Europe Casein and Caseinates Market Size (2024-2030)

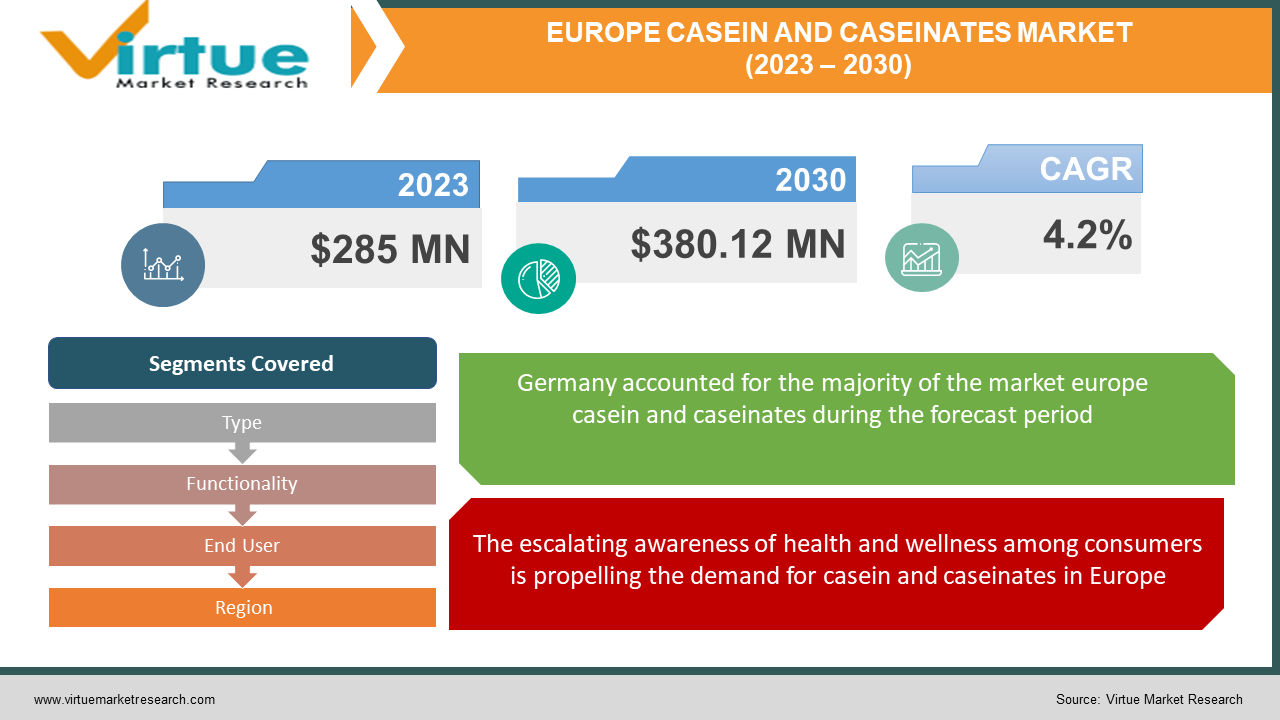

The Europe Casein and Caseinates Market, recorded at USD 285 million in 2023, is projected to reach a size of USD 380.12 million by 2030. With a forecasted growth rate of 4.2% during the period of 2024-2030, the market is witnessing increased demand for these protein-based components in various food and beverage applications across the region.

Key Market Insights:

In Germany, fitness sports are anticipated to become the most popular sports category by 2022, with approximately 9.3 million members as reported by the German Olympic Sports Federation. Technological advancements in processing methods have contributed to the production of superior-quality casein and caseinate products, augmenting market growth. The food supplements industry in France observed a turnover of USD 2730 million in 2021, fostering the increased use of supplements and the growth of casein and caseinate products. These components continue to expand their presence due to their functional properties, encouraging ongoing research and innovation in the market.

Europe Casein and Caseinates Market Drivers:

The escalating awareness of health and wellness among consumers is propelling the demand for casein and caseinates in Europe.

Recognized for their nutritional value, especially in sports nutrition and muscle recovery products, these proteins are sought after by consumers pursuing protein-enriched diets for an active lifestyle. This increased interest is notably observed in products like protein bars, shakes, and dietary supplements.

The expanding applications of casein and caseinates in the food industry are elevating their market growth.

These versatile ingredients, known for enhancing texture, stability, and mouthfeel, are extensively used in dairy-based and non-dairy products, spanning from processed cheeses to bakery goods and meat products.

Market Restraints and Challenges:

A major challenge encountered in the market is the rise in dairy allergies and lactose intolerance among consumers. While efforts are made to process caseinates to reduce lactose content, traces might remain, limiting the market's reach among a substantial segment of the population. Manufacturers may need to explore alternative protein sources and improve labelling to accommodate lactose-intolerant consumers.

The surge in the popularity of plant-based diets presents a challenge for casein and caseinates, as they face competition from plant-derived proteins. Meeting the demand for vegan options while retaining the functional properties of casein and caseinates poses a challenge, urging manufacturers to invest in research for plant-based alternatives.

Market Opportunities:

The market exhibits promising opportunities driven by the increasing focus on protein-enriched foods and functional products. The demand for high-protein items, particularly in sports nutrition and dietary supplements, creates a significant growth avenue. Additionally, the extensive use of casein and caseinates in the food industry for various functions like stabilizing and emulsifying presents opportunities for diversification and technological advancements in ingredient processing. Capitalizing on these advancements and catering to evolving consumer preferences for natural and clean-label products could further fuel market growth in Europe.

