Europe Chitosan Market Size (2024-2030)

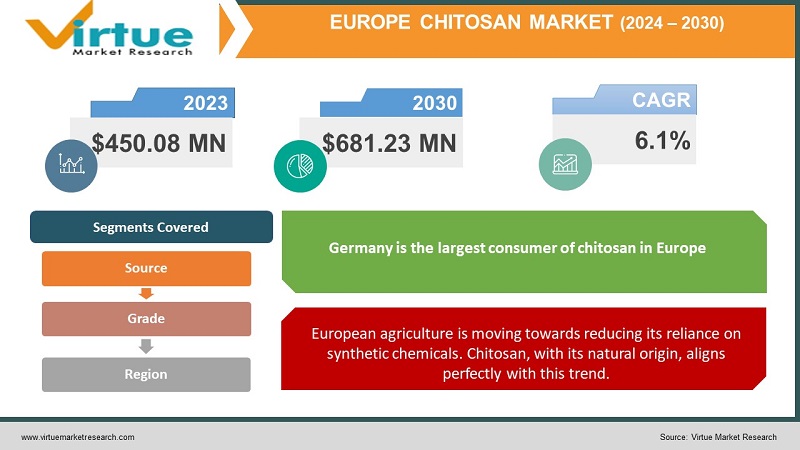

The Europe Chitosan Market is valued at USD 450.08 Million and is projected to reach a market size of USD 681.23 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

Chitosan's natural origins, biodegradability, and potential to replace some synthetic polymers align with Europe's emphasis on sustainable resources and circular economies. Chitosan finds applications in sectors like agriculture, water treatment, healthcare, cosmetics, food processing, and more. This versatility fuels market growth. Improvements in extraction technologies from waste streams (like seafood processing) enhance chitosan production efficiency. Modifications broaden its functionality for specialized applications. Favorable regulations within the European Union regarding using bio-based and biodegradable materials indirectly benefit the chitosan market. The growth of organic agriculture and the need for sustainable crop protection and yield-enhancing solutions boost the demand for bio-based chitosan products. Research into advanced wound dressings targeted drug delivery mechanisms and tissue regeneration often incorporate chitosan due to its biocompatibility and healing properties. The development of strict purity standards and certifications assures quality, especially for sensitive applications like biomedical or food use.

Key Market Insights:

The main contributors to the European chitosan market are Germany, France, and the United Kingdom, collectively holding more than 60% of the regional market share. France and the United Kingdom are the second and third-largest markets, with market values of $92.7 million and $79.2 million, respectively, in 2023.

The Nordics (Sweden, Norway, Denmark, and Finland) and Benelux (Belgium, Netherlands, and Luxembourg) are also significant contributors to the European chitosan market.

In Europe, the pharmaceutical and healthcare sectors account for about 45% of all end-use industries, giving them the biggest market share. With an estimated market size of $180.2 million in 2023, the biomedical and healthcare industries lead the European chitosan market.

The cosmetics and personal care sector is predicted to grow to be the second largest end-user in 2023, with a projected market value of $85.3 million, driven by the rising demand for natural and organic beauty goods.

The agriculture and food industries are also significant contributors to the European chitosan market, with a combined market value of $98.4 million in 2023.

The European chitosan market is characterized by the presence of several major players, including FMC Corporation, Heppe Medical Chitosan GmbH, Kitozyme, Novamatrix, and Primex.

Europe Chitosan Market Drivers:

European agriculture is moving towards reducing its reliance on synthetic chemicals. Chitosan, with its natural origin, aligns perfectly with this trend.

