Entertainment Market Size (2024 – 2030)

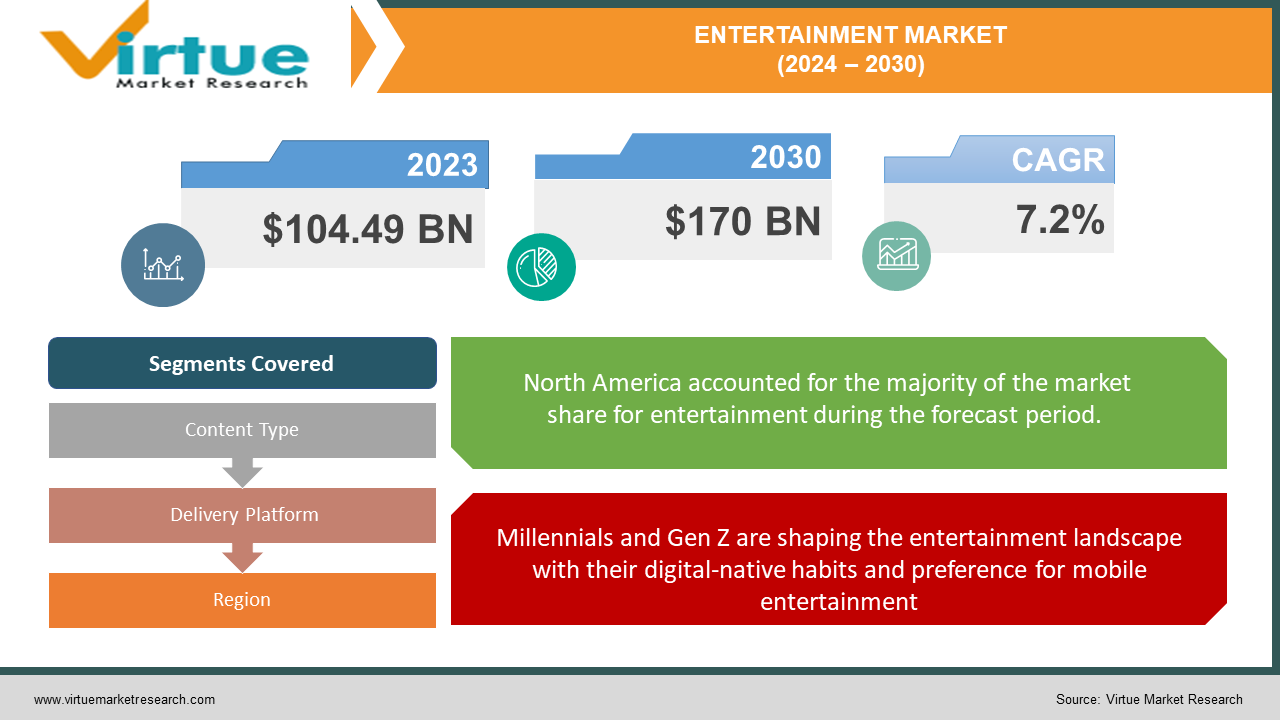

The Global Entertainment Market was valued at USD 104.49 billion in 2023 and will row at a CAGR of 7.2% from 2024 to 2030. The market is expected to reach USD 170 billion by 2030.

The entertainment market encompasses the vast world of activities and products designed to entertain audiences. It includes everything from traditional forms like movies, music, and theater to newer segments like video games, streaming services, and theme parks. This global industry generates billions of dollars annually and is constantly evolving with technological advancements and audience preferences, shaping how people spend their leisure time and consume content.

Key Market Insights:

Non-English language shows are attracting significant audiences on streaming platforms, with a projected 50% of viewers choosing content not in their native language by 2027.Subscription fatigue is driving innovation in revenue models. The entertainment industry is exploring options like ad-supported tiers, microtransactions within games, and bundled services to cater to diverse consumer preferences.Live events and immersive experiences are gaining popularity. Theme parks, concerts, and interactive entertainment attractions are projected to reach a market size of USD 270.3 billion by 2027.

Global Entertainment Market Drivers:

Social media platforms like TikTok and YouTube are becoming major entertainment hubs, with user-generated content attracting significant audiences

The lines between content creator and consumer are blurring thanks to the rise of social media. Platforms like TikTok and YouTube have morphed into entertainment powerhouses, where user-generated content reigns supreme. Aspiring singers, comedians, and gamers are captivating audiences with their creativity, fostering a more participatory entertainment landscape. This "creator economy" empowers individuals to become the stars of the show, and the most successful can build massive followings and potentially lucrative careers.

Millennials and Gen Z are shaping the entertainment landscape with their digital-native habits and preference for mobile entertainment

The entertainment industry is undergoing a generational shift driven by the rise of Millennials and Gen Z. These digital natives have transformed the landscape with their preference for mobile entertainment. Short-form content like TikTok videos and bite-sized shows perfectly match their attention spans and busy lifestyles. They crave interactivity, engaging with games, polls, and live streams. Furthermore, they expect on-demand access across devices, seamlessly switching between smartphones, tablets, and laptops. This isn't the only force shaping the market. The burgeoning global middle class, particularly in emerging economies, represents a massive new audience. These consumers have a growing disposable income and a desire for entertainment options that reflect their cultural identities. Local language content, both classic and newly produced, is experiencing a surge in popularity. The entertainment industry is responding by creating diverse content libraries that cater to a globalized audience, ensuring there's something for everyone in this ever-evolving landscape.

Virtual Reality (VR) and Augmented Reality (AR) are emerging as new frontiers in entertainment

Streaming services personalize recommendations, tailoring content suggestions to individual tastes. Imagine a world where your entertainment choices feel curated just for you. The future holds even more exciting possibilities. Virtual Reality (VR) and Augmented Reality (AR) are ushering in a new era of immersive experiences. Imagine attending a concert from the front row, or exploring a fantastical world in a VR game. These technologies blur the lines between passive consumption and active participation, pulling viewers deeper into the entertainment experience. The future of entertainment is interactive, personalized, and constantly evolving, and high-speed internet and streaming platforms are at the forefront of this revolution.

Global Entertainment Market challenges and restraints:

Subscription Fatigue and Rising Costs are restricting market growth

The streaming boom has led to a plethora of subscription services available, each vying for a slice of consumer spending. This creates "subscription fatigue," where viewers struggle to manage and afford multiple subscriptions. Additionally, the cost of content creation and licensing is rising, leading to price hikes for these services. As consumers become more price-sensitive, they may choose to cut back on subscriptions or resort to illegal alternatives, negatively impacting the entertainment market's revenue streams.

Data Security and Privacy Concerns are restricting the market growth

The rise of personalized recommendations and targeted advertising requires vast amounts of user data. While this data fuels the engine of entertainment platforms, it also raises privacy concerns. Consumers are increasingly worried about how their data is collected, stored, and used. Breaches and leaks can damage user trust and potentially lead to stricter regulations that could limit data collection practices, impacting the effectiveness of personalization and targeted marketing within the entertainment market.

Market Opportunities:

The global entertainment market brims with exciting opportunities. The rise of mobile entertainment presents a chance to develop innovative games, interactive experiences, and short-form content specifically tailored for on-the-go consumption. Emerging technologies like virtual and augmented reality offer immense potential for immersive storytelling and gamified experiences that push the boundaries of entertainment. The growing global middle class creates a vast new audience hungry for diverse content. Catering to local languages and cultural preferences through original productions and dubbing opens doors to untapped markets. Furthermore, the creator economy presents a unique opportunity to collaborate with talented individuals and leverage user-generated content to engage audiences and foster a more participatory entertainment landscape. By embracing these trends and capitalizing on innovation, the entertainment market can continue to grow and evolve, offering ever-more captivating experiences for audiences worldwide.

ENTERTAINMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Content Type, Delivery Platform, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Walt Disney Company, Netflix, Comcast Corporation, Warner Bros. Discovery , Sony Corporation, Apple Inc., Amazon , Meta Platforms (formerly Facebook), Tencent Holdings, ByteDance (owner of TikTok) Universal Music Group, Spotify |

Entertainment Market Segmentation - by Content Type

-

Movies & Television

-

Music

-

Gaming

-

Theme Parks & Live Entertainment

The entertainment industry is a diverse landscape, with each segment holding its ground. Movies & Television reign supreme in cultural influence and revenue, particularly in North America and Asia, but face challenges from streaming services that disrupt traditional release models. Music, fueled by streaming, enjoys global popularity with regional variations in taste. Gaming, especially mobile gaming in Asia, is experiencing explosive growth, with VR and AR promising even more expansion. Theme Parks & Live Entertainment rely on in-person experiences and cater to specific audiences. While pandemics caused temporary setbacks, this segment remains significant, especially in tourist hotspots. Ultimately, the entertainment market thrives on variety, with each segment contributing to the overall experience.

Entertainment Market Segmentation - By Delivery Platform

-

Traditional Media

-

Streaming Services

-

Mobile Entertainment

The battle for dominance in entertainment delivery platforms is currently being fought between Traditional Media and Streaming Services. While Traditional Media (broadcast TV, cable, radio, DVDs) held a long-standing reign, Streaming Services (SVOD, AVOD, TVOD) are rapidly gaining ground. Factors like on-demand access, wider content libraries, and personalized recommendations are fueling the rise of streaming. Mobile Entertainment (games, apps, short-form video) is a strong contender as well, particularly for on-the-go consumption. However, in terms of overall revenue and capturing a wider audience across demographics, Streaming Services are currently the most dominant force, though Traditional Media still holds a significant share, especially in certain regions.

Entertainment Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America boasts a well-developed entertainment infrastructure, major studios, and high disposable income, leading to a significant market share. This region is experiencing a surge due to a burgeoning middle class with growing spending power, increasing internet penetration, and a focus on creating local content that resonates with audiences.

COVID-19 Impact Analysis on the Global Entertainment Market

The COVID-19 pandemic delivered a shock to the global entertainment market, causing a temporary decline in size. Lockdowns and social distancing measures shuttered cinemas, theme parks, and live events, leading to massive revenue losses. Movie releases were delayed, and traditional broadcast television consumption dipped due to a lack of live sports and other programming disruptions.

However, the entertainment industry exhibited remarkable resilience. Streaming services boomed as people turned to them for entertainment at home. The rise of esports and online gaming partially offset the decline in traditional sports viewership. As restrictions eased, the industry began a gradual recovery.

While the full financial impact is still being assessed, the market size is expected to rebound and surpass pre-pandemic levels in the coming years. The pandemic has also had a lasting impact on content consumption habits, accelerating the shift towards streaming services and on-demand entertainment. This trend, coupled with the rise of new markets in Asia-Pacific, is expected to propel the global entertainment market towards a future of continued growth.

Latest trends/Developments

The entertainment industry is undergoing a thrilling transformation, fueled by innovation and evolving consumer preferences. Audiences are seeking experiences that go beyond passive consumption. Virtual Reality (VR) and Augmented Reality (AR) are ushering in a new era of immersive entertainment, with VR concerts, interactive games, and theme park attractions blurring the line between reality and fantasy. Streaming services are no longer one-size-fits-all. They're leveraging data to personalize content recommendations, suggesting shows and movies tailored to individual tastes. This "hyper-personalization" ensures viewers discover content they'll truly connect with, fostering deeper engagement and loyalty. Our fast-paced lives demand bite-sized entertainment, and short-form video platforms like TikTok and YouTube Shorts are capitalizing on this trend. Attention spans are shrinking, and content that entertains and informs in minutes is king. Social media is no longer just a platform for consumption; it's empowering a new wave of creators. User-generated content is a major source of entertainment, with individuals leveraging social media to build massive followings and potentially lucrative careers. This "creator economy" fosters a more participatory entertainment landscape, where viewers can become creators themselves. Finally, the global entertainment landscape is becoming more inclusive. Local content is taking center stage, with streaming services recognizing the power of stories that resonate with specific cultures and languages. Non-English language shows are gaining traction worldwide, reflecting the growing global entertainment market and ensuring there's something for everyone in this ever-evolving world.

Key Players:

-

Walt Disney Company

-

Netflix

-

Comcast Corporation

-

Warner Bros. Discovery

-

Sony Corporation

-

Apple Inc.

-

Amazon

-

Meta Platforms (formerly Facebook)

-

Tencent Holdings

-

ByteDance (owner of TikTok)

-

Universal Music Group

-

Spotify

Chapter 1. Entertainment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Entertainment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Entertainment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Entertainment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Entertainment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Entertainment Market – By Content Type

6.1 Introduction/Key Findings

6.2 Movies & Television

6.3 Music

6.4 Gaming

6.5 Theme Parks & Live Entertainment

6.6 Y-O-Y Growth trend Analysis By Content Type

6.7 Absolute $ Opportunity Analysis By Content Type, 2024-2030

Chapter 7. Entertainment Market – By Delivery Platform

7.1 Introduction/Key Findings

7.2 Traditional Media

7.3 Streaming Services

7.4 Mobile Entertainment

7.5 Y-O-Y Growth trend Analysis By Delivery Platform

7.6 Absolute $ Opportunity Analysis By Delivery Platform, 2024-2030

Chapter 8. Entertainment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Content Type

8.1.3 By Delivery Platform

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Content Type

8.2.3 By Delivery Platform

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Content Type

8.3.3 By Delivery Platform

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Content Type

8.4.3 By Delivery Platform

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Content Type

8.5.3 By Delivery Platform

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Entertainment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Walt Disney Company

9.2 Netflix

9.3 Comcast Corporation

9.4 Warner Bros. Discovery

9.5 Sony Corporation

9.6 Apple Inc.

9.7 Amazon

9.8 Meta Platforms (formerly Facebook)

9.9 Tencent Holdings

9.10 ByteDance (owner of TikTok)

9.11 Universal Music Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Entertainment Market was valued at USD 104.49 billion in 2023 and will row at a CAGR of 7.2% from 2024 to 2030. The market is expected to reach USD 170 billion by 2030.

Social media platforms like TikTok and YouTube are becoming major entertainment hubs, Virtual Reality (VR) and Augmented Reality (AR) are emerging as new frontiers in entertainment these are the reasons which are driving the market.

Based on Delivery Platform it is divided into three segments – Traditional Media, Streaming Services, Mobile Entertainment.

North America is the most dominant region for the Entertainment Market.

Walt Disney Company, Netflix, Comcast Corporation, Warner Bros. Discovery