Europe Brown Rice Market Size (2024-2030)

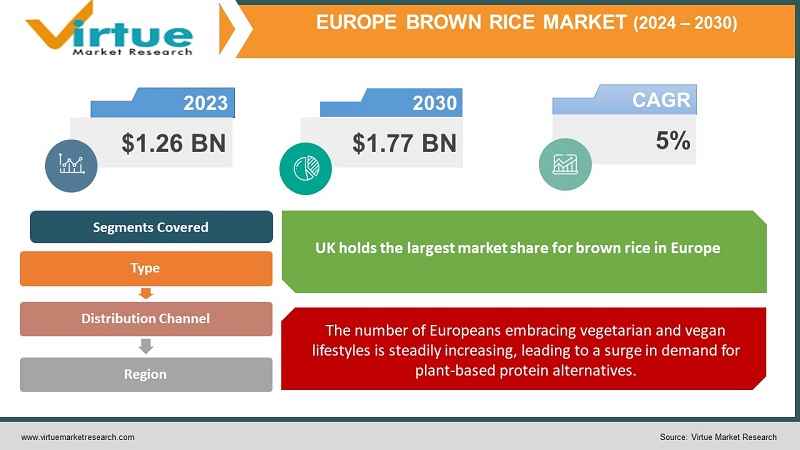

The Europe Brown Rice Market was valued at USD 1.26 Billion in 2023 and is projected to reach a market size of USD 1.77 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

Brown rice, once considered a niche health food, has entered the European mainstream. Driven by evolving consumer preferences, technological advancements, and culinary innovation, it's rapidly expanding its reach. Europe is not a major rice-producing region globally. Italy and Spain are among the primary producers of brown rice within Europe, alongside smaller-scale production in countries like Greece, Portugal, and France. Brown rice is increasingly incorporated into packaged foods – rice cakes, cereals, snacks, ready-to-eat meals, and bakery products. E-commerce platforms are gaining importance, providing increased convenience and access to diverse brown rice products. The core consumer base for brown rice is expanding beyond traditional health-food enthusiasts. It now includes a wider range of demographics, driven by greater awareness of its benefits. Health benefits, taste preference, desire for variety, and ethical or environmental considerations all play a role in the decision to purchase brown rice. Developing pre-cooked, convenience-oriented brown rice formats can address time constraints. Creating blends with other grains, pulses, or seeds can enhance the nutritional profile and appeal of brown rice offerings. Highlighting the versatility, flavor, and health benefits of brown rice through targeted campaigns can broaden its reach.

Key Market Insights:

Approximately 65% of European consumers cite health reasons as the primary driver for their increased consumption of brown rice, recognizing its high fiber, vitamin, and mineral content.

Western European countries, such as Germany, France, and the United Kingdom, have traditionally been the largest markets for brown rice, collectively accounting for over 50% of the total market share.

The organic and specialty brown rice segments are experiencing particularly strong growth, with a projected CAGR of around 8% during the forecast period.

Approximately 25% of the total brown rice consumption in Europe can be attributed to the food service sector.

Supermarkets and hypermarkets remain the dominant retail channels for brown rice, accounting for around 60% of the total market share. Private-label or store-brand brown rice products have experienced significant growth, accounting for around 25% of the total market share. Consumers perceive private-label brands as offering good value for money while maintaining quality standards.

Gluten-free brown rice products account for approximately 15% of the total market share. Approximately 40% of European consumers cite environmental sustainability as a factor influencing their choice of brown rice over white rice.

Europe Brown Rice Market Drivers:

European consumers are increasingly scrutinizing food labels, seeking minimally processed products with recognizable and natural ingredients. Brown rice, a whole grain with the bran and germ intact, embodies this "clean label" preference, offering a clear understanding of what's on the plate.

