Europe Corn Starch Market Size (2024-2030)

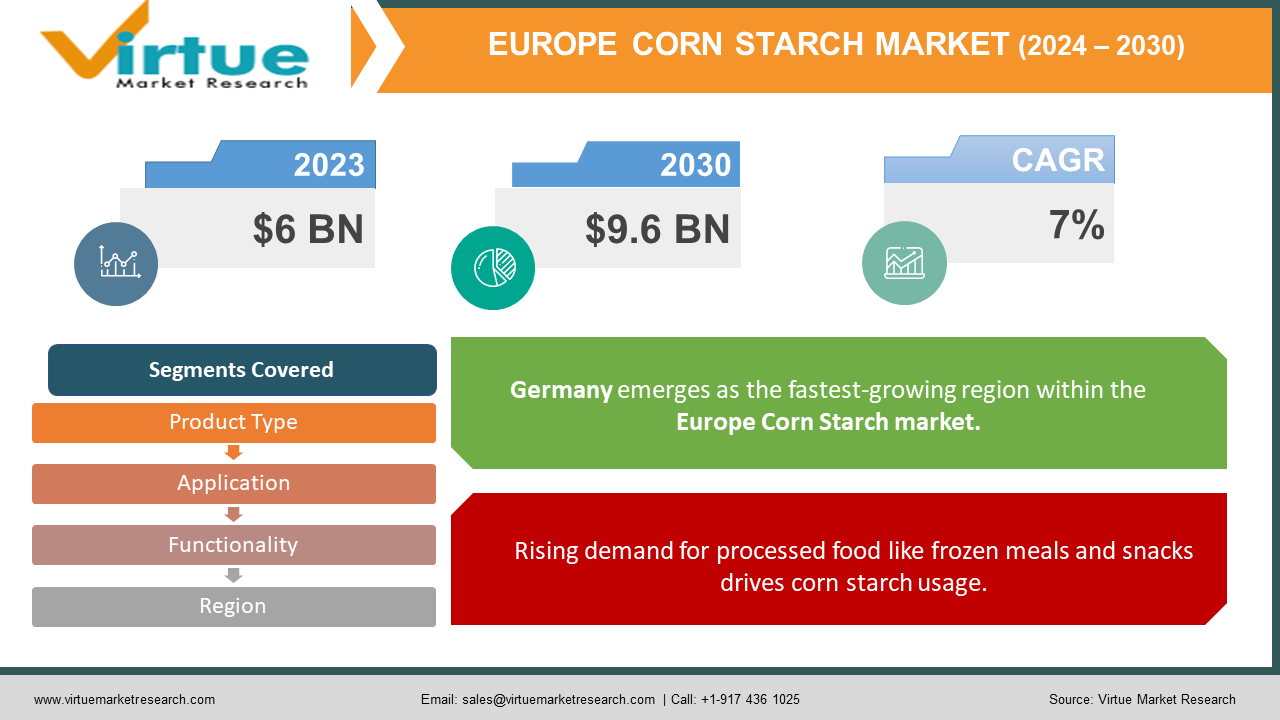

The Europe Corn Starch Market was valued at USD 6 billion in 2023 and is projected to reach a market size of USD 9.6 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 7%.

The European corn starch market is a significant player on the global stage, and its growth trajectory is expected to continue upward in the coming years. Germany leads the pack in both production and consumption within the region. The market is segmented by product type, with native starch, modified starch, and sweeteners being the main categories. Sweeteners currently hold the largest market share. Corn starch finds applications in various sectors, including food (think bakery goods, confectionery, and processed foods), non-food (pharmaceuticals, cosmetics, and textiles), and even the feed industry.

Key Market Insights:

The European corn starch market is a significant player on the global stage, showcasing consistent growth potential. Germany stands out as the leading producer and consumer within the region. This market caters to diverse applications, with corn starch finding its way into various sectors. From food giants like bakeries and confectioners to non-food sectors like pharmaceuticals and textiles, corn starch plays an essential role. Even the animal feed industry utilizes this versatile ingredient.

While challenges exist, including rising raw material costs and competition from other starch sources like wheat and potato, the European corn starch market exhibits promising growth drivers. The increasing demand for processed food, particularly convenient options, is a significant factor propelling the market forward. Additionally, the growing awareness and demand for gluten-free products presents a substantial opportunity for corn starch producers.

Looking ahead, the development of innovative applications for corn starch further expands its reach and potential. This, combined with the growth drivers, paints a positive picture for the future of the European corn starch market, suggesting continued steady growth in the coming years.

The Europe Corn Starch Market Drivers:

Rising demand for processed food like frozen meals and snacks drives corn starch usage.

The European market is witnessing a growing demand for convenient and readily available food options. This includes frozen meals, packaged snacks, and processed meats, all of which often utilize corn starch as a thickener, binder, or bulking agent. This trend is expected to continue, driving the demand for cornstarch in the food processing sector.

Growing awareness of gluten sensitivities fuels the demand for corn starch in gluten-free alternatives.

The growing awareness of gluten sensitivities and celiac disease has led to a surge in demand for gluten-free products. Corn starch, naturally gluten-free, serves as a crucial ingredient in many gluten-free alternatives like bread, pasta, and baked goods. This increasing demand creates a significant opportunity for corn starch producers catering to the gluten-free market.

Development of bioplastics, packaging, and other novel applications expands corn starch's reach.

The corn starch industry is constantly innovating, and developing new and diverse applications for this versatile ingredient. This includes bioplastics, biodegradable packaging materials, and even pharmaceutical and cosmetic applications. As these new applications gain traction, the demand for corn starch is expected to rise further.

Consumers' focus on eco-friendly options positions corn starch as a sustainable choice.

Consumers are increasingly concerned about the environmental impact of the products they consume. Corn starch, a readily available and renewable resource, is often viewed as a more sustainable alternative to other starches or thickening agents. This focus on sustainability could further fuel the demand for corn starch in various industries.

The Europe Corn Starch Market Restraints and Challenges:

While the European corn starch market enjoys positive growth prospects, it also faces some notable restraints and challenges. One major concern is the fluctuation in raw material costs. Corn, the primary source material for corn starch, experiences price variations due to factors like weather conditions, global agricultural trends, and trade policies. These fluctuations can impact the production costs and profitability of corn starch manufacturers.

Another challenge comes from competition from alternative starches. Wheat and potato starches offer similar functionalities and sometimes even lower costs, posing a threat to corn starch's market share. Additionally, the stringent regulations governing food additives in Europe can hinder the adoption of new and innovative corn starch applications, potentially limiting market growth.

Furthermore, the market faces challenges related to sustainability concerns. While corn starch is often considered a renewable resource, its production and processing can still have environmental impacts, such as water usage and greenhouse gas emissions. Addressing these concerns and implementing sustainable practices throughout the supply chain will be crucial for the long-term success of the European corn starch market.

Despite these challenges, the market's potential for innovation and its diverse range of applications offer promising opportunities for future growth. By addressing these restraints and challenges effectively, the European corn starch market can maintain its position as a significant player in the global landscape.

The Europe Corn Starch Market Opportunities:

The European corn starch market brims with potential beyond its current applications. Existing industries like food, pharmaceuticals, and textiles offer opportunities for further exploration. Customized starches or niche market solutions can unlock new possibilities. Additionally, the burgeoning bioplastics market presents a significant avenue for growth. Corn starch, a readily biodegradable resource, can become a game-changer in this eco-friendly sector through strategic partnerships and collaborations. Furthermore, the e-commerce boom presents a golden opportunity to reach a wider audience by establishing a strong online presence and expanding distribution channels. Looking beyond established markets, exploring Eastern Europe with its growing economies and rising disposable incomes can be strategically fruitful. Tailoring products and marketing strategies to these emerging regions can unlock new customer segments. Finally, embracing sustainability throughout the supply chain offers a double win. By minimizing water usage and waste generation, corn starch producers not only contribute to environmental well-being but also enhance their brand image and attract eco-conscious consumers. Capitalizing on these opportunities while addressing existing challenges will ensure the European corn starch market remains a key player on the global stage, poised for continued growth and success.