Chitosan-based seed coatings promote germination, protect against pathogens, and enhance nutrient delivery for robust seedlings. Chitosan strengthens plants' natural defenses against pests and diseases, improving crop resilience and reducing the need for harsh pesticides. Chitosan's film-forming ability is used in foliar sprays to control moisture loss and enhance nutrient uptake by plants. Chitosan coatings extend the shelf-life of fruits and vegetables, minimizing food waste. Europe's Green Deal and the Farm to Fork Strategy emphasize sustainable agriculture, reduced pesticide use, and nutrient management. Chitosan fits seamlessly into this vision. Consumers are increasingly conscious of food production methods and prefer healthy, "clean label" products. Chitosan's natural origin and potential to enhance food safety resonate with these preferences. Chitosan can strengthen plants against abiotic stresses (drought, salinity), becoming vital in adapting to the effects of climate change on agriculture. The growth of organic farming across Europe creates a major niche for chitosan-based solutions, which align perfectly with organic production principles.

Chitosan promotes healing, manages wound exudates, and offers antimicrobial properties. Its versatility allows for the creation of hydrogels, films, and sponges applicable to various wound types.

Chitosan offers a biocompatible scaffold for tissue regeneration applications. Research explores its use in bone repair, nerve regeneration, and other advanced medical fields. Chitosan's unique properties enable targeted and controlled release of pharmaceuticals. Its biocompatibility makes it an attractive option for drug delivery systems. Chitosan-based hemostatic agents aid in controlling bleeding during surgical procedures. Europe's aging population drives the need for advanced wound care solutions and regenerative therapies, where chitosan plays a crucial role. Europe is a leader in medical innovation. Strong research institutions collaborate with industry players to develop cutting-edge chitosan-based applications for wound care, tissue engineering, and more. Ongoing research explores the use of chitosan in areas like osteoarthritis treatment, dentistry, and even cancer therapies. This broadens its potential market impact. While some chitosan-based medical solutions carry a higher initial cost, their efficacy in promoting faster healing and reducing complications offers long-term benefits, making them attractive healthcare choices. Europe has well-established regulatory pathways for medical devices and pharmaceuticals, providing a framework for the development and approval of chitosan-based products.

Europe Chitosan Market Restraints and Challenges:

Chitosan's regulatory status can differ across European countries and applications. It might be classified as a biopesticide, a medical device, a food supplement, a cosmetic ingredient, or a chemical depending on its source and intended use. This creates a complex landscape for manufacturers and potential users. Obtaining regulatory approvals for specific applications of chitosan (particularly in the medical, food, or agricultural sectors) can be a time-consuming and costly process. This can slow down innovation and market penetration. Producing high-quality chitosan, particularly specific grades suitable for medical or pharmaceutical applications, can be relatively expensive. This might limit its wider adoption, especially in cost-sensitive industries. Chitosan faces competition from other biopolymers like hyaluronic acid, alginate, or cellulose derivatives, which might offer comparable functionalities or cost advantages in certain applications. Variability in chitosan properties based on its source (different shellfish species, fungal sources) and extraction methods can pose a challenge for quality control and meeting stringent demands in fields like medicine.

Europe Chitosan Market Opportunities:

Derived from chitin, a biopolymer found in crustacean shells and fungal cell walls, chitosan aligns with Europe's emphasis on renewable, bio-based materials. Europe is actively exploring ways to utilize waste streams from the seafood industry, creating a potential source of raw material for chitosan production. Increasingly environmentally conscious European consumers favor products and ingredients with a sustainable and natural origin, boosting chitosan's appeal. Policies like the European Green Deal and Circular Economy Action Plan encourage bio-based solutions, providing a supportive environment for chitosan applications. Chitosan's antifungal, antibacterial, and immune-stimulating properties make it a promising biopesticide. It also functions as a plant growth promoter. Chitosan-based seed coatings can enhance germination, protect against pathogens, and improve stress tolerance. Chitosan's ability to improve soil structure, nutrient retention, and beneficial microbial activity makes it a valuable soil amendment for sustainable agriculture. Chitosan's biocompatibility, hemostatic properties, and ability to promote cell adhesion make it a valuable material for wound dressings, scaffolds for tissue regeneration, and controlled drug-release systems.

EUROPE CHITOSAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Source, grade, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Kitozyme, Primex, Novamatrix, Heppe Medical Chitosan GmbH, Biopo, Agratech, Advanced Biopolymers AS |

Europe Chitosan Market Segmentation-

Europe Chitosan Market Segmentation: By Source

- Crustacean-Derived Chitosan

- Fungal-Derived Chitosan

- plant-derived chitosan

The portion of the European chitosan market derived from crustaceans is by far the dominant source, accounting for 82% of the regional market share in 2023. The region's widespread regulatory acceptance of chitosan derived from crustaceans, the amount of easily accessible crustacean waste materials, and the established production capabilities of European businesses are the primary causes of this dominance.

The European chitosan Market is expected to grow at the quickest rate among chitosan generated from fungi, with a compound annual growth rate (CAGR) of 7.2% between 2023 and 2030. The main reasons for this rise include the European market's increasing awareness of the unique properties and uses of chitosan made from fungus, as well as the region's growing need for more environmentally friendly and sustainable products. Although the market share of plant-derived chitosan is currently quite small, it is anticipated to grow moderately in the upcoming years due to growing consumer demand for natural and eco-friendly ingredients as well as the possibility of novel applications in specialized industries.

Europe Chitosan Market Segmentation: By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical/Medical Grade

With 45% of the regional market share in 2023, Where high purity isn't paramount, industrial-grade chitosan dominates due to its cost-effectiveness. This grade might have slightly higher variability in terms of molecular weight, and deacetylation degree, and may contain some impurities compared to higher grades. Its flocculation and heavy metal removal properties are essential in wastewater management. Seed coatings and less-stringent soil amendment applications find industrial-grade chitosan suitable. Its use in bioremediation aligns with sustainability goals.

Pharmaceutical-grade chitosan is the grade that is expanding the fastest in the Europe Chitosan Market, it is predicted to increase at a CAGR of 7.4%. Breakthroughs in chitosan-based drug delivery, medical devices, and regenerative medicine are fueling demand for high-purity chitosan. The higher price point of medical-grade chitosan is offset by the value it brings to advanced healthcare solutions. European policies encouraging innovation in biomaterials and medical devices foster a conducive environment for medical-grade chitosan growth.

Europe Chitosan Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany is the largest consumer of chitosan in Europe, accounting for over 27% of the regional market share in 2023. The country's strong pharmaceutical and chemical industries, as well as its focus on sustainable and biodegradable materials, have been the primary drivers of the German chitosan market. German industries are known for demanding high levels of quality and consistency, driving the demand for reliable chitosan products across grades. Germany's established pharmaceutical and biotechnology sector along with its large-scale manufacturing base creates demand for diverse chitosan applications. Research centers and companies in Germany drive innovation in chitosan modification, composites, and tailored solutions for specific industries.

Spain accounts for approximately 9% of the Europe Chitosan Market, making it the fifth-largest consumer in the region. The Spanish chitosan market is characterized by a growing interest in the use of chitosan in the personal care and cosmetics industry, as well as a nascent but promising demand in the food and beverage sector. Spain is anticipated to have the fastest-growing chitosan market due to the increased emphasis on sustainable and natural ingredients in the personal care and cosmetics sectors, as well as the possibility of creative applications in the food and beverage industry. Opportunities exist for producing high-quality, customized chitosan products that appeal to Spanish consumers' health and environmental concerns.

COVID-19 Impact Analysis on the Europe Chitosan Market:

The initial lockdowns across Europe disrupted supply chains for chitosan raw materials, particularly those sourced from Asia, leading to temporary shortages and price fluctuations. With healthcare systems under immense pressure, the immediate focus shifted towards personal protective equipment (PPE) and essential medical supplies. This diverted resources away from research and development in non-critical applications of chitosan. Manufacturing operations for chitosan-based products in some sectors experienced delays or temporary shutdowns due to lockdown restrictions and labor shortages. Chitosan's inherent antimicrobial properties gained renewed interest in the context of hygiene and sanitation. This led to increased exploration of chitosan applications in disinfectant wipes, coatings for surfaces, and potentially even air filtration systems. Research into chitosan's potential use in wound dressings, drug delivery systems, and tissue engineering continued, with a focus on its potential role in wound healing and immune response. Research into chitosan's potential use in wound dressings, drug delivery systems, and tissue engineering continued, with a focus on its potential role in wound healing and immune response. The pandemic heightened public awareness of hygiene and environmental issues, potentially pushing the demand for bio-based and sustainable solutions like chitosan in various applications.

Latest Trends/ Developments:

While crustacean shells remain a major source, there's a push to unlock the potential of alternative feedstocks to enhance sustainability and circularity. Chitin extraction from fungal cell walls, a byproduct of other industries, gains traction offering advantages like lower allergenicity and seasonal independence. Research intensifies using discarded insect exoskeletons as a promising chitin source, linking chitosan production to potential insect protein industries. Research thrust isn't just about production but also advanced modification techniques to create chitosan derivatives with highly targeted properties. Altering chitosan's structure to impart water solubility over a wider pH range, enhance antimicrobial activity, or improve heavy metal adsorption. Combining chitosan with other polymers, bioactive compounds, or forming nanoparticles expands its potential for drug delivery, tissue engineering, and specialized agricultural applications. Chitosan nanoparticles and microspheres tailored for the controlled release of cancer therapeutics, gene therapy payloads, or site-specific drug targeting are revolutionizing treatment approaches. Chitosan scaffolds mimicking native tissue structures, combined with growth factors and stem cells, open new avenues for wound healing, bone regeneration, and organ repair. Chitosan-based dressings that are hemostatic (stop bleeding), antimicrobial, promote healing, and potentially sense wound conditions are under active development.

Key Players:

- Kitozyme

- Primex

- Novamatrix

- Heppe Medical Chitosan GmbH

- Biopo

- Agratech

- Advanced Biopolymers AS

Chapter 1. Europe Chitosan Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Chitosan Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Chitosan Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Chitosan Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Chitosan Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Chitosan Market– By Grade

6.1. Introduction/Key Findings

6.2. Industrial Grade

6.3. Food Grade

6.4. Pharmaceutical/Medical Grade

6.5. Y-O-Y Growth trend Analysis By Grade

6.6. Absolute $ Opportunity Analysis By Grade , 2024-2030

Chapter 7. Europe Chitosan Market– By Source

7.1. Introduction/Key Findings

7.2 Crustacean-Derived Chitosan

7.3. Fungal-Derived Chitosan

7.4. plant-derived chitosan

7.5. Y-O-Y Growth trend Analysis By Source

7.6. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 8. Europe Chitosan Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Grade

8.1.3. By Source

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Chitosan Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Kitozyme

9.2. Primex

9.3. Novamatrix

9.4. Heppe Medical Chitosan GmbH

9.5. Biopo

9.6. Agratech

9.7. Advanced Biopolymers AS

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers and industries in Europe are increasingly focused on sustainability, driving the demand for bio-based, renewable materials like chitosan over synthetic counterparts

Chitosan is derived from crustacean shells, a byproduct of the seafood industry. Variations in shell quality, seasonal availability, and fluctuations in seafood processing can impact chitosan production and lead to inconsistent product characteristics.

Kitozyme, Primex, Novamatrix, Heppe Medical Chitosan GmbH, Biopo, Agratech, and Advanced Biopolymers AS are some of the key players in the market.

Germany currently holds the largest market share, estimated at around 27%.

Spain accounts for approximately 9% of the Europe Chitosan Market, making it the fifth-largest consumer in the region. The Spanish chitosan market is characterized by a growing interest in the use of chitosan in the personal care and cosmetics industry, as well as a nascent but promising demand in the food and beverage sector.