Europe Agrochemicals Market Size (2024-2030)

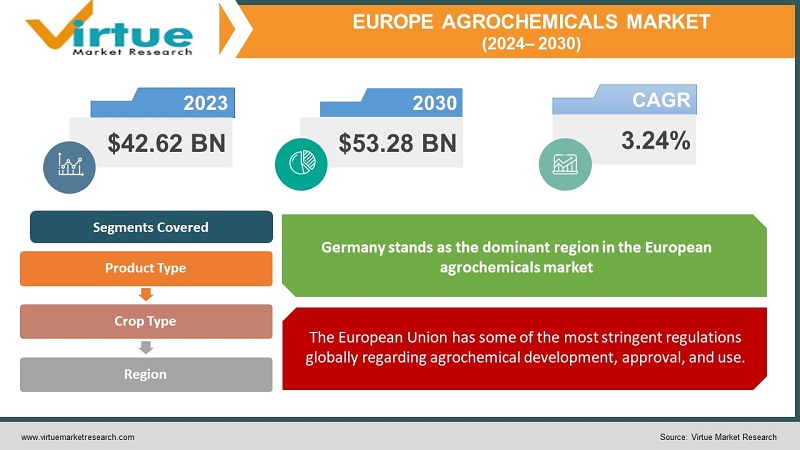

The Europe Agrochemicals Market is valued at USD 42.62 Billion and is projected to reach a market size of USD 53.28 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.24%.

Agrochemicals are a broad category of biological and synthetic products used in agriculture. They are essential for maintaining food security, improving yields, and protecting crops. Some of the world's strongest restrictions against agrochemicals have been implemented by the European Union. The EU Green Deal initiatives and the Farm to Fork Strategy aim to promote sustainable alternatives while lowering the usage of pesticides. Research and development efforts are geared towards finding novel, safer, and more targeted agrochemicals with reduced environmental impact. The integration of digital technologies is enabling the precise application of agrochemicals, optimizing their use, and minimizing off-target effects. The push for reduced reliance on conventional chemical pesticides is fueling the demand for biopesticides, bio-stimulants, and integrated pest management (IPM) strategies. Genetically modified (GM) crops resistant to certain pests or herbicides represent a small but controversial segment in the European market. Research continues in gene editing for crop resilience. Sensor-based systems and variable-rate applicators optimize agrochemical use, promoting efficiency and environmental stewardship. Developing agrochemicals that aid crops in withstanding drought, heat stress, and emerging pest and disease pressures due to climate shifts.

Key Market Insights:

The European agrochemicals market is dominated by the fertilizer category, which holds a 55% market share and was around $16.9 billion in 2022. Herbicides, insecticides, and fungicides make up around 35% of the European agrochemical market share, which was worth $10.8 billion in 2022. Plant growth regulators, with an approximate market value of $3.1 billion, make up the remaining 10% of the market and aid in the optimization of crop development and quality.

Western European countries, such as France, Germany, and Spain, are the largest markets for agrochemicals in the region, collectively accounting for over 60% of the total market share. France and Germany alone account for around $9.2 billion and $6.2 billion of the market share, respectively. The Eastern European market is expected to grow at a CAGR of around 5.5% during the forecast period, reaching an estimated value of $8.6 billion by 2028.

The crop protection segment, encompassing herbicides, insecticides, and fungicides, accounted for approximately 65% of the total pesticide market in Europe in 2023, valued at around $7 billion. The seed treatment market had a valuation of about $2 billion in 2023, and it is anticipated to expand at a compound annual growth rate (CAGR) of about 6% throughout the forecast period, with a target value of $2.9 billion by 2028.

Another major user of agrochemicals is the fruits and vegetables sector, which contributes nearly 25% of the European market share, or $7.7 billion, in 2023. Agricultural cooperatives and retail outlets account for around 60% of the agrochemicals distribution channel in Europe, valued at approximately $18.5 billion in 2023.

In the 2021-2027 budget period, the EU has allocated approximately $4.5 billion specifically for these initiatives, aimed at promoting sustainable agricultural practices and reducing the environmental impact of agrochemicals.

Europe Agrochemicals Market Drivers:

The European Union has some of the most stringent regulations globally regarding agrochemical development, approval, and use.

Policies like the Farm to Fork Strategy, the European Green Deal, and various pesticide reduction targets create a unique market environment. These regulations act as a double-edged sword. They create hurdles for the approval of new conventional agrochemicals, but they also incentivize innovation. The search for safer, naturally derived alternatives gains momentum due to regulatory encouragement and consumer demand. The development of agrochemicals with reduced hazard profiles and minimized environmental impact becomes a priority. Regulations promote holistic approaches combining biological controls, precision application, and cultural practices, often reducing reliance on single-solution chemical pesticides. Growing public awareness of the potential impacts of agrochemicals on the environment and health places further pressure on the industry. This translates into the rising demand for organic products and produce grown with reduced reliance on synthetic pesticides.

European farmers are increasingly adopting precision agriculture technologies that optimize resource use, enhance crop performance, and promote sustainability.

Variable-rate technologies, driven by sensors, GPS mapping, and data analysis allow for highly precise application of agrochemicals. Integration of agrochemical recommendations with precision platforms empowers farmers and agronomists to make informed decisions. This involves tailoring product choices, dosages, and timing based on real-time field conditions. Precision application technologies offer the potential to significantly reduce agrochemical use while maintaining or even improving yields. This reduction aligns with sustainability goals. Stricter regulations fuel the need for precision agriculture tools allowing farmers to optimize agrochemical use and demonstrate compliance with sustainability targets. Collaboration between agrochemical companies, technology providers, and researchers becomes essential to develop integrated solutions – tailored chemistries suited to precision systems.

Europe Agrochemicals Market Restraints and Challenges:

Bringing a new agrochemical to market in Europe can take a decade or more, hindering innovation and the availability of new tools for farmers. Existing active ingredients can be reevaluated and potentially banned (e.g., some neonicotinoids), creating uncertainty for the industry and farmers. The high regulatory hurdles and costs can discourage investments in research and development, particularly for smaller companies and niche solutions. This drives a growing demand for organic and sustainably produced food, pressuring farmers to explore alternative crop protection methods or reduce overall agrochemical use. Building consumer trust necessitates clear and transparent communication about the safety, responsible use, and necessity of both conventional and biological agrochemicals. The repeated use of certain agrochemicals with similar modes of action can lead to the evolution of resistant weeds, pests, and diseases. This diminishes the effectiveness of existing tools. Combating resistance requires integrated management approaches, including crop rotation, the use of diverse agrochemical groups, and the adoption of non-chemical methods. Concerns persist about the potential negative impacts of pesticides on biodiversity, particularly pollinators, beneficial insects, and soil health.

Europe Agrochemicals Market Opportunities:

The rising demand for sustainable agriculture and consumer preferences for 'greener' food products are driving the expansion of biological-based crop protection and enhancement solutions. Biopesticides derived from bacteria, fungi, plant extracts, and beneficial insects offer alternatives or complements to conventional synthetic products. Products containing seaweed extracts, humic substances, microbes, and other natural compounds promote plant health, improve stress tolerance, and enhance nutrient uptake. The biopesticides and biostimulants markets in Europe, while smaller, are experiencing rapid growth. Companies specializing in developing, manufacturing, and effectively integrating these solutions hold immense potential. Europe is a center for research in novel biopesticides and biostimulants, with ongoing exploration of new microbial strains, extraction processes, and understanding of plant-microbe interactions.

EUROPE AGROCHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023- 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product Type, CROP TYPE, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Bayer CropScience, Syngenta, Corteva Agriscience , ADAMA, FMC Corporation, Nufarm, Certis Europe trobe-R-US |

Europe Agrochemicals Market Segmentation-

Europe Agrochemicals Market Segmentation: By Product Type-

- Herbicides

- Insecticides

- Fungicides

- Others (Nematicides, Rodenticides, Plant Growth Regulators (PGRs), Seed Treatments)

Herbicides (Estimated Market Share: 40-50%) hold the largest market share within the European agrochemical market, reflecting their widespread use across vast areas of cultivated land. Weeds compete fiercely with crops for sunlight, water, and nutrients. Herbicides offer a crucial tool for farmers to reduce yield losses and improve productivity, particularly in large-scale cereal and grain production. Herbicides encompass pre-emergent (preventing weed growth) and post-emergent (targeting existing weeds) options. They can be selective (control specific weeds) or broad-spectrum (target a wide range). Herbicide resistance in weeds is a growing concern, driving innovation in new modes of action and the integration of herbicides into diverse weed management strategies.

The biopesticide segment (Estimated Market Share: < 10%), while currently smaller, is exhibiting the most rapid growth within Europe. This is driven by the demand for sustainable solutions, advancements in research, and the growing consumer preference for organically produced food. Many microbial biopesticides offer targeted control of specific pests, minimizing impact on beneficial insects and the wider environment. Biostimulants encompass substances like seaweed extracts, humic acids, beneficial microbes, and amino acids. They enhance plant health, stress tolerance, nutrient uptake, and overall crop performance. The fastest-growing category can shift over time due to technological breakthroughs, regulatory changes, and evolving pest pressures. Biopesticides are often most effective when integrated into broader Integrated Pest Management (IPM) strategies.

Europe Agrochemicals Market Segmentation: By Crop Type-

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds

- Others (Viticulture, Ornamentals and Turfgrass, Emerging Crops)

Cereals and grains (Estimated Market Share: 35-45%) represent the largest market segment for agrochemicals in Europe, driven by the sheer scale of land under cultivation. Cereals like wheat, barley, maize, and oats occupy a vast proportion of arable land in Europe. Agrochemicals play a significant role in ensuring consistent yields. Agrochemical input intensity can vary across Europe for cereals, depending on crop type, regional disease pressure, and farming practices. Herbicides are crucial for weed control, particularly pre-emergent herbicides to secure a strong start for crops. Fungicides are essential to combat diseases like rust and powdery mildew, especially in humid climates. Insecticides are utilized strategically to manage aphid infestations, stem borers, and other yield-reducing pests.

High-value fruits and vegetables (Estimated Market Share: 25-35%) are likely the fastest-growing segment. Fruits and vegetables, with their high value per hectare, often receive diverse agrochemical inputs for pest control, disease prevention, enhancing quality, and extending shelf life. The demand for reduced pesticide residues fuels innovation in biopesticides and precision application solutions in this segment. Increasing consumer demand for diverse and sustainably produced fruits and vegetables. Expansion of greenhouse and protected cultivation, where controlled environments often necessitate intensive crop protection.

Europe Agrochemicals Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Germany stands as the dominant region in the European agrochemicals market, capturing a substantial market share of 22%. This powerhouse nation boasts a robust agricultural sector and a well-established agrochemical industry. Germany's focus on precision agriculture and advanced farming techniques has fueled the demand for innovative agrochemical solutions. The country's commitment to environmental sustainability has also led to the development and adoption of bio-based and low-risk agrochemicals. This region's strong agricultural sector, favorable climatic conditions, and advanced farming practices have contributed to its leading position in the market. Additionally, Germany has been at the forefront of adopting sustainable and eco-friendly agrochemical solutions, further solidifying its dominance.

Eastern Europe, particularly countries like Poland, Romania, and Ukraine, is currently the fastest-growing region in the European agrochemicals market. With an impressive growth rate of approximately 8-10% annually, this region has witnessed a surge in demand for agrochemicals driven by factors such as increasing agricultural productivity, adoption of precision farming techniques, and a growing focus on sustainable agricultural practices. The region's favorable regulatory environment and investment in research and development have further fueled the growth of the agrochemicals market.

COVID-19 Impact Analysis on the Europe Agrochemicals Market:

Lockdowns and travel restrictions disrupted the smooth flow of raw materials and finished products. Restrictions on movement in key manufacturing hubs in Asia, a significant source of active ingredients for agrochemicals, caused temporary shortages and price fluctuations. Travel restrictions and social distancing measures hampered the availability of agricultural labor across Europe. This included shortages in both seasonal migrant workers and local farmhands, impacting activities like planting, crop maintenance, and harvesting. The reduced workforce placed additional strain on farmers' ability to apply agrochemicals effectively according to recommended schedules. Uncertainty surrounding market conditions and potential disruptions in the food supply chain initially led some farmers to prioritize staple crops with longer shelf lives over high-value, more pest-susceptible crops. This shift in focus potentially led to a temporary dip in demand for certain types of agrochemicals, particularly those used for fruits, vegetables, and ornamentals. The economic slowdown triggered by the pandemic impacted farm incomes. Some farmers might have opted to cut back on non-essential expenses, potentially leading to a decrease in overall agrochemical purchases, especially for preventive measures.

Latest Trends/ Developments:

European agriculture is becoming exceptionally data-driven and precise. Farmers are using sensors, drones, GPS-enabled machinery, and specialized software to optimize agrochemical applications. Farmers now have tools that analyze soil conditions, crop health, and weather patterns to make highly targeted applications of fertilizers and crop protection products. This minimizes overuse and environmental impacts. Increased consumer demand for food grown with fewer synthetic chemicals, paired with stricter regulations, is fueling a booming market for biological alternatives. Innovations in biopesticide product development, improved effectiveness, and the expansion of distribution channels are all contributing to widespread adoption. Farmers increasingly use digital platforms that integrate weather forecasts, field-level data, and predictive analytics. Major agrochemical companies are investing in digital platforms, partnering with tech startups, and developing solutions that offer customized advice for crop management throughout the growing season. The European Union has stringent regulations and ambitious environmental targets, including reducing synthetic pesticide use. Companies must innovate to develop new products with improved safety profiles, reduced residues, and lower environmental impact. CRISPR-Cas9 and similar gene-editing tools could revolutionize crop protection by creating varieties resistant to pests, diseases, and environmental stresses. NBTs promise reduced reliance on traditional agrochemicals and a shift towards more sustainable crop protection strategies built into the plants themselves.

Key Players:

- Bayer CropScience

- Syngenta

- Corteva Agriscience

- ADAMA

- FMC Corporation

- Nufarm

- Certis Europe trobe-R-US

Chapter 1. Europe Agrochemicals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Agrochemicals Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Agrochemicals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Agrochemicals Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Agrochemicals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Agrochemicals Market– By Crop Type

6.1. Introduction/Key Findings

6.2. Cereals and Grains

6.3. Fruits and Vegetables

6.4. Oilseeds

6.5. Others (Viticulture, Ornamentals and Turfgrass, Emerging Crops)

6.6. Y-O-Y Growth trend Analysis By Crop Type

6.7. Absolute $ Opportunity Analysis By Crop Type , 2024-2030

Chapter 7. Europe Agrochemicals Market– By Product Type

7.1. Introduction/Key Findings

7.2 Herbicides

7.3. Insecticides

7.4. Fungicides

7.5. Others (Nematicides, Rodenticides, Plant Growth Regulators (PGRs), Seed Treatments)

7.6. Y-O-Y Growth trend Analysis By Product Type

7.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Europe Agrochemicals Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Product Type

8.1.3. By Crop Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Agrochemicals Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Bayer CropScience

9.2. Syngenta

9.3. Corteva Agriscience

9.4. ADAMA

9.5. FMC Corporation

9.6. Nufarm

9.7. Certis Europe trobe-R-US

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European Union prioritizes food security and reducing reliance on imports. This drives demand for agrochemicals that help farmers boost productivity, safeguard yields, and ensure a stable food supply.

Agrochemicals can negatively impact biodiversity, especially pollinators and other beneficial species essential for healthy ecosystems

Bayer CropScience, Syngenta, Corteva Agriscience, ADAMA

FMC Corporation, Nufarm, Certis Europe trobe-R-US.

Germany currently holds the largest market share, estimated at around 22%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns.