Europe Cage Free Eggs Market Size (2024-2030)

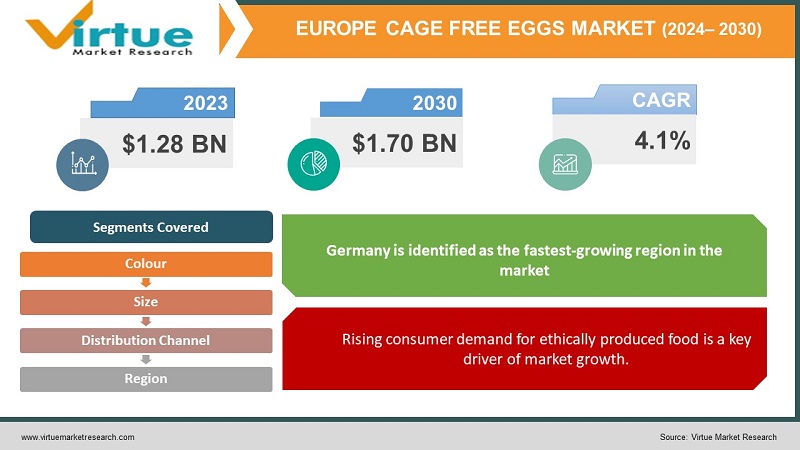

The Europe Cage Free Eggs Market was valued at USD 1.28 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.70 billion by 2030, growing at a CAGR of 4.1%.

The Cage-Free Eggs Market pertains to the sector of the egg industry focused on the production, distribution, and sale of eggs sourced from hens that are not confined within cages. In contrast to traditional egg-laying methods that involve the use of restrictive cages, cage-free hens are allowed to move freely within a designated shelter. This environment generally includes nesting areas, perches, and spaces that enable the hens to engage in natural behaviors, such as scratching and dust bathing.

Key Market Insights:

This approach to egg production is considered more humane and aligns with the rising consumer demand for ethically sourced food products. Cage-free eggs are frequently promoted as healthier and more environmentally sustainable choices, often commanding higher prices.

The expansion of the cage-free eggs market is fueled by evolving consumer preferences, corporate purchasing policies, and legislative initiatives designed to enhance animal welfare within the poultry sector.

As awareness of animal welfare and sustainable farming practices increases, the demand for cage-free eggs is projected to rise, highlighting a significant transformation in consumer values toward more ethically produced food options.

Europe Cage Free Eggs Market Drivers:

Rising consumer demand for ethically produced food is a key driver of market growth.

A significant factor driving the Cage-Free Eggs Market is the growing consumer demand for ethically sourced food. As awareness of animal welfare increases, more consumers are making choices based on the sourcing and production methods of food products. Cage-free eggs are viewed as a more humane alternative to those from caged hens, as they allow chickens to engage in natural behaviors such as walking, nesting, and spreading their wings—behaviors that are severely limited in conventional cage systems.

This shift in consumer preferences is bolstered by various animal welfare organizations and campaigns that bring attention to the living conditions of many egg-laying hens. Consequently, both individual consumers and large corporations are increasingly opting for ethically responsible food options. Numerous major food service companies, retailers, and manufacturers have pledged to source only cage-free eggs, thereby influencing supply chains and market dynamics.

Additionally, the trend toward ethical consumption encompasses broader issues of sustainability and environmental impact. Cage-free egg production often aligns with these values, as it can be part of more sustainable farming practices that utilize less intensive and environmentally harmful methods.

Legislative changes also reflect and strengthen this movement toward ethical food production. In various regions, laws are being introduced or proposed to mandate more humane conditions for farm animals, including egg-laying hens. These regulations not only encourage producers to transition to cage-free systems but also reassure consumers about the standardization of animal welfare practices, further boosting demand.

Europe Cage Free Eggs Market Restraints and Challenges:

Increased production costs pose a challenge to market growth.

A significant restraint impacting the Cage-Free Eggs Market is the elevated production costs associated with cage-free egg farming compared to traditional caged systems. Cage-free environments require more space per hen, resulting in larger facilities or decreased bird density, which in turn raises land and construction expenses. Additionally, managing cage-free systems often demands more complex oversight and labor to ensure the health and welfare of hens in a more open environment. These factors contribute to higher operational costs, potentially affecting the profitability of egg producers.