EUROPE CORN STARCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Product Type, Application, Functionality, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Cargill Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, Associated British Foods plc, Roquette Frères S.A., Tereos Syral S.A.S, AVEBE |

The Europe Corn Starch Market Segmentation:

Europe Corn Starch Market Segmentation: By Product Type:

- Native Starch

- Modified Starch

- Sweeteners

- Bio-based Products

Among product types, modified starch holds the dominant position in the European corn starch market, capturing a larger share than native starch and sweeteners. This is due to its diverse functionalities and ability to cater to specific needs across various industries. However, the bio-based products segment is experiencing the fastest growth, driven by increasing environmental concerns and the demand for sustainable alternatives. This segment holds immense potential for future expansion as innovation in bioplastics and other applications continues.

Europe Corn Starch Market Segmentation: By Application:

- Food Industry

- Non-food Industry

- Animal Feed Industry

- Industrial Applications

The Food Industry reigns supreme in the European corn starch market by application, consuming a significant portion of various food products like bakery goods, confectionery, and processed foods. Meanwhile, the Bio-based Products segment is experiencing the most rapid growth, driven by the rising demand for sustainable alternatives and innovative applications in bioplastics and biodegradable packaging materials.

Europe Corn Starch Market Segmentation: By Functionality:

- Thickening and Gelling

- Sweetening

- Binding and Film Formation

- Moisture Retention

Within the functionality segment of the European corn starch market, thickening and gelling reign supreme, finding applications across diverse industries like food processing, pharmaceuticals, and even industrial processes. However, the fastest-growing segment is bio-based products, driven by the increasing demand for sustainable alternatives. This segment encompasses innovative applications like bioplastics and biodegradable packaging materials, showcasing significant potential for future growth.

Europe Corn Starch Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: The UK market for corn starch presents a unique picture. Unlike other leading regions, the UK demonstrates a preference for imported corn starch. However, this doesn't signify a lack of innovation. The UK market is actively focusing on bio-based products, developing, and utilizing corn starch for sustainable alternatives like bioplastics. This focus on innovation positions the UK as a potential leader in the future of the European corn starch market.

Germany: Germany remains the undisputed leader in the European corn starch market. This dominance stems from its well-established agricultural sector, which provides a reliable source of raw materials, and its long-standing corn starch manufacturing industry. This combination allows Germany to lead in both production and consumption within the European market.

France: France carves out a distinct niche within the European corn starch market. Here, the focus lies on specialty starches, catering to high-quality applications, particularly in the food industry. French producers have built a reputation for innovative starches that enhance texture, flavor, and functionality in various food products.

Italy: While Italy holds a significant market share in Europe, its consumption patterns differ from other leading regions. The non-food sector takes center stage in Italy, with a growing demand for corn starch in industries like textiles and pharmaceuticals. This focus on non-food applications reflects Italy's specific industrial landscape and consumer preferences.

Spain: Spain exhibits a strong focus on the food processing industry, particularly in the consumption of corn starch. Processed meats and bakery products are key drivers of this demand. As the Spanish food processing sector continues to grow, the need for corn starch as a thickening and binding agent is expected to rise as well.

Rest of Europe: The "Rest of Europe" segment encompasses various countries with diverse market dynamics. Emerging markets in Eastern Europe, like Poland, Hungary, and Romania, show increasing demand for corn starch, indicating potential for future growth. Scandinavia, with countries like Denmark, Sweden, and Norway, presents a distinct market with specific preferences and regulations. Additionally, other European countries like Greece, Portugal, and Turkey contribute to the regional market, but with varying levels of production and consumption, shaping the overall European corn starch landscape.

COVID-19 Impact Analysis on the Europe Corn Starch Market:

The COVID-19 pandemic cast a complex shadow on the European corn starch market, presenting both challenges and opportunities. Disrupted supply chains and fluctuating consumer demand due to stockpiling and home cooking initially posed difficulties. The decline in the food service industry, a major consumer of corn starch, further impacted the market. Additionally, logistical challenges hindered the smooth movement of products.

