Epoxy composite Coatings Market Size (2025-2030)

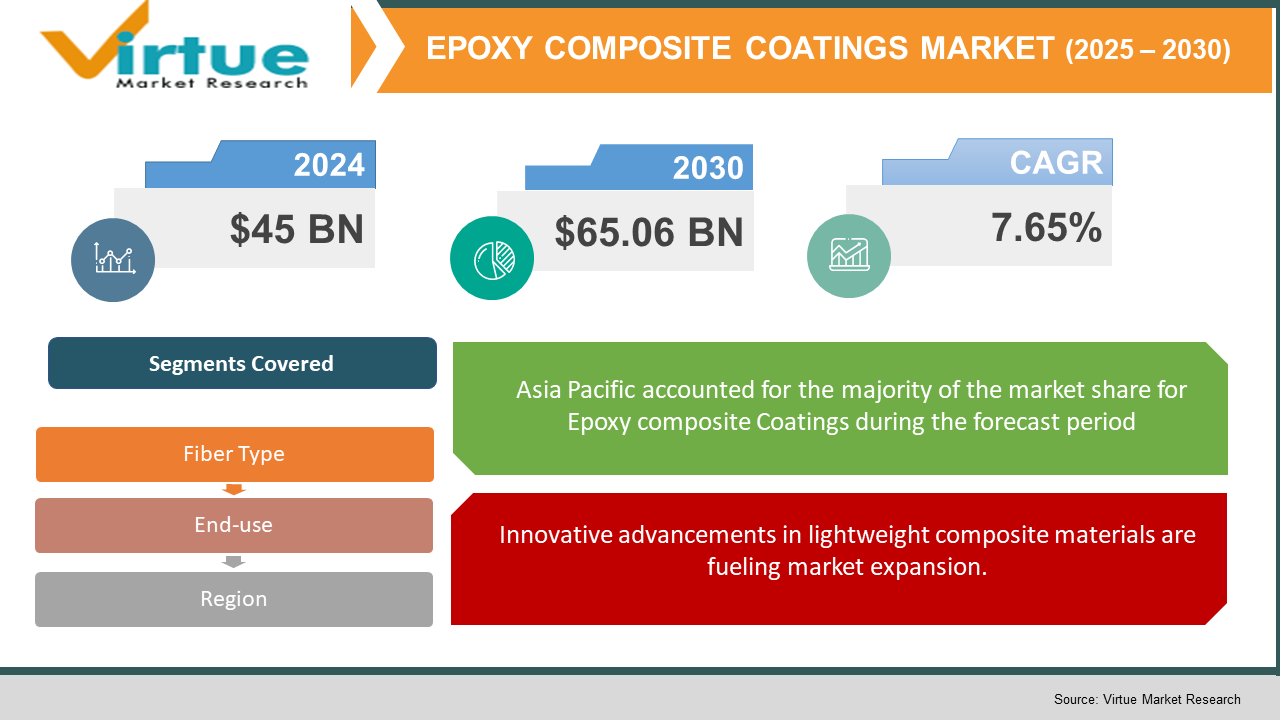

The Epoxy composite Coatings Market was valued at USD 45 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 65.06 billion by 2030, growing at a CAGR of 7.65%.

Epoxy composite is a material recognized for its superior elasticity compared to other available options. It is a category of polymer substance that integrates various components. The use of epoxy composite enables effective fabrication processes. In recent times, glass-reinforced epoxy has emerged as a significant type of fiber-reinforced plastic. The requirement for this material remains substantial. The popularity and utilization of glass-reinforced epoxy are steadily increasing. Growing construction activities worldwide are further driving the application of epoxy composite. These factors collectively contribute to the rising valuation of the epoxy composite market.

Key Market Insights:

- Epoxy composites are gaining widespread preference in the sports and consumer goods industries owing to their lightweight properties, superior strength, design flexibility, and ease of fabrication. These materials are now widely utilized in products such as tennis rackets, golf clubs, bicycles, hiking gear, skis, surfboards, table tennis paddles, badminton rackets, fishing rods, baseball bats, hockey sticks, sports vehicles, and athletic footwear.

- Major industry participants, including Cytec Industries, Toray Industries, Hexcel, and Hyosung, maintain vertical integration throughout the value chain—from raw material sourcing to the distribution of carbon fiber-reinforced polymers (CFRPs). This high level of integration allows these companies to minimize raw material procurement costs and expand their market presence through the development of specialized product offerings.

Epoxy composite Coatings Market Drivers:

Innovative advancements in lightweight composite materials are fueling market expansion.

Epoxy resins play a critical role in composite fabrication where rapid curing and improved strength are necessary. Compared to traditional materials, epoxy composite products offer extended shelf life. These composites demonstrate superior strength and performance across numerous automotive and aerospace applications, despite being approximately 50% lighter than steel and nearly 30% lighter than aluminum. Their combination of lightweight properties and high strength also makes them suitable for selective construction uses, contributing to market growth and prompting increased investment in composite research and development by sectors such as aerospace, space exploration, marine, and automotive.

Within the automotive industry, epoxy composites are utilized in a wide range of applications. The accelerated advancement of lightweight and durable composites in aerospace, transportation, and maritime navigation has intensified the demand for energy efficiency and fuel savings. Implementing epoxy-based composites with high strength-to-weight ratios can significantly reduce energy usage and improve fuel efficiency, thereby propelling the expansion of the epoxy composites market. By lowering the specific gravity of an aircraft or vehicle during operation, these materials contribute to extended travel ranges.

Epoxy composite Coatings Market Restraints and Challenges:

Volatility in raw material pricing presents a significant obstacle to market expansion.

The cost of raw materials across all composite grades remains significantly high. Supply chains for these materials are under considerable strain due to limited inventories, production slowdowns, both scheduled and unscheduled plant shutdowns, feedstock availability constraints, and, in certain instances, suboptimal agricultural yields. Although raw material suppliers are making efforts to absorb some of these rising costs, the situation has escalated to a point where further price adjustments are deemed necessary to ensure future supply stability.

For example, in January 2022, DIC Corporation announced price revisions for epoxy resins and related raw materials. Despite such measures, tight market conditions and imbalances in supply and demand for certain materials have continued to drive prices upward in subsequent months. The financial strain on manufacturers has been further intensified by soaring utility expenses and sudden fluctuations in foreign exchange rates.

These raw material price increases place a significant burden on small-scale manufacturers, adversely affecting their profit margins. As a result, the epoxy composites market is experiencing a slightly reduced growth rate due to the combined effects of high raw material and processing costs.

Epoxy composite Coatings Market Opportunities:

A notable emerging trend within the epoxy composites market, with significant potential to drive growth, is the increasing focus on sustainability and environmental responsibility. With growing concerns over climate change and the depletion of natural resources, industries are progressively transitioning toward environmentally friendly materials and production methods. Due to their lightweight properties and high strength-to-weight ratio, epoxy composites present a viable solution for minimizing fuel consumption and reducing emissions, particularly in transportation sectors such as automotive and aerospace.

Moreover, the development of bio-based epoxy resins sourced from renewable materials further supports efforts to lower the environmental impact of these composites. Companies that prioritize research and development aimed at improving the ecological footprint of epoxy composites are well-positioned to benefit from this trend. Such initiatives are likely to attract environmentally aware consumers and provide a competitive advantage in the marketplace.

As sustainability increasingly influences purchasing behavior, the demand for eco-friendly epoxy composites is anticipated to rise, thereby contributing to the overall expansion of the market.

EPOXY COMPOSITE COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.65% |

|

Segments Covered |

By fiber Type, end use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Teijin Limited, Gurit Holding Ag and Ashland Global Holdings Inc. |

Epoxy composite Coatings Market Segmentation:

Epoxy composite Coatings Market By Fiber Type:

- Glass Fiber

- Carbon Fiber

- Other Fiber

The glass fiber segment dominated the market, accounting for over 60% of total revenue, and is expected to maintain its leading position throughout the forecast period. This dominance is largely driven by the increasing adoption of glass fibers in automotive and marine industries, attributed to their cost-efficiency. Additionally, replacing metal components with composite materials enhances fuel efficiency, contributing to improved overall vehicle performance. The high strength-to-weight ratio of glass fiber composites makes them ideal for a wide array of applications.

Despite their advantages, the challenges associated with recycling glass fiber epoxy composites have led manufacturers to explore alternatives such as carbon and aramid fiber epoxy composites. Among these, the carbon fiber segment is projected to register the highest compound annual growth rate (CAGR) of over 8.5%, owing to the exceptional thermal, mechanical, and electrical performance these fibers impart to composites. Furthermore, their superior strength and durability are expanding their usage across a variety of end-use sectors.

Producers of carbon fiber-reinforced composites are actively pursuing opportunities in industrial applications. Ongoing research focuses on enhancing fiber/matrix interface interactions and ensuring uniform dispersion of nano-fillers within the matrix. Improper dispersion can lead to the agglomeration of carbon fillers, which negatively impacts the performance of carbon fiber epoxy composites.

Epoxy composite Coatings Market By End-use:

- Aerospace & Defense

- Automotive & Transportation

- Electrical & Electronics

- Wind Energy

- Sporting & Consumer Goods

- Others End-use

The automotive and transportation end-use segment led the market, accounting for over 25% of total revenue. The exceptional durability and lightweight properties of epoxy composites make them well-suited for structural components within automotive and transportation systems. These materials are utilized in a variety of automotive applications, including interior headliners, underbody systems, instrument panels, bumper beams, air ducts, airbag housings, and engine covers. Automotive manufacturers worldwide are prioritizing fuel efficiency as regulatory agencies continue to enforce stringent limits on carbon emissions.

Meanwhile, the aerospace end-use segment is projected to experience notable growth over the forecast period, driven by the increasing use of epoxy composites in structural components of aircraft, rockets, and missiles to reduce overall weight and enhance fuel efficiency. Reduced energy consumption and lower weight also contribute to improved speed and performance of aircraft and missile systems. Carbon fiber epoxy composites are particularly favored in aerospace applications due to their superior performance attributes. Key benefits of epoxy composites in aerospace and defense include lightweight construction achieved through high specific strength and stiffness, resistance to fatigue and corrosion, a high degree of structural optimization, and low dielectric loss.

Epoxy composite Coatings Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The Asia Pacific region held the dominant position in the market. This growth is primarily attributed to the significant opportunities arising from rapidly increasing aircraft production and the ambitious capacity expansion targets set by various companies in the electrical and electronics sectors. Additionally, the emergence of countries such as the Philippines, Singapore, Indonesia, Malaysia, and Vietnam as key shipbuilding hubs is anticipated to further boost the demand for composites across the region during the forecast period.

Asia Pacific remains the largest transportation market globally, and the presence of a substantial number of automotive manufacturers, along with consistent growth in vehicle production, is expected to further accelerate regional market expansion in the coming years.

North America is also projected to experience notable growth throughout the forecast period. This can be attributed to an increasing number of air travelers, rising demand for private helicopters, and growing investments in military space programs. Space exploration efforts by NASA and private entities such as SpaceX, along with emerging space tourism initiatives, are likely to positively influence the regional epoxy composites market. Furthermore, the rising adoption of renewable energy technologies is expected to contribute to increased product demand within the region.

COVID-19 Pandemic: Impact Analysis

The sudden onset of the COVID-19 pandemic led to the enforcement of stringent lockdown measures across multiple countries, causing a temporary suspension of numerous epoxy composite manufacturing operations.

The global epoxy composites market experienced significant disruption in 2020 due to the pandemic. Government-imposed lockdowns worldwide, aimed at controlling the virus’s spread, resulted in a temporary halt of production activities during that year. This interruption adversely impacted demand across various industries, particularly in the automotive and aerospace sectors. Moreover, the restrictions on transportation contributed to widespread supply chain disruptions on a global scale.

Latest Trends/ Developments:

In March 2022, Swancor launched two innovative products, "EzCiclo" and "CleaVER," offering advanced solutions for recycling and repurposing wind turbine blades. EzCiclo is a recyclable and reusable epoxy resin system reinforced with glass or carbon fiber composites. These materials can be effectively recycled and broken down using CleaVER technology, developed in collaboration with leading industry experts.

Key Players:

These are top 10 players in the Epoxy composite Coatings Market :-

- Teijin Limited

- Gurit Holding Ag

- Ashland Global Holdings Inc.

- Hexion Inc.

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- Huntsman Corporation

- Sika Ag

- Owens Corning

- Toray Industries, Inc.

Chapter 1. Epoxy composite Coatings Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. EPOXY COMPOSITE COATINGS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. EPOXY COMPOSITE COATINGS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. EPOXY COMPOSITE COATINGS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. EPOXY COMPOSITE COATINGS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. EPOXY COMPOSITE COATINGS MARKET – By Fiber Type

6.1 Introduction/Key Findings

6.2 Glass Fiber

6.3 Carbon Fiber

6.4 Other Fiber

6.5 Y-O-Y Growth trend Analysis By Fiber Type

6.6 Absolute $ Opportunity Analysis By Fiber Type , 2025-2030

Chapter 7. EPOXY COMPOSITE COATINGS MARKET – By End-User

7.1 Introduction/Key Findings

7.2 Aerospace & Defense

7.3 Automotive & Transportation

7.4 Electrical & Electronics

7.5 Wind Energy

7.6 Sporting & Consumer Goods

7.7 Others End-use

7.8 Y-O-Y Growth trend Analysis By End-User

7.9 Absolute $ Opportunity Analysis By End-User , 2025-2030

Chapter 8. EPOXY COMPOSITE COATINGS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-User

8.1.3. By Fiber Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Fiber Type

8.2.3. By End-User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Fiber Type

8.3.3. By End-User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Fiber Type

8.4.3. By End-User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Fiber Type

8.5.3. By End-User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. EPOXY COMPOSITE COATINGS MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 Teijin Limited

9.2 Gurit Holding Ag

9.3 Ashland Global Holdings Inc.

9.4 Hexion Inc.

9.5 Hexcel Corporation

9.6 Mitsubishi Chemical Corporation

9.7 Huntsman Corporation

9.8 Sika Ag

9.9 Owens Corning

9.10 Toray Industries, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Epoxy composites are gaining widespread preference in the sports and consumer goods industries owing to their lightweight properties, superior strength, design flexibility, and ease of fabrication

The top players operating in the Epoxy composite Coatings Market are - Teijin Limited, Gurit Holding Ag and Ashland Global Holdings Inc

The sudden onset of the COVID-19 pandemic led to the enforcement of stringent lockdown measures across multiple countries, causing a temporary suspension of numerous epoxy composite manufacturing operations.

Due to their lightweight properties and high strength-to-weight ratio, epoxy composites present a viable solution for minimizing fuel consumption and reducing emissions, particularly in transportation sectors such as automotive and aerospace.

North America is the fastest-growing region in the Epoxy composite Coatings Market.