The need for increased space not only escalates direct costs related to land and infrastructure but also influences indirect expenses such as heating, cooling, and ventilation, which are more extensive in larger, open systems compared to confined cage setups. Furthermore, cage-free systems generally incur higher feed costs per egg produced, as hens in these environments tend to be less feed-efficient and more active, leading to increased overall feed consumption.

Europe Cage Free Eggs Market Opportunities:

Growing regulatory support and consumer advocacy present significant opportunities in the market.

As public awareness regarding animal welfare expands, governments and regulatory agencies worldwide are progressively implementing and enforcing standards that enhance the welfare of farm animals, including egg-laying hens. This evolving regulatory landscape is fostering a more equitable environment, where cage-free egg production is becoming the standard rather than an exception.

In many regions, legislation has been introduced to either ban or phase out conventional battery cages, requiring the adoption of more humane alternatives, such as cage-free systems. These legal changes not only improve living conditions for hens but also encourage egg producers to transition toward cage-free practices. This shift is often supported by subsidies, grants, or tax incentives, which can help mitigate some of the financial challenges associated with moving to cage-free systems.

EUROPE CAGE FREE EGGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Color, Size, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

Noble Foods, Cal-Maine Foods, Inc, Farm Pride Foods Ltd., Eggland’s Best, LLC and Herbruck’s Poultry Ranch, Inc. |

Europe Cage Free Eggs Market Segmentation:

Europe Cage Free Eggs Market Segmentation By Colour:

- White

- Brown

White cage-free eggs maintain a dominant market position due to their widespread availability and general consumer preference, particularly in the United States, where they are traditionally linked to standard egg purchases. These eggs are commonly utilized in both home cooking and commercial food production because of their consistent quality and familiar appearance.

In contrast, brown cage-free eggs, while commanding a smaller market share, are often perceived by consumers as being more "natural" or healthier, despite being nutritionally equivalent to white eggs. Brown eggs typically come from different breeds of hens than those that lay white eggs, which can contribute to higher production and retail costs. Nonetheless, demand for brown cage-free eggs is on the rise in certain regions and among demographic segments that prioritize perceived quality and ethical food production practices.

Both color segments are responding to evolving consumer preferences, with significant market potential driven by increased awareness of animal welfare and a growing shift toward sustainably produced eggs.

Europe Cage Free Eggs Market Segmentation By Size:

- Small and Medium

- Large

- Extra Large

- Jumbo

Small and medium eggs hold a dominant market position, particularly favored by consumers for their versatility and affordability, making them suitable for a variety of cooking applications. These sizes are commonly used in everyday recipes and serve as staples in household kitchens, as well as in many food service environments where large quantities of eggs are needed for baking and cooking.

Large eggs are preferred for their substantial size, making them ideal for recipes that require larger yolks or more egg whites. They are often used in breakfast dishes and baking, offering good value for consumers seeking larger eggs without venturing into premium pricing.

Extra large and jumbo sizes, while capturing smaller market shares, meet specific consumer needs. Extra large eggs are well-suited for culinary applications where additional egg content is advantageous, such as in omelets or large-batch baking. Jumbo eggs, often regarded as specialty items, appeal to consumers looking for the largest eggs available, whether for particular recipes or perceived value.

Europe Cage Free Eggs Market Segmentation By Distribution Channel:

-

Supermarkets/Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Sales

Supermarkets and hypermarkets maintain a dominant market position as the primary choice for consumers purchasing cage-free eggs. Their wide availability, extensive variety, and the convenience of offering multiple grocery items in one location make them highly popular shopping destinations. These retail giants typically provide a range of egg sizes and colors to cater to diverse consumer preferences and dietary needs.

Convenience stores also play a vital role in distributing cage-free eggs, offering easy access for quick shopping needs. While they hold a smaller market share, they are essential for last-minute purchases and in locations where larger supermarkets may not be easily accessible.

Independent retailers, including local grocery stores and farm shops, are valued for their emphasis on local produce and commitment to sustainable and ethical food choices.

Online sales are experiencing rapid growth as consumers increasingly seek convenient purchasing options. This channel offers the benefits of direct home delivery and the ability to easily compare prices and read product reviews. As more consumers become accustomed to online shopping, the market share for online egg sales is anticipated to rise, driven by the demand for convenience and the growing trend of digital purchasing.

Europe Cage Free Eggs Market Segmentation- by Region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Europe is expected to experience significant growth in the Cage-Free Eggs Market, driven by an increasing consumer preference for eggs sourced from farms that offer better living conditions for hens, along with rising demand from the food processing and hospitality sectors. The region’s stringent animal welfare regulations further enhance the appeal of cage-free eggs in consumer markets.

