Europe Alfalfa Hay Market Size (2023-2030)

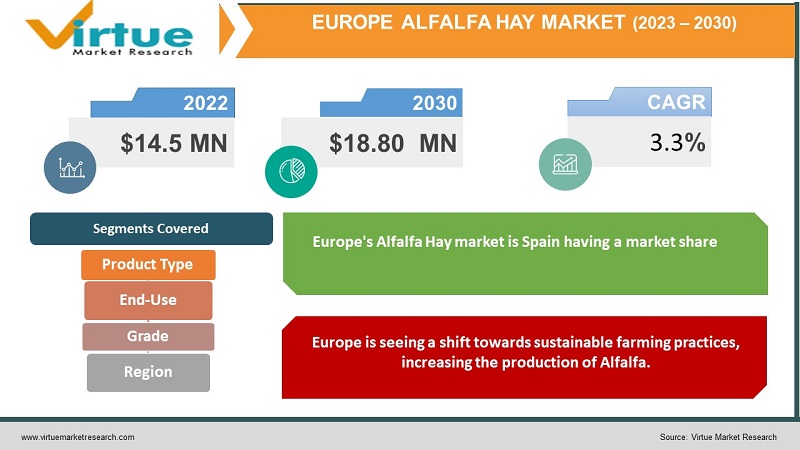

The Europe Alfalfa Hay Market was valued at USD 14.5 Million in 2022 and is projected to reach a market size of USD 18.80 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.3%.

The European alfalfa hay market is characterized by a steady demand for high-quality forage among livestock producers, particularly in the dairy and equine sectors. Alfalfa hay, known for its nutritional value and digestibility, is widely utilized as a key component in animal diets. Spain, France, and Italy are some of the major alfalfa hay producers in the region, with the market also benefiting from imports, primarily from the United States. Sustainability and quality assurance remain essential considerations in this market, with an increasing focus on organic and non-GMO alfalfa production methods to meet evolving consumer preferences. Market dynamics are influenced by factors such as weather conditions, feedstock availability, and global trade fluctuations, which can impact supply and pricing.

Key Market Insights:

In Europe, Spain, France, and Italy are the primary producers of alfalfa, with Spain being the leading exporter of alfalfa hay in Western Europe, followed by France and Italy. This contributes significantly to the European alfalfa hay market. Alfalfa cultivation in Europe is primarily aimed at producing dehydrated forage, particularly hay. Alfalfa is valued for its high agronomic potential and its capacity to yield substantial protein per unit area, making it a crucial component of European agriculture. One significant challenge lies in improving harvesting machinery, for instance, by employing mowing machines with roll conditioners to expedite the drying process and minimize quality losses.

Another emerging practice in certain European regions is on-farm barn drying, especially in areas producing high-quality products. Alfalfa is particularly well-suited for this method, as it dries more efficiently than other forages in ventilated drying cells. The role of alfalfa in European agriculture is expected to remain significant, and its favorable attributes can be further enhanced through technological advancements and varietal improvements aimed at enhancing energy efficiency and reducing costs. Over recent years, alfalfa hay has become increasingly important in poultry and animal feed due to its high crude protein content. This reliance on alfalfa hay for animal feed is likely to drive the global alfalfa hay market in the foreseeable future due to its nutritional advantages.

Europe Alfalfa Hay Market Drivers:

Rising demand for high-quality forage in Europe is going to increase the demand for alfalfa hay in the region.

The market is driven by the increasing awareness among livestock producers about the nutritional benefits of alfalfa hay. It is considered an excellent source of essential nutrients and is known for its high protein content and digestibility, making it a preferred choice for feeding dairy cows and horses. As livestock industries in Europe aim to improve the quality of their products, the demand for high-quality forage like alfalfa hay continues to grow.

Europe is seeing a shift towards sustainable farming practices, increasing the production of Alfalfa.

