European Aquaponics System Market Size (2023-2030)

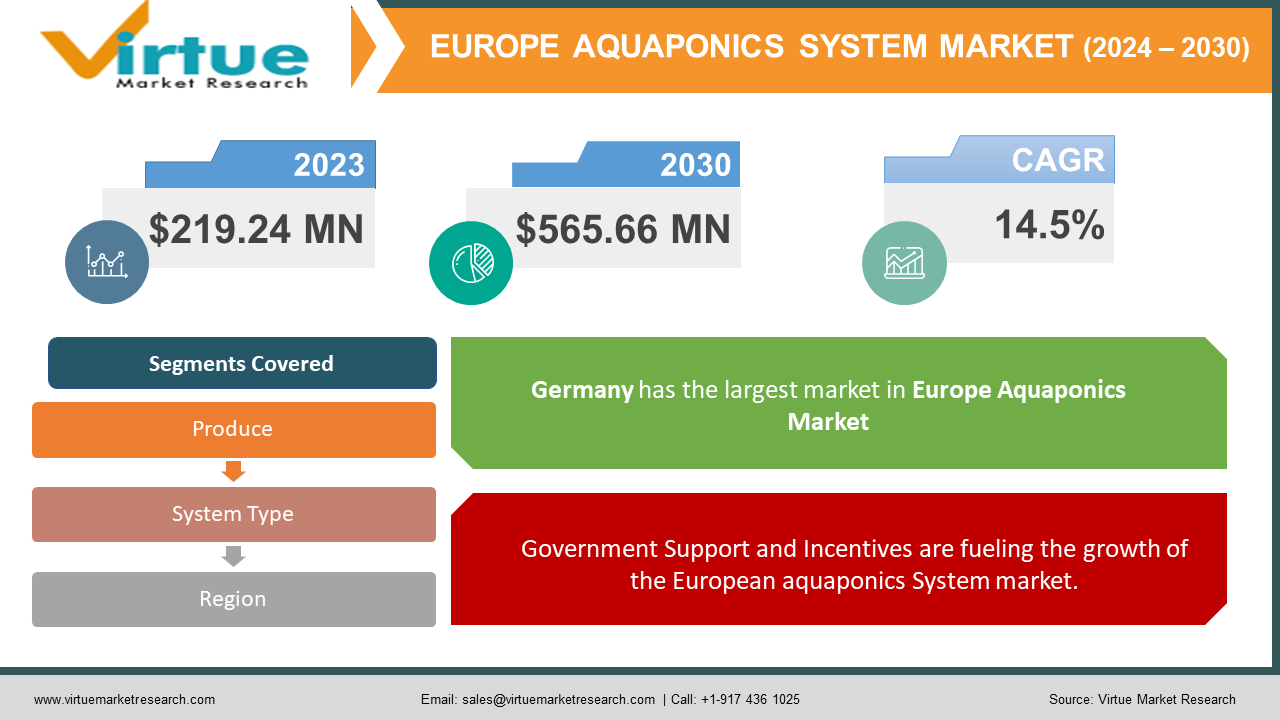

According to the report published by Virtue Market Research in European aquaponics System Market was valued at USD 219.24 Million in 2023 and is projected to reach a market size of USD 565.66 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.5%

The European aquaponics market has been steadily growing in recent years, driven by increasing consumer demand for sustainable and locally sourced food production. This innovative agricultural method combines aquaculture (fish farming) with hydroponics (soil-less plant cultivation), resulting in a closed-loop ecosystem that maximizes resource efficiency and minimizes environmental impact. The market has witnessed a proliferation of small to medium-sized aquaponics farms, as well as commercial-scale operations, catering to a diverse range of crops and fish species. Factors such as rising awareness of food security, environmental concerns, and the desire for fresher, pesticide-free produce have contributed to the market's expansion. Additionally, government incentives and support for sustainable agriculture practices further stimulate growth, positioning the European aquaponics market as a promising sector within the broader agricultural industry.

Key Market Insights:

- In a survey conducted of aquaponics practitioners across Europe, among 68 participants, 42.6% represented universities, 19.1% were engaged in commercial operations, 14.7% were associated with non-profit organizations, and 8.8% were affiliated with vocational schools, with 14.7% remaining unspecified.

- Between 2014 and 2018, the growth of aquaponics in Europe received a notable boost through the European-funded initiative known as COST Action FA1305, also referred to as "the EU Aquaponics Hub." This initiative effectively established a network that connected research efforts with small and medium-sized enterprises (SMEs) across Europe. As a result, aquaponics gained the attention of European policymakers, and the European Parliament Research Services recognized aquaponics as one of the "ten technologies with the potential to transform our lives."

- The majority of aquaponics practitioners, 96% to be precise, either strongly agreed or agreed that aquaponics enhances the sustainability of food production and contributes to mitigating the effects of climate change.

Europe Aquaponics System Market Drivers:

Increasing Demand for Sustainable and Local Food Production is a long-term driver of the European aquaponics System market.

There is a growing consumer preference for sustainable and locally sourced food due to concerns about food security, environmental sustainability, and the desire for fresher produce. Aquaponics, as an eco-friendly and efficient method of food production, aligns with these preferences. The global demand for sustainable agriculture is expected to continue rising, with a CAGR of 9% from 2021 to 2026. Aquaponics, with its ability to reduce water usage and pesticide use, is well-positioned to capitalize on this trend.

Government Support and Incentives are fueling the growth of the European aquaponics System market.

Governments across Europe are increasingly recognizing the potential of aquaponics to address food security, create jobs, and reduce the environmental impact of traditional agriculture. Many countries are offering financial incentives, grants, and research funding to support the development and expansion of aquaponic operations. For instance, the European Union's Common Agricultural Policy (CAP) includes provisions to promote sustainable farming practices, which can benefit aquaponics. Additionally, according to a report by the European Commission, funding for innovative and sustainable agriculture projects is set to increase under the Horizon Europe program, creating favorable conditions for aquaponics market growth in the region.

Europe Aquaponics System Market Restraints and Challenges:

High Initial Investment Costs could limit the growth of the European aquaponics System market.

One significant challenge in the European aquaponics industry is the substantial upfront investment required to establish and operate aquaponic systems. The costs associated with constructing infrastructure, purchasing fish and plant stock, ensuring water quality control, and installing monitoring systems can be prohibitive for many potential entrants, especially small-scale farmers or new startups. According to a study by the European Commission in 2016, the initial investment for aquaponics systems can range from $118,000 to $1.18 million or more, depending on the scale and complexity of the operation. According to a study by the European Aquaponics Hub, the setup cost for a small-scale aquaponics system can range from $6,000 to $36,000 or more, depending on the scale and complexity of the operation. These high costs can act as a barrier to entry for individuals and businesses looking to adopt aquaponics as a sustainable farming method.

Regulatory and Certification Challenges are a hurdle for the European aquaponics System market.

Another significant restraint is the complex and evolving regulatory landscape for aquaponics in Europe. The industry faces challenges in terms of navigating various national and EU regulations related to aquaculture, agriculture, and food safety. Compliance with these regulations can be time-consuming and costly. Moreover, aquaponics products may not always fit neatly into existing certification schemes, making it challenging for aquaponics producers to access markets and demonstrate product quality. The lack of standardized aquaponics-specific certification schemes adds to the complexity. These regulatory and certification challenges can hinder market growth and limit the ability of aquaponics producers to reach wider consumer markets.

Europe Aquaponics System Market Opportunities:

The European aquaponics System market presents promising opportunities driven by increasing consumer demand for sustainable, locally sourced produce, and the growing recognition of aquaponics as an eco-friendly and efficient method of food production. Opportunities include expanding adoption in urban agriculture for fresh, pesticide-free crops, addressing food security concerns, and leveraging government support and funding for sustainable farming practices. Additionally, the market offers room for innovation in system design, automation, and integration with emerging technologies, creating potential avenues for growth, investment, and job creation in the agricultural sector.

