Ethanol Gel Fuel Market Size (2024 – 2030)

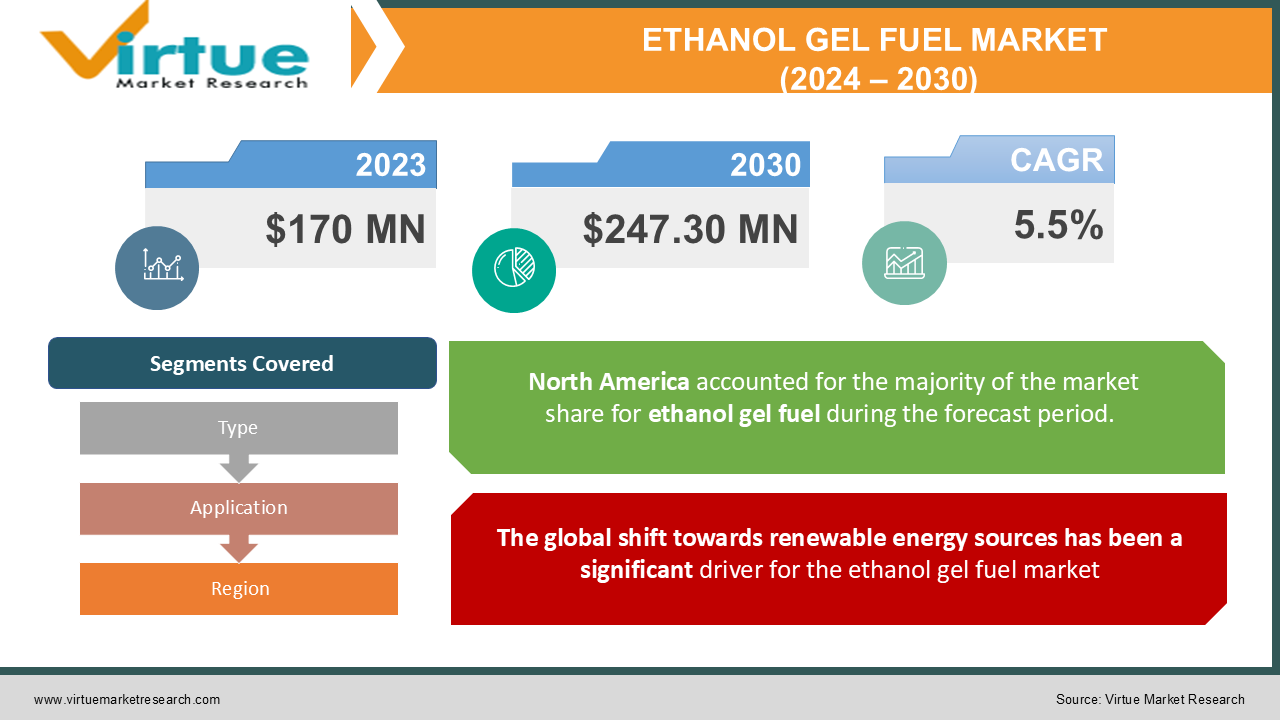

The Global Ethanol Gel Fuel Market was valued at USD 170 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The market is expected to reach approximately USD 247.30 million by 2030.

Ethanol gel fuel, derived from renewable sources, serves as a clean-burning alternative to traditional fuels, making it increasingly popular for both indoor and outdoor applications. This market has gained traction due to rising awareness about environmentally friendly fuel options, particularly in regions focusing on sustainable energy solutions. The versatility of ethanol gel fuels, used in various applications including camping, cooking, and heating, further contributes to market growth. As consumer preferences shift towards eco-friendly products, the ethanol gel fuel market is well-positioned for sustained expansion.

Key Market Insights

-

Ethanol gel fuel is favored for its ease of use and convenience, especially in outdoor settings such as camping and tailgating. The product's portability and safety features make it a preferred choice for consumers seeking reliable fuel options.

-

Stringent regulations and policies promoting the use of renewable energy sources are positively influencing the ethanol gel fuel market. Governments worldwide are encouraging the transition to cleaner fuels, thereby fostering growth in this sector.

-

The market is witnessing technological advancements in the production of ethanol gel fuels, improving efficiency and reducing costs. Innovations in formulation and packaging are enhancing product appeal and consumer satisfaction.

Global Ethanol Gel Fuel Market Drivers

The global shift towards renewable energy sources has been a significant driver for the ethanol gel fuel market:

With growing concerns over climate change and environmental sustainability, consumers and businesses are increasingly seeking alternatives to fossil fuels. Ethanol gel fuel is derived from renewable sources, making it a more sustainable option. The government policies and incentives promoting the use of biofuels further bolster this trend. Additionally, the rising awareness among consumers regarding the ecological impacts of their choices has led to an increase in demand for eco-friendly products, including ethanol gel fuel. This growing acceptance and preference for renewable energy solutions are expected to drive significant growth in the ethanol gel fuel market.

Versatility and Convenience of Ethanol Gel Fuel is driving market growth:

Ethanol gel fuel is valued for its versatility and ease of use, making it suitable for a wide range of applications. From cooking and heating to ambiance creation in homes and outdoor settings, ethanol gel fuel serves multiple purposes. Its portability allows consumers to use it in various scenarios, including camping, tailgating, and outdoor events. The convenience of easy ignition, clean-burning properties, and minimal cleanup after use enhance its appeal among consumers. As lifestyle trends increasingly favor outdoor activities and home gatherings, the demand for versatile fuel options like ethanol gel fuel is anticipated to rise significantly. This versatility in application not only attracts individual consumers but also positions ethanol gel fuel as a viable choice for businesses, such as hospitality and event management, further fueling market growth.

Technological Advancements in Production is driving market growth:

Innovations in the production and formulation of ethanol gel fuels are significantly contributing to market growth. Advances in technology have led to improved efficiency in the production processes, allowing manufacturers to create high-quality ethanol gel fuels that meet consumer demands. The development of new formulations enhances the burn time and efficiency of the gel, making it more appealing to consumers. Furthermore, innovations in packaging have also made the product more user-friendly, with safer and more convenient dispensing methods. As manufacturers continue to invest in research and development to enhance product performance, the ethanol gel fuel market is likely to see continued expansion driven by these technological advancements.

Global Ethanol Gel Fuel Market Challenges and Restraints

Competition from Alternative Fuels is restricting market growth:

One of the significant challenges facing the ethanol gel fuel market is the competition from alternative fuel sources. The energy sector is witnessing rapid advancements in various renewable fuels, including propane, butane, and other biofuels, which are often perceived as more efficient or convenient by consumers. These alternatives can offer comparable performance in terms of heat output and ease of use, creating a competitive environment for ethanol gel fuels. Additionally, the emergence of innovative technologies in fuel production can lead to the introduction of new products that may appeal to consumers, thus impacting the market share of ethanol gel fuel. To overcome this challenge, stakeholders in the ethanol gel fuel market must focus on highlighting the unique benefits of their products, such as environmental friendliness and versatility, while also exploring opportunities for product differentiation.

Regulatory Challenges are restricting market growth:

The ethanol gel fuel market is subject to various regulations and standards that can pose challenges for manufacturers and distributors. Compliance with environmental regulations, safety standards, and labeling requirements can add complexity and costs to the production and marketing of ethanol gel fuels. In some regions, stringent regulations may limit the availability of ethanol gel fuel products, thereby affecting market accessibility. Additionally, the fluctuation of government policies regarding biofuels can create uncertainty in the market, impacting investment decisions and long-term planning for businesses involved in the ethanol gel fuel industry. To navigate these regulatory challenges, companies need to stay informed about the evolving legal landscape and adapt their strategies accordingly to ensure compliance and maintain market presence.

Market Opportunities

The ethanol gel fuel market presents several opportunities for growth, particularly in the context of increasing consumer demand for sustainable and eco-friendly products. As more consumers become environmentally conscious, there is a significant opportunity for ethanol gel fuel manufacturers to position their products as clean-burning alternatives to traditional fossil fuels. Companies can leverage this trend by promoting the renewable aspects of ethanol gel fuels, targeting eco-conscious consumers, and collaborating with retailers focused on sustainability. Furthermore, the growing trend of outdoor recreational activities, including camping and picnicking, offers opportunities for manufacturers to develop specialized ethanol gel fuel products tailored for these markets. Packaging innovations that enhance convenience and safety can also create new avenues for growth. Additionally, expanding the distribution channels to include e-commerce platforms can improve accessibility for consumers, thus broadening the market reach and driving sales. As businesses continue to adapt to changing consumer preferences, the ethanol gel fuel market is well-positioned to capitalize on these opportunities for sustained growth.

ETHANOL GEL FUEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Perfumer's Workshop, SizzleSticks, Stok, Bioethanol, Green Mountain Grills, Cuisinart, EcoSmart Fire, Fire Sense, Flame Genie, Table Top Fireplaces |

Ethanol Gel Fuel Market Segmentation - By Type

-

Standard Ethanol Gel

-

Scented Ethanol Gel

-

Colored Ethanol Gel

-

Specialty Ethanol Gel

The Standard Ethanol Gel segment is the dominant type in the ethanol gel fuel market, accounting for a significant share due to its versatility and widespread application. Standard ethanol gel is preferred for various uses, including heating, cooking, and ambiance creation, making it the go-to choice for consumers seeking reliable and effective fuel options. Its ease of use, affordability, and clean-burning properties contribute to its popularity, driving substantial demand in both residential and commercial markets.

Ethanol Gel Fuel Market Segmentation - By Application

-

Residential

-

Commercial

-

Industrial

In the application segment, the Residential category stands out as the dominant segment. The increasing popularity of ethanol gel fireplaces and stoves for home heating and aesthetic appeal has significantly boosted demand. Consumers favor residential applications for their convenience, safety, and ability to create a warm and inviting atmosphere. The trend of enhancing home environments with eco-friendly products further supports the growth of ethanol gel fuel in residential settings, establishing it as a key driver in the market.

Ethanol Gel Fuel Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Among these regions, North America holds the largest market share for ethanol gel fuel. The region's high adoption of renewable energy sources, coupled with increasing consumer interest in eco-friendly products, has positioned North America as a dominant player in the ethanol gel fuel market. Additionally, the growing trend of home improvement and outdoor recreational activities further supports the demand for ethanol gel fuels in this region.

COVID-19 Impact Analysis on the Ethanol Gel Fuel Market

The COVID-19 pandemic had a mixed impact on the ethanol gel fuel market. Initially, the outbreak led to disruptions in supply chains and manufacturing processes, causing delays in product availability. However, as consumers spent more time at home during lockdowns, there was a noticeable increase in demand for indoor and outdoor heating solutions, including ethanol gel fuels. The rise in home cooking and outdoor activities during the pandemic contributed to higher sales of ethanol gel products as people sought to create comfortable living spaces. Moreover, the focus on cleanliness and hygiene also spurred interest in clean-burning fuels like ethanol gel, as consumers looked for safer alternatives. As restrictions eased and businesses reopened, the ethanol gel fuel market began to stabilize, and the demand trajectory remained positive. Overall, the pandemic accelerated the shift towards eco-friendly fuel options, which could benefit the ethanol gel fuel market in the long term.

Latest Trends/Developments

The ethanol gel fuel market is witnessing several notable trends and developments that are shaping its future. One significant trend is the increasing focus on product innovation, with manufacturers developing specialized ethanol gel products to meet the diverse needs of consumers. This includes the introduction of scented and colored ethanol gels, which enhance the ambiance of spaces while providing a clean-burning fuel source. Additionally, there is a growing emphasis on sustainability, with companies striving to create eco-friendly packaging solutions and explore the use of renewable materials in production. The expansion of e-commerce platforms has also revolutionized the way consumers purchase ethanol gel fuels, allowing for greater accessibility and convenience. Furthermore, the rise in outdoor recreational activities is driving demand for portable and easy-to-use ethanol gel fuel options, catering to the needs of campers and outdoor enthusiasts. As these trends continue to evolve, they are expected to influence consumer preferences and market dynamics significantly.

Key Players

-

The Perfumer's Workshop

-

SizzleSticks

-

Stok

-

Bioethanol

-

Green Mountain Grills

-

Cuisinart

-

EcoSmart Fire

-

Fire Sense

-

Flame Genie

-

Table Top Fireplaces

Chapter 1. Ethanol Gel Fuel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ethanol Gel Fuel Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ethanol Gel Fuel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ethanol Gel Fuel Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ethanol Gel Fuel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ethanol Gel Fuel Market – By Type

6.1 Introduction/Key Findings

6.2 Standard Ethanol Gel

6.3 Scented Ethanol Gel

6.4 Colored Ethanol Gel

6.5 Specialty Ethanol Gel

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Ethanol Gel Fuel Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Ethanol Gel Fuel Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Ethanol Gel Fuel Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Perfumer's Workshop

9.2 SizzleSticks

9.3 Stok

9.4 Bioethanol

9.5 Green Mountain Grills

9.6 Cuisinart

9.7 EcoSmart Fire

9.8 Fire Sense

9.9 Flame Genie

9.10 Table Top Fireplaces

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ethanol Gel Fuel Market was valued at USD 170 million in 2023 and is projected to reach approximately USD 247.30 million by 2030, growing at a CAGR of 5.5%.

Key drivers include the increasing demand for renewable energy solutions, the versatility and convenience of ethanol gel fuel, and technological advancements in production processes.

The market is segmented by product type (Standard, Scented, Colored, and Specialty Ethanol Gel) and by application type (Residential, Commercial, and Industrial).

North America is the most dominant region, supported by high adoption of renewable energy sources and increasing consumer interest in eco-friendly products.

Key players include The Perfumer's Workshop, SizzleSticks, Stok, Bioethanol, Green Mountain Grills, Cuisinart, EcoSmart Fire, Fire Sense, Flame Genie, and Table Top Fireplaces.