Consumers are no longer content with simply seeing "natural flavors" on a label. They want to understand precisely what whole-food ingredients is in their food, seeking out recognizable,. There's an increasing perception that heavily processed foods are laden with artificial additives, preservatives, and excess sodium or sugar, potentially detrimental to health. "Clean label" consumers seek foods as close to their natural state as possible, valuing minimal interference and a focus on whole-food ingredients. Brown rice's inherent advantage is its simplicity. It's a single, whole grain, requiring minimal processing - a major selling point for "clean label" shoppers. Brown rice doesn't need a long ingredient list to be delicious or nutritious. This transparency is inherently appealing to consumers seeking clarity. Brown rice's strong nutritional profile complements the clean-eating philosophy. Its fiber, vitamins, and minerals resonate with health-conscious consumers.

The number of Europeans embracing vegetarian and vegan lifestyles is steadily increasing, leading to a surge in demand for plant-based protein alternatives.

Plant-based diets naturally prioritize whole grains, fruits, vegetables, and legumes – aligning perfectly with brown rice's nutritional profile. Many people adopting plant-based eating do so to lower their intake of heavily processed foods, again favoring minimally processed brown rice. Plant-based diets are often associated with a reduced carbon footprint and lower water usage compared to diets heavily reliant on animal products. Combining brown rice with legumes (lentils, beans, etc.) creates a complete protein profile, making it a cornerstone of satisfying plant-based meals. Fiber is crucial for a healthy plant-based diet, promoting gut health and satiety. Brown rice's high fiber content makes it an excellent fit. Brown rice offers a range of B vitamins, magnesium, iron, and other micronutrients essential for those following plant-based diets. Brown rice's neutral yet nutty flavor makes it adaptable to a vast array of cuisines and spice pairings – essential for keeping plant-based meals exciting. Brown rice features prominently in plant-forward dishes from Asia, Latin America, and the Mediterranean, providing a wealth of culinary inspiration.

Europe Brown Rice Market Restraints and Challenges:

Brown rice can be more expensive than white rice due to lower milling yields and potentially higher production costs for some varieties. Longer cooking time compared to white rice might be a barrier for some time-conscious consumers.

European consumers are increasingly opting for minimally processed, whole grains like brown rice. This aligns with the "clean label" movement that prioritizes recognizable and natural ingredients. Brown rice, with the bran and germ intact, embodies this preference, offering a clear understanding of what's on the plate. While price isn't always the biggest factor, brown rice can sometimes be priced slightly higher than white rice. Strategies to bridge this price gap and promote the value proposition of brown rice in terms of health and nutrition are crucial. Some consumers might have a preconceived notion that brown rice has a less desirable taste or texture compared to white rice. Education and recipe inspiration can help overcome this perception and encourage trial. Public awareness campaigns could highlight the versatility of brown rice across culinary styles.

Europe Brown Rice Market Opportunities:

European consumers are increasingly prioritizing transparency and natural ingredients, driving the "clean label" movement. They seek minimally processed whole grains like brown rice, which aligns perfectly with this trend. Manufacturers can capitalize on this by reformulating existing products with brown rice, replacing heavily processed ingredients. Additionally, innovation in brown rice breakfast cereals, snacks, and ready-to-eat meals presents a significant opportunity. Highlighting brown rice's "clean label" credentials through clear labeling and marketing that emphasizes natural ingredients and minimal processing will resonate with consumers. Health-conscious consumers are actively seeking out food rich in fiber, vitamins, minerals, and antioxidants. Brown rice, a whole grain brimming with these nutrients, positions itself as a superfood contender. Developing brown rice products specifically catering to weight management, gut health, and diabetes management opens doors for market growth. Educational campaigns highlighting brown rice's health benefits can further drive adoption. The rising number of vegetarians and vegans in Europe creates a substantial demand for plant-based protein alternatives. While brown rice isn't a complete protein on its own, it shines when combined with legumes or nuts.

