snacks, Baking & Confectionery, Breakfast Cereals, Desserts, Others.

Germany is the most dominant region in the European Fast Food Market.

Bergin Fruit and Nut Company, Sunsweet Growers Inc., Paradise Fruits Solutions GmbH & Co., Traina Foods are the key players operating in the Europe Dried Fruits Market.