There is a growing emphasis on sustainability and environmentally friendly farming practices in Europe. Alfalfa is recognized for its ability to fix nitrogen in the soil, which can reduce the need for synthetic fertilizers. Additionally, alfalfa fields provide habitat and food for pollinators and other beneficial insects. As a result, more farmers are incorporating alfalfa into their crop rotations to promote sustainable agriculture, which drives the production and consumption of alfalfa hay in the region.

Europe Alfalfa Hay Market Restraints and Challenges:

Weather-dependent production is a limiting factor that could strongly fluctuate the growth of this market.

Alfalfa hay production is highly dependent on weather conditions. Adequate rainfall and favorable temperatures are essential for a successful harvest. In Europe, where weather patterns can be unpredictable and vary from year to year, extreme events like droughts or heavy rainfall can significantly impact alfalfa yields. Such weather-related challenges can lead to fluctuations in supply and increased prices, making it difficult for both producers and consumers to plan effectively.

Competition with other forage crops could impact the position of Alfalfa hay in the Europe market.

Alfalfa hay faces competition from other forage crops and feed options, such as grass hay, clover, and silage. The choice of forage depends on various factors, including regional preferences, the specific needs of livestock, and cost-effectiveness. In some cases, other forage options may be more affordable or better suited to local conditions, which can make it challenging for alfalfa to maintain a dominant position in the market. Producers and suppliers of alfalfa hay must continually demonstrate its superior nutritional value and benefits to remain competitive.

Europe Alfalfa Hay Market Opportunities:

The European alfalfa hay market presents several promising opportunities. The increasing consumer demand for organic and non-GMO products has created a niche market for premium alfalfa hay, particularly among dairy and equine enthusiasts. As the market trends towards healthier and sustainably sourced livestock products, alfalfa hay produced using environmentally friendly and chemical-free methods can command higher prices. The region's growing awareness of the importance of animal nutrition and well-being provides an opening for alfalfa hay suppliers to promote their products as high-quality, nutrient-rich forage options. Moreover, ongoing research and innovation in forage production techniques, such as precision agriculture and improved seed varieties, offer opportunities to enhance alfalfa yield and quality. With the right marketing strategies and a focus on sustainability and animal health, the Europe alfalfa hay market can further expand and cater to evolving consumer preferences.

EUROPE ALFALFA HAY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.56% |

|

Segments Covered |

By Product Type, End Use, Grade, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K. , Germany, France , Italy, Spain, Rest of Europe |

|

Nafosa, Alfalfa Monegros, Al Dahra Agriculture, Cubeit Hay Company, Grupo Osés, Anderson Hay & Grain Inc., AJD Agro Ltd., Gruppo Carli, Fodder Hut, Aziende Agricole Forte |

Europe Alfalfa Hay Market Segmentation:

Europe Alfalfa Hay Market Segmentation: By Product Type:

- Baled Alfalfa Hay

- Cubed Alfalfa Hay

- Pelleted Alfalfa Hay

The largest segment by product type is Baled Alfalfa Hay which has a market share of 46.5%. This is because baled alfalfa hay is the most common and widely accepted form of alfalfa forage, preferred by many livestock producers due to its ease of handling, storage, and transport. Bales are versatile and can be fed to a wide range of livestock, making them a practical choice for dairy and beef cattle, horses, and other animals. The process of baling allows for the efficient preservation of alfalfa's nutritional value, making it a convenient choice for both producers and end-users, contributing to its dominance in the market.

The fastest-growing segment is Pelleted Alfalfa Hay growing at a CAGR of 16.2%. Pelleted alfalfa hay is experiencing rapid growth due to its convenience and ease of handling. Pellets are compact, uniform in size, and have a longer shelf life compared to baled or cubed alfalfa hay, making them a preferred choice for many livestock and pet owners. Additionally, pellets reduce wastage, provide consistent nutrition, and are less dusty, contributing to improved animal health and ease of feeding. As consumers increasingly seek practical and efficient feeding solutions, the demand for pelleted alfalfa hay is surging, propelling it as the fastest-growing product segment in the market.

Europe Alfalfa Hay Market Segmentation: By End-Use

- Livestock Feed

- Pet Food

The largest segment by end use in the Europe alfalfa hay market is typically the Livestock Feed category, including dairy cattle, beef cattle, horses, and other livestock. This segment holds over 75% market share and this is primarily because alfalfa hay is renowned for its high nutritional value, protein content, and digestibility, making it a preferred forage choice for these animals. Dairy and equine industries heavily rely on alfalfa hay to maintain the health, productivity, and quality of their animals. As a result, the demand for alfalfa hay in the livestock feed sector remains consistently high, making it the largest and most significant end-use segment within the market.

The fastest-growing segment by end use is the Pet Food category growing at a CAGR of 10.4%. This growth can be attributed to the increasing popularity of small pets like rabbits, guinea pigs, and chinchillas as household companions. These pet owners are increasingly aware of the importance of providing their animals with high-quality forage, and alfalfa hay is favored for its nutritional content and digestibility. Additionally, the shift toward organic and non-GMO options in the pet food industry has boosted the demand for premium alfalfa hay, creating a thriving market segment for companion animal owners who prioritize their pet's health and well-being.

Europe Alfalfa Hay Market Segmentation: By Grade:

- Premium Grade

- Mid-Grade

- Low-Grade

The largest segment by grade is typically the Mid-Grade. This is because mid-grade alfalfa hay strikes a balance between quality and affordability, making it a popular choice among livestock farmers and other users. Mid-grade alfalfa hay offers decent nutritional value, meets the essential requirements for livestock feed, and is cost-effective, making it a practical choice for many buyers. While premium-grade alfalfa hay is sought after for its superior quality, it may be more expensive, and low-grade hay, although budget-friendly, often falls short of meeting the nutritional needs of animals, making mid-grade the most widely preferred and largest segment in the market.

The fastest-growing segment is the Premium Grade expanding at a CAGR of 11.1%, due to increasing consumer demand for high-quality, nutrient-rich forage, especially in the dairy and equine sectors. Premium-grade alfalfa hay offers superior protein content, improved digestibility, and reduced impurities, which are essential for optimizing livestock health and productivity. As farmers and livestock producers strive to enhance the quality of their products and meet the demands of discerning consumers, premium-grade alfalfa hay has witnessed robust growth, driven by its ability to deliver superior nutritional value and support sustainable and healthy farming practices.

Europe Alfalfa Hay Market Segmentation: Regional Analysis:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

The largest segment in Europe's Alfalfa Hay market is Spain having a market share of almost 33%. This is because of the favorable climate conditions in Southern European countries, which are conducive to alfalfa hay cultivation. The warm and dry Mediterranean climate in Spain, for example, supports robust alfalfa production, making it the largest regional segment. Spain's geographical proximity to other European countries facilitates easier transportation, contributing to its dominant position in supplying alfalfa hay to various markets across Europe.

Italy is the fastest-growing segment in the Europe alfalfa hay market by region growing at a CAGR of 16.3%, due to several key factors. Italy boasts a strong tradition of dairy farming, with a growing emphasis on high-quality milk and cheese production. Alfalfa hay, known for its nutritional value, is increasingly recognized as an essential component of dairy cattle diets. Additionally, Italy's favorable climate and soil conditions have allowed for increased alfalfa cultivation, resulting in improved yields and consistent supply.

COVID-19 Impact Analysis on the Europe Alfalfa Hay Market:

The COVID-19 pandemic had more of a negative impact on the Europe alfalfa hay market. On one hand, there was increased demand for alfalfa hay as consumers focused on ensuring a stable supply of food, including dairy products. However, disruptions in the supply chain, labor shortages, and logistical challenges hindered the production, distribution, and export of alfalfa hay. While some segments, like premium-grade and organic alfalfa, experienced growth due to their nutritional value and health benefits, the market also faced uncertainties regarding future supply chain resilience, emphasizing the need for improved resilience and adaptability in the face of unforeseen challenges.

