Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Size (2024 – 2030)

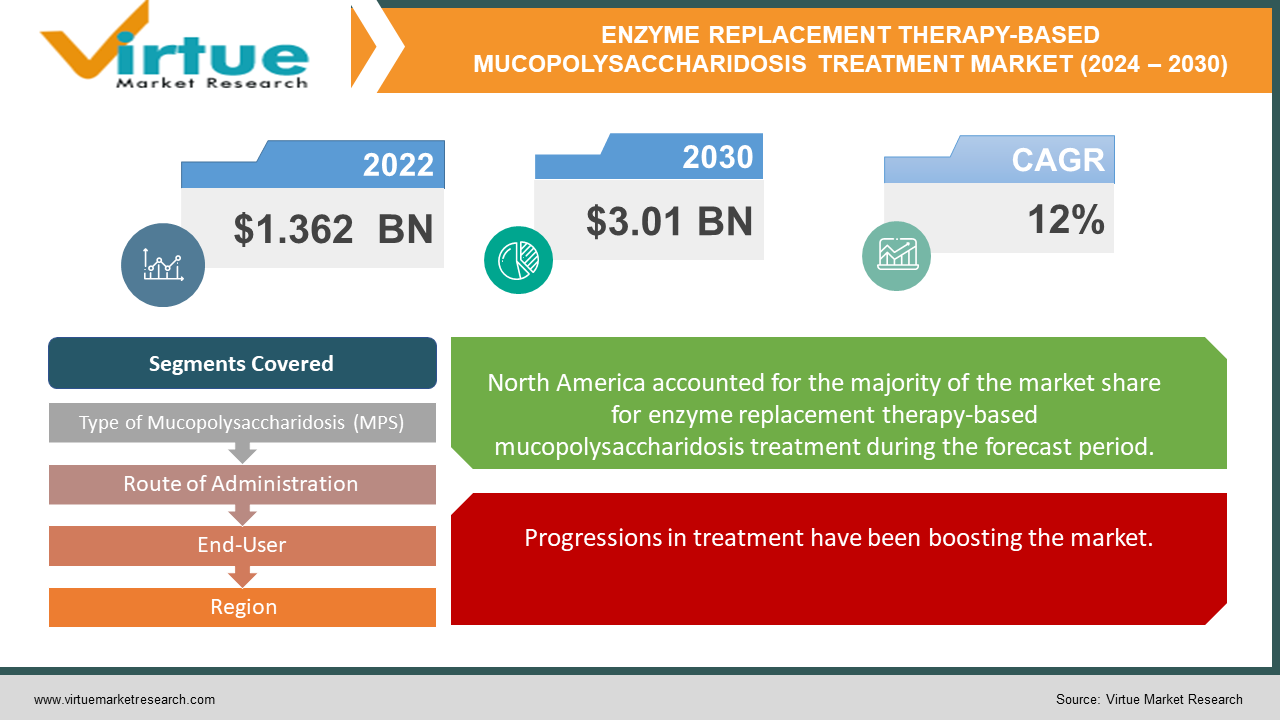

The market for global enzyme replacement therapy-based mucopolysaccharidosis treatment was estimated to be worth USD 1.362 billion in 2023 and is expected to increase to USD 3.01 billion by 2030, with a projected compound annual growth rate (CAGR) of 12% from 2024 to 2030.

Mucopolysaccharidoses (MPS) are treated with enzyme replacement therapy (ERT), which entails periodically injecting certain enzymes intravenously. For MPS I, II, IVA, VI, and VII, ERT is offered. Reducing the buildup of glycosaminoglycan (GAG), enhancing growth, and enhancing organomegaly are the objectives of ERT. By increasing the body's production of the missing enzyme, ERT delays the course of MPS. It can enhance pulmonary function, endurance, and walking capacity.

Key Market Insights:

Diagnosis rates for MPS disorders have risen by 15% globally, leading to increased patient identification and treatment initiation. With a compound yearly growth rate (CAGR) of 7.2%, the ERT market, which was valued at $10 billion in 2023, is projected to expand to $18.6 billion in 2032. The number of approved ERT products for MPS treatment has increased by 25% over the past five years, providing patients with a wider range of therapeutic options. Despite advancements, 30% of MPS patients in low- and middle-income countries still lack access to ERT due to affordability issues and limited healthcare infrastructure. Implementing government-funded subsidy programs and fostering partnerships with pharmaceutical companies can help improve affordability and expand access to ERT for underserved populations.

Global Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Drivers:

Progressions in treatment have been boosting the market.

Headways in treatment innovation drive development inside the worldwide enzyme replacement therapy-based mucopolysaccharidosis treatment market. Breakthroughs in chemical substitution treatments, such as improved protein definitions and a focus on conveyance frameworks, move forward treatment adequacy and persistent results. These innovative progressions empower more exact dosing, delayed protein movement, and decreased treatment burden, thus improving the quality of life for MPS patients and driving market development.

Rising mindfulness is contributing to the success.

Expanding mindfulness and determination rates serve as key drivers of development within the market. Endeavors by healthcare organizations, backing groups, and instructive campaigns have driven increased mindfulness of MPS disarrays among healthcare experts and the general public. As a result, more patients are being analyzed early, leading to the convenient start of ERT-based medicines and driving market requests.

Extending administrative support has been creating an upsurge.

Administrative organizations around the world are progressively recognizing the security and adequacy of ERT items for MPS disarrays, driving quickened endorsement forms and broader market reach. The developing number of affirmed treatments cultivates competition, invigorates development, and extends treatment choices for MPS patients, driving market extension.

Global Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Restraints and Challenges:

High costs and logistical challenges pose barriers to the market.

Reasonableness and openness are noteworthy. The tall fetching of ERT items places a considerable monetary burden on patients and healthcare frameworks, especially in locales with restricted assets and protection scope. Furthermore, calculated challenges such as dissemination systems and healthcare frameworks lack advanced block get to ERT for MPS patients in inaccessible or underserved zones, compounding aberrations in treatment accessibility and results.

Constrained treatment choices create hindrances.

Constrained treatment choices for particular Mucopolysaccharidosis (MPS) subtypes pose challenges in the market. Whereas ERT has illustrated viability in overseeing certain MPS disarrangements, counting MPS I, II, IV, and VI, treatment choices stay constrained for MPS III and other uncommon subtypes. The complex pathophysiology and special characteristics of this clutter display impediments to creating viable ERT-based treatments, clearing outpatients with few practical treatment options, and underscoring the requirement for further investigation and advancement in this zone.

Managing resistant reactions can be challenging.

Resistant reactions and treatment resilience issues show challenges within the worldwide enzyme replacement therapy-based mucopolysaccharidosis treatment market. A few MPS patients may create resistant responses, counting counteracting agent arrangements, infusion-related responses, or touchiness reactions, which can compromise treatment adequacy and security. Moreover, long-term resilience to ERT may reduce over time, requiring dosage alterations, interchange of treatment methodologies, or the investigation of novel immunomodulatory approaches to moderate immune-related challenges and optimize helpful results.

Global Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Opportunities:

Advancements in R&D pave the way for enhanced treatment efficacy and patient outcomes.

Investigate and improvement progressions show noteworthy openings inside the worldwide enzyme replacement therapy-based mucopolysaccharidosis treatment market. Progressing endeavors to upgrade chemical definitions, optimize conveyance frameworks, and create novel helpful modalities hold a guarantee for making strides in treatment adequacy, persistent results, and treatment tolerability. Collaborative associations between the scholarly world, pharmaceutical companies, and biotechnology firms drive development, quickening the interpretation of logical revelations into clinically important treatments for MPS patients and making modern roads for market development.

Global expansion provides the market with many possibilities.

The development of market reach into underserved districts and developing markets offers considerable openings. With the expanding mindfulness of MPS disarrays and administrative endorsements for ERT items, there's a developing request for open and reasonable treatment choices in locales with already constrained get-to. Key activities such as market development programs, administrative harmonization endeavors, and quiet backing campaigns encourage market passage, cultivate evenhanded access to ERT-based treatments, and drive market development.

Personalized medication approaches are elevating demand.

Progresses in the accuracy of medication, pharmacogenomics, and biomarker distinguishing proof empower custom-fitted treatment procedures that account for a person's persistent characteristics, malady seriousness, and treatment reaction inconstancy. By leveraging hereditary profiling, symptomatic biomarkers, and prescient modeling strategies, healthcare suppliers can optimize treatment determination, dosing regimens, and helpful results, in this manner upgrading understanding of care and cultivating market extension.

ENZYME REPLACEMENT THERAPY-BASED MUCOPOLYSACCHARIDOSIS TREATMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Type of Mucopolysaccharidosis (MPS), Route of Administration, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BioMarin Pharmaceutical Inc., Shire (a subsidiary of Takeda Pharmaceutical Company Limited), Sanofi Genzyme, Ultragenyx Pharmaceutical Inc., Sangamo Therapeutics, Inc., Denali Therapeutics, Inc., Regenxbio Inc., JCR Pharmaceuticals Co., Ltd., Abeona Therapeutics Inc., Lysogene S.A., Esteve Pharmaceuticals, S.A., Denovo Biopharma LLC. |

Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Segmentation: By Type of Mucopolysaccharidosis (MPS)

-

MPS I (Hurler syndrome, Hurler-Scheie syndrome, Scheie syndrome)

-

MPS II (Hunter syndrome)

-

MPS III (Sanfilippo syndrome)

-

MPS IV (Morquio syndrome)

-

MPS VI (Maroteaux-Lamy syndrome)

-

MPS VII (Sly syndrome)

MPS II is the largest growing segment. Seeker disorder is an X-linked latent clutter characterized by insufficiency of the protein iduronate-2-sulfatase, driving the collection of glycosaminoglycans (Chokes) in different tissues and organs. The seriousness of Seeker disorder shifts broadly, extending from mellow to serious shapes, with indications regularly showing in early childhood. Due to its X-linked legacy design, seeker disorder overwhelmingly influences guys, even though uncommon cases of influenced females have been detailed. The complex clinical introduction of Seeker disorder, enveloping skeletal anomalies, organomegaly, cognitive impedance, and dynamic neurological weakening, underscores the basic requirement for compelling treatment alternatives. ERT with idursulfase has risen as a foundation for overseeing Seeker disorder, advertising symptomatic alleviation, making strides in organ work, and upgrading the quality of life for influenced people. The accessibility of ERT has revolutionized the treatment scene for Seeker disorder, giving trust to patients and families influenced by this uncommon hereditary clutter. Continuous inquiries about endeavors pointed at optimizing ERT conveyance, tending to resistant reactions, and investigating novel restorative modalities hold a guarantee for encouraging progressing results in people with Seeker disorder. MPS II is the fastest-growing segment. Within the market for mucopolysaccharidosis treatments based on enzyme replacement therapy (ERT), MPS IV (Morquio syndrome) has a great deal of room to grow quickly. There are significant unmet medical needs related to this syndrome, which is marked by severe skeletal abnormalities and increasing systemic symptoms. The need for efficient therapies to reduce symptoms and enhance patients' quality of life is rising as a result of improvements in treatment options and rising awareness of the illness. With ERT treatments specifically designed for MPS IV already on the market and continuous research and development efforts to improve treatment efficacy and increase therapeutic alternatives, MPS IV is positioned to flourish as a potential market in the years to come.

Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Segmentation: By Route of Administration

-

Intravenous (IV)

-

Subcutaneous (SC)

IV is the largest growing segment. The intravenous organization permits the coordinated and fast conveyance of restorative chemicals into the circulatory system, guaranteeing productive systemic dissemination and maximal bioavailability. This route offers precise dosing control, permitting healthcare providers to manage the precise dose required to realize restorative adequacy. Additionally, IV implantation of ERT empowers maintained chemical movement over an amplified term, driving the persistent clearance of gathered glycosaminoglycans (GAGs) within tissues and organs influenced by MPS. Moreover, IV organization encourages the conveyance of higher-atomic-weight proteins and biologics, which will not be appropriate for subcutaneous retention. SC is the fastest-growing category since it offers comfort and decreased healthcare asset utilization. Intravenous mixture remains the favored course for ERT conveyance in MPS treatment, giving ideal restorative results and making strides in the quality of life for patients with MPS clutter.

Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Segmentation: By End-User

-

Hospitals

-

Specialty Clinics

-

Others

Hospitals are the largest and fastest-growing end-users. The main facilities for the diagnosis, treatment, and management of complicated illnesses like mucopolysaccharidosis (MPS) are hospitals. Their patients with MPS can receive comprehensive care from them due to their infrastructure, knowledge, and resources, which include access to specialist medical personnel, diagnostic facilities, and treatment methods. Owing to the severity and complexity of MPS, hospitals are the ideal setting for handling these disorders since patients frequently need multidisciplinary care involving professionals from other medical specialties.

Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The market for enzyme replacement therapy (ERT)-based mucopolysaccharidosis treatment is dominated by North America because of the region's high healthcare spending, sophisticated healthcare infrastructure, and active R&D. Furthermore, North America frequently sets the standard for the early acceptance of cutting-edge treatments and the accessibility of medical resources for the treatment of uncommon illnesses like mucopolysaccharidosis (MPS). On the other hand, the market for ERT-based MPS treatment is frequently expanding at the fastest rate in the Asia-Pacific area. This quick expansion is caused by several variables, such as growing knowledge and diagnosis of MPS, bettering healthcare systems, rising disposable incomes, and expanding access to healthcare in the region's burgeoning countries. Additionally, pharmaceutical firms are concentrating more on growing their footprints in the Asia-Pacific area.

COVID-19 Impact Analysis on the Global Enzyme Replacement Therapy-based Mucopolysaccharidosis Treatment Market:

The COVID-19 has had a multifaceted effect on the market. At first, disturbances to healthcare administrations, counting demonstrative testing, elective methods, and understanding meetings drove delays in MPS determination and treatment start. Also, calculated challenges such as supply chain disturbances and transportation confinements hampered the accessibility and conveyance of ERT items, influencing the understanding of get-to and treatment coherence. Besides, financial vulnerabilities and healthcare asset reallocations provoked by the widespread strained healthcare budgets and repayment approaches may restrict persistent reasonableness and market development. In any case, amid these challenges, the widespread use underscores the significance of telemedicine, inaccessible checking, and advanced well-being arrangements in guaranteeing a proper understanding of care and treatment adherence. Looking ahead, as the world moves into post-pandemic time, progressing immunization endeavors, recuperation in healthcare frameworks, and a recharged center on uncommon illness administration are anticipated to drive market recuperation and quicken development inside the ERT-based MPS treatment market.

Latest Trends/ Developments:

The market is seeing a few outstanding patterns and advancements forming its direction. One noteworthy slant is the development of quality treatment as a promising and helpful approach for MPS clutter, advertising the potential for long-term illness adjustment by tending to the basic hereditary cause. Furthermore, headways in sedate conveyance advances, such as sustained-release details and focused conveyance frameworks, are improving the adequacy and comfort of ERT organizations, progressing persistent adherence and treatment results. Besides, the expanding focus on the exactness of pharmaceutical and personalized treatment approaches is driving the advancement of custom-made treatments that consider a person's understanding of characteristics, malady seriousness, and treatment reaction inconstancy. Besides, the developing emphasis on patient-centric care and all-encompassing administration procedures is inciting the integration of steady administrations, including hereditary counseling, psychosocial support, and multidisciplinary care coordination, into MPS treatment conventions. These patterns emphasize the energetic nature of the ERT-based MPS treatment market and highlight the industry's commitment to development, patient-centric care, and moving forward results for people influenced by MPS disarray.

Key Players:

-

BioMarin Pharmaceutical Inc.

-

Shire (a subsidiary of Takeda Pharmaceutical Company Limited)

-

Sanofi Genzyme

-

Ultragenyx Pharmaceutical Inc.

-

Sangamo Therapeutics, Inc.

-

Denali Therapeutics, Inc.

-

Regenxbio Inc.

-

JCR Pharmaceuticals Co., Ltd.

-

Abeona Therapeutics Inc.

-

Lysogene S.A.

-

Esteve Pharmaceuticals, S.A.

-

Denovo Biopharma LLC.

Chapter 1. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – By Type of Mucopolysaccharidosis (MPS)

6.1 Introduction/Key Findings

6.2 MPS I (Hurler syndrome, Hurler-Scheie syndrome, Scheie syndrome)

6.3 MPS II (Hunter syndrome)

6.4 MPS III (Sanfilippo syndrome)

6.5 MPS IV (Morquio syndrome)

6.6 MPS VI (Maroteaux-Lamy syndrome)

6.7 MPS VII (Sly syndrome)

6.8 Y-O-Y Growth trend Analysis By Type of Mucopolysaccharidosis (MPS)

6.9 Absolute $ Opportunity Analysis By Type of Mucopolysaccharidosis (MPS), 2024-2030

Chapter 7. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – By Route of Administration

7.1 Introduction/Key Findings

7.2 Intravenous (IV)

7.3 Subcutaneous (SC)

7.4 Y-O-Y Growth trend Analysis By Route of Administration

7.5 Absolute $ Opportunity Analysis By Route of Administration, 2024-2030

Chapter 8. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Specialty Clinics

8.4 Others

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Mucopolysaccharidosis (MPS)

9.1.3 By Route of Administration

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Mucopolysaccharidosis (MPS)

9.2.3 By Route of Administration

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Mucopolysaccharidosis (MPS)

9.3.3 By Route of Administration

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Mucopolysaccharidosis (MPS)

9.4.3 By Route of Administration

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Mucopolysaccharidosis (MPS)

9.5.3 By Route of Administration

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Enzyme Replacement Therapy-Based Mucopolysaccharidosis Treatment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BioMarin Pharmaceutical Inc.

10.2 Shire (a subsidiary of Takeda Pharmaceutical Company Limited)

10.3 Sanofi Genzyme

10.4 Ultragenyx Pharmaceutical Inc.

10.5 Sangamo Therapeutics, Inc.

10.6 Denali Therapeutics, Inc.

10.7 Regenxbio Inc.

10.8 JCR Pharmaceuticals Co., Ltd.

10.9 Abeona Therapeutics Inc.

10.10 Lysogene S.A.

10.11 Esteve Pharmaceuticals, S.A.

10.12 Denovo Biopharma LLC.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for global enzyme replacement therapy-based mucopolysaccharidosis treatment was estimated to be worth USD 1.362 billion in 2023 and is expected to increase to USD 3.01 billion by 2030, with a projected compound annual growth rate (CAGR) of 12% from 2024 to 2030.

The essential drivers of the enzyme replacement therapy-based mucopolysaccharidosis treatment market are progressions in treatment, expanding mindfulness, and growing administrative endorsements for ERT items.

The key challenges confronting the global enzyme replacement therapy-based mucopolysaccharidosis treatment market are high costs, logistical challenges, constrained treatment choices, and managing resistant reactions.

In 2023, North America held the largest share of the global enzyme replacement therapy-based mucopolysaccharidosis treatment market.

BioMarin Pharmaceutical Inc., Shire, Sanofi Genzyme, Ultragenyx Pharmaceutical Inc., Sangamo Therapeutics, Inc., Denali Therapeutics Inc., Regenxbio Inc., JCR Pharmaceuticals Co., Ltd., Abeona Therapeutics Inc., Lysogene S.A., Esteve Pharmaceuticals, S.A., and Denovo Biopharma LLC. are the main players.