Ethnic Foods Market Size (2025 – 2030)

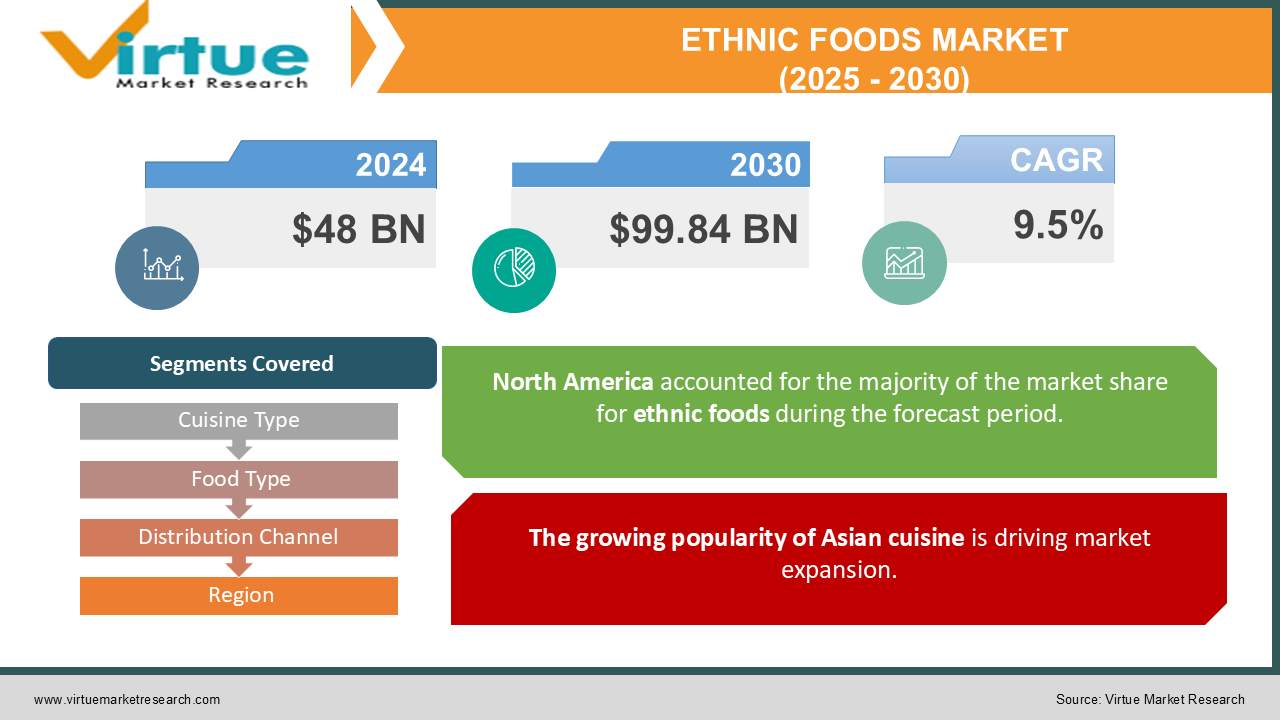

The Ethnic Foods Market was valued at USD 48 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 99.84 billion by 2030, growing at a CAGR of 9.5%.

Ethnic cuisines are characterized as dishes that stem from the traditions and cultural practices of specific ethnic groups, utilizing their understanding of local plant and animal ingredients. Recent years have seen a consistent increase in innovation within the packaged and frozen food industry. Furthermore, companies are emphasizing the expansion of their product offerings across various regions by introducing local food items into global markets.

Key Market Insights:

-

According to Yelp’s 2024 Top 100 Places to Eat in the United States, approximately 25% of the independent restaurants featured serve Asian or Asian fusion cuisine.

-

Market reports indicate that global demand for Asian ingredients surged by around 20% in 2024 compared to the previous year. Among popular non-vegetarian dishes abroad, Indian Chicken Biryani stands out.

Ethnic Foods Market Drivers:

The growing popularity of Asian cuisine is driving market expansion.

The growth of the immigrant population, coupled with an increasing consumer demand for bold flavors, is a significant trend in the ethnic foods market. Increasing immigration is driving the demand for ethnic foods, as globalization has connected the world more closely. The rise in global employment opportunities has resulted in higher immigration rates worldwide. The ethnic food market is thriving due to the significant demand from these immigrants seeking familiar local specialties.

Chilled Ramen is gaining traction as an emerging Asian food, known for its ability to retain quality over time and its customizable options for noodle bases, broths, and vegetables. Additionally, Chinese, Japanese, and Thai restaurants are prevalent in every state across the U.S., with sushi emerging as one of the nation's most favored dishes.

Ethnic Foods Market Restraints and Challenges:

The demand for completely natural products is anticipated to hinder market growth.

