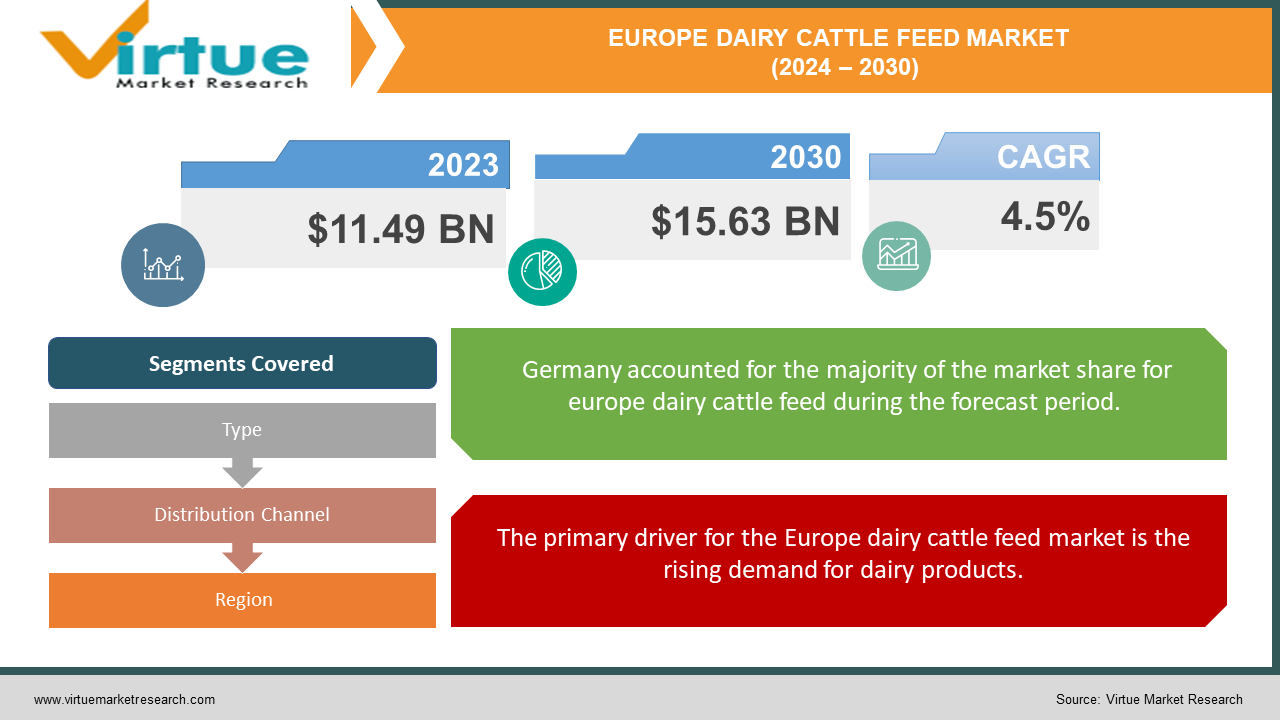

Europe Dairy Cattle Feed Market Size (2024-2030)

The Europe Dairy Cattle Feed Market was valued at USD 11.49 Billion in 2023 and is projected to reach a market size of USD 15.63 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Within the larger animal feed business, the European dairy cattle feed market is an important sector that meets the unique nutritional requirements of dairy cows. This market includes a broad spectrum of feed items intended to improve dairy cattle's health, productivity, and milk output. Europe is one of the world's top milk-producing areas, thus there is a significant and ever-changing need for premium cow feed. Over the upcoming years, sustained expansion is anticipated in the dairy cow feed business in Europe. This expansion is being driven by factors including greater cow health awareness, increased dairy output, and feed formulation innovations. A wide variety of goods, including compound feeds, feed additives, and customized feeds for various lactation and development phases, define the market.

Key Market Insights:

- Roughage sources like hay, silage, and pasture make up around 60% of a typical dairy cow's diet in Europe.

- Sustainability concerns are driving a projected 10% increase in the use of alternative protein sources like insect protein in dairy cattle feed by 2025.

- The market for antibiotic-free dairy cattle feed in Europe is expected to reach over €2 billion by 2024, driven by consumer demand for animal welfare practices.

- Precision livestock farming technologies are expected to be adopted by over 30% of European dairy farms by 2027, leading to more efficient feed management.

- The use of data analytics in the European dairy cattle feed market is projected to grow at a CAGR exceeding 15% by 2026.

- E-commerce platforms for dairy cattle feed are expected to capture over 5% of the market share by 2025, offering farmers greater access and potentially lower prices.

- Greenhouse gas emissions associated with dairy cattle feed production in Europe are estimated to be around 10% of the total agricultural sector emissions.

- Food waste from various industries, like bakeries and breweries, is projected to contribute over 1 million tonnes of ingredients to European dairy cattle feed by 2023.

- The use of single-cell protein derived from algae in dairy cattle feed is expected to reduce the environmental footprint of milk production by an estimated 20% by 2030.

- Consumer demand for organic dairy products is driving a surge in the market for organic dairy cattle feed, with a projected CAGR exceeding 8% by 2024.

- Over 65% of European consumers are willing to pay a slight premium for dairy products sourced from farms using sustainable and animal welfare-friendly feed practices.

Europe Dairy Cattle Feed Market Drivers:

The primary driver for the Europe dairy cattle feed market is the rising demand for dairy products.

People are becoming more and more aware of the health benefits associated with dairy consumption. Among the essential components present in dairy products are vitamins, minerals, calcium, and protein. This understanding leads to an increase in the demand for high-quality milk production since it promotes the use of dairy products. Europe is recognized for producing a large range of dairy products. The sector provides everything from traditional products like milk and cheese to innovative choices like lactose-free and plant-based dairy replacements, catering to a wide spectrum of consumer interests.

Technological advancements in food processing have made it possible to produce whole-grain foods that retain their nutritional value while offering improved taste and texture.

Dairy production has been revolutionized by precision farming technology, which allows farmers to more accurately monitor and manage their herds. For example, feed formulas may be optimized through precision feeding to meet the unique nutritional requirements of individual cows. Better feed efficiency, increased milk output, and less waste are the results of this. In today's dairy farming, automation and robots are crucial. Robotic milking systems, automated feeding systems, and health monitoring equipment lower labour expenses and increase operational efficiency. Additionally, these devices offer insightful data on the health and performance of cows, allowing prompt interventions and improved feed management. High-yielding dairy cow breeds have been developed as a consequence of advances in animal genetics.

Europe Dairy Cattle Feed Market Restraints and Challenges:

The price volatility of raw materials is a major concern for the European dairy cow feed business. Weather, geopolitical unrest, and consumer demand are just a few of the variables that can affect the price of feed components, which include grains, oilseeds, and other commodities. Crop yields can be greatly impacted by a variety of weather phenomena, such as floods, droughts, and extremely high or low temperatures. Low harvests lead to fewer feed ingredients being available, which raises costs. In contrast, good weather patterns can produce bumper crops, which lowers prices. It is difficult for feed makers to keep their prices steady because of this volatility. Trade agreements and geopolitical unrest may also have an impact on the price and accessibility of feed ingredients.