Latest Trends/ Developments:

Many companies in this market recognize the value of diversifying their product offerings to meet varied customer demands. They often expand their product lines to include different forages such as clover, grass hay, and mixed forage options. This diversification strategy allows them to cater to a broader customer base, including those with specific livestock and dietary preferences, ultimately enhancing market share and profitability.

Given the growing consumer preference for sustainable and ethically sourced products, companies focus on promoting their commitment to environmentally friendly and organic alfalfa hay production methods. They invest in certifications and traceability systems to assure customers of product quality, nutritional value, and adherence to ethical and environmental standards. These strategies not only cater to a conscientious customer base but also position companies as responsible and trusted suppliers in the market.

Key Players:

- Nafosa

- Alfalfa Monegros

- Al Dahra Agriculture

- Cubeit Hay Company

- Grupo Osés

- Anderson Hay & Grain Inc.

- AJD Agro Ltd.

- Gruppo Carli

- Fodder Hut

- Aziende Agricole Forte

In February 2022, Nafosa Firm introduced an organic alfalfa pellet to its range of animal feed products, offering customers a nutritionally rich option for their animals.

In October 2021, Al Dhara Holdings inaugurated five new animal feed plants in Serbia, Romania, and Bulgaria. These strategic expansions into international markets enabled the company to diversify and broaden its selection of green feed products, contributing to its overall growth and operational reach.

Chapter 1. Europe Alfalfa Hay Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Alfalfa Hay Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Europe Alfalfa Hay Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Alfalfa Hay Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Europe Alfalfa Hay Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Alfalfa Hay Market– By Product Type

6.1. Introduction/Key Findings

6.2. Baled Alfalfa Hay

6.3. Cubed Alfalfa Hay

6.4. Pelleted Alfalfa Hay

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Europe Alfalfa Hay Market– By End-Use

7.1. Introduction/Key Findings

7.2 Livestock Feed

7.3. Pet Food

7.4. Y-O-Y Growth trend Analysis By End-Use

7.5. Absolute $ Opportunity Analysis By End-Use, 2023-2030

Chapter 8. Europe Alfalfa Hay Market– By Grade

8.1. Introduction/Key Findings

8.2. Premium Grade

8.3. Mid-Grade

8.4. Low-Grade

8.5. Y-O-Y Growth trend Analysis Grade

8.6. Absolute $ Opportunity Analysis Grade , 2023-2030

Chapter 9. Europe Alfalfa Hay Market, By Geography – Market Size, Forecast, Trends & Insights

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5.Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Grade

9.2.4. By End-Use

9.2.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Alfalfa Hay Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nafosa

10.2. Alfalfa Monegros

10.3. Al Dahra Agriculture

10.4. Cubeit Hay Company

10.5. Grupo Osés

10.6. Anderson Hay & Grain Inc.

10.7. AJD Agro Ltd.

10.8. Gruppo Carli

10.9. Fodder Hut

10.10. Aziende Agricole Forte

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Alfalfa Hay Market was valued at USD 14.5 Million in 2022 and is projected to reach a market size of USD 18.80 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.3%.

Rising demand for high-quality forage and a shift towards sustainable farming practices are helping to expand Europe's Alfalfa Hay market.

Based on product type, the European alfalfa Hay market is divided into Baled Alfalfa Hay, Cubed Alfalfa Hay, and Pelleted Alfalfa Hay

Spain is the most dominant region for the European Alfalfa Hay Market.

Nafosa, Alfalfa Monegros, Al Dahra Agriculture, and Cubeit Hay Company are a few of the key players operating in the European Alfalfa Hay Market