Consumer awareness regarding the consumption of natural food products has been on the rise. Ethnic food products are primarily transported internationally, often necessitating the use of edible chemical preservatives to ensure longevity. However, as knowledge about natural

ingredients grows, producers may encounter challenges related to the incorporation of chemicals for preservation. Furthermore, the predominant reliance on sea transport can prolong the journey of these products, making the use of natural ingredients less practical for maintaining shelf life.

To address these challenges, local manufacturers may need to collaborate with international partners established in various regions. Given the large number of local and small-scale producers, transitioning from chemical to natural ingredients could prove difficult, presenting a significant barrier to the growth of the global market.

Ethnic Foods Market Opportunities:

The globalization of regional products and the rise of online sales are poised to create significant opportunities for market growth.

The majority of ethnic food production is in the Asia-Pacific region. As a result, this region significantly leads global ethnic cuisine production. With rising global demand for Asian food products—including Japanese, Thai, Chinese, Indian, and Vietnamese cuisines—these countries are becoming major exporters of ethnic foods.

As the demand for traditional ethnic foods continues to grow, these nations are also being introduced to various new types of cuisines, gaining recognition in international markets. Furthermore, the rapid expansion of online sales channels has opened the market, allowing consumers to purchase their favorite local foods from anywhere in the world.

Social media platforms have enabled consumers to share their unique culinary experiences, further enhancing their appetite for ethnic foods. Additionally, Western influences have transformed the food landscape in developing regions, prompting individuals to explore new and innovative cuisines. This trend is driving the ongoing growth of the industry.

ETHNIC FOODS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.5% |

|

Segments Covered |

By Cuisine Type, Food Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Associated British Foods PLC , ARYZTA AG, General Mills, Inc., McCormick & Company Inc. , Ajinomoto Co. Inc., The Spice Tailor ,Orkla ASA, TRS Group Paulig Group, Asli Fine Foods |

Ethnic Foods Market Segmentation: By Cuisine Type

-

Asian

-

Italian

-

Mexican

-

Others

The Asian segment leads the market in 2024 due to its widespread acceptance and popularity across nearly all regions. The significant migration of working groups from Asia has resulted in a large diaspora, driving increased demand for regional ethnic cuisine in various countries. Additionally, there is a growing appetite for Italian dishes such as pasta, pizza, and lasagna, facilitated by their availability in ready-to-cook formats, even in smaller markets around the world. The Mexican segment is also expected to demonstrate strong market growth, driven by rising consumption in Asian and North American countries. In nations like the U.S., Canada, Mexico, the UAE, and India, the consumption of Mexican products has been on the rise in recent years. This trend presents promising growth opportunities for the expansion of the global market.

Ethnic Foods Market Segmentation: By Food Type

-

Veg

-

Non-Veg

In 2024, the non-vegetarian segment currently dominates the global market and is expected to retain its leadership throughout the forecast period. Non-vegetarian foods are integral to the daily diets of households in Europe, North America, South America, China, and the Middle East, where meals typically contain a higher proportion of non-vegetarian options compared to vegetarian ones. Consequently, global consumption of non-vegetarian foods significantly exceeds that of vegetarian options, resulting in a substantial market share for non-vegetarian ethnic foods.

Nonetheless, as awareness of the benefits of vegan and vegetarian diets increases, a growing number of consumers are shifting towards vegetarianism. This trend is expected to enhance the growth of the vegetarian segment, positioning it is the fastest-growing category during the forecast period.

Ethnic Foods Market Segmentation: By Distribution Channel

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Grocery Stores

-

Online Sales Channels

The hypermarkets & supermarkets segment dominates the global market, due to the wide variety of products offered. Additionally, migration for study and work has prompted these mass merchandisers to offer a variety of international cuisines.

Sales of ethnic foods through online channels are projected to increase in the upcoming year. E-commerce platforms provide consumers with the opportunity to access a broad selection of ethnic products that may not be easily found in traditional brick-and-mortar stores. This shift is primarily fueled by the increasing convenience and accessibility of online shopping, as well as a diverse, tech-savvy consumer base eager to discover unique culinary experiences from the comfort of their homes.

Ethnic Foods Market Segmentation- By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is anticipated to experience steady growth driven by increasing demand for Asian cuisines, particularly Thai, fueled by the relocation of Asian consumers to the region. The rising popularity of Asian food products and other ethnic cuisines has further spurred the demand for importing various regional ethnic foods. The growing consumer interest in frozen foods and regional products from smaller countries such as Thailand, Vietnam, and the Philippines has also attracted attention to this market segment. Ongoing advancements in preservation and freezing technologies are expected to significantly enhance the U.S. ethnic cuisine food market.