Europe Dairy Cattle Feed Market Opportunities:

The market for dairy cow feed is poised for substantial growth due to the increasing consumer demand for organic and non-GMO dairy products. Organic and non-GMO feed choices are in high demand as consumers seek out natural and ethically produced food items, especially dairy. The market for organic food is growing quickly due to customer preferences for natural and eco-friendly products. Organic dairy products are becoming more and more popular since they are made without the use of artificial fertilizers, pesticides, or genetically modified organisms. Because of this tendency, there is a market niche for feed makers that produces organic cow feed. The market for dairy cow feed is poised for substantial expansion because of innovations in sustainable feed options. The creation of feed crops resistant to drought can help with the problem of water shortage and increase the resilience of dairy production. Because these crops are drought-tolerant and have low water requirements, they may be grown even in harsh regions without the need for irrigation, providing a consistent source of food. The environmental impact of feed production can be decreased by investigating substitute protein sources for cow feed, such as algae and insect protein. Compared to conventional protein sources like fish meal and soybean meal, these alternative proteins utilize less energy and produce fewer greenhouse gas emissions. Precision feeding systems have the potential to improve feed efficiency and minimize waste by customizing feed formulas to meet the unique nutritional requirements of individual cows.

EUROPE DAIRY CATTLE FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Cargill (US), Archer Daniels Midland Company (ADM) (US), Groupe Avril (France), Nutreco N.V. (Netherlands), Roquette Frères (France), For Farmers N.V. (Netherlands), Agrifarm Group (Netherlands), DLG Group (Germany), Agravis Raiffeisen (Germany), Royal Agrifirm Group (Netherlands) |

Europe Dairy Cattle Feed Market Segmentation:

Europe Dairy Cattle Feed Market Segmentation: By Types:

- Compound feed

- Feed additives

- Specialty feed

Compound feed is the most dominant type in the dairy cattle feed market. It is a carefully balanced mixture of various feed ingredients, including grains, protein meals, vitamins, and minerals, designed to meet the nutritional requirements of dairy cows. Compound feed is widely used due to its convenience and comprehensive nutritional profile, making it a staple in dairy farming.

Specialty feed includes customized feed formulations designed for specific stages of lactation, growth, or health conditions. These feeds are tailored to address particular nutritional needs, such as high-energy feeds for lactating cows or calcium-rich feeds for calving cows. Specialty feed is gaining traction as farmers seek targeted nutritional solutions to optimize dairy production.

Europe Dairy Cattle Feed Market Segmentation: By Distribution Channel:

- Direct Sales

- Online Platforms

- Retail stores

Direct sales remain the most dominant distribution channel for dairy cattle feed. This channel involves transactions between feed manufacturers and end-users, including dairy farmers and large-scale dairy operations. Direct sales offer personalized service, bulk purchasing options, and tailored nutritional solutions, making it the preferred choice for large dairy farms.

In the market for dairy cattle feed, online platforms are the distribution channel that is expanding the fastest. Specialized feed providers and e-commerce websites provide a large selection of feed items together with thorough product details and affordable prices. The popularity of online platforms for feed purchasing is being driven by the ease of online shopping combined with the capacity to compare items and read customer feedback.

Europe Dairy Cattle Feed Market Segmentation: Regional Analysis:

- Italy

- Spain

- Russia

- Germany

- UK

- France

- Rest of Europe

In Europe, Germany is by far the leading nation in the dairy cattle feed industry. One of the biggest dairy farming sectors in Europe is found in Germany. The nation produces a lot of milk, and dairy production is supported by a sophisticated infrastructure. High levels of milk production are caused by a combination of improved farming techniques, suitable climatic circumstances, and the availability of enormous areas of agricultural land. When it comes to implementing cutting-edge technologies in dairy production, Germany leads the way. There is widespread use of automated feeding systems, sophisticated health monitoring equipment, and precision farming practices. These innovations protect dairy cows' general health, increase milk output, and optimize feed efficiency.

In Europe, the market for dairy cow feed is expanding at the quickest rate in Spain. In recent years, milk output has increased significantly in Spain. Increased herd management, better feed formulas, and investments in contemporary dairy farming techniques have all helped to boost milk output. great-quality cow feed is in great demand due to the emphasis on increasing production. With an increasing number of dairy farms and processing facilities, the Spanish dairy sector is booming. Opportunities for exports as well as local consumption are driving this growth. Effective and nutrient-rich cow feed is becoming more and more necessary due to the growing demand for Spanish dairy products, especially in foreign markets.

