Europe Almond Drinks Market Size (2023-2030)

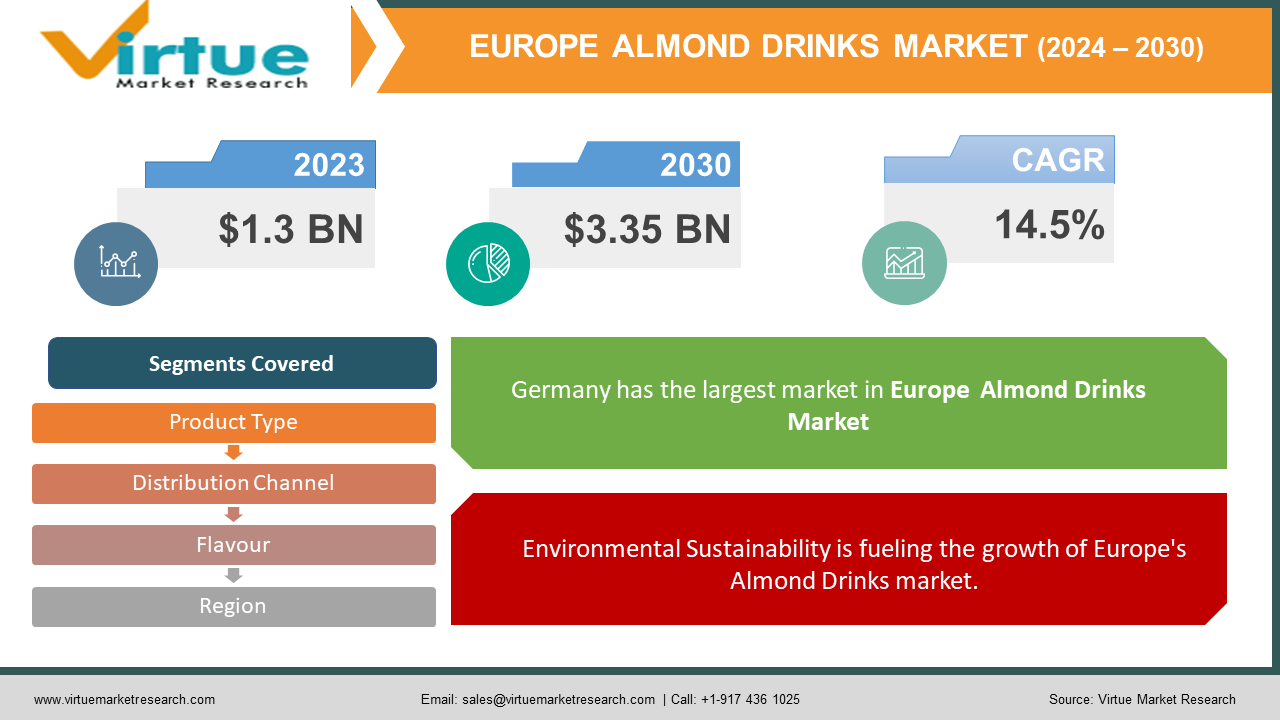

The European almond Drinks Market was valued at USD 1.3 Billion in 2023 and is projected to reach a market size of USD 3.35 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.5%.

The European almond drink market has witnessed significant growth in recent years, driven by a rising consumer preference for plant-based and dairy-free alternatives. This shift is largely attributed to health consciousness, lactose intolerance, and environmental concerns. Almond milk, a popular non-dairy beverage, has gained prominence for its nutritional benefits and versatility in various culinary applications. European consumers are increasingly incorporating almond milk into their diets, not only as a milk substitute but also in coffee, smoothies, and cereals. Market growth is further fueled by product innovation, including flavored almond milk, fortified options, and organic varieties. With a growing emphasis on sustainability and eco-friendly packaging, the European almond drink market is expected to continue its expansion, offering diverse choices to health-conscious consumers seeking plant-based alternatives.