However, the pandemic also presented opportunities. The rise in home cooking led to increased demand for corn starch in specific food products like baking mixes and sauces. The e-commerce boom offered new avenues for producers to reach consumers online. Furthermore, the growing focus on health and immunity during the pandemic could benefit the demand for corn starch in certain pharmaceutical and nutraceutical applications. Finally, the surge in the bioplastics market, driven by increased sustainability awareness, presents a potential future opportunity for corn starch as a bio-based alternative.

Overall, the COVID-19 pandemic's impact on the European corn starch market was multifaceted. While initial challenges emerged, the market exhibited signs of adaptation and resilience. By capitalizing on opportunities in home cooking, e-commerce, and sustainable alternatives, the European corn starch market is expected to recover and resume its growth trajectory in the coming years, with the long-term impact depending on the market's effectiveness in adapting to these evolving dynamics.

Latest Trends/ Developments:

The European corn starch market is abuzz with activity, constantly adapting to new trends and developments. Sustainability is a major driver, with producers embracing non-GMO corn, minimizing water usage, and exploring biodegradable packaging solutions. Additionally, the booming bioplastics market presents corn starch as a viable and eco-friendly alternative. Innovation reigns supreme, with producers developing novel starches boasting unique functionalities like improved texture, extended shelf life, and enhanced nutritional profiles. This focus ensures corn starch remains competitive in a rapidly evolving landscape.

New markets are being explored, with corn starch venturing into the pharmaceutical, cosmetic, and personal care industries. Furthermore, emerging Eastern European markets with growing economies and rising disposable incomes offer exciting future growth potential.

The regulatory landscape is dynamic; strict EU regulations governing food additives necessitate constant adaptation from producers to ensure compliance. Navigating these evolving regulations and securing necessary approvals is crucial for success.

Finally, advancements in biotechnology and processing technologies pave the way for the development of novel corn starch products with unique functionalities. These innovations hold immense potential, opening doors to entirely new applications and market segments, ensuring the European corn starch market remains a key player in the global arena.

Key Players:

- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Tate & Lyle PLC

- Associated British Foods plc

- Roquette Frères S.A.

- Tereos Syral S.A.S

- AVEBE

Chapter 1. Europe Corn Starch Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Corn Starch Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Corn Starch Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Corn Starch Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Corn Starch Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Corn Starch Market– By Application

6.1. Introduction/Key Findings

6.2. Food Industry

6.3. Non-food Industry

6.4. Animal Feed Industry

6.5. Industrial Applications

6.6. Y-O-Y Growth trend Analysis By Application

6.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. Europe Corn Starch Market– By Product Type

7.1. Introduction/Key Findings

7.2 Native Starch

7.3. Modified Starch

7.4. Sweeteners

7.5. Bio-based Products

7.6. Y-O-Y Growth trend Analysis By Product Type

7.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Europe Corn Starch Market– By Functionality

8.1. Introduction/Key Findings

8.2. Thickening and Gelling

8.3. Sweetening

8.4. Binding and Film Formation

8.5. Moisture Retention

8.6. Y-O-Y Growth trend Analysis Functionality

8.7. Absolute $ Opportunity Analysis Functionality , 2024-2030

Chapter 9. Europe Corn Starch market Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Application

9.1.3. By Product Type

9.1.4. By Functionality

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Corn Starch market Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill Incorporated

10.2. Archer Daniels Midland Company (ADM)

10.3. Ingredion Incorporated

10.4. Tate & Lyle PLC

10.5. Associated British Foods plc

10.6. Roquette Frères S.A.

10.7. Tereos Syral S.A.S

10.8. AVEBE

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Corn Starch Market was valued at USD 6 billion in 2023 and is projected to reach a market size of USD 9.6 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 7%.

Rising Demand for Processed Food, Increasing Gluten-free Awareness, Development of Innovative Applications, and Growing Focus on Sustainability

Thickening and Gelling, Sweetening, Binding and Film Formation, and Moisture Retention

Germany remains the undisputed leader in the European corn starch market, holding the top spot in both production and consumption

Cargill Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, Associated British Foods plc, Roquette Frères S.A., Tereos Syral S.A.S, AVEBE.