The UK leads the market, with Noble Foods, the country's largest egg producer, committing to exclusively cage-free egg production by 2025. This decision aims to alleviate the suffering of millions of birds annually, following the release of distressing footage by Animal Equality, which showcased the conditions on a Noble Foods caged-hen farm in Dorset.

Germany is identified as the fastest-growing region in the market. The situation in Germany illustrates that legal reforms regarding animal welfare can either be impeded or flourish based on the prevailing political climate. Some political contexts are more conducive to animal welfare reforms than others. Historical patterns indicate that conservative local and federal governments often prioritize agricultural industry needs over animal welfare concerns. Therefore, it is essential to closely monitor political developments and strategically time advocacy efforts.

COVID-19 Pandemic: Impact Analysis

Consumer consumption patterns have experienced notable shifts, primarily due to the COVID-19 pandemic. Additionally, there has been a growing demand for clean-label products, reflecting heightened awareness of animal welfare issues and the negative aspects of the poultry industry. This rising preference for healthier options has significantly driven the adoption of organic eggs in the market, as organic and free-range eggs are perceived to be more nutritious than conventional alternatives.

Latest Trends/ Developments:

In 2022, Nestlé announced that it fulfilled its 2017 commitment to achieve 100% cage-free egg sourcing in Europe. The company now exclusively uses cage-free eggs in all its food products available in the European market. Each year, Nestlé utilizes approximately 4,500 tons of eggs across its food brands, which include products like Thomy and Winiary mayonnaise, as well as offerings from the Garden Gourmet portfolio.

Key Players:

These are top 10 players in the Europe Cage Free Eggs Market: -

- Noble Foods

- Cal-Maine Foods, Inc

- Farm Pride Foods Ltd.

- Eggland’s Best, LLC

- Herbruck’s Poultry Ranch, Inc.

- Granja Agas SA

- Hickman’s Family Farms

- Kuramochi Sangyo Co., Ltd.

- Hillandale Farms

- Lintz Hall Farm

Chapter 1. Europe Cage Free Eggs Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Cage Free Eggs Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Cage Free Eggs Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Cage Free Eggs Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Cage Free Eggs Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Cage Free Eggs Market– By Colour

6.1. Introduction/Key Findings

6.2 White

6.3. Brown

6.4. Y-O-Y Growth trend Analysis By Colour

6.5. Absolute $ Opportunity Analysis By Colour , 2024-2030

Chapter 7. Europe Cage Free Eggs Market– By Size

7.1. Introduction/Key Findings

7.2 Small and Medium

7.3. Large

7.4. Extra Large

7.5. Jumbo

7.6. Y-O-Y Growth trend Analysis By Size

7.7. Absolute $ Opportunity Analysis By Size , 2024-2030

Chapter 8. Europe Cage Free Eggs Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Independent Retailers

8.5. Online Sales

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Cage Free Eggs Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By End-use

9.1.3. By Distribution Channel

9.1.4. By Colour

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Cage Free Eggs Market– Company Profiles – (Overview, Size Portfolio, Financials, Strategies & Developments)

10.1. Noble Foods

10.2. Cal-Maine Foods, Inc

10.3. Farm Pride Foods Ltd.

10.4. Eggland’s Best, LLC

10.5. Herbruck’s Poultry Ranch, Inc.

10.6. Granja Agas SA

10.7. Hickman’s Family Farms

10.8. Kuramochi Sangyo Co., Ltd.

10.9. Hillandale Farms

10.10. Lintz Hall Farm

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Cage-free eggs are frequently promoted as healthier and more environmentally sustainable choices, often commanding higher prices

The top players operating in the Europe Cage Free Eggs Market are - Noble Foods, Cal-Maine Foods, Inc, Farm Pride Foods Ltd., Eggland’s Best, LLC and Herbruck’s Poultry Ranch, Inc.

Consumer consumption patterns have experienced notable shifts, primarily due to the COVID-19 pandemic.

As public awareness regarding animal welfare expands, governments and regulatory agencies worldwide are progressively implementing and enforcing standards that enhance the welfare of farm animals, including egg-laying hens. This evolving regulatory landscape is fostering a more equitable environment, where cage-free egg production is becoming the standard rather than an exception.

Germany is identified as the fastest-growing region in the market.