Key Market Insights:

- In 2022, the cost of cow's milk in UK supermarkets rose to $1.52 per liter, while plant-based options like almond milk remained lower at $1.30 per liter.

- The almond milk market experienced a substantial 14.2% growth compared to 2021. More people are turning to almond milk due to its health benefits and concerns about the environmental impact of dairy production. Additionally, the increasing focus on fitness and health has contributed to this shift. In 2020, 32% of UK consumers reported having dairy intolerances.

- Almond milk is considered a healthier choice among non-dairy options due to its lower calorie content. It has become increasingly popular, with a 27% per capita consumption growth from 2020 to 2022, making it a top choice among plant-based milk in Europe. The number of vegans in Europe doubled from 1.3 million to 2.6 million in 2021. Countries like France, Italy, and Spain lead in almond milk consumption, with Spain being a notable leader due to its extensive almond tree cultivation. Almond milk is not only a milk substitute but also a versatile ingredient in various dishes and beverages, including coffee, soups, and baked goods.

Europe Almond Drinks Market Drivers:

Rising Health and Wellness Trends among consumers are tremendously increasing the growth of Europe's Almond Drinks market.

Increasing consumer awareness of health and wellness is a significant driver of the almond milk market. Almond milk is perceived as a healthier alternative to dairy milk due to its lower calorie content, lack of cholesterol, and being naturally lactose-free. Consumers are opting for almond milk because it aligns with their desire for nutritious, plant-based options, and it caters to dietary preferences, such as vegan and lactose-free diets. The trend towards fitness and health-conscious lifestyles has also led to the adoption of almond milk, which is often viewed as a nutritious addition to smoothies and cereals.

Environmental Sustainability is fueling the growth of Europe's Almond Drinks market.

Concerns about the environmental impact of the dairy industry, including greenhouse gas emissions and land use, are driving consumers and businesses to consider more sustainable alternatives like almond milk. Almond milk production typically has a lower carbon footprint compared to dairy farming. As environmental awareness grows, consumers are making choices that support sustainability, and almond milk is seen as a more eco-friendly option. The growing interest in reducing the environmental impact of food choices has led to the popularity of almond milk in Europe, as it is perceived as a greener choice compared to traditional dairy.

Europe Almond Drinks Market Restraints and Challenges:

Competitive Market is a main hindrance in the Europe Almond Drinks Market.

The plant-based milk market, including almond milk, is highly competitive, with numerous alternatives like soy, oat, coconut, and cashew milk. This variety presents a challenge for almond milk brands to stand out and differentiate themselves in terms of taste, nutrition, and sustainability. Effective marketing and branding are crucial to gain and maintain market share.

Environmental Concerns associated with the making of almond milk pose challenges for businesses in Europe's Almond Drinks Market.

While almond milk is considered a more sustainable option compared to dairy milk in terms of greenhouse gas emissions, almond cultivation requires significant water resources. This has raised concerns about water usage in almond farming, particularly in regions with water scarcity. Brands and producers need to address these sustainability concerns and consider more environmentally friendly practices to meet consumer expectations and regulatory requirements.

Europe Almond Drinks Market Opportunities:

The European almond drinks market presents substantial opportunities for growth, driven by a shift towards plant-based and dairy-free alternatives among health-conscious consumers. With a rising number of vegans and individuals with dairy intolerances, almond milk is positioned to capture a significant market share. The increasing awareness of environmental sustainability and concerns about the dairy industry's greenhouse gas emissions make almond milk an attractive choice. Manufacturers can seize these opportunities by introducing innovative almond-based products, including flavored and fortified varieties, and by emphasizing sustainable sourcing and packaging practices to cater to the growing demand for healthier and eco-friendly beverage options.

