Europe Cider Market Size (2024-2030)

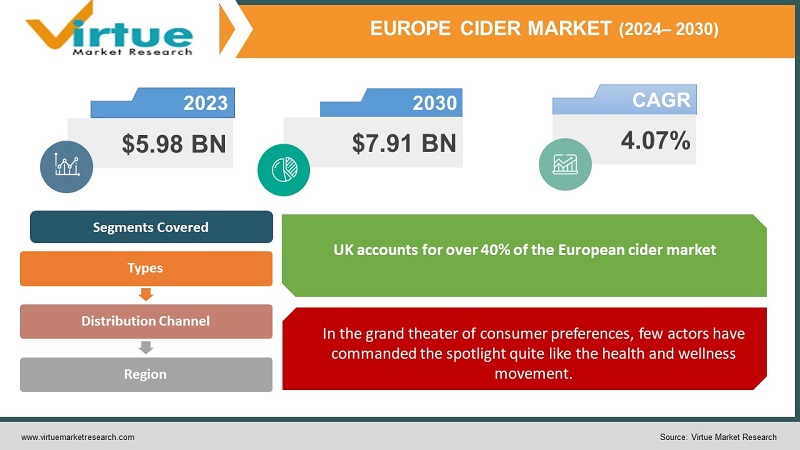

The Europe Cider Market was valued at USD 5.98 Billion in 2023 and is projected to reach a market size of USD 7.91 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.07%.

The market landscape is as varied as the apples used to create these effervescent elixirs. From bone-dry Spanish sidra to sweet Swedish Sommars Ryck, the range of flavors and styles is dizzying. This diversity is both a strength and a challenge for the industry, offering consumers unparalleled choice while making market positioning a complex dance for producers. In recent years, the cider market has experienced a renaissance of sorts. No longer relegated to the dusty corners of pub cellars, cider has found its way into trendy bars, high-end restaurants, and even the carefully curated refrigerators of discerning millennials. This resurgence has been driven by a perfect storm of factors: a growing interest in artisanal and craft beverages, increased awareness of gluten-free options, and a shift towards lower-alcohol alternatives to traditional spirits and beers. But it's not all sunshine and apple blossoms. The market faces headwinds in the form of changing consumer preferences, regulatory challenges, and the ever-present spectre of competition from other alcoholic and non-alcoholic beverages. Climate change, too, casts a long shadow over the industry, with unpredictable weather patterns threatening apple harvests and forcing producers to adapt or perish. Despite these challenges, the European cider market continues to fizz with potential. Innovation is the watchword, with producers experimenting with new flavors, production methods, and packaging formats. From oak-aged ciders that rival fine wines in complexity to convenient canned options perfect for picnics and festivals, the industry is constantly evolving to meet consumer demands.

Key Market Insights:

The UK accounted for 45% of the total European cider market sales in 2023. France held a 20% share of the European cider market in 2023.

Germany's cider consumption reached 500 million liters in 2023. Spain contributed to 10% of the European cider market revenue in 2023.

The European cider market experienced a 10% increase in sales from 2022 to 2023. Apple-based ciders represented 70% of the total cider sales in Europe in 2023.

Pear-based ciders accounted for 15% of the European cider market in 2023. Flavoured ciders made up 15% of the market in 2023.

60% of cider sales in Europe were through retail channels in 2023.

The cider market in Europe employed approximately 50,000 people in 2023. 80% of European cider consumers were aged between 18 and 45 in 2023.

Women made up 55% of cider consumers in Europe in 2023. 75% of cider producers in Europe were small to medium-sized enterprises in 2023.

30% of cider consumers preferred craft ciders in 2023. The market saw a 15% increase in online cider sales in 2023.

Cider represented 10% of the total alcoholic beverage market in Europe in 2023. The average annual cider consumption per capita in Europe was 12 liters in 2023.

Europe Cider Market Drivers:

In the grand theater of consumer preferences, few actors have commanded the spotlight quite like the health and wellness movement.

At the heart of this phenomenon lies the consumer's quest for "better-for-you" options in all aspects of life, including their choice of libations. Cider, with its fruit-based origin and natural fermentation process, has positioned itself as a virtuous alternative in a sea of artificial additives and high-calorie competitors. It's as if each sparkling glass carries a halo of wholesomeness, appealing to health-conscious consumers who still wish to indulge in the pleasure of an alcoholic drink. The gluten-free aspect of cider has become a particular selling point, riding the wave of increased celiac disease diagnoses and the broader trend of gluten avoidance. For those who must bid farewell to barley-based beers, cider offers a lifeline – a bubbly, refreshing alternative that doesn't compromise on taste or social experience. Producers have seized upon this opportunity, emblazoning their packaging with prominent "gluten-free" declarations, turning a natural characteristic of the product into a powerful marketing tool. But the health halo of cider extends beyond its gluten-free status. The fruit-based nature of the beverage aligns perfectly with the "clean eating" movement. Consumers, increasingly wary of artificial ingredients and complex chemical additives, find solace in the simple, understandable ingredient list of cider. It's a return to basics, a nod to traditional production methods that resonate with those seeking authenticity and naturalness in their food and drink choices.