EUROPEAN AQUAPONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14.5% |

|

Segments Covered |

By Produce, System Type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K. , Germany, France , Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

ECF Farmsystems, UrbanFarmers, Ouroboros Farms, AquaBioTech Group, Bioaqua Farm, Les Nouvelles Fermes , FarmedHere, Ponix Systems, Edenworks, GreenLife Aquaponic |

Europe Aquaponics System Market Segmentation:

Europe Aquaponics System Market Segmentation: By Produce:

- Leafy greens & herbs

- Fruit-bearing plants

- Fish

The largest segment by produce in the European aquaponics market is leafy greens and herbs, holding roughly 67% share. These crops are among the most commonly grown and harvested in aquaponic systems across the region. Leafy greens and herbs are well-suited to aquaponic conditions, as they can thrive in the nutrient-rich water provided by the aquaponics setup. These crops often have relatively short growth cycles, allowing for more frequent harvests and faster turnover of produce. Leafy greens and herbs have consistent and high consumer demand, making them attractive choices for aquaponic growers looking to supply local markets, restaurants, and supermarkets.

Fish is the fastest-growing segment in the European aquaponics System market. Many European consumers are seeking alternatives to conventionally farmed fish, which often involve issues like overfishing, environmental pollution, and the use of antibiotics. Aquaponics offers a sustainable and eco-friendly approach to fish production, aligning with these consumer preferences. Aquaponic systems are adapted to cultivate various fish species, offering growers flexibility to meet market demands. Commonly raised fish in European aquaponics included tilapia, trout, catfish, and carp. Advances in aquaponic technology, including improved water quality management, monitoring systems, and automation, have made it more efficient and feasible to raise fish in aquaponic systems.

Europe Aquaponics System Market Segmentation: By System Type

- Media-Based Aquaponics

- Nutrient Film Technique Aquaponics

- Deep Water Culture Aquaponics

- Vertical Aquaponics

- Others

The media-based aquaponics segment was one of the largest and most widely adopted system types in the European aquaponics market. This system type is favored for its versatility and suitability for a wide range of crops, including leafy greens, herbs, and some fruiting plants. Media-based systems use a growing medium, such as gravel or clay pebbles, to support plant growth and provide a habitat for beneficial bacteria that convert fish waste into plant nutrients. Media-based aquaponics systems have been popular among both small-scale and medium-scale aquaponic operations due to their relative simplicity and effectiveness. These systems are versatile and suitable for a wide range of crops, including leafy greens, herbs, and some fruiting plants.

Vertical aquaponics registers the fastest-growing rate in this market. These systems allow for the efficient use of limited space, making it particularly suitable for urban agriculture and indoor farming settings. In densely populated urban areas, where available land is limited, vertical systems offer a way to maximize production in a small footprint. Vertical aquaponics systems can be adapted for year-round production, making them attractive for growers seeking consistent harvests regardless of seasonal changes. These systems enable growers to experiment with a wide variety of crops, including leafy greens, herbs, and even some fruiting plants, contributing to market diversification.

Europe Aquaponics System Market Segmentation: Regional Analysis:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany held the largest market share, accounting for 24.8% of market revenue in the European aquaponics System market. Its strong presence in the market is attributed to factors such as advanced agricultural practices, technological innovation, and a growing interest in sustainable food production. Germany's well-established agricultural sector and increasing consumer demand for locally sourced, sustainable, and organic produce have driven the growth of aquaponics. Additionally, government support and favorable policies for sustainable agriculture have contributed to the expansion of aquaponic operations in the country.

France is the fastest-growing region and is anticipated to grow at 14% CAGR during the forecast period. Increasing consumer awareness about the environmental impact of traditional agriculture has led to a surge in demand for sustainably produced food. French consumers are increasingly valuing locally sourced, pesticide-free, and eco-friendly products, which align with the principles of aquaponics. France has implemented various initiatives and subsidies to promote sustainable agriculture, including aquaponics. These incentives have attracted new entrants and investments into the aquaponics sector.

COVID-19 Impact Analysis on the Europe Aquaponics System Market:

The COVID-19 pandemic has had a mixed impact on the European aquaponics System market. On one hand, the pandemic heightened awareness of the vulnerabilities in global supply chains, driving interest in local and sustainable food production, which benefitted the aquaponics industry. However, disruptions in supply chains, reduced restaurant demand, and logistical challenges affected some commercial aquaponics operations. According to a report by the European Aquaponics Hub, there was a noticeable increase in consumer demand for locally produced food, which resulted in a 20% growth in direct-to-consumer sales for some aquaponics farms during the height of the pandemic. Still, uncertainties and restrictions posed challenges, highlighting the need for resilience and adaptability within the industry.

