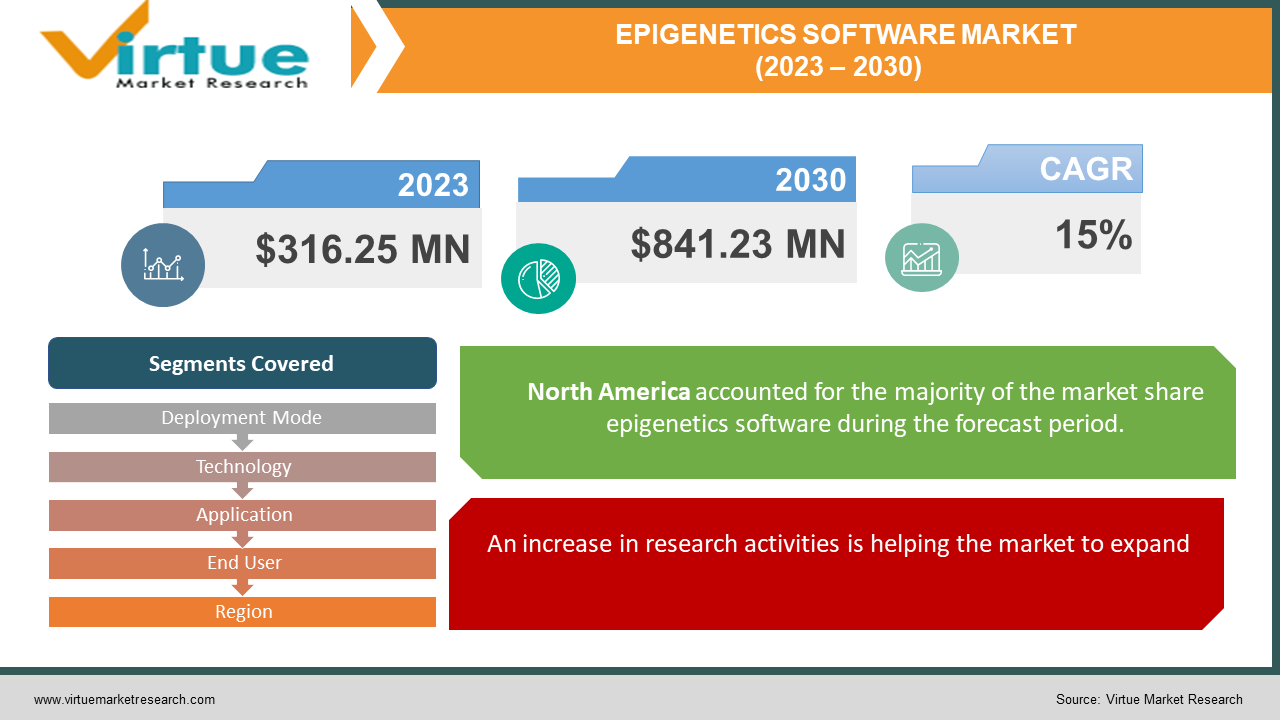

Epigenetics Software Market Size (2023 – 2030)

The Global Epigenetics Software Market is valued at USD 316.25 million in 2023 and is projected to reach a market size of USD 841.23 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15%.

DNA methylation, chromatin, and non-coding RNA are among the epigenetic resources and databases that bring epigenomics software into existence. In the past even though epigenetics was studied for its application and purpose knowledge and availability of software were confined and limited. However, this market came to light in the early 2000s. This has been experiencing steady growth in the fields of bioinformatics and genetics. This is a niche market where there is still ongoing research to determine the possibilities. In the future, with extensive research activities as well as technological advancements in AI and ML, this market will play a vital role in potential diagnosis, therapeutics, and prevention.

Key Market Insights:

Bioinformatics is predicted to grow at a CAGR of 13.8% from 2021 to 2028.

Approximately every seven months, genomic data doubles as a result of improvements in sequencing technology.

In 2020, it was anticipated that 2.5 exabytes (2.5 billion gigabytes) of biological data would be produced.

The use of bioinformatics in the field of drug discovery is expected to increase by 12% by 2026.

Over 600 reports of data breaches were filed during 2020 affecting the healthcare, bioinformatics, and other subsets of the bioinformatics industry. To tackle this, data privacy, integration with technologies, and implementation of strict access control were implemented across many sectors.

Epigenetics Software Market Drivers:

An increase in research activities is helping the market to expand.

There has been a growing interest in broadening human understanding of various software to identify the mechanism, treatment, and prevention of diseases. Cancer and diabetes are the top ones since there is no one permanent cure available. Software is extremely crucial for the understanding of various genes and sequences. They help to detect errors if any and also the exact mutation in the gene code to find a cure. Investments from the Government and other business tycoons have been helping renowned scholars delve into deeper layers. There are quite a few research papers published online where one can get a basic understanding of the new tools and the potential they hold. Apart from this, there have been various courses and specializations in biotechnology encompassing fields like oncology, neurobiology, genetics, and computational biology. This heightened interest and initiatives taken will help the market to grow significantly aiding towards analyzing as well as interpreting the complex data.

Personalized medicines and expanding clinical applications have been a boon for the market to grow.

Biological markers (biomarkers) help in analyzing and capturing all the activities that take place in a cell. This is beneficial for pre-warning serious diseases and diagnosing them in the early stage. Epigenetic biomarkers are being looked upon for diseases like cancer, neurological, and other cardiovascular diseases. There are various software assigned for each biomarker and the disease. They help in diagnosing, classifying, and curating specialized plans for an individual. This will be one of the biggest milestones. The concept of personalized medicines which involves finding the drug targets and suitable drugs for the same is rapidly emerging. More and more youngsters are keen on pursuing research activities in these areas which is helping this market to progress.

Epigenetics Software Market Restraints and Challenges:

Limited understanding, data complexity, pricing, and ethical & and privacy concerns are the main issues that are currently faced by the market.

Epigenetics is a field that has less awareness and expertise which can be a major hindrance. Even though there are research papers available, it has insufficient information. A deeper understanding of the process and software is vital for the market to develop. Secondly, the data available is again insufficient and very complex. It can be very challenging for scientists to comprehend the data and find suitable software for the same. Thirdly, the software is associated with huge costs. Moreover, installation, maintenance, and upgrades need constant attention which can drain the firms. Ensuring the secrecy of all the data is very difficult and may lead to misuse and the creation of new pathogens.

Epigenetics Software Market Opportunities:

Cloud-based solutions and integration of computer science which includes artificial intelligence, machine learning, data analytics, and other predictive analysis tools are predicted to provide the market with an ample number of opportunities. R&D developments targeting drug sites, biochemical reactions, and other markers are being prioritized. Training and workshops will help in gaining enthusiastic minds to focus on specific problems and finding reliable solutions. Moreover, startups are helping by focusing on the concept of personalized medicine for particular diseases.

EPIGENETICS SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Deployment Mode, Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc, Qiagen N.V., BGI Genomics, Zymo Research, Active Motif, Agilent Technologies, EpigenDx, Bio-Rad Laboratories, Thermo Fisher Scientific, Bioinformatics Solutions Inc. |

Epigenetics Software Market Segmentation: By Deployment Mode

-

Cloud-based

-

On Premises

Based on deployment mode, the cloud-based segment is the largest and fastest-growing holding a share exceeding 70%. This is due to accessibility, scalability, cost-effectiveness, advanced features, data security, easier maintenance, and efficient performance. This makes it an apt choice to be employed in small-scale and other large-scale organizations.

Epigenetics Software Market Segmentation: By Technology

-

DNA Methylation

-

Histone Modification

-

Others

Based on technology, DNA methylation is the largest segment in the market. This is due to interest in the research of this topic, epigenetic regulations, data availability, technological breakthroughs, disease association, and their help in developing personalized medicines. This holds a total share of around 40%. Histone modification is the fastest growing because of its role in gene silencing, transcriptions, involvement of enzymes, DNA replication, DNA repair, epigenomic profiling, and the availability of specialized software and data. This holds a total share of around 25% in this market.

Epigenetics Software Market Segmentation: By Application

-

Oncology

-

Solid Tumors

-

Liquid Tumors

-

-

Non-oncology

-

Metabolic Diseases

-

Developmental Biology

-

Immunology

-

Cardiovascular Diseases

-

Others

-

Based on application, the oncology segment is the largest growing. This is due to change in lifestyle and habits which has in turn increased the number of cancer patients, piqued interest amongst researchers and the younger generation, launches of various technologies, and the presence of various investors coupled with Governmental initiatives. Non-oncology is the fastest growing due to growing interest in finding suitable markers for various neurological disorders like Parkinson's', Alzheimer's, and other neurogenerative diseases. The cardiovascular segment is also one of the profitable categories owing to the rising cases of heart-related diseases and R&D activities.

Epigenetics Software Market Segmentation: By End User

-

Research Laboratories and Academic Institutes

-

Pharmaceutical and Biotechnology Companies

-

Contract Research Organizations (CROs)

-

Hospitals and Diagnostic Centers

Based on end users, pharmaceutical and biotechnology companies are the largest growing in this market. They are estimated to hold a share of around 37%. The dominance is due to the increasing need and demand to develop new drug formulations for diseases that have no cure. Moreover, research activities carried out are very much advanced and are backed up by generous investments. These companies will have easier access to different technologies and research publications. Furthermore, the emergence of various startups focusing on molecular and drug research is contributing to the success. However, research laboratories and academic institutes are the fastest growing owing to Governmental support, the presence of prodigies, elaborative research activities, and increasing interest of young minds to join these organizations to deepen human understanding. They hold a share of around 27%.

Epigenetics Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, North America is the largest growing in this market. This is due to the technological advancements, presence of key companies, increasing number of patients with various disorders and diseases, research activities, funds, and economic developments. This region is estimated to hold a share of around 38%. Asia Pacific is the fastest growing holding a share of around 21%. This is because of easing investments, growing research focus, improving economies, emerging startups and other bigger firms, increasing number of biotechnological establishments, and demand towards personalized medicine concept. Countries like Japan, China, and Singapore are at the forefront.

COVID-19 Impact Analysis on the Global Epigenetics Software Market:

The outbreak of the virus had a positive impact on the market. There was an increase in research activities for studying the mechanism of the virus and developing suitable vaccines for the same. The role of epigenetics in preventing the infection was given importance. Software tools help in analyzing the different sets of data. Drug repurposing effects, suitable biomarkers, and other potential treatments were studied with the aid of different epigenetics software. Various research institutes presented their findings through online conferences and other prestigious journals during the pandemic. In a survey conducted by the Careers Research and Advisory Centre in February-March 2021, 27% agreed COVID-19 had provided unexpected opportunities for their research.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance the existing technology and find better ones. This has also led to greater enlargement.

Multiomics is a novel strategy that combines the data sets from many omic groupings for analysis. Software that is integrated with multi-omics is expected to help the market by providing an understanding of concepts in a better way. Furthermore, software technology focusing on gene editing and other tools is propelling the market.

Key Players:

-

Illumina, Inc

-

Qiagen N.V.

-

BGI Genomics

-

Zymo Research

-

Active Motif

-

Agilent Technologies

-

EpigenDx

-

Bio-Rad Laboratories

-

Thermo Fisher Scientific

-

Bioinformatics Solutions Inc.

In August 2023, FOXO and DataRobot partnered for AI-based epigenetic biomarker research. FOXO utilized the predictive AI’s capabilities and high-throughput automation to predict factors related to human longevity using epigenetic biomarkers.

In July 2022, a report published that three startups that is Chroma Medicine, Tune Therapeutics, and Epic Bio merged with plans to use CRISPR tools to alter gene expression without changing DNA. Epic Bio specifically targeted two forms of genetic vision loss, an inherited disease that causes high cholesterol, a liver disorder called alpha-1 antitrypsin deficiency, and a type of muscular dystrophy.

In March 2021, an international team of scientists published a study demonstrating the beneficial effects of a particular group of chemical compounds on the epigenetic landscape in a specific and aggressive type of cancer using a wide range of biochemical tests and sequencing techniques,

Chapter 1. Epigenetics Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Epigenetics Software Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Epigenetics Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Epigenetics Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Epigenetics Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Epigenetics Software Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On Premises

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2023-2030

Chapter 7. Epigenetics Software Market – By Technology

7.1 Introduction/Key Findings

7.2 DNA Methylation

7.3 Histone Modification

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2023-2030

Chapter 8. Epigenetics Software Market – By Application

8.1 Introduction/Key Findings

8.2 Oncology

8.3 Solid Tumors

8.4 Liquid Tumors

8.5 Non-oncology

8.6 Metabolic Diseases

8.7 Developmental Biology

8.8 Immunology

8.9 Cardiovascular Diseases

8.10 Others

8.11 Y-O-Y Growth trend Analysis By Application

8.12 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Epigenetics Software Market – By End User

9.1 Introduction/Key Findings

9.2 Research Laboratories and Academic Institutes

9.3 Pharmaceutical and Biotechnology Companies

9.4 Contract Research Organizations (CROs)

9.5 Hospitals and Diagnostic Centers

9.6 Y-O-Y Growth trend Analysis By End User

9.7 Absolute $ Opportunity Analysis By End User, 2023-2030

Chapter 10. Epigenetics Software Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Mode

10.1.2.1 By Technology

10.1.3 By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Mode

10.2.3 By Technology

10.2.4 By Application

10.2.5 By By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Mode

10.3.3 By Technology

10.3.4 By Application

10.3.5 By By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Mode

10.4.3 By Technology

10.4.4 By Application

10.4.5 By By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Mode

10.5.3 By Technology

10.5.4 By Application

10.5.5 By By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Epigenetics Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Illumina, Inc

11.2 Qiagen N.V.

11.3 BGI Genomics

11.4 Zymo Research

11.5 Active Motif

11.6 Agilent Technologies

11.7 EpigenDx

11.8 Bio-Rad Laboratories

11.9 Thermo Fisher Scientific

11.10 Bioinformatics Solutions Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Epigenetics Software Market was valued at USD 275 million and is projected to reach a market size of USD 841.23 million by the end of 2030.

An increase in research activities and personalized medicines as well as expanding clinical applications are propelling the Global Epigenetics Software Market.

Based on End User, the Global Epigenetics Software Market is segmented into Research Laboratories and Academic Institutes, Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs), and Hospitals and Diagnostic Centers.

North America is the most dominant region for the Global Epigenetics Software Market.

Illumina, Inc., Qiagen N.V., and BGI Genomics are the key players operating in the Global Epigenetics Software Market.