Evolving demographic trends, including increased diversity due to immigration, have contributed to a faster growth in consumer demand for ethnic foods over recent decades. Cuisines from Asia, Mexico, and Africa boast rich histories rooted in the indigenous cultures of their respective countries, evolving through foreign colonization. Mexican ethnic food products, characterized by a diverse blend of indigenous, African, European, and Asian influences, are particularly known for their bold flavors. Popular items such as tacos, enchiladas, burritos, tamales, mole, and pozole are gaining traction in international markets, further boosting the growth of Mexican ethnic foodsThe ethnic food market share in Europe is projected to experience slower growth compared to other regions. The presence of established local ethnic cuisines, including Italian, Spanish, French, and Greek, restricts the rapid growth of other ethnic categories in Europe. Nevertheless, demand is projected to grow steadily. Italian and Spanish cuisines have maintained high popularity for an extended period, resulting in only gradual increases in the consumption of Mexican cuisine.

COVID-19 Pandemic: Impact Analysis

Manufacturers are adopting new and innovative business models to address the challenges posed by the COVID-19 pandemic. As one of the world's largest producers of ethnic foods, China encountered significant hurdles in both production and export during this period. The pandemic led to widespread factory shutdowns globally, resulting in production levels plummeting.

To overcome these issues, manufacturers are implementing creative marketing strategies aimed at expanding their global reach and exploring profitable opportunities in the marketing and sales of local ethnic cuisines during the forecast period. Additionally, an increase in travel frequency is expected to contribute to market growth by attracting more travelers to local ethnic food establishments.

Latest Trends/ Developments:

In June 2024, DDC Enterprise, Ltd., acquired Omsom, an Asian food brand. This acquisition aims to expedite Omsom's product innovation by reducing research and development timelines by 50%. Additionally, the operational synergies expected from the merger are anticipated to enhance efficiency and improve the financial performance of both companies.

In February 2023, Omsom expanded its retail presence by launching in over 550 Target stores across the U.S., effectively doubling its market footprint.

In July 2022, Premier Foods acquired The Spice Tailor for USD 57.10 million. This acquisition enhances Premier Foods' geographic presence in the UK, India, Australia, Canada, and Ireland, while also significantly strengthening its ethnic foods portfolio in the Australian market.

Key Players:

These are top 10 players in the Ethnic Foods Market :-

-

Associated British Foods PLC

-

ARYZTA AG

-

General Mills, Inc.

-

McCormick & Company Inc.

-

Ajinomoto Co. Inc.

-

The Spice Tailor

-

Orkla ASA

-

TRS Group Paulig Group

-

Asli Fine Foods

Chapter 1. Ethnic Foods Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ethnic Foods Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ethnic Foods Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ethnic Foods Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ethnic Foods Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ethnic Foods Market – By Cuisine Type

6.1 Introduction/Key Findings

6.2 Asian

6.3 Italian

6.4 Mexican

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Cuisine Type

6.7 Absolute $ Opportunity Analysis By Cuisine Type, 2025-2030

Chapter 7. Ethnic Foods Market – By Food Type

7.1 Introduction/Key Findings

7.2 Veg

7.3 Non-Veg

7.4 Y-O-Y Growth trend Analysis By Food Type

7.5 Absolute $ Opportunity Analysis By Food Type, 2025-2030

Chapter 8. Ethnic Foods Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarkets/Supermarkets

8.3 Convenience Stores

8.4 Grocery Stores

8.5 Online Sales Channels

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 9. Ethnic Foods Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Cuisine Type

9.1.3 By Food Type

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Cuisine Type

9.2.3 By Food Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Cuisine Type

9.3.3 By Food Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Cuisine Type

9.4.3 By Food Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Cuisine Type

9.5.3 By Food Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ethnic Foods Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Associated British Foods

10.2 PLC ARYZTA AG

10.3 General Mills, Inc.

10.4 McCormick & Company Inc.

10.5 Ajinomoto Co. Inc.

10.6 The Spice Tailor

10.7 Orkla ASA

10.8 TRS Group

10.9 Paulig Group

10.10 Asli Fine Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Increasing immigration is driving the demand for ethnic foods, as globalization has connected the world more closely. The rise in global employment opportunities has resulted in higher immigration rates worldwide.

The top players operating in the Ethnic Foods Market are - Associated British Foods PLC ARYZTA AG, General Mills, Inc., McCormick & Company Inc., Ajinomoto Co. Inc. and The Spice Tailor.

Manufacturers are adopting new and innovative business models to address the challenges posed by the COVID-19 pandemic. As one of the world's largest producers of ethnic foods, China encountered significant hurdles in both production and export during this period.

The rapid expansion of online sales channels has opened the market, allowing consumers to purchase their favorite local foods from anywhere in the world.

North America is anticipated to experience growth driven by increasing demand for Asian cuisines, particularly Thai, fueled by the relocation of Asian consumers to the region.