The growing focus on health and wellness has become a significant driver in the European cider market, influencing both consumer preferences and product development.

One of the key aspects of this trend is the demand for lower alcohol content in ciders. Many consumers are looking to moderate their alcohol intake without completely abstaining, leading to a surge in popularity for session ciders. These products typically have an alcohol by volume (ABV) content of 2.8% to 4.5%, allowing for longer drinking sessions with reduced alcohol consumption. Producers have responded by developing flavorful, low-ABV ciders that don't compromise on taste, often using techniques like arrested fermentation or blending with fresh juice to achieve the desired balance. The rise of completely alcohol-free ciders is another manifestation of this trend. These products cater to teetotalers, designated drivers, and those looking to enjoy the cider experience without any alcohol content. Advances in production techniques have allowed for the creation of non-alcoholic ciders that closely mimic the flavor profile of their alcoholic counterparts, offering a satisfying alternative for health-conscious consumers.

Europe Cider Market Restraints and Challenges:

One of the primary challenges is the intense competition from other alcoholic beverages, particularly craft beer and ready-to-drink (RTD) cocktails. The craft beer revolution has captured a significant portion of the market that might otherwise have been attracted to premium ciders. Craft beers offer a wide range of flavors and styles, appealing to consumers seeking unique and artisanal products. Similarly, the rise of RTD cocktails, with their convenience and variety, poses a threat to cider's market share, especially among younger consumers. The seasonality of cider consumption presents another significant challenge. In many European countries, cider is still primarily perceived as a summer drink, leading to fluctuating demand throughout the year. This seasonality can create difficulties in production planning and inventory management for cider makers, potentially leading to oversupply in winter months or shortages during peak summer demand.

Europe Cider Market Opportunities:

A notable prospect is the increasing market for specialty and artisanal ciders. There is plenty of room for producers to create upscale, artisanal ciders as customers grow more discriminating and ready to pay for quality. Small-scale manufacturers can now carve out specialized markets by concentrating on distinctive flavor profiles, regional ingredients, and conventional production techniques, thanks to the premiumization trend. Reputable companies can benefit from this trend as well by acquiring craft cideries or introducing premium labels. Another significant possibility is the growing interest in provenance and locally produced goods. The narrative of their orchards can be utilized by cider manufacturers to highlight the particular apple varieties they employ and the terroir that contributes to the flavor of their cider. This appeals to customers looking for real, locally sourced goods and is consistent with the larger farm-to-table movement. Innovation in flavors and styles represents a significant growth area. While traditional apple ciders remain popular, there's increasing consumer interest in novel flavor combinations. Producers can experiment with different fruit additions, spices, or even hop infusions to create unique products that stand out in the market. The development of ciders that mimic other popular beverages, such as cider-based alternatives to sparkling wine or cocktails, could also attract new consumer segments.

EUROPE CIDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.07% |

|

Segments Covered |

By Type, , Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

Heineken N.V., C&C Group plc, Carlsberg Group, Distell Group Limited, Aston Manor Cider, Thatcher's Cider, Kopparberg Brewery, Westons Cider, Aspall Cyder, Sheppy's Cider, Brännland Cider, Cidre Le Brun, Stella Artois Cidre (Anheuser-Busch InBev), Angry Orchard (Boston Beer Company), Maeloc Sidra.

|

Europe Cider Market Segmentation:

Europe Cider Market Segmentation: By Types:

- Traditional Apple Cider

- Pear Cider (Perry)

- Fruit-flavored Ciders

- Craft/Artisanal Ciders

- Ice Cider

- Low-alcohol and Alcohol-free Ciders

- Organic Ciders

- Sparkling Ciders

- Still Ciders

- Dry Ciders

- Sweet Ciders

Traditional Apple Cider remains the most dominant type in the European market. Traditional apple cider caters to a wide range of consumer preferences, from dry to sweet. It pairs well with many foods and suits various consumption occasions. Many well-established brands in the market focus on traditional apple ciders. Larger producers can achieve economies of scale with traditional apple ciders, making them widely available and often more affordable.

In the European cider market, fruit-flavored ciders have become the fastest-growing category. Because it appeals to younger consumers and those looking for unique flavor sensations, this segment has grown quickly. Beyond only apples, fruit-flavored ciders come in a wide variety of tastes, including berries, tropical fruits, and even botanicals.

Europe Cider Market Segmentation: By Distribution Channel:

- On-trade (Bars, Pubs, Restaurants)

- Off-trade Retail Stores (Supermarkets, Hypermarkets, Convenience Stores)

- Online Retail

- Specialty Stores

- Direct-to-Consumer (DTC)

- Wholesalers

- Food Service

Off-trade Retail Stores, particularly supermarkets and hypermarkets, remain the most dominant distribution channel for ciders in Europe. A wide network of stores makes ciders easily available to consumers. Large retail spaces can stock a diverse range of cider brands and types. Bulk purchasing power often allows for more competitive pricing. Consumers can purchase ciders along with other groceries. Ability to run tastings, displays, and other promotional activities. Many consumers are accustomed to purchasing alcoholic beverages from these outlets.