EUROPE ALMOND DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14.5% |

|

Segments Covered |

By Product Type, Distribution Channel, Flavour, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K. , Germany, France , Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Simple Food Inc, Danone SA, Rude Health Foods Ltd, Calidad Pascual SAU, Ecotone, Alpro, Provamel, Plenish, Almond Breeze, Joya |

Europe Almond Drinks Market Segmentation Analysis:

Europe Almond Drinks Market Segmentation: By Product Type

- Almond Milk

- Almond Milk-Based Yogurts

- Almond Milk-Based Ice Creams

- Almond Milk-Based Creamers

- Others

The largest segment by product type in the European almond drinks market is Almond Milk which has a market share of 76%. Almond milk has gained prominence due to its versatility, serving as a dairy milk alternative in various applications, including drinking, cereal, coffee, and baking. It caters to a broad consumer base, including those with lactose intolerance, vegans, and individuals seeking healthier beverage options. The availability of a wide range of almond milk flavors and variations, from unsweetened to flavored options, makes it a highly adaptable and popular choice, contributing to its dominant position in the market. The fastest-growing segment in the European almond drinks market by product type is Almond Milk-Based Yogurts growing at a rate of 14.1%. This segment has experienced significant growth due to the increasing demand for dairy-free alternatives and the growing popularity of yogurt as a healthy snack and breakfast option. Almond milk-based yogurts offer a creamy, plant-based, and lactose-free alternative to traditional dairy yogurts, appealing to consumers with lactose intolerance, vegans, and those seeking healthier options.

Europe Almond Drinks Market Segmentation: By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Health Food Stores

- Others

The largest segment by distribution channel in the European almond drinks market is Supermarkets and Hypermarkets having a revenue share of 62%. This is due to the extensive reach and accessibility of these retail outlets across Europe. Supermarkets and hypermarkets offer a wide variety of almond drink brands, flavors, and packaging options, making it convenient for consumers to purchase almond drinks during their routine grocery shopping. The trust and familiarity associated with these established retail channels contribute to their dominance in the market, as consumers often prefer to buy such products in-store, where they can compare choices and access a broader range of grocery items in one location. The fastest growing segment by distribution channel in the European almond drinks market is Online Retail anticipated to grow at a CAGR of 22.3% This growth can be attributed to the increased consumer shift towards e-commerce platforms, particularly during the COVID-19 pandemic. The convenience and safety of online shopping, coupled with a broader product selection and often competitive pricing, have driven the rapid expansion of the online retail channel for almond drinks. As a result, more consumers are opting to purchase almond drinks online, contributing to the segment's significant growth.

Europe Almond Drinks Market Segmentation: By Flavor

- Original/Unsweetened

- Vanilla

- Chocolate

- Coffee

- Others

The largest segment by flavor in the European almond drinks market is Original/Unsweetened because the original/unsweetened flavor caters to a broad consumer base, including those seeking a neutral, dairy-like taste as well as those aiming to control their sugar intake. The preference for original/unsweetened almond drinks aligns with health-conscious and versatile consumers who may use it in various culinary applications and beverages, making it the dominant flavor choice in the market. The fastest-growing segment by flavor in the European almond drinks market is Chocolate. This growth is driven by the ever-increasing consumer demand for indulgent and enjoyable beverage experiences. The rich and familiar taste of chocolate appeals to a broad demographic, including those seeking a dairy-free alternative that still provides a satisfying and comforting flavor.

Europe Almond Drinks Market Segmentation: Regional Analysis

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

The largest region in the European almond drinks market is Germany having a market share of 28%. Germany's prominence in the market can be attributed to a combination of factors, including a strong tradition of health-conscious consumer preferences, a robust focus on sustainability, and a growing demand for dairy alternatives. The country's large population and its reputation for environmentally friendly practices have made it a key market for almond drinks, as consumers seek healthier and eco-conscious beverage options. The fastest-growing region in the European almond drinks market is Spain. This growth can be attributed to Spain's strong cultural connection to almond-based products, extensive almond cultivation, and rising awareness of health and sustainability among consumers. The country's historical use of almonds in culinary traditions and the popularity of almond milk in various regional dishes have significantly boosted its consumption. Spain's almond orchards are among the largest in the world, fostering local production and supporting the almond drink industry. The combination of tradition, accessibility, and the pursuit of eco-friendly choices makes Spain a robust and fast-growing market for almond drinks.

