Environmental Remediation Market Size ((2024-2023)

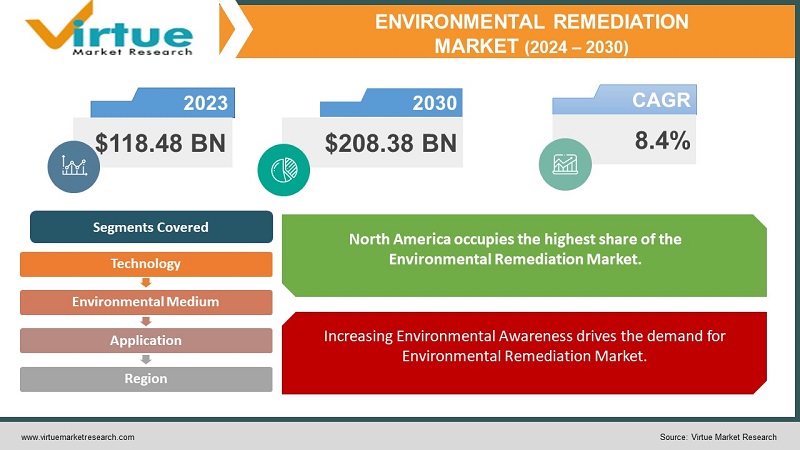

The Global Environmental Remediation Market was valued at USD 118.48 billion and is projected to reach a market size of USD 208.38 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.4%.

The environmental remediation market focuses on addressing and mitigating environmental pollution and contamination. This market includes various technologies, services, and products designed to clean up or manage polluted sites, restore ecosystems, and protect human health. The Environmental Remediation Market is expected to grow significantly in the coming years due to increasing environmental awareness and technological advancements. The major well-established key players in the Environmental Remediation Market are Clean Harbors, AECOM, Veolia Environment, Golder Associates, and Tetra Tech.

Key Market Insights:

Environmental remediation involves various methods such as soil vapor extraction, pump and treat systems, bioremediation, thermal treatment, and more. Environmental remediation is applied across industrial, commercial, residential, and government sites. Some common applications include brownfield redevelopment, industrial site cleanup, and restoration of contaminated water bodies. Regulatory compliance, increasing environmental awareness, technological advancements, government initiatives, growing industrial activities, economic incentives for brownfield redevelopment, rising demand for sustainable practices, expanding urbanization, and heightened focus on water resource management are propelling the Environmental Remediation Market. The restraints to the Environmental Remediation Market include cost constraints, complexity of contaminants, liability issues, and emerging pollutants. North America occupies the highest share of the Environmental Remediation Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Environmental Remediation Market Drivers:

Increasing Environmental Awareness drives the demand for Environmental Remediation Market.

Growing awareness of environmental issues has led to increased demand for sustainable and eco-friendly practices. Growing concern about environmental issues among the general public, businesses, and policymakers contributes significantly to the demand for environmental remediation. The communities are becoming more conscious of the impact of pollution on ecosystems, air and water quality, and human health. This increases the adoption of sustainable and responsible practices.The heightened awareness creates pressure on industries to adopt environmentally friendly practices. Businesses that commit to environmental responsibility can enhance their public image and brand reputation. There is an increased willingness to invest in remediation projects and sustainable technologies. This drives innovation and growth in the environmental remediation market. Public support for environmental initiatives also leads to the allocation of government funds for remediation projects and the development of more environmental policies.

Regulatory Compliance is Propelling the Environmental Remediation Market.

Stringent environmental regulations and compliance standards by government bodies worldwide play a pivotal role in driving the environmental remediation market. Governments establish laws to ensure the protection of ecosystems, public health, and natural resources. Companies operating in various industries must comply with these regulations. This mandates the cleanup of contaminated sites and waste management practices. The need for companies to adhere to environmental laws creates a high demand for environmental remediation services. Compliance-driven activities include the assessment, cleanup, and monitoring of polluted sites. This drives the growth of the market. Companies that fail to meet regulatory standards face penalties, legal action, or damage to their reputation. This further incentivizes them to invest in remediation solutions.

Environmental Remediation Market Restraints and Challenges

The major challenge faced by the Environmental Remediation Market is the cost and funding constraints. Environmental remediation projects involve substantial costs associated with site assessment, cleanup technologies, and ongoing monitoring. Limited financial resources hinder the ability of governments, businesses, or responsible parties to fund comprehensive remediation efforts. This leads to delays or incomplete cleanup, especially in cases where the responsible parties are unable or unwilling to cover the expenses. Another challenge is the diversity and complexity of contaminants at polluted sites. Some contaminants may be resistant to traditional cleanup methods. The coexistence of multiple contaminants further complicates the remediation process. The other restraints to the Environmental Remediation Market include long-term monitoring, liability issues, public opposition, and emerging pollutants.

