ESG Reporting Software Market Size (2024 – 2030)

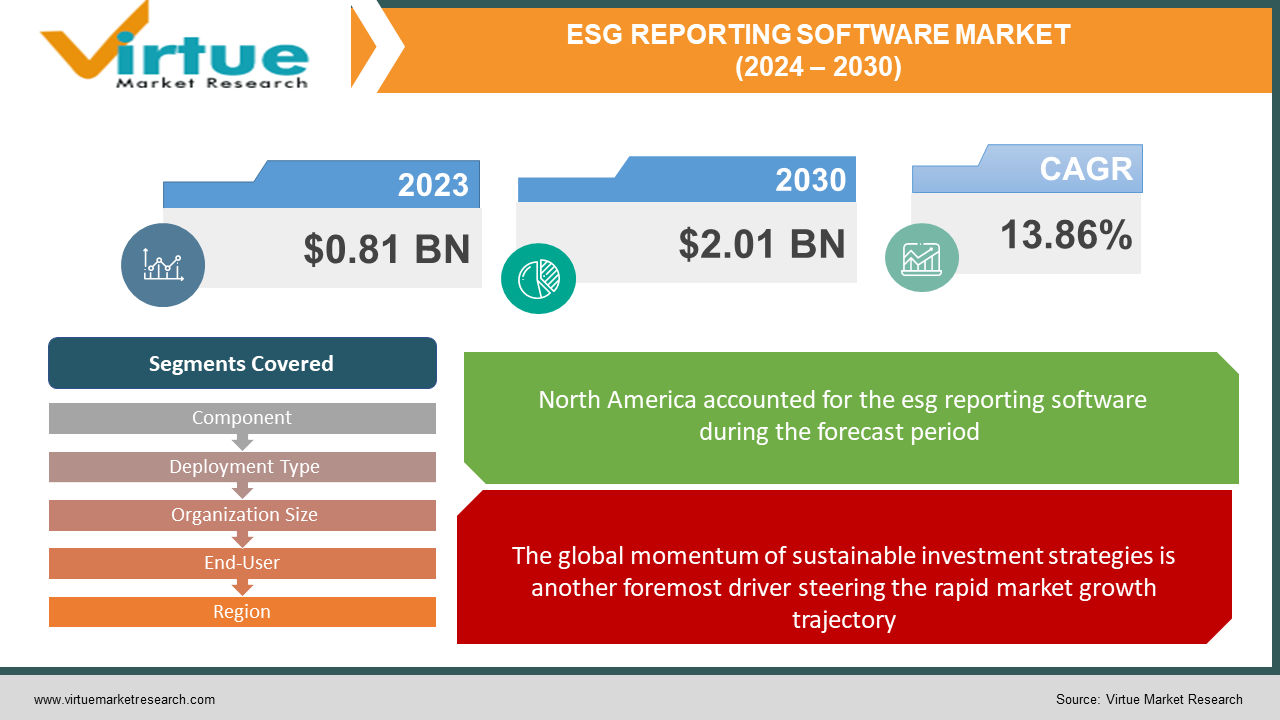

The ESG reporting software market was valued at USD 0.81 billion in 2023 and is projected to reach a market size of USD 2.01 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 13.86%.

Tracking and publicly disclosing environmental, social, and governance (ESG) metrics has developed into an essential practice for corporations to demonstrate their commitment to operating sustainably while generating long-term value for all stakeholders. However, collecting, analyzing, and reporting accurate, consistent ESG data from disparate systems across global operations is an intricate process. This has created a surging demand for dedicated ESG reporting software tools offering a centralized platform to streamline and automate sustainability performance management. The global ESG reporting software market refers to the systems enabling organizations to systematically measure, monitor, manage, and report on their environmental footprint, social impact, governance practices, and other non-financial drivers of enterprise value. Core capabilities provided by leading solutions in this space include collecting ESG data from multiple sources, calculating baseline performance and reduction targets, analyzing trends, creating visual sustainability reports and detailed disclosures aligned with prominent ESG reporting frameworks, communicating progress to stakeholders, and more. Several interrelated factors are responsible for the rapid growth in the ESG reporting software market worldwide. These include intensifying pressure from shareholders, creditors, regulators, customers, and the public at large for enhanced transparency and superior ESG risk management from companies. Developing appropriate ESG strategies and disclosures is no longer optional but a business-critical requirement for maintaining legal and social legitimacy. Sophisticated software tools are making this journey easier for sustainability teams.

Key Market Insights:

The global ESG reporting software market is witnessing remarkable growth attributed to regulatory obligations and investor pressure on companies for elevated ESG transparency. Currently, uptake is highest among large enterprises, especially public companies, across the financial services, energy, logistics, and technology industries. Stringent government mandates combined with public scrutiny make ESG reporting vital for maintaining regulatory compliance and brand reputation for these corporations. Sophisticated software tools automate the collation of ESG metrics from myriad sources, analysis, target setting, and detailed reporting aligned to major voluntary disclosure frameworks. However, small and midsized businesses are an emerging high-growth customer segment as sustainability begins to catch their management's attention. The ease of getting started with cloud-based ESG software-as-a-service solutions that provide actionable carbon and energy insights even with minimal data inputs is driving rapid adoption. Institutional investors increasingly employ ESG performance to gauge risks and return potential. Showcasing progress via reporting becomes critical for companies to attract investor dollars and lower capital costs. Tracking ESG KPIs like emissions, diversity metrics, and accident rates enables corporations to identify and respond better to financial and operational risks associated with climate change, discrimination lawsuits, and safety incidents, respectively. Major technology trends disrupting the ESG reporting software industry comprise the rising deployment of artificial intelligence and machine learning technology for analyzing unstructured data and predicting ESG performance.

ESG Reporting Software Market Drivers:

One of the foremost catalysts propelling the adoption of ESG reporting systems is tightening government regulations worldwide and compelling public disclosure of ESG metrics, targets, and risk management strategies.

One of the primary catalysts spurring the rapid growth trajectory of the global ESG reporting software market is the regulatory push from governments worldwide toward mandatory sustainability disclosures by large corporations. As the tangible impacts of climate change intensify and global consensus builds around mitigating long-term environmental risks, policymakers are expediting the sustainability reporting rulemaking process to compel transparency from businesses. Binding regulations are making ESG disclosures no longer voluntary but an obligatory compliance prerequisite with stiff penalties for non-conformity. This urgent regulatory thrust is set to significantly expand the addressable market for ESG software vendors globally. Thousands of corporations will need to urgently implement comprehensive software tools to collect, analyze, and report emissions, resource usage, workforce diversity, community engagement, and other ESG data points accurately per statutory guidelines. The most influential regulatory mandate is the European Union's Corporate Sustainability Reporting Directive (CSRD), which will make sustainability reporting mandatory for around 50,000 large EU companies starting in 2024. This far-reaching directive supersedes the EU's existing Non-Financial Reporting Directive. Software adoption will spike as organizations realign existing reporting procedures to fulfill CSRD dictates. Beyond Europe, multiple governments from Canada to Australia, Brazil, and Singapore are also drafting sweeping regulations to coerce climate and sustainability disclosures from domestic entities shortly. Securities regulators in the United States are hot on the heels of the climate disclosure rulemaking for public firms underway in 2023.

The global momentum of sustainable investment strategies is another foremost driver steering the rapid market growth trajectory.

The mushrooming global momentum towards sustainable investment strategies that incorporate environmental, social, and governance (ESG) factors while allocating capital is a pivotal driver fueling the rapid growth of the ESG reporting software industry. As the world grapples with intensifying climate impacts, institutional investors managing trillions in assets like BlackRock, State Street, Goldman Sachs, and Vanguard have been unequivocal regarding their intentions to increasingly integrate material ESG criteria into investment analysis to deduce genuine connections with risk-adjusted returns. These financial giants are also ramping up shareholder activism efforts by leveraging their voting power to actively engage with portfolio companies on stepping up sustainability commitments. Additionally, they are re-aligning passive index funds and actively managing strategies to channel more capital flows towards businesses demonstrating ESG leadership in their industries. Simultaneously, divestment momentum is mounting against poor ESG performers with lagging sustainability credentials across the globe, spanning university endowments, sovereign wealth funds, and pension plans. This investor focus on sustainability implies that for corporations seeking equity or debt financing, implementing ESG tracking and reporting software to maintain transparency on ESG metrics aligned with investor priorities has become invaluable to attract capital inflows by signaling reduced risk profiles and future readiness. The demand explosion for ESG data from the investment community is being further catalyzed by burgeoning product innovation such as passive ETFs focused on companies with high ESG ratings, such as MSCI's ESG Leaders indices.

ESG Reporting Software Market Restraints and Challenges:

Enterprises considering investment in ESG software tools remain cautious regarding the fluid regulatory climate around mandatory sustainability disclosures.

A key factor injecting uncertainty into the ESG reporting software adoption decisions of otherwise enthusiastic enterprises is the somewhat fluid and dynamically changing regulatory climate surrounding sustainability disclosure mandates worldwide. While policy directives unanimously point towards heightened transparency obligations for businesses within the next 3–5 years, the precise statutory disclosures required and phase-in timelines remain fluid across major economic blocs. This fluid and ever-changing regulatory outlook is creating a dichotomy for software procurement decision-makers. While appreciating that some futureproofing investments before external compliance deadlines hit are prudent, organizations are wary about overcommitting budgets before regulations attain complete maturity and stability. Unless mandatory disclosure norms and taxonomies solidify quickly across key markets, regulatory uncertainty will prevail as a restraining factor, keeping some intended buyers of ESG management software firmly on the sidelines or limiting project scope for early adopters to minimally viable functionality. Vendors may also hesitate to engage in aggressive platform development until the market needs a better definition. However, corporations need to balance temporary ambiguity against the certainty that extensive disclosures are coming sooner or later. Once enacted, re-architecture to align with compliance dictates will become prohibitive, and non-compliance invites penalties. Hence, strategically staged software adoption despite fluid policy contours seems the judicious path for most organizations rather than indefinite postponements.

ESG Reporting Software Market Opportunities:

Small and midsize businesses represent a sizeable untapped customer segment beyond current high-value accounts, typically comprising publicly listed multinationals and large private corporations. SMEs account for over 90% of global enterprises. Although smaller companies have generally lagged on sustainability commitments historically, worsening climate events combined with growing consumer and community expectations around responsible operations are creating momentum for change. However, most SMEs struggle with the organizational and technological sophistication for comprehensive in-house ESG data collection. This creates a major opportunity for agile SaaS products catering to SMB needs for user-friendly carbon accounting, waste monitoring, renewable energy sourcing, sustainable supply chain management, and related functionalities via cloud delivery without extensive in-house capacity building. Pricing is a key barrier inhibiting uptake, which vendors can creatively address through tiered subscription models. If tapped effectively, the global SME segment can significantly expand the addressable market. Emerging markets like China, India, Brazil, and Mexico with swelling middle-class populations offer another high-growth opportunity. Although regulatory pressure remains relatively soft currently, progressive corporations in these geographies realize sustainability commitments and disclosures can help attract global ESG-sensitive investors and customers. This creates demand for localized ESG software supporting domestic languages, reporting frameworks, and data norms, which established Western vendors can target through partnerships with regional players. Upselling and cross-selling for integrated ESG suites align with the product roadmaps most vendors have already charted to widen functional footprints spanning carbon accounting, operational analytics, supply chain monitoring, water usage optimization, and community relations management under unified platforms. This creates scope for additional license sales and bundled subscription pricing to incentivize adoption across modules. Customer education on tangible benefits around data synergies, process consolidation, and compliance ease offered by integrated ESG software suites will be pivotal to tapping this value-building opportunity.

ESG REPORTING SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.86% |

|

Segments Covered |

By Component, Deployment Type, Organization Size, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Wolters Kluwer, Workiva, Nasdaq, Sphera, Diligent, City Greenstone, Isometrix |

ESG Reporting Software Market Segmentation: By Component

-

Solution

-

Services

With a market share of more than 50% in 2023, the solution category is the largest growing. The primary reason for this segment's rise is that the company's strategy needs to be communicated constantly. The regulatory bodies have adopted several regulations, which have increased demand for ESG solutions. The market is expanding due to rising awareness of the need for businesses to maintain openness for stakeholders and investors. Services are the fastest-growing segment. Services are important in the software industry as they include training, support, customization, and installation, making sure that customers can use the program to suit their demands. By customizing software solutions to meet unique organizational needs and providing continuing support, services raise the total value proposition of software solutions.

ESG Reporting Software Market Segmentation: By Deployment Type

-

On-Premises

-

Cloud-Based

The on-premise deployment type has the largest ,market share in 2023. With a strong emphasis on large emitters, the majority of early business ESG management technologies were on-premises installations that allowed for adaptation to specific client infrastructure while keeping control behind company borders. Additionally, installations make it simpler to integrate with the reporting, analytics, and business intelligence technologies already present in on-site enterprise IT ecosystems. However, growth is slowing given the growing complexity of licensing packages, infrastructure, and upgrade management needed to maintain relevancy with fast-changing external disclosure policies and data schema. The cloud-based segment is the fastest-growing. With limited internal IT teams, cloud solutions provide an easier starting point for SMEs to get hands-on with external sustainability disclosures through pre-configured templates, without extensive custom coding needed. Secondly, with regulations still evolving across reporting parameters, cloud architectures allow faster reconfigurations by software vendors as disclosure norms mature over the coming years. Limited in-house re-engineering is necessitated for clients.

ESG Reporting Software Market Segmentation: By Organization Size

-

Large Enterprises

-

SMEs (Small and Medium-sized Enterprises)

Large enterprises are the largest growing segment. The market dominance of tools catering to large multinational corporations and listed companies reflects the origins of the ESG software industry serving organizations facing acute investor, regulatory, and social pressures to quantify and report on environmental performance, chiefly carbon emissions. Prevalent sustainability reporting frameworks also revolve around public companies. Building customized emissions monitoring mechanisms requires sizable budgets accessible chiefly to large corporations. SMEs are the fastest-growing category. The small and midsized business segment, conversely, offers the most lucrative expansion possibilities, with a projected 19% growth CAGR forecast until 2030. With rising investments, this sector has seen significant growth. Governments, too, are expanding transparency regulations beyond publicly listed entities. This creates a sizable demand for easy-to-adopt ESG software offerings.

ESG Reporting Software Market Segmentation: By End-User

-

Retail & Consumer Goods

-

BFSI

-

IT & Telecommunications

-

Healthcare

-

Manufacturing

-

Others

The BFSI sector is the largest grower in this market. There is increasing demand for banking, financial services, and insurance (BFSI) companies to operate more sustainably, considering their impact on the environment, society, and economy. This means following environmental, social, and governance (ESG) regulations, which call for businesses to have strong standards on stakeholder rights, risk management, and company leadership, as well as to be aware of their impact on the environment and their relationships with clients, employees, and suppliers.

The healthcare sector is the fastest-growing end-user. Improved patient care, operational efficiency, and regulatory compliance are driving the massive digital revolution of the healthcare sector. To improve patient outcomes and streamline operations, healthcare providers are progressively implementing telemedicine platforms, electronic health records (EHRs), and other technological solutions.

ESG Reporting Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest market share, roughly 35–40% in 2023. This is attributed to the early adoption of ESG principles, a strong investor focus on sustainability, and a mature technology landscape. Asia-Pacific (APAC) holds about 20–25% of the market and is the fastest-growing. It boasts significant growth potential, fueled by rising awareness, government initiatives, and the growth of sustainability-focused businesses in the region.

COVID-19 Impact Analysis on the ESG Reporting Software Market:

The global onset of the unprecedented COVID-19 pandemic and the resulting humanitarian crisis have significantly influenced the trajectory of the ESG reporting software market. Some technology sectors witnessed muted demand during economic uncertainty, but conversely, the urgency around sustainability has elevated the uptake of platforms enabling organizations to measure and disclose environmental, social, and governance performance. The major dimension in which software adoption has accelerated amidst the pandemic is that enterprises are seeking to measure, assess, and reduce risks related to complex global disruptions like health emergencies and climate change, which are viewed as interlinked events. COVID created corporate vulnerability and global catastrophic events, spurring urgency around quantifying and mitigating longer-term environmental and social risks, especially for supply chains through technology transformation. This growing strategic scrutiny of risk scenarios among executives is driving priority on reliable ESG data measurement. COVID has also heightened societal focus on racial equality, inclusivity, and workforce welfare, amplifying demand for technology solutions and providing related performance insights beyond historical concentrations largely on emissions.

Latest Trends/ Developments:

Incorporating AI and ML algorithms for automated ESG data collection, analysis, and report writing is a pivotal innovation priority for software vendors. Natural language generation allows the customization of annual sustainability reports and regulatory filings based on analytics outputs. Computer vision on manufacturing shop floors or mines captures near-real-time data on safety gear usage, hazardous leaks, and other risk events feeding into disclosures. Big data analytics spot decarbonization opportunities within operational data lakes through pattern discovery that is unfeasible to do manually. With transparency expectations going beyond environmental metrics into social and governance parameters, providers are racing to break corporate data silos and deliver integrated cross-domain analytical capabilities on a single platform encompassing the full spectrum of ESG metrics, from emissions to ethics complaints to board diversity. Open and flexible system architectures are enabling integration with existing business intelligence tools to give executives and managers self-service access to interrelated sustainability KPIs alongside conventional financial and operational dashboards for unified insights.

Key Players:

-

Wolters Kluwer

-

Workiva

-

Nasdaq

-

Sphera

-

Diligent

-

City

-

Greenstone

-

Isometrix

Chapter 1. ESG Reporting Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ESG Reporting Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ESG Reporting Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ESG Reporting Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ESG Reporting Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ESG Reporting Software Market – By Component

6.1 Introduction/Key Findings

6.2 Solution

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. ESG Reporting Software Market – By Deployment Type

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud-Based

7.4 Y-O-Y Growth trend Analysis By Deployment Type

7.5 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 8. ESG Reporting Software Market – By Organization Size

8.1 Introduction/Key Findings

8.2 Large Enterprises

8.3 SMEs (Small and Medium-sized Enterprises)

8.4 Y-O-Y Growth trend Analysis By Organization Size

8.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 9. ESG Reporting Software Market – By End-User

9.1 Introduction/Key Findings

9.2 Retail & Consumer Goods

9.3 BFSI

9.4 IT & Telecommunications

9.5 Healthcare

9.6 Manufacturing

9.7 Others

9.8 Y-O-Y Growth trend Analysis By End-User

9.9 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. ESG Reporting Software Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Deployment Type

10.1.3 By Organization Size

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Deployment Type

10.2.4 By Organization Size

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Deployment Type

10.3.4 By Organization Size

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Deployment Type

10.4.4 By Organization Size

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Deployment Type

10.5.4 By Organization Size

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. ESG Reporting Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Wolters Kluwer

11.2 Workiva

11.3 Nasdaq

11.4 Sphera

11.5 Diligent

11.6 City

11.7 Greenstone

11.8 Isometrix

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Tightening government regulations worldwide, and compelling public disclosure of ESG metrics, targets, risk management strategies, and sustainable investment strategies are the key drivers in the market.

Ensuring data accuracy, completeness, and consistency across different formats are the major challenges.

Wolters Kluwer, Workiva, Nasdaq, Sphera, Diligent, and Cority are the major players.

North America currently holds the largest market share.

Asia-Pacific exhibits the fastest growth in this market.