The cider industry's fastest-growing distribution channel in Europe is now online retail. The epidemic caused a sharp increase in the use of e-commerce for alcoholic drinks. Online shopping provides home delivery and convenience of use for purchases. A wider selection of ciders can be found on internet platforms than in traditional stores. Personalized recommendations based on customer preferences are possible with e-commerce. Craft cideries have embraced Internet sales as a direct means of connecting with customers. Online sales have increased due to the growth of subscription boxes and cider clubs.

Europe Cider Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK accounts for over 40% of the European cider market, making it the largest shareholder. The nation's protracted history of cider production and consumption greatly adds to its market dominance. Cider production has a long history in the UK, going all the way back to the Roman era. Cider has become a staple beverage in British society due to this long-standing practice. The tradition of producing cider is ingrained in areas like Herefordshire, Somerset, and Worcestershire, which are recognized for their superior apples and orchards.

Spain is emerging as the fastest-growing region in the European cider market. There is a resurgence of interest in traditional Spanish cider, particularly in regions like Asturias and the Basque Country. These areas have a long history of cider production, and recent efforts to revive and promote this heritage have been successful. Events such as cider festivals and tastings have raised awareness and interest in traditional Spanish cider. Spanish cider producers are increasingly experimenting with new flavors and production techniques. The introduction of sparkling ciders and fruit-infused varieties has appealed to younger consumers and those looking for alternatives to traditional alcoholic beverages.

COVID-19 Impact Analysis on the Europe Cider Market:

One of the most immediate and significant impacts was the closure of on-trade venues such as pubs, bars, and restaurants during lockdowns. This had a severe effect on cider sales, particularly in countries with strong pub cultures like the UK and Ireland. Many cider producers, especially those heavily reliant on on-trade sales, faced substantial revenue losses. Some were forced to pivot their business models or risk closure. Conversely, off-trade sales saw a notable increase as consumers shifted to at-home consumption. Supermarkets and other retail outlets experienced a surge in cider purchases, particularly during the initial lockdown periods. This shift benefited larger brands with established retail presences but posed challenges for smaller craft producers who typically relied more on on-trade sales or direct-to-consumer channels.

Latest Trends/ Developments:

Sustainability is becoming more and more important throughout the whole cider-making process. This includes using less water during manufacturing, eco-friendly packaging options, and sustainable orchard management techniques. To cut down on food waste, some cideries are experimenting with using "ugly" or extra apples. Many producers are starting to aim for carbon neutrality, and some are even integrating renewable energy sources into their manufacturing plants. This pattern is consistent with growing consumer demand for green products. There is a growing trend toward hyper-local production, as evidenced by the emergence of small-scale cideries in metropolitan settings. These producers emphasize the relationship between the product and its local surroundings by sourcing apples from nearby orchards or even urban fruit trees.

Key Players:

- Heineken N.V.

- C&C Group plc

- Carlsberg Group

- Distell Group Limited

- Aston Manor Cider

- Thatcher's Cider

- Kopparberg Brewery

- Westons Cider

- Aspall Cyder

Chapter 1. Europe Cider Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Cider Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Cider Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Cider Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Cider Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Cider Market– By Type

6.1. Introduction/Key Findings

6.2. Traditional Apple Cider

6.3. Pear Cider (Perry)

6.4. Fruit-flavored Ciders

6.5. Craft/Artisanal Ciders

6.6. Ice Cider

6.7. Low-alcohol and Alcohol-free Ciders

6.8. Organic Ciders

6.9. Sparkling Ciders

6.10. Still Ciders

6.11. Dry Ciders

6.12. Sweet Ciders

6.13. Y-O-Y Growth trend Analysis By Type

6.14. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Cider Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 On-trade (Bars, Pubs, Restaurants)

7.3. Off-trade Retail Stores (Supermarkets, Hypermarkets, Convenience Stores)

7.4. Online Retail

7.5. Specialty Stores

7.6. Direct-to-Consumer (DTC)

7.7. Wholesalers

7.8. Food Service

7.9. Y-O-Y Growth trend Analysis By Distribution Channel

7.10. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Europe Cider Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Cider Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Heineken N.V.

9.2. C&C Group plc

9.3. Carlsberg Group

9.4. Distell Group Limited

9.5. Aston Manor Cider

9.6. Thatcher's Cider

9.7. Kopparberg Brewery

9.8. Westons Cider

9.9. Aspall Cyder

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A shift towards more diverse and premium alcoholic beverages, including cider, has contributed to market expansion

Cider consumption tends to be seasonal, with higher demand during autumn and winter, which can impact sales and production planning.

Heineken N.V., C&C Group plc, Carlsberg Group, Distell Group Limited

Aston Manor Cider, Thatcher's Cider, Kopparberg Brewery, Westons Cider, Aspall Cyder, Sheppy's Cider, Brännland Cider, Cidre Le Brun, Stella Artois Cidre (Anheuser-Busch InBev), Angry Orchard (Boston Beer Company), Maeloc Sidra

The UK is the most dominant region in the market, accounting for approximately 40% of the total market share.

Spain although currently holding a smaller market share of 20%, is the fastest-growing region in the market