Europe Biodegradable Plastics Market Size (2024-2030)

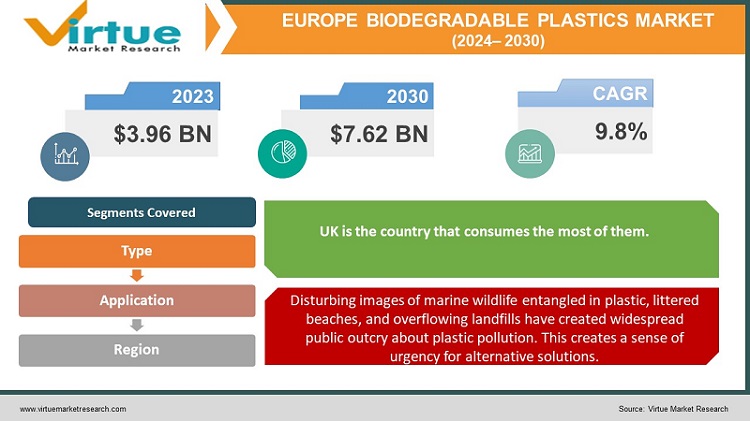

The Europe Biodegradable Plastics Market was valued at USD 3.96 Billion in 2023 and is projected to reach a market size of USD 7.62 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.8%.

European consumers are increasingly concerned about plastic pollution and its environmental impact. Biodegradables offer a seemingly eco-friendly solution, contributing to their adoption. Europe is a source of ongoing innovation in biodegradable plastics, from developing new bio-based materials to optimizing processes for biodegradation efficiency. EU policies phasing out certain single-use plastics and incentivizing bio-based materials provide a robust framework for market expansion. Plastic pollution in oceans, landfills, and the natural environment fuels a strong desire for alternatives, boosting the appeal of biodegradable options. Major corporations across industries are making sustainability commitments. The adoption of biodegradable packaging and products aligns with these goals and enhances brand image. Continuous research and development are making biodegradable plastics more affordable, functional, and tailored for diverse applications.

Key Market Insights:

Western European countries, such as Germany, France, and the United Kingdom, are leading the charge in the adoption of biodegradable plastics, collectively accounting for over 60% of the market share.

More than 80% of European customers are willing to pay more for sustainable and eco-friendly items, such as biodegradable plastics, according to a new survey by the European Commission.

It is estimated that the adoption of biodegradable plastics could reduce plastic waste in Europe by up to 25% by the end of this decade.

Over €500 million has been invested in research and development projects by major participants in the European biodegradable plastics market, including NaturePlast, BASF, Novamont, and Corbion Purac, to improve product offerings and investigate novel bio-based materials.

The biodegradable plastics market has a significant share of the packaging industry, accounting for around 45% of its total market value.

Polylactic acid (PLA) and polyhydroxyalkanoates (PHAs) are also gaining traction, contributing to approximately 25% of the market share.

Other sectors that also contribute significantly to the market share include agriculture, consumer goods, and healthcare, collectively comprising over 30% of the market share.

Starch-based plastics, derived from renewable sources like corn, wheat, and potatoes, dominate the market, accounting for approximately 60% of the total market share.

Europe Biodegradable Plastics Market Drivers:

The European Union is at the forefront of sustainability initiatives, with ambitious targets to reduce plastic waste, promote circularity, and transition to a bio-based economy. This translates into stringent regulations that are rapidly transforming the landscape for plastics.

Single-Use Plastics directive bans specific single-use plastic items (like straws, cutlery, balloon sticks) and mandates recycled content targets for others. Biodegradable alternatives gain significant traction within this framework. The circular economy package focuses on rethinking how products are designed, produced, and disposed of creating incentives for biodegradables that integrate more seamlessly into end-of-life scenarios. Discussions around EPR schemes could hold producers financially responsible for end-of-life management. This might make biodegradable options more attractive compared to hard-to-manage conventional plastics. Major corporations, particularly in the consumer goods sector, face mounting pressure to reduce their environmental footprint. Many have made bold sustainability commitments involving increased use of recycled and bio-based materials. This drives demand for biodegradable packaging solutions. European consumers are increasingly aware of plastic pollution and favor brands demonstrating environmental responsibility. Biodegradable packaging aligns with this shift, influencing purchasing decisions.

