Europe Corn Flour Market Size (2024-2030)

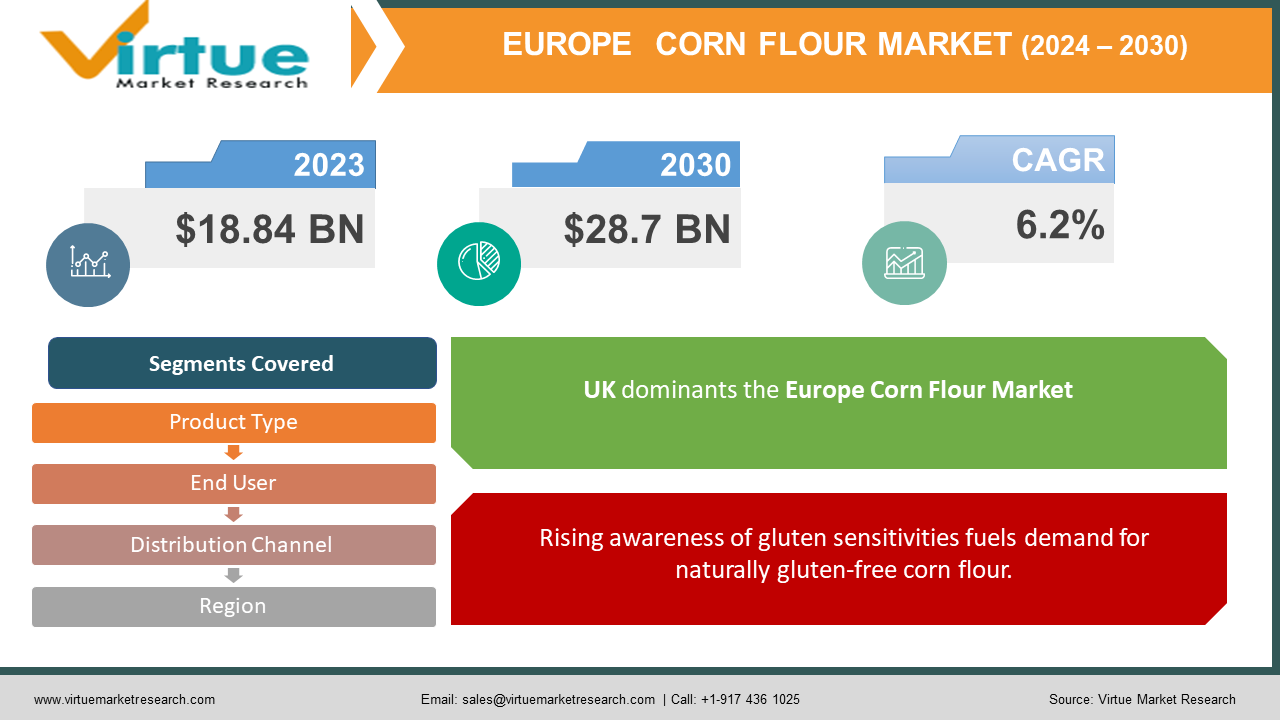

The European Corn Flour Market was valued at USD 18.84 billion in 2023 and is projected to reach a market size of USD 28.7 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6.2%.

The European corn flour market shows promising signs of growth, driven by several key trends. Consumers are increasingly seeking healthy and convenient food options, and corn flour fits the bill perfectly. Its versatility, nutritional value, and natural gluten-free nature make it a popular choice for various dietary needs. Additionally, the growing popularity of ethnic cuisines that heavily utilize corn flour, such as Mexican and Latin American, further fuels the market. Rising disposable income and the increasing adoption of online shopping provide further impetus to the European corn flour market's growth trajectory. Major players in the market are actively investing in research and development to create innovative corn flour products that cater to evolving consumer preferences.

Key Market Insights:

The European corn flour market is experiencing a surge in popularity, driven by several key trends. Health-conscious consumers are increasingly seeking convenient and nutritious food options, and corn flour perfectly fits the bill. Its versatility allows for its use in various quick and easy meals and snacks, while its natural gluten-free nature caters to individuals with celiac disease or gluten sensitivity. This growing demand for gluten-free products is a major driver of the market's expansion.

Furthermore, the rising popularity of ethnic cuisines such as Mexican and Latin American, which heavily feature corn flour as a key ingredient, is further fueling market growth. Additionally, increasing disposable income and the growing adoption of online shopping are creating a favorable environment for the European corn flour market. This easy access and convenience further encourage consumers to incorporate corn flour into their diets.

Major players in the market are actively investing in research and development to capitalize on this growth. They are constantly innovating to create new corn flour products that cater to evolving consumer preferences and dietary needs, ensuring the market's continued success in the years to come.

The European Corn Flour Market Drivers:

Health-conscious consumers seek convenience and nutrition, making corn flour a perfect choice.

Consumers are increasingly prioritizing health and convenience in their food choices. Corn flour fits perfectly into this trend, offering both aspects. Its nutritional value, including carbohydrates, fiber, and vitamins, combined with its versatility in various recipes, makes it a popular choice for quick and healthy meals or snacks.

Rising awareness of gluten sensitivities fuels demand for naturally gluten-free corn flour.

The growing awareness of celiac disease and gluten sensitivity has led to a surge in demand for gluten-free products. As corn flour is naturally gluten-free, it serves as a viable alternative for individuals with these dietary restrictions, propelling the market forward.

The growing popularity of ethnic cuisines featuring corn flour drives market expansion.

The increasing popularity of ethnic cuisines, particularly Mexican and Latin American, which heavily utilize corn flour in various dishes, is another significant driver of the market. This trend further expands the consumer base for corn flour products.

Increasing disposable income and online shopping create a favorable market environment.

Increasing disposable income allows European consumers to spend more on diverse food items, including corn flour. Additionally, the growing popularity of online shopping creates convenient avenues for purchasing corn flour, further stimulating market growth.

The European Corn Flour Market Restraints and Challenges:

The European corn flour market, while flourishing, faces certain restraints and challenges that hinder its unbridled growth. One major concern is the volatility of corn prices, the primary raw material. Factors like weather conditions, global demand fluctuations, and supply chain disruptions can significantly impact production costs and ultimately, pricing for consumers. This can lead to price sensitivity and potentially discourage purchase decisions.

Furthermore, corn flour faces stiff competition from alternative flours like wheat, rice, and various gluten-free options. These alternatives cater to diverse dietary needs and preferences, potentially impacting corn flour's market share. Additionally, maintaining consistent quality and texture across corn flour batches can be challenging. Variations in the final product can affect the consistency and quality of end products, potentially discouraging consumers who value predictability in their cooking and baking experiences.

Lastly, inadequate storage facilities, particularly in developing regions within Europe, can lead to significant food waste. This not only presents ethical concerns but also translates to economic losses for manufacturers and potential supply chain disruptions. Addressing these restraints and challenges is crucial for the European corn flour market to maintain its growth trajectory and ensure long-term sustainability.

The European Corn Flour Market Opportunities:

The European corn flour market, while experiencing growth, also faces challenges. Fluctuations in corn prices, competition from alternative flours, quality inconsistencies, and inadequate storage can hinder its full potential. However, exciting opportunities exist to overcome these hurdles and propel the market forward.

Innovation is key. Manufacturers can develop corn flour with added functionalities like fiber or protein, cater to health-conscious consumers with organic and non-GMO options, and tap into new applications beyond traditional food products. Corn flour's potential extends to biodegradable packaging, industrial thickening agents, or even cosmetics, offering exciting new avenues for growth.

Furthermore, adopting sustainable practices throughout the supply chain, from sourcing corn to packaging and distribution, can attract environmentally conscious consumers. This includes utilizing sustainable farming practices, employing eco-friendly packaging solutions, and minimizing food waste within the production process.

Finally, targeting specific consumer segments holds immense potential. Athletes, individuals with dietary restrictions, and specific ethnic communities with a strong cultural connection to corn flour all present unique opportunities. By tailoring marketing and product development efforts to these segments, the market can broaden its reach and cater to diverse preferences.

Seizing these opportunities will not only ensure the continued growth of the European corn flour market but also pave the way for its long-term success and sustainability.

EUROPE CORN FLOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Product Type, End User, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, France, Italy, UK, Spain, Rest of Europe |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Bunge Limited, General Mills, Inc., Grain Millers, Inc., Buffaloe Milling CO Inc., Glen Miller |

The European Corn Flour Market Segmentation:

European Corn Flour Market Segmentation: By Product Type

- Native Starch

- Modified Starch

- Sweeteners

The dominant segment in the European corn flour market by product type is native starch, accounting for over 60% of the market share. Its versatility makes it a key ingredient in various food and beverage products. Modified starch is expected to be the fastest-growing segment due to its potential for innovation and new functionalities. This segment caters to the growing demand for unique textures and functionalities in food applications.

European Corn Flour Market Segmentation: By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

Supermarkets/Hypermarkets are the dominant channel for corn flour sales in Europe due to their wide product variety and accessibility. However, online retail is expected to be the fastest-growing segment due to the increasing preference for online shopping convenience and access to a wider selection of brands.

European Corn Flour Market Segmentation: By End-Use

- Food and Beverage Industry

- Food Service and Restaurants

- Home Cooking

The dominant segment in the European Corn Flour Market by End-Use is the 'Food and Beverage Industry', which utilizes corn flour in a vast array of applications. However, the 'Home Cooking' segment is expected to be the fastest-growing segment. This growth is driven by factors like rising health consciousness, increasing demand for convenient food options, and the growing popularity of ethnic cuisines that feature corn flour prominently.

European Corn Flour Market Segmentation: Regional Analysis

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: The UK market shows a strong preference for convenience food items like corn chips and tortillas, which utilize significant amounts of corn flour. Additionally, the growing popularity of gluten-free diets is driving demand for corn flour alternatives.

Germany: Germany has a well-established corn flour industry, with a focus on both traditional uses in baking and industrial applications like thickening agents. The growing demand for organic and sustainable products presents an opportunity for manufacturers in this region.

Spain: Spain boasts a strong presence of corn flour in its cuisine, particularly for dishes like tortillas and churros. This ingrained cultural connection to corn flour contributes to a robust market in the region.

COVID-19 Impact Analysis on the European Corn Flour Market:

The COVID-19 pandemic's impact on the European corn flour market was a double-edged sword. Initial lockdowns disrupted supply chains, causing temporary shortages and price fluctuations. Consumer behaviour also shifted – panic buying spiked demand initially, followed by a rise in home cooking, leading to increased use of corn flour in various recipes. However, the closure of restaurants significantly reduced demand from the foodservice industry. Looking ahead, the long-term trends appear positive. The emphasis on home cooking is expected to continue, potentially leading to sustained demand for corn flour. Additionally, the pandemic's focus on health is likely to drive the popularity of gluten-free alternatives like corn flour. Furthermore, the surge in e-commerce grocery shopping could benefit the market by offering consumers convenient access to a wider variety of corn flour products. While the initial disruptions were undeniable, the overall impact of COVID-19 seems to favor long-term growth for the European corn flour market, with the increasing focus on home cooking, health consciousness, and online shopping outweighing the temporary negative effects. However, the success will depend on how effectively manufacturers and distributors adapt their strategies to these evolving consumer behaviors in the post-pandemic era.

Latest Trends/ Developments:

The European corn flour market is brimming with innovation. Manufacturers are developing corn flour products packed with extra benefits like increased fiber or protein, catering to health-conscious consumers. Additionally, the focus on organic and non-GMO options is growing, prompting sustainable sourcing practices. Corn flour's potential is expanding beyond food, with explorations in biodegradable packaging, industrial thickeners, and even cosmetics. Sustainability is also a major focus, with manufacturers adopting practices like eco-friendly packaging and reduced food waste throughout the supply chain. Finally, the ever-growing popularity of ethnic cuisines, particularly those from Latin America and Asia, continues to fuel demand for corn flour. By embracing these trends – innovation, sustainability, and evolving consumer preferences – the European corn flour market is poised for continued growth and exciting new possibilities.

Key Players:

- Archer Daniels Midland Company

- Cargill, Incorporated

- Ingredion Incorporated

- Bunge Limited

- General Mills, Inc.

- Grain Millers, Inc.

- Buffaloe Milling CO Inc.

- Glen Miller

Chapter 1. Europe Corn Flour Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Corn Flour – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Corn Flour Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Corn Flour - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Corn Flour Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Corn Flour Market– By Product Type

6.1. Introduction/Key Findings

6.2. Native Starch

6.3. Modified Starch

6.4. Sweeteners

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Corn Flour Market– By End User

7.1. Introduction/Key Findings

7.2 Food and Beverage Industry

7.3. Food Service and Restaurants

7.4. Home Cooking

7.5. Y-O-Y Growth trend Analysis By End User

7.6. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Europe Corn Flour Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and hypermarkets

8.3. Specialty stores

8.4. Online retail

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Corn Flour Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Type

9.1.3. By End User

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Corn Flour Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2. Cargill, Incorporated

10.3. Ingredion Incorporated

10.4. Bunge Limited

10.5. General Mills, Inc.

10.6. Grain Millers, Inc.

10.7. Buffaloe Milling CO Inc.

10.8. Glen Miller

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European Corn Flour Market was valued at USD 18.84 billion in 2023 and is projected to reach a market size of USD 28.7 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6.2%.

Health and Convenience, Rise of Gluten-Free Diets, Ethnic Cuisines Gaining Popularity, Rising Disposable Income and Online Shopping

Supermarkets/Hypermarkets, Convenience Stores, Online Retail.

Spain likely holds the strongest position in the European Corn Flour Market due to its ingrained cultural connection to corn flour in popular dishes

Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Bunge Limited, General Mills, Inc., Grain Millers, Inc., Buffaloe Milling CO Inc., Glen Miller.