COVID-19 Impact Analysis on the Europe Dairy Cattle Feed Market:

Border closures and lockdown measures hampered the transportation of essential raw materials like grains, oilseeds, and protein sources (soybean meal, fishmeal). This limited the availability of ingredients for feed production and caused price fluctuations. Social distancing protocols and worker illnesses disrupted operations at feed mills and manufacturing plants. Reduced production capacity led to shortages of certain feed types, impacting dairy farm planning and animal nutrition. Disruptions in major exporting countries, coupled with panic buying, triggered volatility in global commodity prices. This created uncertainty for European feed producers, making it difficult to secure raw materials at stable prices. Lockdown restrictions spurred the adoption of e-commerce platforms for buying and selling feed products. This provided a convenient and safe alternative for farmers to access essential supplies while minimizing physical contact.

Latest Trends/ Developments:

Methane emissions from enteric fermentation in cows are a significant environmental concern. Research is ongoing to develop feed additives and formulations that can reduce methane production without compromising animal health or milk yield. These might include specific seaweeds, essential oils, or targeted probiotics. The concept of a circular bioeconomy is gaining traction. This involves utilizing byproducts from other industries, such as food processing waste streams, to create high-quality feed ingredients. This reduces reliance on virgin resources and promotes waste minimization. Insect protein offers a promising alternative with a lower environmental impact compared to soy. Regulatory hurdles are being addressed, and the use of insect protein in animal feed is expected to increase in the coming years. Single-cell protein derived from microorganisms like yeast or algae is another potential alternative. These protein sources are highly digestible and can be produced efficiently using fermentation processes. Roughage sources like hay, silage, and pasture offer several benefits. They promote ruminant digestion, improve gut health, and provide essential fiber for optimal cow well-being.

Key Players:

- Cargill (US)

- Archer Daniels Midland Company (ADM) (US)

- Groupe Avril (France)

- Nutreco N.V. (Netherlands)

- Roquette Frères (France)

- For Farmers N.V. (Netherlands)

- Agrifarm Group (Netherlands)

- DLG Group (Germany)

- Agravis Raiffeisen (Germany)

- Royal Agrifirm Group (Netherlands)

Chapter 1. Europe Dairy Cattle Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Dairy Cattle Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Dairy Cattle Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Dairy Cattle Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Dairy Cattle Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Dairy Cattle Feed Market– By Type

6.1. Introduction/Key Findings

6.2. Compound feed

6.3. Feed additives

6.4. Specialty feed

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Dairy Cattle Feed Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Direct Sales

7.3. Online Platforms

7.4. Retail stores

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Europe Dairy Cattle Feed Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Dairy Cattle Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Cargill (US)

9.2. Archer Daniels Midland Company (ADM) (US)

9.3. Groupe Avril (France)

9.4. Nutreco N.V. (Netherlands)

9.5. Roquette Frères (France)

9.6. For Farmers N.V. (Netherlands)

9.7. Agrifarm Group (Netherlands)

9.8. DLG Group (Germany)

9.9. Agravis Raiffeisen (Germany)

9.10. Royal Agrifirm Group (Netherlands)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Concerns about greenhouse gas emissions are pushing for the development of feed formulations and practices that minimize methane emissions from cows and promote a circular bioeconomy through utilizing food processing byproducts.

. The European market relies heavily on imported protein sources like soybeans. Price fluctuations in the global market for these commodities can significantly impact the cost of feed production and create uncertainty for farmers.

Cargill (US), Archer Daniels Midland Company (ADM) (US), Groupe Avril (France), Nutreco N.V. (Netherlands), Roquette Frères (France), For Farmers N.V. (Netherlands), Agrifarm Group (Netherlands), DLG Group (Germany), Agravis Raiffeisen (Germany), Royal Agrifirm Group (Netherlands).

The market is dominated by Germany, which commands a market share of around 30%.

With a market share of about 15%, Spain is the nation that is expanding the fastest.