EUROPE BROWN RICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

T.K. Ricemill , Surgut, Ebro Foods , SunRice, Amisa Nature Foods, Clear spring, Rapunzel, TerraSana |

Europe Brown Rice Market Segmentation:

Europe Brown Rice Market Segmentation: By Type

- Conventional Brown Rice

- Organic Brown Rice

Conventional Brown Rice: Conventional brown rice holds the dominant position in the European market, capturing an estimated 75% share. This dominance can be attributed to its generally lower price point compared to organic brown rice. Value-conscious consumers seeking a healthy whole-grain option often gravitate towards conventional brown rice. Conventional brown rice benefits from its established presence in supermarkets and hypermarkets. This broad distribution ensures easy access for consumers across Europe, making it a familiar and convenient choice.

Organic Brown Rice: The organic brown rice segment, currently estimated at 25% of the market share, is experiencing significant growth. This surge is fueled by a rise in health-conscious consumers who prioritize ethically sourced and sustainable food options. Organic certification signifies adherence to stricter agricultural practices, often free from synthetic pesticides and fertilizers, which appeals to this segment. Organic brown rice often commands a premium price compared to conventional options due to its production costs. While conventional brown rice is the current market leader, its growth is likely to be steady rather than explosive. However, there's still room for innovation within this segment. The organic brown rice segment boasts significant growth potential due to rising health and sustainability concerns.

Europe Brown Rice Market Segmentation: By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Grocery Stores

- Direct-to-Consumer (D2C)

Supermarkets & Hypermarkets (Estimated Market Share: 55-60%) hold the lion's share of the European brown rice market. Their sheer size, accessibility, and broad product range make them a one-stop shop for most consumers. They offer a wide variety of brown rice options, encompassing conventional and organic varieties in different packaging formats (bags, pouches, jars) to cater to diverse budgets and preferences. Specialty Stores (Estimated Market Share: 10-15%) including health food stores and organic grocery stores, cater to a more niche consumer segment. They often prioritize organic brown rice and might offer a wider range of specialty varieties, such as heirloom brown rice or brown rice blends featuring ancient grains.

Online Grocery Stores (Estimated Market Share: 10-15%) are experiencing a surge in Europe, offering a convenient alternative to traditional brick-and-mortar stores. Brown rice is increasingly available through this channel, catering to busy consumers and those seeking a wider product range. Online retailers often offer a diverse selection of brown rice options, similar to what supermarkets carry. Additionally, they might provide access to niche or specialty brown rice varieties not readily available in physical stores. Some online retailers might offer subscription services for brown rice, ensuring a consistent supply for regular consumers. Direct-to-Consumer (D2C) (Estimated Market Share: 5-10%) model allows brown rice producers to sell directly to consumers through online platforms, bypassing traditional intermediaries. This offers greater control over branding, messaging, and potentially, pricing. D2C models often rely on subscriptions, providing consumers with regular deliveries of brown rice, sometimes tailored to specific needs (organic, pre-measured portions). D2C allows for a more direct relationship with consumers. Producers can engage with them through social media platforms, offering valuable information, recipes, and personalized recommendations.

Europe Brown Rice Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK holds the largest market share for brown rice in Europe, driven by a growing health and wellness consciousness and a rising interest in global cuisines. The "Clean Label" movement and the popularity of plant-based diets are significant drivers in the UK. Consumers are increasingly seeking minimally processed, whole grains like brown rice to incorporate into their meals. Convenience is a key factor, with pre-cooked brown rice options and recipe inspiration readily available. Additionally, there's a growing interest in brown rice flour and alternative pasta options made from brown rice. Germany is a pioneer in brown rice innovation. Here, we see a wider variety of brown rice products, including brown rice breakfast cereals, snacks, and even brown rice-based beer alternatives. German consumers are increasingly environmentally conscious. The potentially lower water footprint of brown rice compared to other grains resonates with these eco-conscious buyers. Supermarkets and discount grocery chains dominate brown rice distribution in Germany. However, specialty stores and online retailers are also gaining traction. France has a long tradition of rice consumption, but primarily with white rice. However, brown rice is gaining acceptance, particularly in innovative culinary applications. Chefs are incorporating it into salads, grain bowls, and vegetarian dishes. The growing popularity of Asian and Latin American cuisines in France is driving brown rice consumption. Consumers are seeking authentic ingredients to recreate these dishes at home. Italy, traditionally a land of white risotto rice, is witnessing a rise in brown rice consumption. Health-conscious consumers are driving this change, seeking alternatives with higher fiber content. Italian consumers are incorporating brown rice into their traditional dishes, such as risotto, with interesting variations. The remaining European countries, collectively referred to as the "Rest of Europe," account for a significant market share of approximately 46%. This diverse region encompasses countries like Belgium, Netherlands, Switzerland, Poland, and others, each with its unique culinary traditions and consumer preferences.

