Epoxy Silane Coupling Agents Market Size (2024 – 2030)

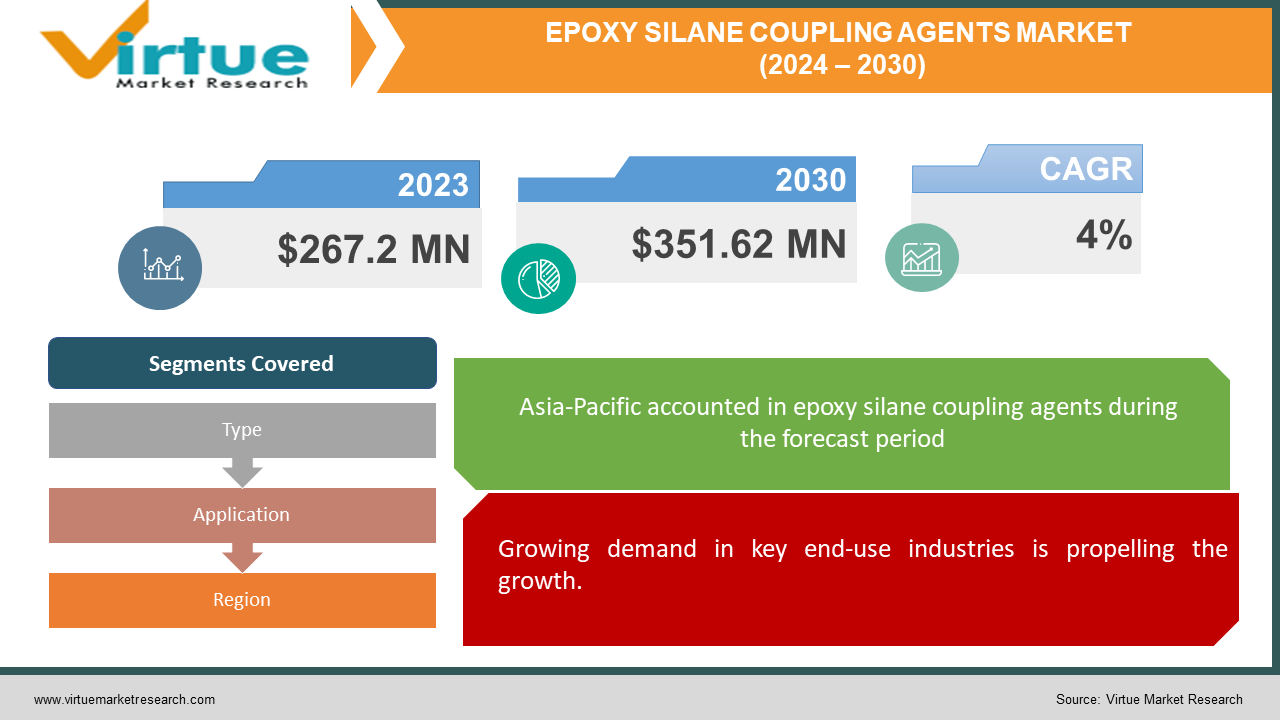

The global epoxy silane coupling agent market was valued at USD 267.2 million in 2023 and will grow at a CAGR of 4% from 2024 to 2030. The market is expected to reach USD 351.62 million by 2030.

Silane coupling agents with epoxy groups as functional groups are known as epoxy silane coupling agents. They can function as agents for surface treatment, resin modifiers, and adhesion aids. Epoxy silanes are organosilanes that serve two purposes: they have an alkoxy group that may hydrolyze and a reactive epoxy group. They can increase the adhesion of organic polymers to inorganic materials, including glass, metals, fillers, dyes, silicone, epoxy, urethane, acrylic, and polysulfide resins. One of the special qualities of epoxy silanes is their non-yellowing adherence.

Key Market Insights:

Increasing demand from important end-use sectors, improved material qualities, and an emphasis on performance and durability are propelling market growth. Obstacles to market expansion include the scarcity of raw materials, strict environmental laws, and competition from substitute coupling agents. The market might rise as a result of the convergence of thriving industries, the focus on sustainability, and developments in nanotechnology. Asia-Pacific is now the largest and fastest-growing market because of its strong manufacturing sectors, quick urbanization, and infrastructural development, as well as the support of important industry players and government initiatives that encourage industrial expansion.

Global Epoxy Silane Coupling Agent Market Drivers:

Growing demand in key end-use industries is propelling the growth.

Epoxy silane coupling agents are poised for growth due to their strong synergy with expanding industries like construction, transportation, and manufacturing. This aligns perfectly with the rising demand for silane coupling agents in key sectors like adhesives & sealants, paints & coatings, and composites. In construction, epoxy silane coupling agents can improve the bonding strength of mortars and concrete, leading to more durable buildings and infrastructure. Within transportation, they can enhance adhesion in automotive parts and lightweight composites used in aircraft, contributing to stronger and more fuel-efficient vehicles. Similarly, in manufacturing, epoxy silane coupling agents can strengthen the bond between fillers and resins in composites, creating high-performance components for various applications. This synergy between Epoxy Silane Coupling Agents and the growth of these crucial industries is a significant driver for the market's expansion.

Enhanced material properties are facilitating the expansion.

One of the main forces propelling the silane coupling agent market, and likely epoxy silane coupling agents in particular, is their unique ability to bridge the gap between organic and inorganic materials. Traditionally, these materials struggle to adhere well due to their inherent differences. Silane coupling agents, with their bifunctional structure, act like molecular bridges. One end of the molecule chemically bonds with the inorganic material, while the other end interacts strongly with the organic material. This creates a powerful connection, significantly improving adhesion and the overall performance of the final product. In the realm of composites, for instance, epoxy silane coupling agents can ensure a stronger bond between the polymer matrix and reinforcing fibers, leading to a more robust and durable composite material. Similarly, paints and coatings can enhance adhesion between the organic resin and inorganic fillers or pigments, resulting in a more durable, scratch-resistant, and weatherproof coating. This ability to overcome the adhesion barrier between organic and inorganic materials unlocks a vast potential for epoxy silane coupling agents across various industries.

The focus on durability and performance is accelerating the growth rate.

The relentless pursuit of longevity and peak performance in countless industries is another factor likely fueling growth. These innovative agents play a crucial role in fortifying the very qualities manufacturers and consumers crave. By enhancing adhesion between organic and inorganic materials, epoxy silane coupling agents empower the creation of sturdier and more dependable end products. In the construction sector, for example, their use can lead to stronger concrete and mortars, resulting in buildings and infrastructure with superior resistance to cracking and wear. Within the transportation industry, they can contribute to the development of more robust and lightweight composites used in aircraft and automobiles. This translates to enhanced fuel efficiency and a longer lifespan for vehicles. Similarly, in the manufacturing domain, these agents can fortify the bond between resins and fillers in various composites, leading to the production of high-performance components that can withstand demanding conditions across diverse applications. By essentially bridging the gap between dissimilar materials and creating a robust foundation, epoxy silane coupling agents have become a valuable tool for industries striving to deliver long-lasting and high-performing products.

Global Epoxy Silane Coupling Agents Market Challenges and Restraints:

Limited raw material availability is a major barrier.

A potential hurdle for the market lies in the availability and price stability of their key raw materials. Just like other silane coupling agents, epoxy-based ones rely on silicon tetrachloride and chlorosilanes as building blocks. However, if the supply of these materials becomes limited or their prices fluctuate significantly, it can disrupt production and ultimately impact the market. Limited access to these raw materials could force manufacturers to throttle production, leading to shortages of epoxy silane coupling agents. Price fluctuations can also pose a challenge. If the cost of raw materials rises sharply, manufacturers may be forced to raise their prices for epoxy silane coupling agents, potentially dampening demand. Therefore, ensuring a stable and cost-effective supply of silicon tetrachloride and chlorosilanes is crucial for the smooth operation and growth of the epoxy silane coupling agent market.

Stringent environmental regulations are causing concerns.

A growing hurdle for the market stems from the increasingly stringent environmental regulations surrounding their production. The manufacturing process often involves hazardous chemicals, raising concerns about environmental impact. Regulatory bodies are enacting stricter controls on the use and disposal of these chemicals. This trend adds a layer of complexity to the manufacturing process. Producers may need to invest in new equipment or modify existing processes to comply with regulations. These changes can be costly and time-consuming, potentially impacting production efficiency. Furthermore, the proper disposal of hazardous waste generated during production adds another cost burden. While these regulations are essential for environmental protection, they can act as a restraint on the epoxy silane coupling agent market by increasing production costs and potentially limiting the pool of manufacturers willing to operate in this space.

Competition from alternative coupling agents can create losses.

The epoxy silane coupling agent market, despite its potential, faces competition from alternative coupling agents. While epoxy silane coupling agents bring unique strengths to the table, other options like isocyanate or titanate coupling agents may pose a threat. These alternatives might offer a cost advantage, making them more attractive to manufacturers seeking budget-friendly solutions. Additionally, some applications may have specific requirements better suited by these competitors. For instance, isocyanate coupling agents might be preferred for their strong adhesion to specific polymers, while titanate coupling agents could be a better fit for applications requiring high thermal stability. To stay competitive, manufacturers will need to emphasize their unique advantages, such as improved performance in specific areas or broader applicability across various materials. Ultimately, the choice between Epoxy Silane Coupling Agents and alternatives depends on a careful consideration of cost-effectiveness, specific application needs, and desired material properties.

Global Epoxy Silane Coupling Agent Market Opportunities:

The market is poised for significant growth due to its synergy with several flourishing industries. The rising demand for high-performance and durable products in construction, transportation, and manufacturing creates fertile ground. Their ability to bridge the adhesion gap between organic and inorganic materials unlocks a multitude of opportunities. In construction, they can strengthen concrete and mortars, leading to longer-lasting buildings and infrastructure. Within transportation, they can contribute to the development of lighter and more robust composites in aircraft and automobiles, resulting in increased fuel efficiency and vehicle lifespan. Similarly, in manufacturing, epoxy silane coupling agents can fortify the bond between resins and fillers in composites, enabling the production of high-performing components across various applications. Furthermore, the growing focus on sustainability presents an opportunity for the development of bio-based epoxy silane coupling agents, catering to the increasing demand for eco-friendly solutions. Additionally, advancements in nanotechnology and material science research hold the potential to unlock new functionalities and applications for epoxy silane coupling agents. By addressing potential challenges like limited raw material availability, stricter environmental regulations, and competition from alternative coupling agents, the epoxy silane coupling agents market can capitalize on these opportunities and experience substantial growth in the years to come.

EPOXY SILANE COUPLING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dow (US), Wacker Chemie AG (Germany), Evonik Industries AG (Germany), Momentive (US), Shin-Etsu Chemical Co. Ltd (Japan), Jiangxi Hungpai New Material (China), Jingzhou Jianghan Fine Chemical (China), Nanjing Shuguang Fine Chemical (China), Guangzhou Ecopower New Materials (China), WD Silicone (China) |

Epoxy Silane Coupling Agent Market Segmentation: By Type

-

Glycidoxy silane

-

Aminoglycidyl silane

Glycidoxy silane is the largest and fastest-growing type. It is a popular choice, excels at adhesion, and works well with many resins. This makes it a versatile option across various applications. However, for situations requiring extra bonding power to specific materials like glass or metals, Aminoglycidyl silane steps up. This type incorporates an amine group, providing additional functionality that strengthens the bond between organic resins and inorganic substrates.

Epoxy Silane Coupling Agent Market Segmentation: By Application

-

Adhesives & Sealants

-

Paints & Coatings

-

Fiberglass & Composites

-

Fillers & Reinforcements

-

Plastics & Rubber

-

Electronic Materials

-

Construction Materials

Adhesives & sealants are the largest and fastest-growing application. In adhesives and sealants, they act like adhesion superheroes, bridging the gap between organic adhesives and inorganic materials like concrete or glass. This translates to stronger, more durable bonds that can withstand stress and strain. Their talents extend to paints and coatings as well. Here, they play the role of adhesion architects, reinforcing the connection between the organic resin and inorganic fillers or pigments. This not only enhances scratch resistance and weatherproofing but also elevates the overall performance of the paint or coating, ensuring a longer-lasting and visually appealing finish. By wielding their adhesion-boosting powers, epoxy silane coupling agents play a crucial role in the strength, durability, and performance of various everyday products.

Epoxy Silane Coupling Agent Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. Strong manufacturing sectors may be found in many nations, including consumer products, electronics, automobiles, South Korea, India, and China. The need for epoxy silane coupling agents has been fueled by the region's rising urbanization, industry, and infrastructural development. Furthermore, the region's position in the market is attributed to the existence of significant market players and supportive government policies encouraging industrial expansion.

COVID-19 Impact Analysis on the Global Epoxy Silane Coupling Agents Market

The COVID-19 pandemic left its mark on the epoxy silane coupling agents market, though the impact wasn't uniform across the globe. The initial lockdowns and disruptions to global supply chains caused a temporary decrease in demand. Industries heavily reliant on Epoxy Silane Coupling Agents, like construction, transportation, and automotive, experienced a slowdown, leading to a reduced need for these agents. Additionally, limitations on raw material availability and production capacity due to pandemic restrictions added to the challenges. However, as the global economy started recovering, the demand for epoxy silane coupling agents began to pick up again. The ongoing focus on infrastructure development, increasing emphasis on durable and high-performance materials, and growth in sectors like renewable energy are expected to propel the market forward. While the pandemic caused a temporary setback, the long-term growth prospects for the epoxy silane coupling agents market remain positive.

Latest trends/Developments

The market is brimming with exciting developments. One key trend is the rise of bio-based epoxy silane coupling agents. Manufacturers are innovating to create eco-friendly options using renewable resources, catering to the growing demand for sustainable solutions and aligning with stricter environmental regulations, particularly in Europe. Additionally, advancements in nanotechnology are opening doors for new functionalities. Epoxy silane coupling agents with nanoparticles are being explored to enhance properties like fire retardancy and electrical conductivity, broadening their potential applications. Furthermore, research and development efforts are focused on improving adhesion to challenging substrates and compatibility with various resins, pushing the boundaries of what these agents can achieve. With a focus on sustainability, innovation, and expanding functionalities, the market is poised for exciting advancements in the years to come.

Key Players:

-

Dow (US)

-

Wacker Chemie AG (Germany)

-

Evonik Industries AG (Germany)

-

Momentive (US)

-

Shin-Etsu Chemical Co. Ltd (Japan)

-

Jiangxi Hungpai New Material (China)

-

Jingzhou Jianghan Fine Chemical (China)

-

Nanjing Shuguang Fine Chemical (China)

-

Guangzhou Ecopower New Materials (China)

-

WD Silicone (China)

Chapter 1. EPOXY SILANE COUPLING AGENTS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. EPOXY SILANE COUPLING AGENTS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. EPOXY SILANE COUPLING AGENTS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. EPOXY SILANE COUPLING AGENTS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. EPOXY SILANE COUPLING AGENTS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. EPOXY SILANE COUPLING AGENTS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Glycidoxy silane

6.3 Aminoglycidyl silane

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. EPOXY SILANE COUPLING AGENTS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Adhesives & Sealants

7.3 Paints & Coatings

7.4 Fiberglass & Composites

7.5 Fillers & Reinforcements

7.6 Plastics & Rubber

7.7 Electronic Materials

7.8 Construction Materials

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. EPOXY SILANE COUPLING AGENTS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. EPOXY SILANE COUPLING AGENTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Dow (US)

9.2 Wacker Chemie AG (Germany)

9.3 Evonik Industries AG (Germany)

9.4 Momentive (US)

9.5 Shin-Etsu Chemical Co. Ltd (Japan)

9.6 Jiangxi Hungpai New Material (China)

9.7 Jingzhou Jianghan Fine Chemical (China)

9.8 Nanjing Shuguang Fine Chemical (China)

9.9 Guangzhou Ecopower New Materials (China)

9.10 WD Silicone (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global epoxy silane coupling agent market was valued at USD 267.2 million in 2023 and will grow at a CAGR of 4% from 2024 to 2030. The market is expected to reach USD 351.62 million by 2030.

Growing demand in key end-use industries, enhanced material properties, and a focus on durability and performance are the reasons that are driving the market.

Based on type, the market is divided into glycidoxy silane and aminoglycidyl silane.

Asia-Pacific is the most dominant region for the global epoxy silane coupling agent market.

Dow, Wacker Chemie AG, Evonik Industries AG, Momentive, and Shin-Etsu Chemical Co. Ltd. are the major players in the global epoxy silane coupling agent market.