COVID-19 Impact Analysis on the Europe Almond Drinks Market:

The COVID-19 pandemic has had a notable impact on the European almond drinks market, with consumers increasingly prioritizing health and wellness. While the initial lockdowns disrupted supply chains and created stockpiling tendencies, the market rebounded as individuals sought healthier, shelf-stable alternatives. Almond drinks, known for their nutritional benefits and dairy-free appeal, experienced heightened demand as more people turned to plant-based options. The pandemic underscored the importance of online shopping and home cooking, providing a platform for almond drink manufacturers to reach consumers. As health-conscious and environmentally aware trends continue, the European almond drinks market is expected to maintain its growth trajectory, driven by consumers' preferences for both health and sustainability.

Latest Trends/ Developments:

A notable trend in the European almond drinks market is the diversification of flavors and product varieties. Manufacturers are continuously innovating by introducing a wide range of flavored almond drinks, such as vanilla, chocolate, and coffee-infused options, catering to varying consumer tastes. This trend reflects the evolving preferences of consumers who seek not only the health benefits of almond drinks but also unique and appealing flavors, expanding the market's appeal and reach.

A significant development in the market is the increasing emphasis on sustainability. Almond drink brands are making efforts to source almonds more sustainably, including supporting responsible farming practices and reducing water consumption in almond orchards, addressing environmental concerns. Moreover, there's a growing focus on using eco-friendly packaging, such as recyclable materials, and reducing plastic usage, aligning with consumer expectations for environmentally responsible products. This development aligns with the broader global movement towards sustainability and underscores the industry's commitment to mitigating its impact on the environment.

Key Players:

- Simple Food Inc

- Danone SA

- Rude Health Foods Ltd

- Calidad Pascual SAU

- Ecotone

- Alpro

- Provamel

- Plenish

- Almond Breeze

- Joya

Chapter 1. Europe Almond Drinks Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Almond Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Almond Drinks Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Almond Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Almond Drinks Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Almond Drinks Market – By Product Type

6.1. Introduction/Key Findings

6.2. Almond Milk

6.3. Almond Milk-Based Yogurts

6.4. Almond Milk-Based Ice Creams

6.5. Almond Milk-Based Creamers

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Europe Almond Drinks Market – By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Health Food Stores

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 8. Europe Almond Drinks Market – By Flavor

8.1. Introduction/Key Findings

8.2 Original/Unsweetened

8.3 Vanilla

8.4. Chocolate

8.5. Coffee

8.6. Others

8.7. Y-O-Y Growth trend Analysis Flavor

8.8. Absolute $ Opportunity Analysis Flavor , 2023-2030

Chapter 9. Europe Almond Drinks Market , By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Type

9.1.3. By Distribution Channel

9.1.4. By Flavor

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Almond Drinks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Simple Food Inc

10.2. Danone SA

10.3. Rude Health Foods Ltd

10.4. Calidad Pascual SAU

10.5. Ecotone

10.6. Alpro

10.7. Provamel

10.8. Plenish

10.9. Almond Breeze

10.10. Joya

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European almond Drinks Market was valued at USD 1.3 Billion in 2023 and is projected to reach a market size of USD 3.35 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.5%.

Rising Health and Wellness Trends among consumers and Environmental Sustainability are drivers of Europe's Almond Drinks market.

Based on product type, the European almond Drinks Market is segmented into Almond Milk, Almond Milk-Based Yogurts, Almond Milk-Based Ice Creams, Almond Milk-Based Creamers, and Others

Germany is the most dominant region for the Europe Almond Drinks Market.

Simple Food Inc, Danone SA, Rude Health Foods Ltd, and Calidad Pascual SAU are a few of the key players operating in the Europe Almond Drinks Market.