EUROPE CASEIN AND CASEINATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Type, Functionality, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arla Foods, FrieslandCampina, Glanbia Nutritionals, Kerry Group, Lactalis Ingredients, Saputo Dairy Ingredients, AMCO Proteins, Epi Ingredients, Charotar Casein Company, Erie Foods International Inc. |

Europe Casein and Caseinates Market Segmentation - By Type

-

Acid Casein

-

Rennet Casein

-

Sodium Caseinate

-

Calcium Caseinate

-

Potassium Caseinate

-

Others

Sodium Caseinate holds the largest share among the types, credited to its multifunctional properties across various food and beverage applications. Its role as an emulsifier, stabilizer, and texturizing agent in processed foods, dairy, and personal care products establishes its market significance. The fastest-growing segment in this market is Sodium Caseinate due to its extensive application in food and beverage industries, particularly in processed foods, dairy products, and protein-enriched items, meeting the increasing demand for convenience foods.

Europe Casein and Caseinates Market Segmentation - By Functionality

-

Emulsification

-

Thickening

-

Stabilization

-

Texturization

-

Others

Emulsification dominates with 48% revenue share, owing to the versatile emulsifying properties of casein and caseinates in stabilizing fat-in-water or water-in-fat systems. These ingredients enhance texture and maintain product quality in dairy products, dressings, and processed foods. The Texturization segment is expected to grow at a CAGR of 12.3%, driven by the rising demand for improved mouthfeel in food and beverage products.

Europe Casein and Caseinates Market Segmentation - By End User

-

Food Industry

-

Pharmaceutical Industry

-

Cosmetic and Personal Care Industry

-

Others

The Food Industry captures the largest market share (67%) due to the extensive utilization of casein and caseinates in various food products for stabilization, texture enhancement, and emulsification. The Pharmaceutical Industry, on the other hand, shows rapid growth, leveraging the functional properties of these ingredients in controlled drug release systems.

Europe Casein and Caseinates Market Segmentation - Regional Analysis

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

Germany leads the market (36%) due to its robust food and beverage industry and technological prowess in casein and caseinates production. The U.K. demonstrates the fastest growth attributed to increased adoption of protein-enriched foods, clean-label preferences, and the surge in vegetarian and vegan diets.

COVID-19 Impact Analysis:

The pandemic initially disrupted supply chains but subsequently led to heightened consumer interest in health and nutrition, boosting the demand for protein-rich products. This shift drove opportunities for casein and caseinates in functional foods, aligning with evolving consumer preferences for healthier options.

Latest Trends/Developments:

Consumers' preference for natural ingredients is a notable trend, urging manufacturers to offer casein and caseinates with minimal additives. Additionally, the incorporation of these ingredients in protein-enriched functional foods aligns with the growing demand for high-protein diets and functional beverages, expanding their applications in the market.

Major Players:

-

Arla Foods

-

FrieslandCampina

-

Glanbia Nutritionals

-

Kerry Group

-

Lactalis Ingredients

-

Saputo Dairy Ingredients

-

AMCO Proteins

-

Epi Ingredients

-

Charotar Casein Company

-

Erie Foods International Inc.

Chapter 1. Europe Casein and Caseinates Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Casein and Caseinates Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Europe Casein and Caseinates Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Casein and Caseinates Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Casein and Caseinates Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Casein and Caseinates Market – By Type

6.1. Introduction/Key Findings

6.2. Acid Casein

6.3. Rennet Casein

6.4. Sodium Caseinate

6.5. Calcium Caseinate

6.6. Potassium Caseinate

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Europe Casein and Caseinates Market – By Functionality

7.1. Introduction/Key Findings

7.2 Emulsification

7.3. Thickening

7.4. Stabilization

7.5. Texturization

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Functionality

7.8. Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 8. Europe Casein and Caseinates Market – By End User

8.1. Introduction/Key Findings

8.2 Food Industry

8.3. Pharmaceutical Industry

8.4. Cosmetic and Personal Care Industry

8.5. Others

8.6. Y-O-Y Growth trend Analysis End User

8.7. Absolute $ Opportunity Analysis End User, 2024-2030

Chapter 9. Europe Casein and Caseinates Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Functionality

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Casein and Caseinates Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Arla Foods

10.2. FrieslandCampina

10.3. Glanbia Nutritionals

10.4. Kerry Group

10.5. Lactalis Ingredients

10.6. Saputo Dairy Ingredients

10.7. AMCO Proteins

10.8. Epi Ingredients

10.9. Charotar Casein Company

10.10. Erie Foods International Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Casein and Caseinates Market achieved a valuation of USD 285 million in 2023 and is anticipated to reach USD 380.12 million by 2030, displaying a forecasted Compound Annual Growth Rate (CAGR) of 4.2% between 2024 and 2030.

The European casein and caseinates market are propelled by the increasing consciousness surrounding health and wellness among consumers, alongside the expanding applications of these products in the food industry.

The Europe Casein and Caseinates Market segments by functionality include Emulsification, Thickening, Stabilization, Texturization, and Others.

Germany stands out as the leading region in the European Casein and Caseinates Market.

Key players in the European Casein and Caseinates Market comprise Arla Foods, FrieslandCampina, Glanbia Nutritionals, Kerry Group, among others.