Ethylene Glycol-based Antifreeze Market Size (2023 – 2030)

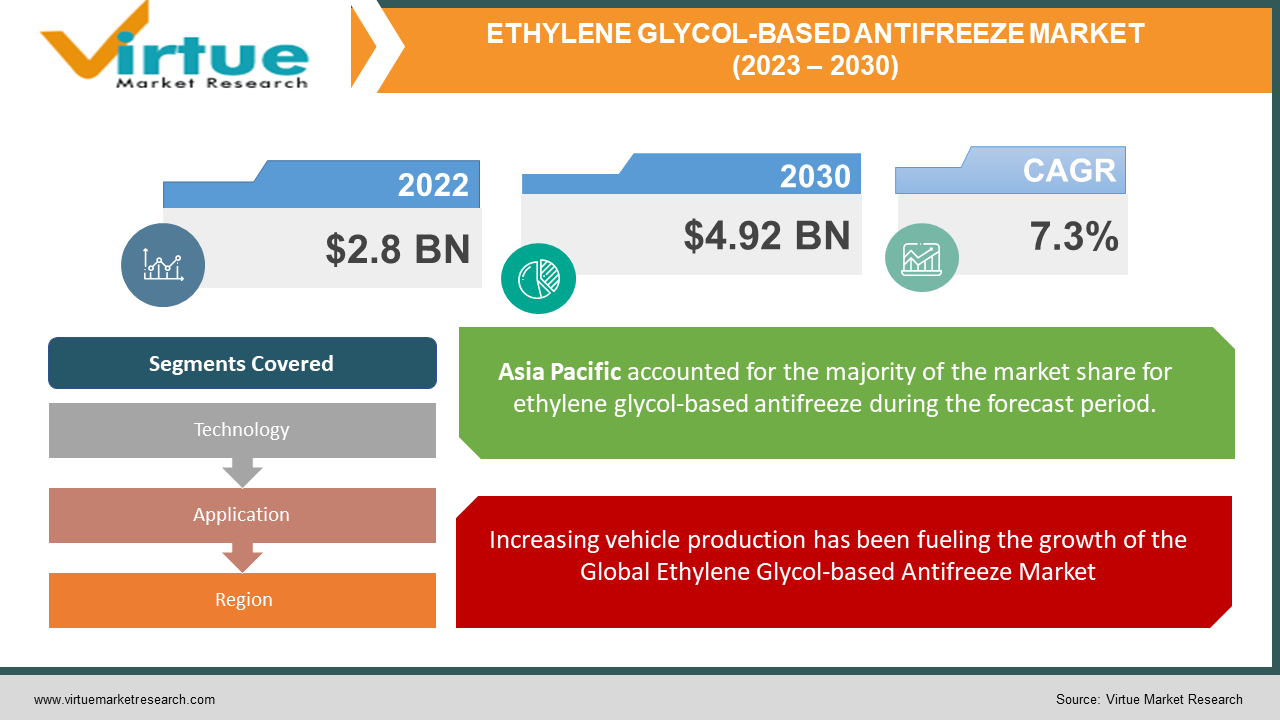

In 2022, the Global Ethylene Glycol-based Antifreeze Market was valued at $2.8 Billion and is projected to reach a market size of $4.92 Billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.3%.

Ethylene Glycol-based Antifreeze serves as an essential coolant for engines, playing a crucial role in regulating temperatures within vehicles. Particularly during hotter weather, antifreeze prevents engine and radiator water from boiling over, effectively managing temperature levels. Its functionality extends to cope with temperatures as high as 275 degrees Fahrenheit, showcasing its robust capabilities. The escalating demand for safeguarding against corrosion and freezing, alongside efficient heat dissipation, is anticipated to be a key driver for increased demand. The growth trajectory of the automotive antifreeze industry is being significantly propelled by several factors, including the rise in vehicle production, a preference for regular automobile maintenance practices, and the surge in vehicle sales. These elements collectively contribute to the expanding market landscape. To maintain a competitive edge, manufacturers within the automotive antifreeze sector are placing a notable emphasis on product innovation and development. This strategic focus enables them to stay at the forefront of advancements, meeting evolving consumer needs while driving market growth.

Key Market Insights:

The surging automotive sales within the region are generating a substantial need for antifreeze products. As per information from the India Brand Equity Foundation, the automotive industry in India contributes a notable 6.4% to the nation's Gross Domestic Product (GDP). This very source indicates that the Indian passenger car market attained a valuation of approximately US$ 32.70 billion in 2021, with projections indicating an ascent to around US$ 54.84 billion by the year 2027.

Additionally, there is a notable upsurge in the adoption of solar energy within the region. Antifreeze finds application in solar water heating systems, serving as a heat transfer fluid. Collectively, these factors exert a positive impact on the antifreeze market within the region.

In 2022, China's solar manufacturing association projected an addition of 75 to 90 gigawatts of solar power to the country's capacity. The International Energy Agency has indicated that over the upcoming five-year period, 36% of the global expansion in solar energy will be driven by China.

Asia Pacific is anticipated for substantial expansion throughout the projected timeframe, primarily driven by the escalating need for passenger cars and light commercial vehicles across nations like China, Japan, India, and Indonesia. The demand in the coming future will be propelled by the easy accessibility of raw materials such as ethylene glycol, particularly in India, China, and the United States.

The aerospace and defense sector is anticipated to undergo substantial revenue expansion at a CAGR of 6.2% from 2023 to 2030. This growth trajectory is attributed to considerable investments directed towards aerospace research and development, coupled with the presence of various industry participants within countries such as the UK, France, Germany, Poland, and Sweden.

Global Ethylene Glycol-based Antifreeze Market Drivers:

Increasing vehicle production has been fueling the growth of the Global Ethylene Glycol-based Antifreeze Market:

Antifreeze plays a vital role within the automotive sector, serving as a key component in the internal combustion of liquid-cooled engines. Its function extends to the regulation of freezing and boiling points. Notably, the automotive industry has experienced remarkable expansion over the past decade, witnessing substantial growth. The surge in the automotive industry's development across diverse economies including Germany, the UK, France, China, India, and Italy has emerged as the principal driving force behind the global growth of the antifreeze market. There is a heavy need for ethylene glycol-based antifreeze products in the automotive sector which will propel the global market.

The toxic nature of Ethylene Glycol-based Antifreeze and its bio-based alternative is also estimated to contribute to propel the Ethylene Glycol-based Antifreeze Market.

Extended contact with automotive antifreeze can lead to human poisoning and toxic repercussions in small animals. To counteract these adverse effects that pose environmental risks, governments in numerous nations are implementing regulatory measures. These actions aim to prevent the contamination of water sources. Consequently, manufacturers operating within the automotive antifreeze market are integrating bio-based alternatives into diverse lubricant compositions. This strategic move aligns with the benchmarks established by different governmental authorities. Bio-based Ethylene Glycol antifreeze holds ecological advantages, being both environmentally friendly and capable of biodegradation. In light of these benefits, consumers are increasingly favoring bio-based options.

An increase in the use of high-quality and technologically advanced additives is augmenting the rise of the Ethylene Glycol-based Antifreeze Market.

The coolant formulations encompass two key components: a foundational fluid and an additive package primarily comprised of corrosion-inhibiting additives. The foundational fluid serves as a control factor for heat transfer attributes, as well as offering protection against freezing and boiling. Furthermore, the significance of coolant additives becomes pronounced in the context of diesel engines' durability and operational well-being. Diesel engines are susceptible to a phenomenon known as cavitation, or liner pitting, which can lead to detrimental effects. Both corrosion and cavitation have the potential to curtail engine lifespan, underscoring the importance of diligent monitoring and maintenance of coolant additive levels. The escalating adoption of coolant additives, pivotal for safeguarding engine components against corrosion and cavitation, while simultaneously preserving engine health, is poised to act as a catalyst for propelling growth within the automotive sector of the ethylene glycol-based antifreeze market during the forecasted period.

Global Ethylene Glycol-based Antifreeze Market Restraints and Challenges:

Regulatory frameworks by various governments across the world aiming to minimize environmental impact are becoming increasingly stringent, pressuring manufacturers to develop formulations that are more eco-friendly and compliant with evolving standards. The gradual shift towards electric vehicles and alternative propulsion systems can reduce the demand for traditional internal combustion engine antifreeze products, impacting market growth. Economic fluctuations and global supply chain disruptions can also influence the availability and pricing of raw materials, affecting the production and distribution of ethylene glycol-based antifreeze products. The rising awareness of potential health hazards associated with antifreeze exposure necessitates proper handling, storage, and disposal procedures, adding to the complexities of market dynamics. These factors have the potential to hinder the growth of the Global Ethylene Glycol-based Antifreeze Market.

Global Ethylene Glycol-based Antifreeze Market Opportunities:

The growth of the ethylene glycol-based antifreeze market is propelled by increased requisites for antifreeze and engine coolant items, both in the original equipment manufacturing sector and the aftermarket of the automotive industry. Moreover, as the forecast period unfolds, a promising avenue for market growth lies in the realm of battery thermal management, particularly via liquid cooling systems within electric and hybrid vehicles. This domain is anticipated to provide lucrative prospects, aiding the expansion of the ethylene glycol-based antifreeze market.

ETHYLENE GLYCOL-BASED ANTIFREEZE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Chevron Corporation, Castrol, Exxon Mobile Corporation, Petronas, Sinopec Corporation Prestone Products Corporation, Valvoline LLC, Arteco, Amsoil Inc. |

Global Ethylene Glycol-based Antifreeze Market Segmentation: By Technology

-

Inorganic Acid Technology (IAT)

-

Organic Acid Technology (OAT)

-

Hybrid Organic Acid Technology (HOAT)

In 2022, the OAT (Organic Acid Technology) segment emerged as the dominant force, achieving the highest market share and generating revenue exceeding USD 3.5 billion. Distinguished by its composition devoid of phosphate and silicates, OAT incorporates sebacate, 2-ethylhexanoic, and other organic acids. The absence of nitrites contributes to an extended service cycle. Moreover, OAT formulations encompass neutral inorganic salts and acids, which degrade without causing environmental harm.

The utilization of IATS (Inorganic Acid Technology) has seen a decline in North America and Europe due to stringent environmental regulations. In contrast, OATS usage has surged in recent years. This trend is attributable to OATS' capacity to align with eco-friendly principles and its longer replacement cycle. The escalating global demand for OAT is set to amplify, driven by its environmentally conscious attributes and extended lifespan.

HOAT (Hybrid Organic Acid Technology) is the fastest-growing segment and is estimated to hold a significant share during the forecast period. In this, inorganic nitrates are mixed with organic carboxylic acids. Nitrites play an important role in mitigating cavitation and corrosion in heavy-duty vehicles. Although nitrites are prone to rapid depletion, especially in primary IAT coolant components, it's noteworthy that the chief protection primarily stems from organic carboxylates. This characteristic delineates the advantageous position of HOAT (Hybrid Organic Acid Technology) in escaping the majority of drawbacks associated with IAT. This strategic advantage is instrumental in propelling the revenue growth of this segment.

Global Ethylene Glycol-based Antifreeze Market Segmentation: By Application

-

Aerospace

-

Automotive

-

Industrial Heat Transfer

-

Others

The automotive application category asserted its dominance within the market, commanding a substantial revenue share exceeding 80% in 2022. This supremacy finds its roots in the escalating incorporation of antifreeze in the Heating, Ventilation, and Cooling (HVAC) systems across both the automotive and industrial sectors, thereby projecting a trajectory of industry expansion. Moreover, a confluence of factors, including propitious governmental initiatives, augmented disposable income, evolving lifestyles, and rapid urbanization, is poised to serve as catalysts propelling the market's growth over the ensuing eight years.

Aerospace is the fastest-growing segment, with a projected CAGR of 6.2% from 2023 to 2030. This upward trajectory can be ascribed to huge investments being channeled into aerospace Research and Development augmented by the presence of abundant industry participants within countries such as the UK, France, Germany, Poland, and Sweden, among others. Furthermore, the growing commercial aerospace subsector, driven by an accelerated equipment replacement cycle and increasing passenger travel demand, is anticipated to be a major driver in fostering industry expansion.

Global Ethylene Glycol-based Antifreeze Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, the Asia Pacific region assumed market dominance, commanding a revenue share of 26%. This ascendancy can be attributed to the escalating appetite for passenger cars and light commercial vehicles, notably concentrated in China and India. The surge in the automotive sector across diverse nations such as India, China, Indonesia, and Thailand, coupled with an uplifted standard of living, increasing consumer awareness, and rising disposable income levels, collectively account for growth across the projected timeframe. Moreover, the growing trajectory of electric vehicle sales, coupled with intensified investments directed toward Research and Development for hybrid vehicles, is anticipated to open fresh avenues for expansion.

North America is the largest growing region and is poised to manifest consistent growth throughout the projected timeframe, propelled by the escalating pace of automotive manufacturing across nations like the U.S., Canada, and Mexico. Additionally, the increasing production of both light and heavy-duty commercial vehicles is projected to serve as a driving force behind the expansion of the ethylene glycol-based antifreeze market.

The European market is also set to experience steady growth throughout the forecasted period, due to the escalating activities within the automotive manufacturing and aerospace sectors. The surge in demand for both light and heavy commercial vehicles, particularly for freight transportation purposes, across the European landscape, is poised to act as a prime driver, catalyzing the demand for heavy-duty ethylene glycol-based antifreeze.

COVID-19 Impact on Global Ethylene Glycol-based Antifreeze Market:

The pandemic caused significant economic and industrial disruptions worldwide, triggered by measures like lockdowns, travel restrictions, and business closures. These actions led numerous sectors to curtail their activities due to interruptions in supply chains caused by the shutdown of national and international borders at the outset of the pandemic. The automotive industry, a major consumer of antifreeze, experienced a substantial reduction in consumer interest. China held a dominant position in both the production and consumption aspects of the automotive industry, which also bore the brunt of these impacts. The construction and infrastructure domains faced global setbacks as a consequence of the pandemic. Nevertheless, as COVID-19 guidelines are gradually eased and lifted, there is a notable resurgence in demand for antifreeze across diverse sectors, particularly within the automotive field. As industries, including the automotive sector, restart their operations, the need for ethylene glycol-based antifreeze is on the rise once again.

Latest trends/ Developments:

Industry participants are primarily directing their efforts towards investing in research and development activities, aiming to broaden their range of products and secure a competitive advantage on a global scale. Additionally, the convenient accessibility of raw materials essential for antifreeze production raises the potential for new players to enter the market. The main strategic endeavors within the worldwide antifreeze market encompass the creation of novel products, the formation of strategic partnerships, and the augmentation of the product lineup.

The trajectory of market growth within the automotive antifreeze industry is propelled by factors such as the rise in vehicle manufacturing, a preference for maintaining automobiles, increased vehicle sales, and various other influences. To uphold their competitive edge, automotive antifreeze manufacturers are placing significant emphasis on advancing product innovation and development. The growing need for safeguarding against corrosion, freezing, and efficient heat dissipation is anticipated to drive demand. Furthermore, consistent investments in research and development aimed at creating environmentally friendly, cost-efficient, low-toxic products with extended shelf life, undertaken by several manufacturers such as BP, Shell, and Chevron, are poised to generate substantial market opportunities throughout the projected timeframe.

Key Players:

-

BASF SE

-

Chevron Corporation

-

Castrol

-

Exxon Mobile Corporation

-

Petronas

-

Sinopec Corporation

-

Prestone Products Corporation

-

Valvoline LLC

-

Arteco

-

Amsoil Inc.

In August 2022, Valvoline Inc., a renowned global lubricant manufacturer, launched Valvoline Advanced Coolant, a full-antifreeze coolant designed for both passenger cars and commercial vehicles. The product is formulated with glycol and features OAT (Organic Acid Technology) that reportedly ensures a service life/drain interval of 5 years or up to 500,000 kilometers.

In August 2021, Valvoline Inc. and Haertol unveiled novel coolant technologies tailored to modern engines, presenting Valvoline Antifreeze Coolant HT-12 Green and Valvoline Antifreeze Coolant HT-12 Pink.

Chapter 1. Ethylene Glycol-based Antifreeze Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Ethylene Glycol-based Antifreeze Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Ethylene Glycol-based Antifreeze Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Ethylene Glycol-based Antifreeze Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Ethylene Glycol-based Antifreeze Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Ethylene Glycol-based Antifreeze Market – By Technology

6.1. Introduction/Key Findings

6.2 Inorganic Acid Technology (IAT)

6.3 Organic Acid Technology (OAT)

6.4 Hybrid Organic Acid Technology (HOAT)

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2023-2030

Chapter 7. Ethylene Glycol-based Antifreeze Market – By Application

7.1. Introduction/Key Findings

7.2 Aerospace

7.3 Automotive

7.4 Industrial Heat Transfer

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Ethylene Glycol-based Antifreeze Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2 By Technology

8.1.3 By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Technology

8.2.3 By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2 By Technology

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.3.4. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2 By Technology

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.4.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.2. By Technology

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Ethylene Glycol-based Antifreeze Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Chevron Corporation

9.3 Castrol

9.4 Exxon Mobile Corporation

9.5 Petronas

9.6 Sinopec Corporation

9.7 Prestone Products Corporation

9.8 Valvoline LLC

9.9 Arteco

9.10 Amsoil Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ethylene Glycol-based Antifreeze Market was valued at USD 2.8 billion and is projected to reach a market size of USD 5.03 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.6%.

The increasing vehicle production market and the use of high-quality technologically advanced additives are driving the Global Ethylene Glycol-based Antifreeze Market.

Based on technology, the Global Ethylene Glycol-based Antifreeze Market is segmented into Inorganic Acid Technology (IAT), Organic Acid Technology (OAT), and Hybrid Organic Acid Technology (HOAT).

China is the most dominant country in the region of Asia-Pacific in the Global Ethylene Glycol-based Antifreeze Market.

BASF SE, Chevron Corporation, Castrol, Exxon Mobile Corporation, Petronas, Sinopec Corporation, Prestone Products Corporation, Valvoline LLC, Arteco, Amsoil Inc.