Disturbing images of marine wildlife entangled in plastic, littered beaches, and overflowing landfills have created widespread public outcry about plastic pollution. This creates a sense of urgency for alternative solutions.

The growing awareness of the prevalence of microplastics in the environment, their potential entry into the food chain, and possible health ramifications fuel a desire for materials that don't persist indefinitely. While not a magic solution to all pollution issues, the concept of biodegradability aligns with the public perception of a "natural" and environmentally responsible option. The drive to tackle plastic pollution is creating interest in biodegradable plastics for applications beyond single-use items – think fishing gear, agricultural products, or coatings designed to minimize long-term environmental harm. Companies associated with plastic pollution can face negative publicity and consumer backlash. Switching to biodegradable alternatives is a proactive strategy to mitigate this risk.

Europe Biodegradable Plastics Market Restraints and Challenges:

Even with increasing environmental awareness, price remains a major factor in purchasing decisions. The willingness to pay a premium for biodegradability varies among consumers and product categories.

While the gap is narrowing thanks to innovation and economies of scale, many biodegradable plastics still tend to be more expensive than their conventional, fossil-fuel-based counterparts. Achieving price parity for biodegradable plastics often hinges on larger-scale production and wider market adoption. This creates a chicken-and-egg scenario, where demand and scaled-up manufacturing need to grow in tandem. The cost of bio-based feedstocks (if used) and specialized production processes can contribute to the higher price tag of biodegradable end products. Not all biodegradable plastics are created equal. Some require specific conditions in industrial composting facilities, while others might degrade under more limited environments. While expanding, industrial composting facilities aren't universally available across Europe. This creates a bottleneck – even if consumers sort correctly, biodegradables may end up in landfills due to a lack of appropriate end-of-life infrastructure. While certifications are emerging, standardization surrounding biodegradability claims across the EU remains a work in progress. This can create a murky landscape for consumers and businesses alike.

Europe Biodegradable Plastics Market Opportunities:

While packaging (films, bags, containers) dominates the current market, the true potential of biodegradable plastics lies in diversifying applications and unlocking new opportunities. Biodegradable plastics with enhanced mechanical properties, heat resistance, and tailored functionality could find applications in durable and semi-durable goods, reducing reliance on traditional plastics in sectors like automotive, electronics, or construction. Going beyond mulch films, biodegradable plant pots, seed coatings, controlled-release fertilizer capsules, and irrigation components, present a substantial opportunity to minimize plastic pollution in the agricultural sector. Biodegradable scaffolds for tissue engineering, sutures, drug delivery systems, and implantable devices demonstrate the potential of these materials within the healthcare industry. While nascent, developing biodegradable fibers, coatings for sustainable textiles, and end-of-life solutions for the fashion industry hold long-term promise. Marine biodegradation presents unique challenges due to lower temperatures, varying salinity, and different microbial communities compared to terrestrial or composting scenarios.

EUROPE BIODEGRADABLE PLASTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

BASF,Novamont, Total Corbion PLA, NatureWorks, Biotec, FKuR, Rodenburg Biopolymers, Synbra |

Europe Biodegradable Plastics Market Segmentation:

Europe Biodegradable Plastics Market Segmentation: By Type

- Starch Blends

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHAs)

- Polybutylene Adipate Terephthalate (PBAT)

Starch blends are typically derived from plant sources like corn, potato, or wheat. They are often combined with other biodegradable polymers or additives to enhance their properties and processability. Starch blends are known for their relatively low cost, ease of processing, and wide availability of raw materials. This makes them an attractive choice for simple, high-volume applications. Dominant in single-use items like shopping bags, food packaging films, loose-fill packaging materials, and disposable cutlery. PLA is a thermoplastic polymer derived from renewable resources like corn starch or sugarcane. Its production involves fermentation to obtain lactic acid, which is then polymerized. PLA boasts good mechanical properties, processability, printability, and a degree of transparency. It offers greater versatility than starch blends alone. Widely used in rigid food containers, cups, 3D printing filaments, some medical applications, and other products where strength and clarity are desired.

PHAs are a family of Bio polyesters produced naturally by microorganisms under specific conditions of nutrient imbalance. PHAs exhibit excellent biodegradability in various environments, including marine settings. They possess good moisture and barrier properties. Currently, the cost of production and scaling up PHA manufacturing are hurdles to wider commercialization. The research seeks to optimize yields and make them more economical. Polybutylene Adipate Terephthalate (PBAT) is a biodegradable, often fossil-fuel-derived copolymer. However, bio-based variants are emerging. Known for its flexibility, toughness, and good processability. PBAT is often blended with other biodegradable polymers (like PLA or starch) to improve their properties. Commonly found in compostable bags, films, agricultural mulch films, and coatings where enhanced flexibility is needed.

Europe Biodegradable Plastics Market Segmentation: By Application -

- Packaging

- Agriculture & Horticulture

- Consumer Goods

- Textiles

- Technical Applications

Packaging: (Market Share: 65-75%) Demand for sustainable packaging solutions, particularly in the food industry, fuels this segment's dominance. Regulations like the Single-Use Plastics Directive play a major role in pushing this sector. Starch blends, PLA, PBAT, and various blends are frequently used to achieve desired properties like flexibility, barrier properties, and suitability for specific composting scenarios. Agriculture & Horticulture: (Market Share: 10-15%) Biodegradable plastics offer solutions designed to enhance agricultural practices while minimizing environmental impact. Mulch Films suppress weeds, regulate soil temperature, and moisture, eventually biodegrading in the field. Seed Coatings may contain nutrients or protectants that break down after planting. Plant Pots and Containers eliminate plastic waste from nurseries and can sometimes be planted directly.

Consumer Goods: (Market Share: 5- 10%) This segment focuses on disposable or short-lifespan products where biodegradability can reduce long-term waste. Cutlery, straws, and disposable tableware offer alternatives to traditional single-use plastics. Personal care items like cotton swabs, hygiene product components, and wipes (require careful consumer understanding of disposal pathways). In toys and novelty items biodegradability can be a selling point, especially in kids' products. Textiles: (Market Share: <5%) Biodegradable plastics hold promise in tackling the textile industry's environmental footprint, though still in its early stages. Biodegradable fibers involve the development of fibers derived from renewable sources that can break down over time. Compostable hangtags and labels eliminate plastic waste associated with garment labeling. Technical Applications: (Market Share: <5%) This segment encompasses diverse applications where biodegradable plastics offer performance advantages or address end-of-life environmental concerns. Highly tailored blends, often utilizing PLA, PHA, or specially developed materials for strength, heat resistance, and specific biodegradability scenarios.

Packaging unquestionably holds the major share due to policy drivers and strong demand. Agriculture & Horticulture is projected to show significant growth due to its practicality in reducing farm plastic waste and increasing sustainability.

Europe Biodegradable Plastics Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK has its directives and targets for reducing plastic waste and promoting a circular economy, alongside broader EU regulations. UK consumers are generally receptive to biodegradable packaging and products, fueling the demand for these solutions. The UK is home to significant research and development efforts focused on novel biodegradable materials and applications. Germany is known for its high standards across the value chain. Biodegradable plastics must meet stringent performance and end-of-life requirements to thrive in this market. Germany's strong industrial and manufacturing base creates opportunities for technical applications of biodegradable plastics across various sectors.

France has active regulations targeting single-use plastics and promotes a transition to a circular economy. This framework creates space for the expansion of the biodegradable plastics market. With a sizable agricultural sector, France holds the potential for significant growth in the use of biodegradable mulch films, plant pots, and other agriculture-related applications. Italy, with its extensive coastline, is acutely aware of the problem of marine plastic pollution. This could drive interest in biodegradables, particularly those designed for marine environments. Similar to other European regions, the biggest segment for biodegradable plastics in Italy is currently packaging applications.