Environmental Remediation Market Opportunities:

The Environmental Remediation Market has various opportunities in the market. The continuous development and adoption of innovative technologies, such as nanotechnology, machine learning, and robotics present a significant opportunity for the environmental remediation market. This offers more efficient and targeted solutions for cleaning up contaminated sites. Companies that invest and adopt these cutting-edge technologies may gain a competitive edge and contribute to the industry's growth. Other Opportunities in the market include increasing emphasis on sustainable practices, government incentives, brownfield redevelopment opportunities, and a growing market for water resource management

ENVIRONMENTAL REMEDIATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

8.4% |

|

|

Segments Covered |

By Technology, environmental medium, application, and Region |

|

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

|

Key Companies Profiled |

|

Environmental Remediation Market Segmentation

Environmental Remediation Market Segmentation: By Technology:

- Soil Vapor Extraction

- Pump and Treat Systems

- Bioremediation

- Thermal Treatment

- Chemical Treatment

- Others

In 2023, based on market segmentation by Technology, Pump and Treat Systems occupy the highest share of the Environmental Remediation Market. This is due to the global widespread groundwater pollution issue. Pump and treat systems are commonly applied to manage and treat large volumes of contaminated groundwater.

However, Bioremediation is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 10%. This is due to its eco-friendly and sustainable nature. As environmental awareness increases, there is a growing emphasis on green and sustainable solutions. Advancements in biotechnologies and the exploration of microbial solutions contribute to the rapid growth of this segment.

Environmental Remediation Market Segmentation: By Environmental Medium:

- Soil Remediation

- Water Remediation

- Air Remediation

In 2023, based on market segmentation by Environmental Medium, the Water Remediation segment occupies the highest share of the Environmental Remediation Market. This is mainly due to the growing contamination of water sources, whether from industrial discharges, agricultural runoff, or other sources. Consequently, the demand for water remediation technologies and services is significant.

However, the Air Remediation is the fastest-growing segment during the forecast period. This is mainly due to the increasing focus on air quality and the recognition of air pollution as a major environmental and public health concern. The demand for air remediation technologies has the potential to experience rapid growth. Technologies addressing volatile organic compounds (VOCs) and air pollutants from industrial processes also contribute to the growth of this segment.

Environmental Remediation Market Segmentation: By Application:

- Industrial Sites

- Commercial Sites

- Residential Sites

- Government and Municipal Sites

In 2023, based on market segmentation by Application, the Industrial sites segment occupies the highest share of the Environmental Remediation Market. This is mainly due to a significant amount of hazardous waste and contaminants due to manufacturing processes and other industrial activities. The need for environmental remediation services is typically high in industrial areas. Cleanup efforts involve addressing soil and groundwater contamination, air emissions, and other environmental hazards associated with industrial operations.

However, the Residential Sites are the fastest-growing segment during the forecast period. This is mainly due to the increasing awareness of environmental health risks and a growing focus on community well-being. Residential areas are affected by historical contamination, such as from underground storage tanks or improper waste disposal. As public awareness grows, there is an increasing demand for remediation services in residential communities.

Environmental Remediation Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Environmental Remediation Market. It has a market share of 45%. This growth is due to a well-established regulatory framework, a history of industrial activities, and a high level of environmental awareness. North America is a technologically advanced region with a focus on addressing contamination from various sources, including manufacturing, mining, and urban development. Nations like the U.S. and Canada have higher growth rates.

Europe has a significant market share of environmental remediation services due to a well-established regulatory framework for environmental protection.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to rapid industrialization, urbanization, and increasing awareness of environmental issues.

Countries like China, India, and Japan, have significant market share due to the increasing need for cleanup efforts and sustainable practices.

COVID-19 Impact Analysis on the Global Environmental Remediation Market:

The COVID-19 pandemic had a significant impact on the Environmental Remediation Market. There were lockdowns and other safety restrictions. The pandemic disrupted global supply chains. This impacted the availability of equipment, materials, and technologies necessary for environmental remediation projects. The pandemic also delayed or canceled many environmental remediation projects. The pandemic accelerated the adoption of digital technologies for remote monitoring, data analysis, and project management within the environmental remediation sector. Thus, the pandemic accelerated certain trends in the Environmental Remediation Market.

Latest Trends/ Developments:

One of the developments, in the Environmental Remediation Market is the rise of integration of artificial intelligence (AI), robotics, and machine learning (ML) capabilities. There has been a trend towards adopting advanced technologies. Growing emphasis on sustainable practices has led to the development and adoption of eco-friendly and green remediation approaches. There has been a trend toward the integration of smart monitoring systems and sensor technologies for real-time data collection and analysis. This allows for more effective and adaptive remediation strategies. Bioremediation innovations, circular economy practices, community engagement, climate change considerations, and policy developments are other key trends in the environmental remediation sector.

Key Players:

- Clean Harbors, Inc.

- AECOM

- Veolia Environment S.A.

- Golder Associates

- Tetra Tech, Inc.

- Bechtel Corporation

- Jacobs Engineering Group Inc. (formerly CH2M HILL)

- ARCADIS N.V.

- TRC Companies, Inc.

- Intertek Group plc

Market News:

- In 2023, UK startup Salinity Solutions introduced its SAM50 system, utilizing Sealed Loop Reverse Osmosis Technology. The system recirculates feedwater for higher recovery in a compact design and features a patented energy-efficient pressure exchange process. Salinity Solutions' technology benefits industrial applications, such as water reuse and mineral extraction. A successful trial collaboration with Cornish Lithium demonstrated the system's efficacy in concentrating lithium from geothermal waters.

- In 2023, Canada's AITera announced the use of AI for soil and groundwater decontamination. Their tool analyzes vast databases for treatment methods, employing NLP to tailor solutions. AITera's approach reduces risks, delays, and costs for environmental remediation experts.

- In 2023, Turkish startup Inovista announced the usage of activated carbon from biomass for eco-friendly air purification. Their technology enhances processes like vapor and solvent recovery, odor control, and biogas purification, benefitting both industries and communities aiming for improved air quality solutions.

- In 2023, Indian startup NatureDot introduced AquaNurch, an AI-powered system that uses IoT and geospatial analysis to monitor water parameters for comprehensive ecological analysis. It aids environmental agencies, fisheries, and decision-makers in preserving water health, ensuring food security, and forecasting climate scenarios.

Chapter 1. GLOBAL ENVIRONMENTAL REMEDIATION MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ENVIRONMENTAL REMEDIATION MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ENVIRONMENTAL REMEDIATION MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ENVIRONMENTAL REMEDIATION MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL ENVIRONMENTAL REMEDIATION MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ENVIRONMENTAL REMEDIATION MARKET– BY APPLICATION

6.1. Introduction/Key Findings

6.2. Industrial Sites

6.3. Commercial Sites

6.4. Residential Sites

6.5. Government and Municipal Sites

6.6. Y-O-Y Growth trend Analysis By Application

6.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. GLOBAL ENVIRONMENTAL REMEDIATION MARKET– BY ENVIRONMENTAL MEDIUM

7.1. Introduction/Key Findings

7.2. Soil Remediation

7.3. Water Remediation

7.4. Air Remediation

7.5. Y-O-Y Growth trend Analysis By ENVIRONMENTAL MEDIUM

7.6. Absolute $ Opportunity Analysis By ENVIRONMENTAL MEDIUM , 2024-2030

Chapter 8. GLOBAL ENVIRONMENTAL REMEDIATION MARKET– BY Technology

8.1. Introduction/Key Findings

8.2. Soil Vapor Extraction

8.3. Pump and Treat Systems

8.4. Bioremediation

8.5. Thermal Treatment

8.6. Chemical Treatment

8.7. Others

8.8. Y-O-Y Growth trend Analysis Technology

8.9. Absolute $ Opportunity Analysis Technology , 2024-2030

Chapter 9. GLOBAL ENVIRONMENTAL REMEDIATION MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By ENVIRONMENTAL MEDIUM

9.1.3. By Application

9.1.4. By Technology

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By ENVIRONMENTAL MEDIUM

9.2.3. By Technology

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By ENVIRONMENTAL MEDIUM

9.3.3. By Application

9.3.4. By Technology

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By ENVIRONMENTAL MEDIUM

9.4.3. By Application

9.4.4. By Technology

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By ENVIRONMENTAL MEDIUM

9.5.3. By Application

9.5.4. By Technology

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL ENVIRONMENTAL REMEDIATION MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Clean Harbors, Inc.

10.2. AECOM

10.3. Veolia Environment S.A.

10.4. Golder Associates

10.5. Tetra Tech, Inc.

10.6. Bechtel Corporation

10.7. Jacobs Engineering Group Inc. (formerly CH2M HILL)

10.8. ARCADIS N.V.

10.9. TRC Companies, Inc.

10.10. Intertek Group plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Environmental Remediation Market was valued at USD 118.48 billion and is projected to reach a market size of USD 208.38 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.4%.

Regulatory compliance and increasing environmental awareness are the main market drivers of the Global Environmental Remediation Market.

Soil Remediation, Water Remediation, and Air Remediation are the segments under the Global Environmental Remediation Market by Environmental Medium.

North America is the most dominant region for the Global Environmental Remediation Market.

Clean Harbors, AECOM, Veolia Environment, Golder Associates, and Tetra Tech are the key players in the Global Environmental Remediation Market.