Ethiopia Agriculture Market Size (2025-2030)

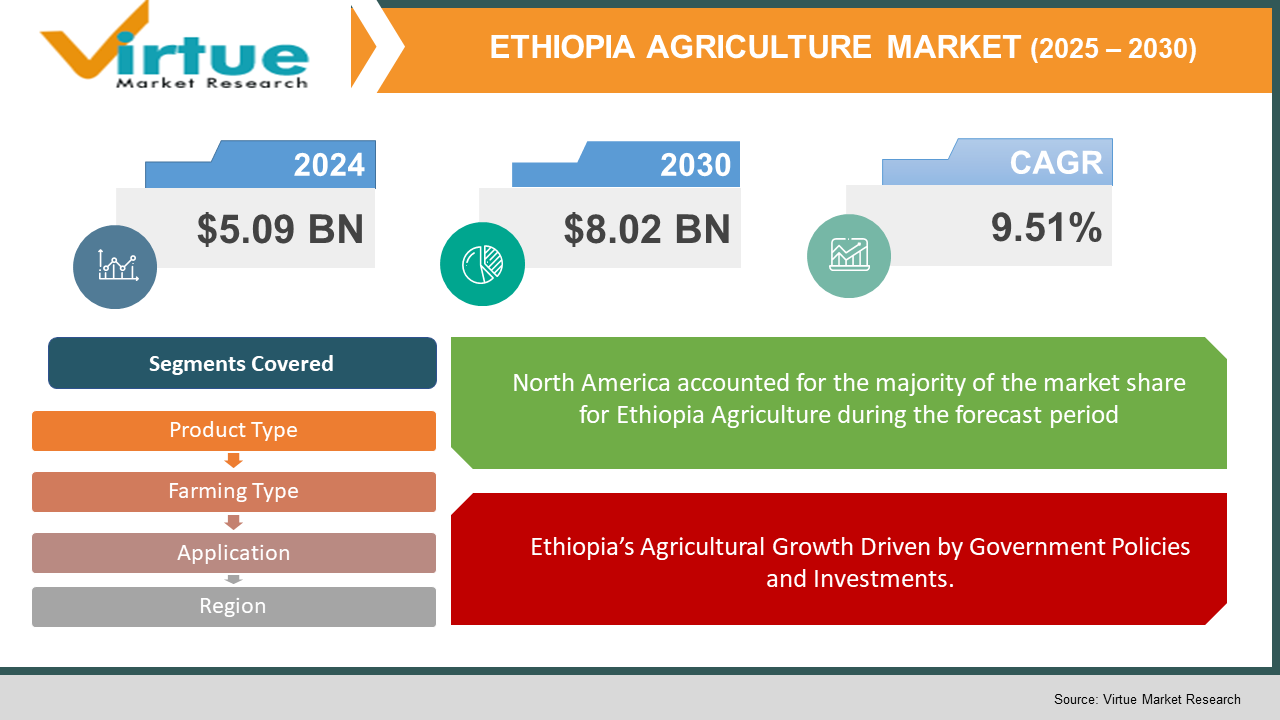

The Ethiopia Agriculture Market was valued at USD 5.09 billion in 2024 and is projected to reach a market size of USD 8.02 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.51%.

Ethiopia is still a net importer of food products despite this enormous potential. Ethiopia imports a million metric tons of wheat every year. The government of Ethiopia started a program to replace wheat imports with local production by implementing irrigated farming techniques for wheat cultivation twice a year. This will offer a huge opportunity for American irrigation equipment firms to supply their technology to the Ethiopian agricultural industry. There are three agro-industrial processing parks already available and more planned for future years. American firms capable of supplying equipment and technology for food processing plants have huge opportunities in the Ethiopian market.

Key Market Insights:

- Ethiopian agriculture is the backbone of the economy of the country, contributing about 36% of the Gross Domestic Product (GDP) in 2020 and employing about 80% of its population.

- Ethiopia is globally renowned as the homeland of Arabica coffee and is among Africa's top producers. The nation is the largest foreign exchange earner, with approximately 15 million Ethiopians relying on coffee growth and processing.

- The major cereal crops include wheat, barley, teff, millet, sorghum, and maize. In 2018, Ethiopia produced 7.3 million tons of maize, ranking it as the second-largest maize producer in Africa. The country is a large producer of legumes like chickpeas and lentils and oilseeds like sesame and linseed, which are very important for both local consumption and export.

- It has resulted in widespread land degradation due to overgrazing, deforestation, and soil erosion. In particular, more than half of the land in Ethiopia is degraded to some extent, with about 11 million hectares under threat of desertification.

- In December 2024, the Climate Investment Funds (CIF) approved a $500 million financial plan that will help restore degraded landscapes, conserve forests, and enhance food security in Ethiopia. The program will restore over 320,000 hectares of land across different regions and establish an online registry for forests, ultimately benefiting pastoralists and smallholder farmers.

Ethiopia Agriculture Market Drivers:

Ethiopia’s Agricultural Growth Driven by Government Policies and Investments.

The government of Ethiopia has a strong role in propelling agricultural development through policies and investments to enhance productivity and exports. It has designed programs such as the Agricultural Transformation Agenda and Growth and Transformation Plan (GTP) to mechanize farming methods, enhance irrigation, and commercialize agriculture. Foreign investors' large-scale leasing of land has stimulated commercial farming in crops such as coffee, sesame, and horticulture crops. Subsidies offered by the government on fertilizers, seeds, and agricultural equipment have boosted the production of smallholder farmers. Infrastructure development, including rural road expansion and irrigation improvement, has also enhanced market access and minimised post-harvest losses. Also emphasizing policies promoting agro-processing industries further fortifies the agriculture sector by processing raw goods into higher-value products. Additional investment in mechanization and research will be critical to maintaining this growth and ensuring food security.

Ethiopia’s agriculture sector benefits significantly from increasing global demand for organic and speciality agricultural products, particularly coffee, oilseeds, and flowers.

Ethiopia's agricultural sector derives considerable benefits from rising world demand for organic and speciality crops, such as coffee, oilseeds, and flowers. Trade policies such as the African Continental Free Trade Area (AfCFTA) and preferential access to the European Union and U.S. markets under the AGOA (African Growth and Opportunity Act) have spurred exports. The reputation of the country for high-quality Arabica coffee and organic oilseeds has drawn foreign customers, which increases foreign exchange receipts. Ethiopia is also growing its presence in the Middle Eastern and Asian markets, especially for pulses and livestock. Increased investment in logistics, including the Djibouti-Ethiopia transport corridor, has made supply chains more efficient. If Ethiopia diversifies its export base further and invests in quality control, it can further consolidate its position in world agricultural trade.

Ethiopia Agriculture Market Restraints and Challenges:

One of the biggest challenges facing Ethiopia’s agriculture market is climate change and environmental degradation, which threaten crop yields and livestock production.

Perhaps the most daunting problem confronting Ethiopia's agricultural market is climate change and environmental degradation, which affect crop production and livestock production. Repeated droughts, unpredictable rainfall, and increased temperatures have resulted in low soil fertility and water shortages, impacting millions of smallholder farmers. Desertification and deforestation have also contributed to shrinking arable land, making agriculture challenging. The growing intensity of natural disasters, including floods and locust plagues, has also been interfering with food production. Lack of access to climate-resilient seeds, inefficient irrigation, and traditional farming methods make it more difficult for farmers to transition. Although the government has rolled out climate-smart agriculture schemes and reforestation initiatives, additional investment in drought-tolerant crops, efficient irrigation systems, and reforestation is necessary to secure long-term food security.

Ethiopia Agriculture Market Opportunities:

Ethiopia's agricultural market offers substantial growth possibilities fueled by rising world demand, supportive policies, and technological innovation. The nation's extensive cultivable land and favourable agro-climatic environment offer a solid base for the growth of commercial agriculture, specifically in high-value crops such as coffee, oilseeds, pulses, and horticultural crops. Increasing public-private partnerships and foreign investment are promoting mechanization, and expansion of irrigation, and agro-processing sectors, leading to value addition and a decrease in post-harvest losses. The sustainable and organic agriculture movement is another prominent opportunity since traditional farming in Ethiopia has similarities with the world's demand for organic products. Further, digital agriculture solutions like mobile-based market platforms, precision farming solutions, and financial inclusion initiatives are enhancing productivity and market access. Upgrading export infrastructure such as logistics and storage units can further enhance the role of Ethiopia in international agricultural trade. With further investment in climate-resilient practices and agri-tech innovations, Ethiopia can potentially turn its agricultural sector into a leading source of economic growth and food security.

ETHIOPIA AGRICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.51% |

|

Segments Covered |

By Product Type, farming type, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

ETHIOPIA |

|

Key Companies Profiled |

Oromia Coffee Farmers Cooperative Union, Netafim, MIDROC Ethiopia, One Acre Fund, Ethiopian Agricultural Transformation Agency, and Ethiochicken |

Ethiopia Agriculture Market Segmentation:

Ethiopia Agriculture Market Segmentation: By Product Type

- Crops

- Cash Crops

- Livestock & Dairy

- Forestry & Fisheries

Ethiopia's agricultural market is diversified, with major product categories supporting economic growth and exportation. Grains such as teff, maize, and wheat lead staple food consumption, underpinning food security but suffering from challenges of climate variability. Pulses and oilseeds form the backbone of both domestic diets and exports, with sesame and chickpeas playing leading roles. Cash crops, especially coffee, earn considerable foreign exchange, with Ethiopia ranking as the biggest producer of Arabica coffee in Africa. The horticulture industry, covering fruits, vegetables, and flowers, has experienced fast growth, with cut flowers becoming a major export. Livestock production is also a vital component since Ethiopia boasts one of the biggest cattle populations in the continent, serving dairy, meat, and leather industries. Yet, productivity is low because of traditional farming practices and limited exposure to advanced technology. Forestry and fisheries also provide economic potential, although underdeveloped infrastructure prevents full market realization. Overall, Ethiopia's agriculture sector is full of promise, with rising investment and policy reforms fueling modernization and export growth.

Ethiopia Agriculture Market Segmentation: By Farming Type

- Subsistence Farming

- Commercial Farming

- Organic Farming

- Agroforestry

Ethiopia's farming is largely subsistence agriculture, in which small-scale farmers grow food for home consumption, with frequent constraints such as low productivity and climatic vulnerabilities. Commercial agriculture is growing, particularly in cash crops such as coffee, sesame, and floriculture, drawing foreign investment. Organic farming is increasingly popular, boosted by international demand for pesticide-free and environmentally friendly products, particularly in coffee and oilseeds. Agroforestry, where trees and crops are combined, is now being encouraged as a sustainable approach to address soil loss and climate change. While these developments are taking place, traditional farming remains predominant for most farmers with limited mechanization and capital. More government assistance, improving infrastructure, and technology adoption are necessary for productivity enhancement and food security.

Ethiopia Agriculture Market Segmentation: By Application

- Food

- Beverage

- Textile & Leather

- Animal Feed

The Ethiopian agricultural market caters to several industries, with the production of food making up the largest sector, producing staple cereals, pulses, and oilseeds for consumption within the country and exports. The soft drink industry highly depends on tea and coffee, with Ethiopia also being a primary global supplier of Arabica coffee. The cotton farming and enormous livestock resources in Ethiopia support the textile and leather industries, adding to an increasing leather export market. Animal feed manufacturing is growing as livestock production expands, but feed shortages tend to affect productivity. Agriculture also serves biofuel and pharmaceutical uses, using oilseeds and medicinal crops. Value chain and agro-processing industries can be strengthened to maximize the sector's contribution to economic growth.

Ethiopia Agriculture Market Segmentation: Regional Analysis:

Ethiopia's agricultural production varies significantly by region due to climate and topography. The Oromia region is the leading agricultural hub, producing coffee, cereals, and livestock, benefiting from fertile land and favourable climate conditions. Amhara follows closely, known for wheat, barley, and oilseed production, but often affected by droughts. Tigray, despite challenges from land degradation and conflict, contributes to sesame and horticulture production. Southern Nations, Nationalities, and Peoples' Region (SNNPR) are renowned for coffee, inset (false banana), and fruit cultivation, with high rainfall supporting diverse crop production. Afar and Somali regions, with arid conditions, primarily rely on pastoralism, though irrigation projects are expanding date palm and vegetable farming. Strengthening irrigation, climate adaptation, and regional infrastructure will be critical to sustaining Ethiopia’s agricultural growth across all regions.

COVID-19 Impact Analysis on the Ethiopia Agriculture Market:

The pandemic of COVID-19 had a mixed effect on the agricultural sector in Ethiopia, hindering supply chains as well as raising the stakes on food security. Movement control and closure of borders created shortages in labour, impacting planting and harvesting periods, particularly on commercial farms. Export industries such as coffee, oilseeds, and floriculture experienced logistic setbacks, including delays at the ports and lower world demand that initially impacted revenues. Domestic food markets also experienced price volatility, with transportation restrictions leading to supply shortages in cities while unsold surplus production in rural areas. Smallholder farmers, who depend on local markets, were affected by decreased market access and increased input prices for fertilizers and seeds. The crisis also spurred digital transformation, with increased use of mobile platforms by farmers and traders for market access and financial transactions. Government action, such as subsidies and food distribution programs, stabilized food supplies. As the economy recovers, it will be important to build resilient supply chains and local processing industries to help prevent future disruptions.

Latest Trends/ Developments:

Ethiopia's agricultural sector is witnessing significant progress fueled by sustainable agriculture and heavy investments. One of the key developments is the greenlighting of a $500 million project by the Climate Investment Funds (CIF) in December 2024 to restore degraded lands, conserve forests, and improve food security. This initiative aims to restore more than 320,000 hectares of land in areas such as Amhara, Oromia, South Ethiopia, and Somalia, tackling the burning need for land degradation in over half of the country. At the same time, there is a developing tendency towards agroecology with a focus on biodiversity and customary farming practices rather than industrial farming. Farmers in Ethiopia are increasingly shifting towards these sustainable approaches, resulting in enhanced productivity and adaptation to climate stresses.

These innovations reflect Ethiopia's dedication to sustainable agricultural development, reconciling the protection of the environment with economic progress.

Key Players:

- OCFCU

- Netafim

- MIDROC Ethiopia

- One Acre Fund

- Ethiopia ATA

- EthioChicken

- ECX

- Guts Agro Industry

Chapter 1. Ethiopia Agriculture Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Farming source

1.5. Secondary Farming source

Chapter 2. Ethiopia Agriculture Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Ethiopia Agriculture Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Farming Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Ethiopia Agriculture Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Ethiopia Agriculture Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Ethiopia Agriculture Market – By Product Type

6.1 Introduction/Key Findings

6.2 Crops

6.3 Cash Crops

6.4 Livestock & Dairy

6.5 Forestry & Fisheries

6.6 Y-O-Y Growth trend Analysis By Deployment:

6.7 Absolute $ Opportunity Analysis By Deployment:, 2025-2030

Chapter 7. Ethiopia Agriculture Market – By Farming Type

7.1 Introduction/Key Findings

7.2 Subsistence Farming

7.3 Commercial Farming

7.4 Organic Farming

7.5 Agroforestry

7.6 Y-O-Y Growth trend Analysis By Farming Type

7.7 Absolute $ Opportunity Analysis By Farming Type , 2025-2030

Chapter 8. Ethiopia Agriculture Market – By Application

8.1 Introduction/Key Findings

8.2 Food

8.3 Beverage

8.4 Textile & Leather

8.5 Animal Feed

8.6 Y-O-Y Growth trend Analysis Application

8.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Ethiopia Agriculture Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. Ethiopia

9.5.2. By APPLICATION

9.5.3. By Farming Type

9.5.4. By Product Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ethiopia Agriculture Market – Company Profiles – (Overview, Product Product Type Type Portfolio, Financials, Strategies & Developments)

10.1 OCFCU

10.2 Netafim

10.3 MIDROC Ethiopia

10.4 One Acre Fund

10.5 Ethiopia ATA

10.6 EthioChicken

10.7 ECX

10.8 Guts Agro Industry

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Ethiopia Agriculture Market was valued at USD 5.09 billion in 2024 and is projected to reach a market size of USD 8.02 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.51%.

. Ethiopia’s agriculture sector benefits significantly from increasing global demand for organic and speciality agricultural products, particularly coffee, oilseeds, and flowers.

Based on the Service Provider, the Ethiopia Agriculture Market is segmented into Government-Owned Companies, Private Agribusiness Companies, Financial Institutions & Microfinance Providers, Agricultural Cooperatives & Farmer Organizations, and Research & Development Institutions

The Oromia region is the most dominant region for the Ethiopia Agriculture Market.

Oromia Coffee Farmers Cooperative Union, Netafim, MIDROC Ethiopia, One Acre Fund, Ethiopian Agricultural Transformation Agency, and Ethiochicken are the key players in the Ethiopia Agriculture Market.