Spain's agricultural sector presents a significant opportunity for the adoption of biodegradable mulch films and other products to reduce agricultural plastic waste. Coastal regions heavily impacted by tourism could benefit from biodegradable solutions to mitigate plastic pollution. Countries like Sweden and Denmark often spearhead sustainability initiatives, including the adoption of biodegradable materials. The market is developing in nations like Poland and the Czech Republic, with varying levels of policy support and consumer awareness. Western Europe generally leads the way, with the UK often a frontrunner. Eastern Europe has the potential for significant growth spurred by increasing awareness and evolving regulations.

COVID-19 Impact Analysis on the Europe Biodegradable Plastics Market:

National lockdowns across Europe disrupted the production and transportation of biodegradable plastics. Manufacturing facilities faced temporary closures or reduced capacity due to social distancing measures and labor shortages. Restrictions on the movement of goods hampered the flow of raw materials and finished products, creating temporary shortages and price fluctuations. With healthcare taking center stage, some investments in biodegradable plastics projects might have been put on hold as businesses reassessed priorities. The pandemic's exponential growth led to a significant increase in single-use personal protective equipment (PPE) like masks and gloves. This, coupled with concerns over potential virus transmission from reusable alternatives, raised anxieties about plastic waste. As lockdowns eased and economic activity resumed, the biodegradable plastics market witnessed a rebound. However, the full extent of recovery remains to be seen, and long-term impacts are still unfolding. The pandemic's global impact has sharpened the focus on sustainable practices. This could lead to a renewed push for policies and initiatives that favor biodegradable plastics over traditional options.

Latest Trends/ Developments:

The focus is shifting from mere biodegradability to creating materials that match conventional plastics in strength, barrier properties (ability to protect products), heat resistance, and processability. Research is underway to develop new bio-based polymers, blends, and composites that offer a wider range of properties tailored to diverse applications. The goal is to create biodegradable alternatives that can truly serve as drop-in replacements for traditional plastics, reducing barriers to adoption for manufacturers. Biodegradable plastics are being designed with specific end-of-life scenarios in mind. This means tailoring them to degrade optimally within industrial composting facilities or under certain environmental conditions. While starch and sugar-based feedstocks often dominate, the research explores alternative sources to reduce competition with food production and expand the potential of bio-based plastics. Harnessing the power of microorganisms to produce biopolymers from various organic materials offers exciting avenues for innovation.

Key Players:

- BASF

- Novamont

- Total Corbion PLA

- NatureWorks

- Biotec

- FKuR

- Rodenburg Biopolymers

- Synbra

Chapter 1. Europe Biodegradable Plastics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application

1.5. Secondary Application

Chapter 2. Europe Biodegradable Plastics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Biodegradable Plastics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Biodegradable Plastics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Biodegradable Plastics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Biodegradable Plastics Market– By Type

6.1. Introduction/Key Findings

6.2. Starch Blends

6.3. Polylactic Acid (PLA)

6.4. Polyhydroxyalkanoates (PHAs)

6.5. Polybutylene Adipate Terephthalate (PBAT)

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Biodegradable Plastics Market– By Application

7.1. Introduction/Key Findings

7.2 Packaging

7.3. Agriculture & Horticulture

7.4. Consumer Goods

7.5. Textiles

7.6. Technical Applications

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Biodegradable Plastics Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Biodegradable Plastics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF

9.2. Novamont

9.3. Total Corbion PLA

9.4. NatureWorks

9.5. Biotec

9.6. FKuR

9.7. Rodenburg Biopolymers

9.8. Synbra

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European Union is at the forefront of sustainability initiatives. This translates into stringent regulations that are rapidly transforming the landscape for plastics.

Industrial composting facilities, essential for the optimal breakdown of many biodegradable plastics, are not yet universally available. The mismatch between material innovation and infrastructure creates confusion and could hinder end-of-life outcomes.

BASF, Novamont, Total Corbion PLA, NatureWorks, Biotec

FKuR, Rodenburg Biopolymers, Synbra

The UK currently holds the largest market share, estimated at around 18%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns