Europe Cloud Kitchen Market Size (2024-2030)

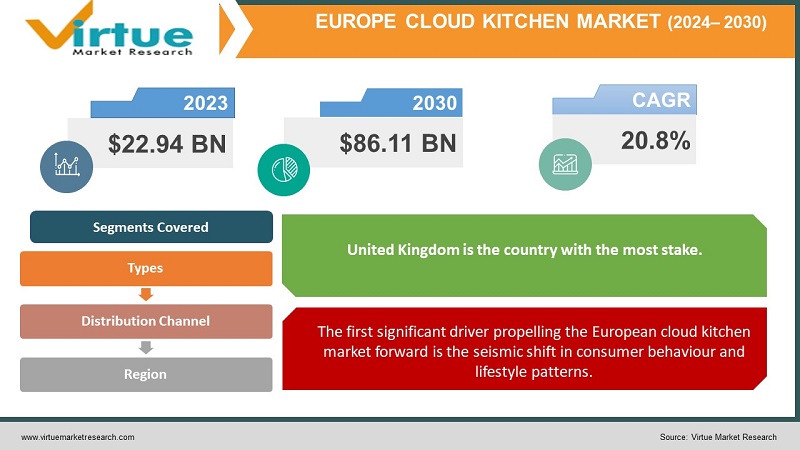

The Europe Cloud Kitchen Market was valued at USD 22.94 Billion in 2024 and is projected to reach a market size of USD 86.11 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 20.8%.

The European cloud kitchen landscape is undergoing a remarkable transformation, reshaping the very essence of food delivery and culinary entrepreneurship. These ghost kitchens, invisible to the casual diner yet pulsing with culinary innovation, are rapidly becoming the backbone of a new gastronomic revolution across the continent. From the bustling streets of London to the charming canals of Amsterdam, cloud kitchens are sprouting up like digital-age mushrooms, feeding an insatiable appetite for convenient, diverse, and high-quality delivered meals. This burgeoning market is not just a flash in the pan but a simmering cauldron of opportunity, blending technology, culinary artistry, and logistical wizardry into a potent recipe for success. The market is also seeing a fascinating interplay between global trends and local flavors. While some cloud kitchens focus on international cuisines, others are championing regional specialties, ensuring that traditional dishes aren't lost in the digital shuffle. This localization strategy is proving crucial in markets like Italy and Spain, where food is inextricably linked to cultural identity. The regulatory landscape is evolving alongside the market. European governments, known for their stringent food safety standards, are grappling with how to adequately oversee these virtual restaurants. This has led to a patchwork of regulations across different countries, adding an extra layer of complexity for operators looking to expand across borders.

Key Market Insights:

There are over 1,200 cloud kitchen facilities operating in Europe as of 2023.

The average initial investment for setting up a cloud kitchen in Europe is around $100,000.

Cloud kitchens in Europe serve an average of 500 orders per day. About 60% of cloud kitchen orders in Europe are placed via mobile apps.

Around 70% of cloud kitchen businesses in Europe partner with third-party delivery services. Online food delivery accounts for 80% of cloud kitchen revenue in Europe.

Approximately 50% of cloud kitchen operators in Europe offer multi-brand concepts under one roof.

Delivery times for cloud kitchens in Europe average 30 minutes. The average order value for a cloud kitchen meal in Europe is $20.

Approximately 50% of cloud kitchens in Europe offer healthy or diet-specific menus.

The European cloud kitchen market is projected to support over 5,000 brands by the end of 2023.

About 35% of cloud kitchens in Europe are operated by established restaurant chains.

Around 75% of cloud kitchens in Europe utilize advanced kitchen management software.

Over 90% of cloud kitchens in Europe have implemented digital payment solutions.

The food waste reduction rate for cloud kitchens in Europe is approximately 20%.

Europe Cloud Kitchen Market Drivers:

The first significant driver propelling the European cloud kitchen market forward is the seismic shift in consumer behaviour and lifestyle patterns.

With the potential to serve restaurant-caliber food at the touch of a smartphone, cloud kitchens are ideally positioned to meet the demands of this new reality. It is impossible to exaggerate the convenience element. Gourmet food delivery is more than just a luxury in places like Munich or Paris, where parking may be a daunting effort and traffic can be a nightmare; it is a useful way to deal with the challenges of urban living. With cloud kitchens, every house can become a fancy restaurant—just without the reservations and dress code. In addition, European customers' gastronomic preferences have become more daring. A love of many cuisines has long been encouraged by the continent's rich cultural tapestry, but cloud kitchens are fostering this to new heights.

The second pivotal driver accelerating the growth of the European cloud kitchen market is the rapid advancement of technology and its seamless integration into every aspect of the food service industry.

At the forefront of this technological surge are sophisticated food delivery platforms. These are no longer simple order-taking systems but complex algorithms that optimize everything from kitchen operations to delivery routes. In cities like London and Amsterdam, these platforms are using AI to predict demand spikes, allowing cloud kitchens to prepare ingredients and staff appropriately, reducing waste and improving efficiency. The Internet of Things (IoT) is playing a crucial role in kitchen management. Smart appliances in cloud kitchens across Europe are now interconnected, allowing for real-time monitoring of cooking processes, inventory levels, and even energy consumption. This level of control and insight was unthinkable just a few years ago and is proving to be a game-changer in managing multiple virtual brands from a single kitchen space.

Europe Cloud Kitchen Market Restraints and Challenges:

Foremost among these challenges is the regulatory labyrinth that cloud kitchens must navigate. Europe's stringent food safety regulations, designed primarily for traditional restaurants, are struggling to keep pace with the virtual kitchen model. Each country within the EU has its own nuanced approach to food safety, creating a patchwork of compliance requirements that can be daunting for cloud kitchen operators looking to expand across borders. In some cases, local authorities are grappling with how to classify these new entities, leading to legal gray areas that can stifle growth and innovation. The issue of food quality control presents another significant hurdle. Without the immediate feedback loop present in traditional dining experiences, cloud kitchens must work doubly hard to maintain consistency and quality. The journey from kitchen to customer introduces variables that can impact food temperature, presentation, and overall quality. Negative experiences can spread rapidly through social media, potentially tarnishing a brand's reputation before it has a chance to establish itself. Labor concerns also loom large on the horizon. The gig economy model often employed by delivery services associated with cloud kitchens is facing increasing scrutiny in Europe.

Europe Cloud Kitchen Market Opportunities:

One of the most exciting opportunities lies in the realm of culinary experimentation. Cloud kitchens, unburdened by the constraints of traditional restaurant models, can become test labs for avant-garde cuisine. Chefs and food entrepreneurs can launch concept menus, fusion cuisines, or even entire virtual restaurants with minimal financial risk. This low-stakes environment for culinary innovation could lead to the next big food trend, born in the cloud and spreading across Europe's diverse palates. The potential for hyper-localization presents another tantalizing opportunity. Cloud kitchens can tailor their offerings not just to cities or neighborhoods, but to specific blocks or even individual buildings. Imagine a virtual restaurant that caters exclusively to the tastes of residents in a particular apartment complex, or one that adjusts its menu based on the microclimate of a specific urban area. This level of customization could revolutionize how Europeans think about local food.

EUROPE CLOUD KITCHEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20.8% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

Deliveroo Editions, Keatz, Taster, Kitopi, Karma Kitchen, Kitch, Virtual Kitchen Co, Foodology, Rebel Foods, JustKitchen, Cloud Kitchens, Popchew, Cook Lane, Curb Food, Kbox Global |

Europe Cloud Kitchen Market Segmentation:

Europe Cloud Kitchen Market Segmentation: By Types:

- Independent Cloud Kitchens

- Commissary Kitchens

- Kitchen Pods

- Shared Kitchens

- Virtual Restaurants

Independent Cloud Kitchens remain the dominant force in the European market. These standalone facilities, purpose-built for food delivery and takeaway, have established themselves as the backbone of the cloud kitchen ecosystem. The dominance of Independent Cloud Kitchens can be attributed to their versatility and scalability. These kitchens offer the space and infrastructure to host multiple virtual brands under one roof, allowing for efficient resource utilization and cost management. This model has proven particularly successful in major European cities where diverse culinary offerings are in high demand. Independent Cloud Kitchens also benefit from their ability to optimize operations for delivery-only models.

Combining mobility, efficiency, and scalability, Kitchen Pods are the fastest-growing category in the European cloud kitchen industry. Redefining the idea of food preparation areas, these small, modular kitchen units provide a degree of versatility and flexibility that is difficult for more conventional cloud kitchen models to match. Several things have contributed to Kitchen Pods' explosive growth. They may be quickly deployed in a variety of settings, including suburban areas, temporary event venues, and urban centers, thanks to their modular design.

Europe Cloud Kitchen Market Segmentation: By Distribution Channel:

- Online

- Offline

- Hybrid

Right now, the European cloud kitchen market is dominated by the hybrid model. This strategy offers a flexible solution that accommodates a variety of consumer preferences and circumstances by combining the best features of offline and internet channels. The hybrid concept usually entails a cloud kitchen that is mostly operational online, but it also keeps a physical presence. Partnerships with already-open eateries, tiny pickup counters, food trucks, and pop-up events are a few ways to achieve this. Numerous reasons contribute to the hybrid model's dominance.

The online distribution channel is experiencing explosive growth in the European cloud kitchen market, outpacing all other channels. This rapid ascension is fueled by a perfect storm of technological advancements, changing consumer behaviours, and the unique advantages that online platforms offer to both customers and businesses. The proliferation of food delivery apps across Europe has been a key driver of this growth. Platforms like Deliveroo, Just Eat, and Uber Eats have become household names, offering consumers unprecedented access to a vast array of culinary options at their fingertips.

Europe Cloud Kitchen Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

With 35% of the European cloud kitchen market, the United Kingdom is the country with the most stake. Numerous variables, such as a high rate of digital penetration, a sophisticated infrastructure for food delivery, and a notable change in consumer dining patterns, are responsible for this supremacy. Over 90% of people in the UK have internet connection, indicating a high degree of internet penetration in the country. As a result, cloud kitchens and online meal delivery services have grown more popular.

With a growth rate that far exceeds that of other nations, Germany is the area of the European cloud kitchen market that is expanding the fastest. Germany presently has a 20% market share, but over the next few years, this is anticipated to rise significantly. Germany's urban population is expanding, with notable increases in the number of inhabitants in large cities like Hamburg, Munich, and Berlin. Cloud kitchens are an appealing choice since there is a growing need for quick and easy meal options in tandem with this urban boom.

COVID-19 Impact Analysis on the Europe Cloud Kitchen Market:

When the epidemic first started, typical eateries were forced to cease or drastically curtail their operations due to lockdowns and social distancing measures. Cloud kitchens have become the industry leader in food service due to this abrupt change that caused an unheard-of spike in demand for meal delivery services. Because of their delivery-focused business strategy and advanced technology, a large number of cloud kitchens were able to swiftly expand their operations to accommodate the higher demand. In line with the cloud kitchen concept, the pandemic also hastened the introduction of digital payment mechanisms and contactless delivery techniques. Customers who had been reluctant to place online food orders soon grew accustomed to the ease and security of delivery services, increasing the pool of possible clients for cloud kitchens. But the effects were not all favorable. Significant difficulties were presented by supply chain disruptions, especially in the early phases of the pandemic. In order to deal with ingredient shortages and pricing variations, a lot of cloud kitchens had to quickly modify their menus and sourcing techniques. The aforementioned circumstance brought to light the significance of supply chain resilience and local sourcing, leading numerous operators to expand their supplier networks.

Latest Trends/ Developments:

One of the most significant trends is the rise of hyper-local cloud kitchens. These small-scale operations focus on serving specific neighbourhood's or communities, often specializing in local cuisines or catering to niche dietary preferences. This trend is driven by a growing consumer desire for authentic, community-connected food experiences, even in the context of delivery-only models. Sustainability is becoming a central focus for many cloud kitchen operators. Beyond eco-friendly packaging, we're seeing innovative approaches to reducing food waste, such as AI-powered inventory management systems and partnerships with food rescue organizations. Some cloud kitchens are even exploring vertical farming techniques to grow fresh herbs and vegetables on-site, reducing transportation emissions and ensuring peak freshness. The integration of robotics and automation is advancing rapidly. From burger-flipping robots to AI-powered quality control systems, these technologies are being deployed to improve consistency, reduce labor costs, and enhance food safety. While full automation remains a distant goal, the incremental adoption of these technologies is significantly impacting operational efficiency.

Key Players:

- Deliveroo Editions

- Keatz

- Taster

- Kitopi

- Karma Kitchen

- Kitch

- Virtual Kitchen Co

- Foodology

- Rebel Foods

- Just Kitchen

- Cloud Kitchens (founded by Travis Kalanick)

- Popchew

- Cook lane

- Curb Food

- Kbox Global

Chapter 1. Europe Cloud Kitchen Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Cloud Kitchen Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Cloud Kitchen Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Cloud Kitchen Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Cloud Kitchen Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Cloud Kitchen Market– By Type

6.1. Introduction/Key Findings

6.2. Independent Cloud Kitchens

6.3. Commissary Kitchens

6.4. Kitchen Pods

6.5. Shared Kitchens

6.6. Virtual Restaurants

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Cloud Kitchen Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Online

7.3. Offline

7.4. Hybrid

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Europe Cloud Kitchen Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Cloud Kitchen Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Deliveroo Editions

9.2. Keatz

9.3. Taster

9.4. Kitopi

9.5. Karma Kitchen

9.6. Kitch

9.7. Virtual Kitchen Co

9.8. Foodology

9.9. Rebel Foods

9.10. Just Kitchen

9.11. Cloud Kitchens (founded by Travis Kalanick)

9.12. Popchew

9.13. Cook lane

9.14. Curb Food

9.15. Kbox Global

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The surge in popularity of food delivery platforms has created a strong demand for efficient kitchen setups to handle a high volume of orders

Maintaining stringent food safety standards in a high-volume, fast-paced environment is crucial. Negative incidents can severely damage a brand's reputation.

Deliveroo Editions, Keatz, Taster, Kitopi, Karma Kitchen, Kitch, Virtual Kitchen Co, Foodology, Rebel Foods, JustKitchen, Cloud Kitchens, Popchew, Cook Lane, Curb Food, Kbox Global.

The UK is the most dominant region in the market, accounting for approximately 35% of the total market share.

Germany although currently holding a smaller market share of 20%, is the fastest-growing region in the market.