GLOBAL ETHYLENEAMINES MARKET SIZE (2023-2030)

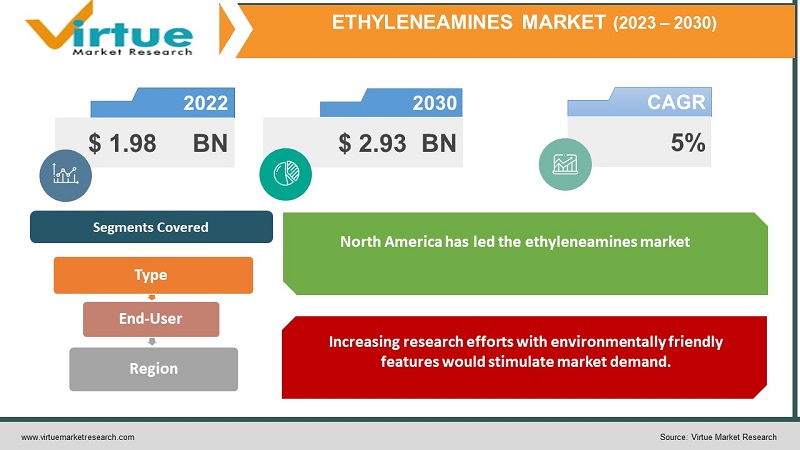

In 2022, the Global Ethyleneamines Market was valued at USD 1.98 Billion and is projected to reach a market size of USD 2.93 Billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5%.

Market Overview

Ethyleneamines are amine compounds with ethylene bonds between the amine groups. These substances are white liquids having a fishy amine odour. The reactions of ethylene dichloride and ammonia, and the reductive amination of monoethanolamine, are the two major methods for producing ethyleneamines.

On a large scale, ethyleneamines are typically produced in one of two ways. The first method includes generating ethyleneamines by reacting ammonia with 1,2-dichloroethane in an aqueous medium at a certain pressure and temperature, resulting in triethylenetetramine and Diethylenetriamine as by-products.

The major driving factor in the ethyleneamines market are predicted to be leading manufacturers and their tactics to handle present demand-supply concerns, as well as newer application advancements across various sectors. The industry is likely to place a greater focus on the usage of various ethyleneimine applications, which are projected to considerably boost demand over the next five years.

Because of their unusual combination of reactivity, basicity, and surface action, ethyleneamines are used in a wide range of applications. Among the many applications for ethylene amines are cosmetics, medicines, paper, paints, cement, and cleaners. Ethyleneamines are strong bases with chelating properties.

Global Ethyleneamines Market Driver:

-

Wide variety of end-use application drive the growth of the market

The product is in high demand in a variety of end-use applications, including chelating agents, lubricant oil additives, epoxy curing agents, polyamide resins, and others, which is projected to fuel market expansion. Furthermore, increased demand for ethyleneamines as raw materials in the agrochemical and paper sectors is estimated to boost the target market's expansion throughout the forecast period.

Because of their outstanding foaming properties, ethylene amines are commonly used in surfactants, which is predicted to greatly boost product demand by 2028. Consumer awareness of cleanliness and hygiene has increased demand for laundry and detergent products, driving the ethylene amines market size in surfactant applications.

-

Increasing research efforts with environmentally friendly features would stimulate market demand.

The market for end-use products has risen overall as a consequence of a rising population in the end-use industry and the advent of cutting-edge technologies. The development of new industry participants aided the market's expansion.

Initiatives to become competitive may assist new market competitors overcome a supply-demand mismatch by finding profitable applications. Significant technical breakthroughs have been achieved in response to ongoing industry demand, thus increasing this market.

Global Ethyleneamines Market Restraint

1.Risk involved with ethyleneamines hinder the market growth

However, dangers connected with the chemical compound's toxicity may limit market expansion. Furthermore, ethyleneamines are very reactive to many other compounds, and the reaction is generally exothermic, therefore the molecule must be handled with caution.

As a consequence of asthmatic conditions on the manufacturing line, it is projected that many health difficulties would impede the growth of the ethylene amines market. Furthermore, the basic ingredients necessary to make ethylene amines are cost prohibitive. A significant hurdle to commercialization of ethylene amines may also exist.

Covid 19 Impact on Ethyleneamines Market:

Because of its dependency on the textile, automotive, and chemical sectors, the ethyleneamines market suffered as a result of the COVID-19 outbreak.

The pandemic had a severe influence on the worldwide automobile manufacturing business, resulting in a 16% decline in output owing to lockdowns and plant closures, according to the International Organization of Motor Vehicle Manufacturers.

The risk of illness spreading among workers in regions where ethyleneamines are used to make lubricants has resulted in the halting or major decrease of operations at a number of automobile firms.

It produced a brief decline in demand for ethyleneamines during the COVID-19 timeframe.

On the other hand due to Covid-19 pandemic, there has been an increase in demand for pharmaceutical chemicals, particularly ethylenediamine and piperazine, which are utilised as raw ingredients in the synthesis of various widely available medications. Furthermore, continuous research & development to optimise the usage of ethyleneamines for many industrial applications is projected to drive market expansion.

Global Ethyleneamines Market Recent Development

-

In August 2021, BASF and SINOPEC have announced plans to further expand their Verbund site in Nanjing, China. Plans include expanding the production capacities of propionic acid, propionic aldehyde, ethyleneamines, ethanolamines, purified ethylene oxide and building a new tert-butyl acrylate plant.

-

In September 2021, Dow Chemical Company has increased the prices of some of its ethyleneamine products by as much as 68% in North America.

-

In May 2022, INEOS has awarded a contract to Técnicas Reunidas for work on the construction of Europe's largest ethylene plant in Antwerp, Belgium. The plant will be able to produce 1.5 million tons of steel annually and is estimated to start operating in 2026.

KEY PLAYERS COVERED: The key players in the ethyleneamines market include

-

Akzo Nobel N.V.,

-

Aminat, BASF SE,

-

Delamine B.V.,

-

Diamines and Chemicals Limited,

-

DowDuPont Inc.,

-

Huntsman International LLC,

-

Tosoh Corporation,

-

BASF S.E.

-

The Dow Chemical Company

-

LANXESS , Parsol Chemicals Pvt. Ltd., and others.

GLOBAL ETHYLENEAMINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akzo Nobel N.V., Aminat, BASF SE, Delamine B.V., Diamines and Chemicals Limited, DowDuPont Inc., Huntsman International LLC, Tosoh Corporation, BASF S.E. The Dow Chemical Company, LANXESS , Parsol Chemicals Pvt. Ltd., and others. |

Global Ethyleneamines Market Segmentation-By Type

-

Ethylenediamene (EDA)

-

Heavy Ethyleneamines

-

Diethylenetriamine (DETA)

-

Triethylenetetramine (TETA)

-

Tetraethylenepentamine (TEPA)

-

Aminoethylpiperazine (AEP-HP)

-

Others

-

Ethylenediamine (EDA) is one of the most important ethyleneamine derivatives, accounting for the majority of the ethyleneamines market. The reaction of ethanolamine with ammonia in the presence of a nickel catalyst produces ethylenediamine. It can be further refined by removing water with sodium hydroxide.

Ethylenediamine is a common component in pharmaceuticals. It is utilised in the production of the bronchodilator medication aminophylline, which is used to treat asthma and other chronic lung illnesses.

Among the above-mentioned compounds, ethylenediamine (EDA) and diethylenetriamine (DETA) are two of the most commonly utilised products, primarily as reactive intermediates in the manufacture of other valuable chemicals.

Furthermore, ethylenediamine is utilised as an intermediary in the synthesis of tetra acetyl ethylenediamine (TAED), which is a bleaching activator in detergents and additives for washing clothing and dishes. The pharmaceutical sector significantly relies on ethylenediamine as a component.

Global Ethyleneamines Market Segmentation-By End User

-

Agro Chemical

-

Automotive

-

Oil and Gas

-

Pharmaceutical

-

Personal Care

-

Paints and Resins

-

Other End User Industries

Rising demand from key application sectors such as resin, paper, automotive, and adhesive is predicted to boost demand over the next five years, owing mostly to increased expansion in emerging nations such as China, India, Brazil, and the South-East Asian area.

The resin business is the most major application industry for ethyleneamines. In terms of volume, it accounted for more than 32% of total demand.

Ethyleneamines are primarily utilised as an intermediary in the production of end-use goods such as chelating agents, surfactants, epoxy resin curing agents, lubricant oil additives, fuel additives, corrosion inhibitors, insecticides, and other chemicals. The adhesives and automotive application industries are the key prospective market categories with the highest growth over the next five years.

The Global Ethyleneamines Market is estimated to increase as a result of the increasing usage of ethyleneamines in automotive applications to reduce particle emissions. Ethyleneamines are widely utilised as an ash-free emissions additive in vehicle fuel and lubricant. It is used in lubricants to prevent the formation of sludge and deliquesce deposits in IC engines.

Global Ethyleneamines Market Segmentation-By Region

-

North America

-

South America

-

Europe

-

Asia Pacific

-

Middle East & Africa

North America has led the ethyleneamines market, which is predicted to develop at a significant CAGR in the next years due to rising demand in the water treatment and pharmaceutical industries.

Because of its large automotive base and expanding technical improvements, the European area retained a considerable market share.

The Middle East and Africa have a moderate market share and are likely to increase at a strong CAGR in the future years as oil field chemicals usage rises. Despite having a modest market share, the Latin American area is estimated to develop at a stable CAGR due to the expanding water treatment and pharmaceutical industries.

The Asia-Pacific area consumes the most ethyleneamines. In terms of volume, China had the highest proportion in regional consumption. Large population needs, a growth in end-users, and improved infrastructure are essential characteristics for this region's expanding consumption.

According to current market dynamics, the key drivers include high demand for ethyleneamines from end-user industries in growing economies such as China, India, and South-East Asian nations.

The Rest of the world market is relatively small in terms of volume, but emerging economies in this area, such as Brazil and the Middle East, are projected to drive the industry during the next five years.

Chapter 1. GLOBAL ETHYLENEAMINES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ETHYLENEAMINES MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL ETHYLENEAMINES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL ETHYLENEAMINES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL ETHYLENEAMINES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ETHYLENEAMINES MARKET – By Companies

6.1. Akzo Nobel N.V.

6.2. Aminat BASF SE

6.3. Delamine B.V.

6.4. Diamines and Chemicals Limited

6.5. DowDuPont Inc.

6.6. Huntsman International LLC

6.7. Tosoh Corporation

6.8. BASF S.E.

6.9. The Dow Chemical Company

6.10. LANXESS

6.11. Parsol Chemicals Pvt Ltd and Others

Chapter 7. GLOBAL ETHYLENEAMINES MARKET – By Type

7.1. Ethylenediamene (EDA)

7.2. Heavy Ethyleneamines

7.3. Diethlenetriamine (DETA)

7.4. Triethylenetetramine (TETA)

7.5. Tetraethylenepentamine (TEPA)

7.6. Aminoethylpiperazine (AEP-HP)

7.7. Others

Chapter 8. GLOBAL ETHYLENEAMINES MARKET – By End User

8.1. Agro Chemical

8.2. Automotive

8.3. Oil and Gas

8.4. Pharmaceutical

8.5. Personal Care

8.6. Paints and Resins

8.7. Other End User Industries

Chapter 9. GLOBAL ETHYLENEAMINES MARKET – By Region

9.1. North America

9.2. Europe

9.3. Asia - Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Asia Pacific is estimated to develop at the fastest rate between 2023 and 2030.

In 2022, the Global Ethyleneamines Market was valued at USD 1.98 Billion and is projected to reach a market size of USD 2.93 Billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5%.

Rising disposable incomes, a growing agrochemicals business, expansion of the packaging industry, and a boom in the pharmaceutical industry are all projected to boost market growth.

The prominent players in the Ethyleneamines Market are Huntsman Corporation, Dow, BASF SE, Nouryon, and Tosoh Corporation.

Based on their use, ethyleneamines are classed as agrochemicals, automotives, adhesives, paints and resins, pharmaceuticals, personal care, oil and other sectors.