Europe Cocoa and Chocolate Market Size (2024-2030)

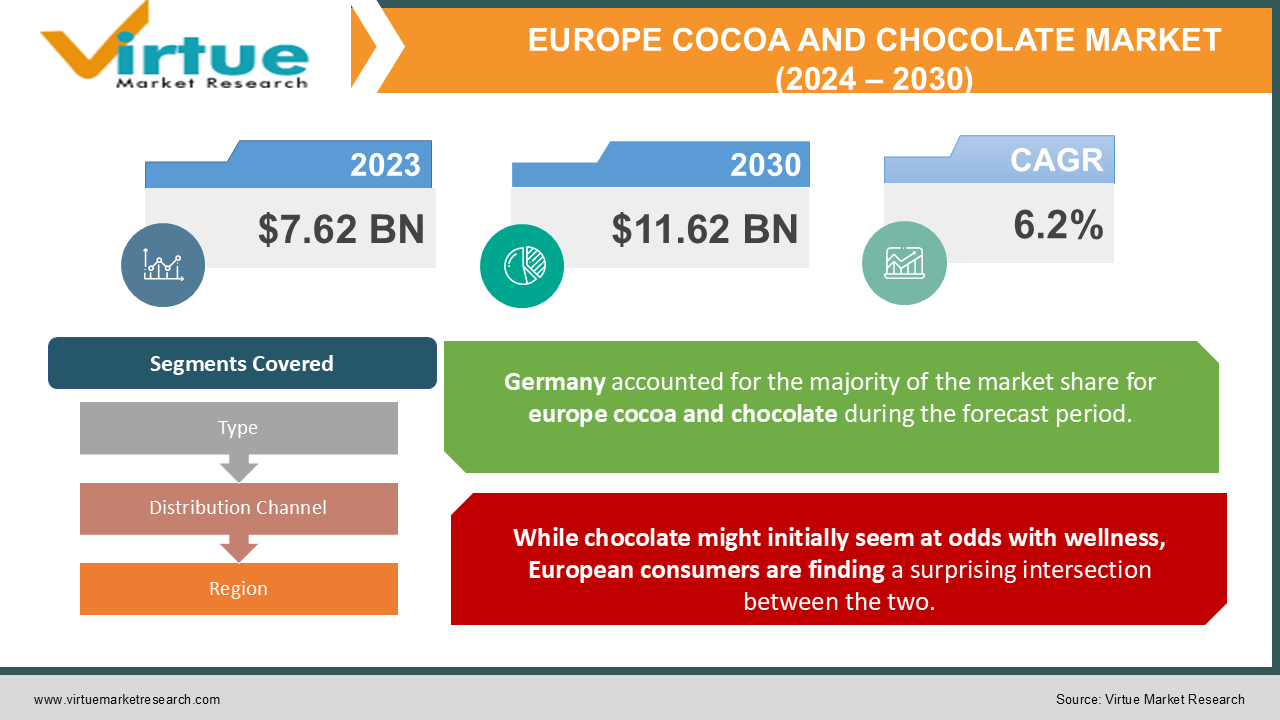

The Europe Cocoa and Chocolate Market was valued at USD 7.62 Billion in 2023 and is projected to reach a market size of USD 11.62 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

Europe is a major force within the global cocoa and chocolate industry. It houses world-renowned chocolate producers and boasts a high per capita chocolate consumption in many countries. While growth rates may be slightly lower than in some emerging markets, Europe's chocolate market exhibits consistent expansion. Factors include rising disposable incomes, evolving consumer tastes, and the strength of chocolate within established food cultures. Europe is one of the primary consumers of cocoa beans, fueling a large import market. The Netherlands, in particular, is a significant hub for cocoa bean processing and re-export. The market encompasses everything from simple chocolate bars to gourmet truffles, molded chocolates, seasonal holiday figures, and chocolate as an ingredient in various confections and baked goods. Premium and artisanal chocolates hold a growing share alongside the mass-produced option. Increasing interest in single-origin chocolates and sustainability certifications contribute to this premiumization trend. Supermarkets dominate, but specialty chocolate shops, online retail, convenience stores, and cafes all play vital roles in distribution, reaching different consumer segments.

Key Market Insights:

Europe reigns as a global hub of chocolate consumption and production. European countries like Germany, Switzerland, and Belgium boast storied traditions in chocolate making. Consumers aren't simply eating chocolate; they're indulging. Demand for premium, origin-specific, and bean-to-bar varieties reflects a heightened sensory experience. A growing health consciousness among European consumers drives a shift towards dark chocolate. Its lower sugar content and higher percentage of cocoa are seen as healthier choices. A growing health consciousness among European consumers drives a shift towards dark chocolate. Its lower sugar content and higher percentage of cocoa are seen as healthier choices. The intense flavor profiles offered by different cocoa origins and percentages within dark chocolate attract those seeking complex, nuanced taste experiences. Innovative uses of dark chocolate – in baking, savory dishes, and even pairings with traditionally contrasting flavors – broaden its appeal and usage occasions. Products infused with probiotics, vitamins, or adaptogens appear within niche segments. The intersection of wellness and chocolate indulgence is intriguing for specific consumer groups. Fairtrade and transparent sourcing practices reassure consumers about ethical production. Partnerships between European chocolate makers and small-scale cocoa growers are expanding, offering storytelling and connection. Premium, eye-catching packaging elevates chocolate from a mere treat to a giftable or self-care indulgence. Eco-conscious materials appeal to sustainability-minded consumers. Pairings with wines or craft beers, chocolate-making workshops – chocolate is going beyond mere consumption into experience-based enjoyment.

Europe Cocoa And Chocolate Market Drivers:

European consumers possess a long-standing love affair with chocolate, but the concept of 'indulgence' itself is evolving to encompass aspects like conscientiousness and a desire for heightened experiences.

Consumers are increasingly willing to pay more for chocolate that offers exceptional quality and unique sensory experiences. This drives demand for origin-specific cacao varieties, small-batch bean-to-bar chocolate, and the inclusion of exquisite ingredients and flavors. While health consciousness is on the rise, chocolate lovers aren't giving up on indulgence. Rather, they are seeking 'worthwhile' indulgences – dark chocolate with its lower sugar or chocolates showcasing thoughtful sourcing and ethical production. Chocolate is moving away from just being a treat and into the realm of a multi-sensory experience. Pairings with fine wines, the use of chocolate in gourmet dishes, and an emphasis on the visual artistry of chocolate all redefine indulgence. The act of savoring chocolate – its scent, textures, and complex flavors – moves chocolate consumption from an 'impulse' action to a mindful, pleasurable moment in itself. Small-scale chocolate makers who prioritize bean quality, unique flavor profiles, and beautiful presentation find a receptive audience willing to pay for this elevated experience. Consumers interested in mindful indulgence seek detailed information on cocoa percentages, sourcing practices, and even bean varietals. This information goes beyond basic labeling and becomes a marketing tool.

While chocolate might initially seem at odds with wellness, European consumers are finding a surprising intersection between the two.

The growing body of research highlighting the potential antioxidant and cardiovascular benefits of flavanol-rich dark chocolate aligns it with health rather than a pure 'guilty pleasure'. While still a niche market, chocolate infused with probiotics, adaptogens, or marketed as having energy-boosting properties, appeal to those wanting a 'boost' along with the taste of chocolate. The spotlight is turning towards the use of cocoa in its less-processed forms – pure cocoa powder with its intense flavor for baking, cacao nibs, and even explorations into beverages utilizing the entirety of the cacao bean. Sugar-free chocolate using natural sweeteners taps into a wellness-minded segment. Innovations in improving the taste profile of these options are key to increasing broader market appeal. Clear, detailed information about cocoa bean sourcing, ethical labor practices, and sustainable production becomes part of the 'wellness' equation for socially and environmentally conscious consumers. Messaging that emphasizes the potential 'wellness' aspects of chocolate, particularly dark varieties, gains traction and opens new market segments. Expect more product offerings focused on low sugar, 'functional chocolate', and expanded uses of cocoa within the culinary and beverage space.

Europe Cocoa And Chocolate Market Restraints and Challenges:

There is a lot of room for price fluctuation in the global cocoa market because of weather-related occurrences, crop diseases, shifting demand, and even speculation.

The global cocoa market is prone to price volatility due to weather events, crop disease, changing demand, and even speculation. These fluctuations directly impact the cost of raw materials for chocolate makers. Small-scale and artisanal chocolate makers often lack the resources to hedge against price spikes, making it difficult to manage costs and maintain consistent pricing for consumers. Sharp rises in cocoa prices can lead to higher chocolate prices, potentially dampening demand among price-sensitive consumers. The cocoa industry faces ongoing pressure concerning unethical labor practices, including child labor, within cocoa-producing countries. European consumers are increasingly aware and demand ethically sourced products. The long, fragmented cocoa supply chain makes ensuring complete traceability and transparency challenging. This can lead to reputational damage for chocolate brands involved, however unintentionally, in unethical practices. Obtaining certifications like Fairtrade or Rainforest Alliance, while desirable to ethically minded consumers, adds costs for cocoa producers and along the supply chain which may be reflected in the final price of chocolate.

Europe Cocoa And Chocolate Market Opportunities:

Cocoa-growing regions in Southeast Asia (Vietnam, Philippines) and emerging regions within Africa offer flavor profiles less familiar to the mainstream European market. Educating consumers on the nuances of terroir, fermentation processes, and the impact of bean variety creates an appreciation for less conventional chocolate origins. Collaborations with growers from unique regions or special limited releases of single-origin chocolates spark curiosity and drive trial among chocolate enthusiasts. Pairing chocolates from lesser-known origins with tasting guides that highlight flavor notes (fruity, floral, nutty) creates a multi-sensory discovery experience. Vegan milk-chocolate alternatives need significant improvement in both flavor and texture to truly compete with the real milk counterparts that many European consumers love. Finding natural sweeteners that provide an authentic sweetness profile without aftertaste is crucial for the wider adoption of low-sugar or sugar-free chocolate. While the ethical aspect is important, products need to appeal to a broader group of consumers seeking better options, positioning themselves on flavor and health benefits beyond just being plant-based. Workshops on-site at bean-to-bar chocolate facilities, curated tours at cacao plantations (potentially combined with eco-tourism), and visits with chocolate makers, create a deeper connection with the source of chocolate.

EUROPE COCOA AND CHOCOLATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK. GERMANY. FRANCE, ITALY, SPAIN |

|

Key Companies Profiled |

Barry Callebaut , Cargill, Mars, Incorporated, Mondelēz International , Nestlé, Duffy's Chocolate, Naive, Akesson's |

Europe Cocoa And Chocolate Market Segmentation:

Europe Cocoa And Chocolate Market Segmentation: By Type -

- Industrial Chocolate

- Premium Chocolate

- Bean-to-Bar Chocolate

Industrial Chocolate- The focus is on large-scale production, cost-efficiency, and homogenous flavor profiles. Often uses bulk-sourced cocoa beans, prioritizing affordability over unique origins. While declining, industrial chocolate still commands a significant portion of the market, particularly within everyday value-priced products. Premium Chocolate- Emphasizes higher-quality cocoa beans, more careful processing, and often highlights specific origins or flavor profiles. Appeals to consumers who prioritize taste experience and are willing to pay more for quality. Encompasses a wide range, from well-known confectionery brands offering 'premium' lines to smaller chocolate makers. Bean-to-Bar Chocolate- Represents the niche, the artisanal segment with chocolate makers controlling the entire process from bean selection to final bar. Transparency, ethical sourcing, and sustainability are often core values of bean-to-bar makers. Currently, industrial chocolate remains dominant in terms of sheer volume, driven by its use in mass-produced confectionery products. The premium and bean-to-bar segments are experiencing the most significant growth.

Europe Cocoa And Chocolate Market Segmentation: By Distribution Channel -

- Supermarkets and Hypermarkets

- Specialty Chocolate Shops

- Online Marketplaces/Brand Websites

- Convenience Stores

- Gourmet Food Stores & Markets

- Other Channels

Supermarkets and Hypermarkets: These hold the position of the most dominant sales channel, offering convenience, wide selection (from basic to premium chocolate), and competitive pricing. Estimated Market Share: 50-60%. Specialty Chocolate Shops: These boutiques offer highly curated collections, artisan brands, bean-to-bar varieties, and a focus on the knowledgeable chocolate enthusiast. Estimated Market Share: 5-10%. Online Marketplaces/Brand Websites: Direct-to-consumer sales are a rapidly growing channel, enabling chocolate enthusiasts to discover niche brands and access exclusive products at their convenience. Estimated Market Share: 10-15%. Convenience Stores: These focus on impulse purchases and snacking formats with a smaller selection compared to supermarkets, often prioritizing well-known brands. Estimated Market Share: 8-12%. Gourmet Food Stores & Markets: These emphasize premium and often locally sourced chocolate with a gifting focus. Estimated Market Share: 5-8%. Other Channels: This includes a small percentage of sales from channels like duty-free shops, cafes with chocolate offerings, and direct sales at chocolate festivals or fairs.

Europe Cocoa And Chocolate Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: Arguably the most mature market for chocolate in Europe, with strong consumer interest in both premium chocolate and innovative flavors. (Estimated Market Share: 20-25%). Germany: A significant market known for a love of chocolate and a large manufacturing base. A focus on quality and tradition resonates with the German consumer. (Estimated Market Share: 18-23%). France: While chocolate consumption is less ingrained than in the UK or Germany, France boasts a growing appreciation for high-quality, often dark chocolate. (Estimated Market Share: 15-20%). Switzerland: Known globally for its chocolate prowess, Switzerland is a crucial player in the European chocolate industry. Belgium: Chocolate is an integral part of Belgian cultural identity, known for pralines and a thriving chocolatier culture. Strong tourist appeal influences market dynamics. Italy: Chocolate appreciation is growing. Interest in premium dark chocolate and traditional Italian recipes featuring chocolate is on the rise. (Estimated Market Share: 8-12%). Spain: While less dominant than other regions, a growing interest in 'better-for-you' and plant-based chocolate products offers potential. (Estimated Market Share: 6-10%). Rest of Europe: Includes diverse countries like the Netherlands, Poland, Scandinavian nations, and Eastern Europe. Market development varies, with some nations showing considerable growth potential. (Estimated Market Share: 10-15%).

COVID-19 Impact Analysis on the Europe Cocoa and Chocolate Market:

Lockdowns and travel restrictions disrupted the smooth flow of cocoa beans from countries of origin to European chocolate producers. This led to temporary shortages and price fluctuations in the short term. Consumer stockpiling initially saw a surge in sales, followed by a period of hesitation due to economic anxieties and potential income insecurity. With restaurants and cafes closed, in-person gifting occasions reduced, and people spending more time at home, chocolate consumption shifted towards household indulgence and online gifting. Online chocolate sales platforms experienced a surge, as consumers turned to convenient home delivery options, bypassing traditional brick-and-mortar stores. Smaller, artisanal chocolate makers, often reliant on local events and farmers' markets, faced significant challenges due to canceled events and social distancing measures. Restrictions on gatherings and celebrations negatively impacted sales of chocolates traditionally associated with holidays like Easter and Christmas. The economic uncertainty triggered a temporary shift towards value-driven purchases, putting pressure on premium chocolate brands.

Latest Trends/ Developments:

The rise of small-batch, bean-to-bar chocolate makers who highlight the unique flavor nuances of different cocoa bean origins and varieties. It's about showcasing chocolate as an agricultural product. Expect more chocolates with surprising inclusions (sea salt, pink peppercorns, unique herbs). Pairings with specialty teas, coffees, wines, and even craft beers, elevate chocolate into an adult, multi-sensory experience. Consumer interest in dark chocolate continues to grow, driven by its lower sugar content and potential health benefits. High percentages (70%+) are increasingly common, and makers are emphasizing the flavor profiles within dark chocolate, not just bitterness. Smaller formats of meticulously crafted, premium chocolates make indulgence more accessible for everyday enjoyment. New technologies are tackling the challenge of replicating the creamy texture and 'melt in your mouth' feel of milk chocolate using plant-based ingredients. Plant-based chocolate brands are positioning themselves not simply as the 'alternative' but as a delicious choice with a focus on unique flavors and ethical sourcing. Chocolates with both milk and plant-based chocolate elements cater to consumers wanting to reduce but not fully eliminate dairy.

Key Players:

- Barry Callebaut

- Cargill

- Mars, Incorporated

- Mondelēz International

- Nestlé

- Duffy's Chocolate

- Naive

- Akesson's

Chapter 1. Europe Cocoa and Chocolate Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Cocoa and Chocolate Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Cocoa and Chocolate Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Cocoa and Chocolate Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Cocoa and Chocolate Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Cocoa and Chocolate Market– By Type

6.1. Introduction/Key Findings

6.2. Industrial Chocolate

6.3. Premium Chocolate

6.4. Bean-to-Bar Chocolate

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Cocoa and Chocolate Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3. Specialty Chocolate Shops

7.4. Online Marketplaces/Brand Websites

7.5. Convenience Stores

7.6. Gourmet Food Stores & Markets

7.7. Other Channels

7.8. Y-O-Y Growth trend Analysis By Distribution Channel

7.9. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Cocoa and Chocolate Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Cocoa and Chocolate Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Barry Callebaut

9.2. Cargill

9.3. Mars, Incorporated

9.4. Mondelēz International

9.5. Nestlé

9.6. Duffy's Chocolate

9.7. Naive

9.8. Akesson's

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Chocolate, beyond mere sweetness, is celebrated for its complex flavors. Chefs and home cooks explore single-origin bars, and unconventional pairings, and use cocoa beyond just desserts.

Child labor, unfair wages, and poor working conditions for cocoa farmers remain a persistent issue, particularly in West Africa, where a significant portion of the world's cocoa originates

Barry Callebaut, Cargill, Mars, Incorporated, Mondelēz International

The UK currently holds the largest market share, estimated at around 25%.

Germany while mature, has significant room for growth in specific segments, like online sales of herbal supplements and formats targeting stress and sleep support.