Latest Trends/ Developments:

Companies operating in the European aquaponics market are increasingly integrating sustainable practices into their operations. This trend is driven by growing consumer awareness and demand for environmentally friendly food production methods. By utilizing closed-loop aquaponic systems that minimize water and resource usage, these companies not only reduce their environmental footprint but also position themselves as eco-conscious suppliers in a market where sustainability is a key selling point. This strategic shift not only enhances their market share but also aligns them with European Union policies promoting sustainable agriculture and aquaculture.

Another notable trend in the European aquaponics market is the diversification of product offerings. Companies are expanding beyond traditional crops and fish species to cater to a wider range of consumer preferences. This includes the cultivation of niche or exotic crops, such as herbs, microgreens, and specialty fish species, to tap into new market segments. By broadening their product portfolios, these companies are better positioned to capture a larger share of the market and adapt to changing consumer tastes and dietary trends, thereby bolstering their competitive edge in the industry.

Key Players:

- ECF Farmsystems

- UrbanFarmers

- Ouroboros Farms

- AquaBioTech Group

- Bioaqua Farm

- Les Nouvelles Fermes

- FarmedHere

- Ponix Systems

- Edenworks

- GreenLife Aquaponic

- In April 2021, Les Nouvelles Fermes, a French indoor farming company, secured its initial funding round, raising EUR 2 million. The funding was provided by investors including IRDI, the Banque des Territoires, Crédit Agricole Aquitaine, and the CIC. The company's strategic intent with this capital injection is to embark on the construction of the largest aquaponic farm in Europe.

- In March 2021, Malta-based Aquabiotech Group, the China Agricultural University National Innovation Center for Digital Fishery, and Mingbo Aquatic partnered together for a research project, Aquadetector, to enhance the digitalization of the aquaculture industry and to research high-precision detection technologies in aquaculture.

Chapter 1. Europe Aquaponics System Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Aquaponics System Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Aquaponics System Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Aquaponics System Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Europe Aquaponics System Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Aquaponics System Market– By Produce

6.1. Introduction/Key Findings

6.2. Leafy greens & herbs

6.3. Fruit-bearing plants

6.4. Fish

6.5. Y-O-Y Growth trend Analysis By Produce

6.6. Absolute $ Opportunity Analysis By Produce, 2023-2030

Chapter 7. Europe Aquaponics System Market– By System Type

7.1. Introduction/Key Findings

7.2. Media-Based Aquaponics

7.3. Nutrient Film Technique Aquaponics

7.4. Deep Water Culture Aquaponics

7.5. Vertical Aquaponics

7.6. Others

7.7. Y-O-Y Growth trend Analysis By System Type

7.8. Absolute $ Opportunity Analysis By System Type, 2023-2030

Chapter 8. Europe Aquaponics System Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Produce

8.1.3. By System

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Aquaponics System Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. ECF Farmsystems

9.2. UrbanFarmers

9.3. Ouroboros Farms

9.4. AquaBioTech Group

9.5. Bioaqua Farm

9.6. Les Nouvelles Fermes

9.7. FarmedHere

9.8. Ponix Systems

9.9. Edenworks

9.10. GreenLife Aquaponic

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

According to the report published by Virtue Market Research in European aquaponics System Market was valued at USD 219.24 Million in 2023 and is projected to reach a market size of USD 565.66 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.5%

Increasing Demand for Sustainable, Local Food Production and Government Support and Incentives are helping to expand the European aquaponics System market.

Based on the source, the European aquaponics System market is divided into Media-Based Aquaponics, Nutrient Film Technique Aquaponics, Deep Water Culture Aquaponics, Vertical Aquaponics, and Others

. Germany is the most dominant region for the European aquaponics System Market

. ECF Farmsystems, UrbanFarmers, Ouroboros Farms, and AquaBioTech Group are a few of the key players operating in the European aquaponics System Market