COVID-19 Impact Analysis on the Europe Brown Rice Market:

The initial months of the pandemic were marked by panic buying. Consumers, concerned about potential food shortages, stockpiled staple foods like white rice. This surge in demand temporarily overshadowed brown rice, leading to potential shortfalls on supermarket shelves. Lockdowns and border restrictions disrupted global supply chains, impacting the import of brown rice from key Asian producers. This posed a logistical hurdle for European distributors and retailers. With restaurants closed and people confined to their homes, the focus shifted towards home cooking. However, the initial emphasis was on easy-to-prepare meals, potentially leading to a temporary dip in brown rice consumption, perceived by some as requiring longer cooking times. With physical stores limiting capacity or facing closures, online grocery shopping witnessed a surge. This benefited brown rice sales, as online platforms offered a wider variety of brown rice options compared to brick-and-mortar stores. The demand for convenient meal solutions grew. Pre-cooked brown rice options, microwaveable rice pouches, and brown rice meal kits gained popularity as time-strapped consumers juggled work-from-home realities and childcare. With travel restrictions limiting the exploration of foreign cultures, consumers continued to embrace ethnic cuisines at home. This translates to a sustained demand for brown rice, a staple ingredient in many Asian and Latin American dishes.

Latest Trends/ Developments:

While brown rice isn't a complete protein on its own, its rise alongside plant-based diets goes beyond simply replacing meat. Consumers are exploring creative combinations of brown rice with legumes, nuts, and seeds to create complete protein meals. Food manufacturers are capitalizing on this by developing innovative pre-mixed blends featuring brown rice and complementary protein sources. These convenient options cater to busy consumers seeking healthy and sustainable plant-based meals. A focus on recipe development showcasing brown rice's versatility in creating complete protein bowls, salads, and stir-fries can further fuel this trend. Social media platforms can be leveraged to share these recipes and inspire consumers.

Key Players:

- T.K. Ricemill

- Surgut

- Ebro Foods

- SunRice

- Amisa Nature Foods

- Clear spring

- Rapunzel

- TerraSana

Chapter 1. Europe Brown Rice Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Brown Rice Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Brown Rice Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Brown Rice Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Brown Rice Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Brown Rice Market– By Type

6.1. Introduction/Key Findings

6.2. Conventional Brown Rice

6.3. Organic Brown Rice

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Brown Rice Market– By Distribution channel

7.1. Introduction/Key Findings

7.2 Supermarkets & Hypermarkets

7.3. Specialty Stores

7.4. Online Grocery Stores

7.5. Direct-to-Consumer (D2C)

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. Europe Brown Rice Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Brown Rice Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. T.K. Ricemill

9.2. Surgut

9.3. Ebro Foods

9.4. SunRice

9.5. Amisa Nature Foods

9.6. Clear spring

9.7. Rapunzel

9.8. TerraSana

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers are increasingly drawn to brown rice for its well-being benefits. It's a whole grain, naturally higher in fiber and essential nutrients compared to refined white rice. This resonates with health-conscious individuals seeking to incorporate more fiber into their diet for digestive health, weight management, and potential blood sugar control.

Brown rice often carries a price premium compared to refined white rice. This can be a significant barrier for budget-conscious consumers, particularly in regions where price sensitivity is high.

T.K. Ricemill, Surgut, Ebro Foods, SunRice, Amisa Nature Foods, Clear

Spring, Rapunzel, TerraSana

The UK currently holds the largest market share, estimated at around 15%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns