Entertainment Insurance Market Size (2024 – 2030)

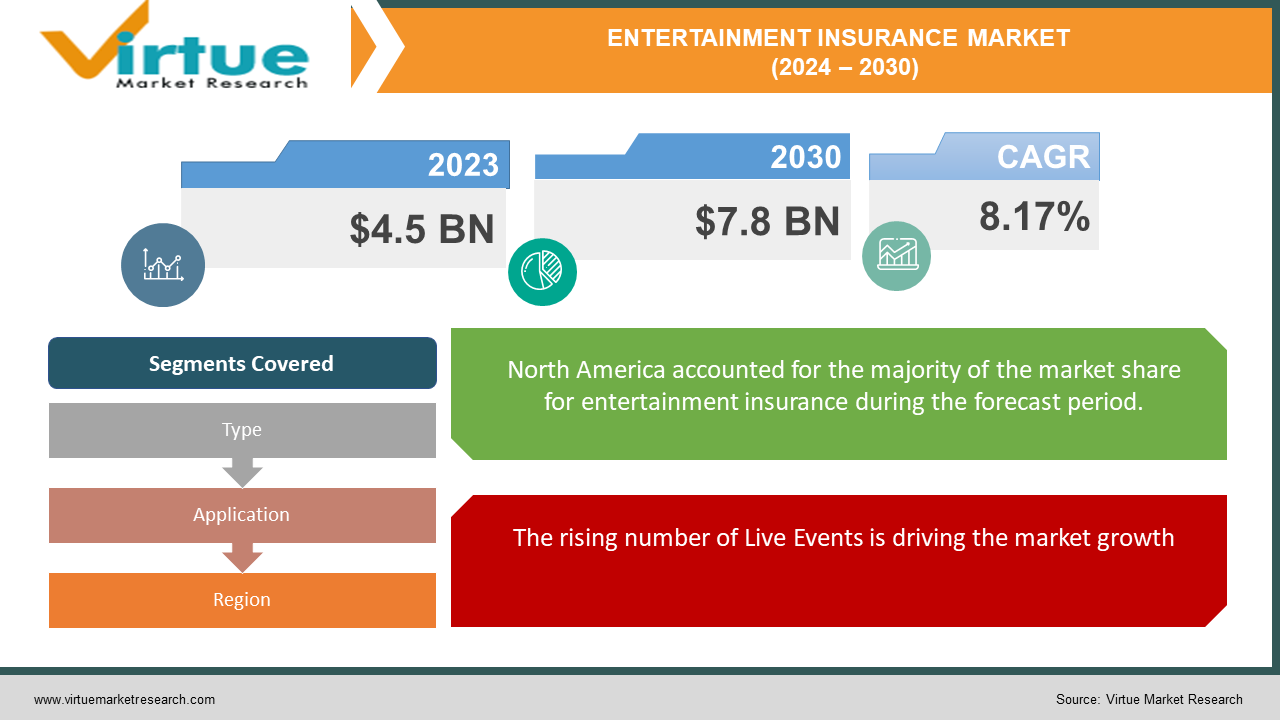

The Global Entertainment Insurance Market was valued at USD 4.5 billion in 2023 and is projected to grow at a CAGR of 8.17% from 2024 to 2030. The market is expected to reach USD 7.8 billion by 2030.

The rising number of live events, increasing investments in film production, and the growing complexity of media projects are driving the demand for entertainment insurance. Productions and events taking place in multiple countries require cross-border solutions that address diverse regulatory and risk management requirements.

Key Market Insights:

The film production segment is the largest consumer of entertainment insurance, driven by the need for comprehensive risk coverage.

North America is the leading region in the entertainment insurance market, followed by Europe and Asia-Pacific.

The increasing complexity of media projects and the growing number of live events are key drivers for the market.

The integration of digital technologies, focus on sustainability, and globalization are shaping the future of the entertainment insurance market, driving innovation and growth.

Global Entertainment Insurance Market Drivers:

The rising number of Live Events is driving the market growth

The increasing number of live events, such as concerts, festivals, sports events, and theatrical productions, is a significant driver of the entertainment insurance market. These events involve substantial investments, extensive planning, and coordination, making them vulnerable to various risks, including cancellations, equipment damage, and liability issues. Event organizers and promoters seek comprehensive insurance coverage to protect their investments and ensure smooth execution. The rising popularity of large-scale music festivals, international sports tournaments, and live performances by renowned artists has further fueled the demand for entertainment insurance. Additionally, the trend of experiential marketing, where brands create immersive and interactive events, has increased the need for specialized insurance coverage. The growing consumer demand for live entertainment experiences and the rising number of events worldwide are expected to drive the growth of the entertainment insurance market.

Increasing Investments in Film Production is driving the market growth.

The film production industry is a major driver of the entertainment insurance market. Film production involves substantial financial investments, and any disruptions or accidents can lead to significant financial losses. Producers, studios, and filmmakers seek comprehensive insurance coverage to mitigate risks associated with production delays, equipment damage, cast injuries, and other unforeseen events. The increasing investments in film production, driven by the growing demand for content across various platforms, including streaming services, cinemas, and television, are boosting the demand for entertainment insurance. The trend towards high-budget productions, international co-productions, and complex special effects further underscores the need for robust insurance coverage. Additionally, the expansion of the global film industry, with emerging markets becoming significant players in film production, is contributing to the growth of the entertainment insurance market. The increasing investments in film production and the need to protect these investments are expected to drive the demand for entertainment insurance.

The growing complexity of Media Projects is driving the market growth.

The growing complexity of media projects, including film and television productions, digital content creation, and interactive media, is driving the demand for entertainment insurance. Media projects today involve advanced technologies, large-scale sets, international locations, and complex logistics, making them susceptible to various risks. The increasing use of special effects, computer-generated imagery (CGI), and cutting-edge production techniques adds to the complexity and potential risks of media projects. Entertainment insurance provides comprehensive coverage for these risks, ensuring that production processes are not disrupted and financial losses are minimized. The trend toward multi-platform content distribution, including streaming services, social media, and virtual reality, has further increased the need for specialized insurance coverage. The growing complexity of media projects and the evolving nature of content creation are driving the demand for entertainment insurance, ensuring that projects are completed successfully and investments are protected.

Global Entertainment Insurance Market Challenges and Restraints:

High Premium Costs are restricting the market growth

One of the significant challenges faced by the entertainment insurance market is the high premium costs associated with comprehensive coverage. The entertainment industry is inherently risky, and insurance providers charge high premiums to cover potential losses from various risks, including cancellations, equipment damage, and liability claims. The high cost of insurance premiums can be a barrier for smaller production companies, independent filmmakers, and event organizers with limited budgets. Additionally, the high premiums may deter some industry players from purchasing adequate coverage, leaving them vulnerable to financial losses in the event of unforeseen incidents. The challenge for the entertainment insurance market is to balance the need for comprehensive coverage with affordability, ensuring that all industry participants can access insurance solutions that meet their needs.

Complex Claims Processes restricting the market growth

The complex claims processes associated with entertainment insurance can be a significant restraint for the market. Claims in the entertainment industry often involve multiple stakeholders, extensive documentation, and detailed investigations, leading to lengthy and complicated procedures. The complexity of claims processes can result in delays in settlements, disputes, and dissatisfaction among policyholders. Additionally, the lack of standardized claims procedures and varying requirements across different insurance providers can add to the complexity. The challenge for the entertainment insurance market is to streamline claims processes, improve transparency, and enhance customer service to ensure timely and fair settlements. Simplifying claims procedures and providing clear guidelines can help build trust and confidence among policyholders, driving the growth of the market.

Market Opportunities:

The entertainment insurance market presents several significant opportunities for growth and innovation. One of the key opportunities lies in the increasing demand for specialized insurance products tailored to the unique needs of the entertainment industry. As the industry evolves and new forms of entertainment emerge, there is a growing need for insurance solutions that address specific risks associated with digital content creation, virtual reality experiences, and live-streaming events. The rise of esports and gaming tournaments, for instance, presents an opportunity for insurers to develop coverage options that cater to the unique risks faced by these events. Additionally, the trend towards globalization of the entertainment industry, with productions and events taking place in multiple countries, creates opportunities for insurers to offer international coverage and cross-border solutions. The growing focus on sustainability and environmental responsibility in the entertainment industry also presents opportunities for insurers to develop products that address environmental risks and promote sustainable practices. Furthermore, advancements in technology, such as blockchain and artificial intelligence, offer opportunities to enhance the efficiency and transparency of insurance processes, from underwriting to claims management. The increasing demand for specialized insurance products, the globalization of the entertainment industry, and technological advancements are expected to drive the growth and innovation of the entertainment insurance market.

ENTERTAINMENT INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.17% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Allianz Global Corporate & Specialty, Chubb, AXA XL, Hiscox, Marsh, Aon, Gallagher, Tokio Marine HCC, Berkshire Hathaway Specialty Insurance, Zurich Insurance Group |

Entertainment Insurance Market Segmentation - by Type

-

Production Insurance

-

Event Insurance

-

Liability Insurance

Production insurance is the most dominant segment in the entertainment insurance market. It provides comprehensive coverage for film, television, and digital content productions, protecting against risks such as equipment damage, cast injuries, and production delays. The high investments in production and the need for robust risk management make production insurance a critical requirement for filmmakers and studios.

Entertainment Insurance Market Segmentation - by Application

-

Film Production

-

Music Concerts

-

Sports Events

-

Theatrical Productions

-

Others

The film production segment is the most dominant application segment in the entertainment insurance market. Film productions involve substantial financial investments and complex logistics, making them highly susceptible to various risks. Comprehensive insurance coverage is essential to protect against potential financial losses and ensure the successful completion of projects.

Entertainment Insurance Market Segmentation - by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the entertainment insurance market. The region's well-established entertainment industry, particularly in the United States and Canada, drives the demand for insurance coverage. The presence of major film studios, production companies, and event organizers, along with the high frequency of live events and productions, contributes to the region's dominance in the market.

COVID-19 Impact Analysis on the Entertainment Insurance Market:

The COVID-19 pandemic had a significant impact on the entertainment insurance market. The widespread cancellations and postponements of live events, film productions, and theatrical performances led to an unprecedented surge in insurance claims. Event organizers, production companies, and artists faced substantial financial losses due to the disruptions caused by lockdowns, travel restrictions, and social distancing measures. Insurance providers experienced a sharp increase in claims related to event cancellations, production delays, and liability issues. The pandemic highlighted the critical importance of having comprehensive insurance coverage to mitigate the financial risks associated with unforeseen events. Additionally, the uncertainty surrounding the pandemic prompted insurers to reassess their risk assessment models and policy terms, leading to changes in coverage options and premium rates. As the entertainment industry gradually recovers from the pandemic, the demand for insurance coverage is expected to increase, with a heightened focus on including pandemic-related risks in policies. The COVID-19 pandemic underscored the necessity of robust insurance solutions to protect the entertainment industry from future disruptions and ensure business continuity.

Latest Trends/Developments:

The entertainment insurance market is witnessing several key trends and developments. One significant trend is the increasing focus on digital content and virtual events. The rise of streaming platforms, virtual concerts, and online gaming tournaments has created a demand for specialized insurance coverage that addresses the unique risks associated with digital and virtual entertainment. Insurers are developing products that cover risks such as data breaches, cyberattacks, and technical failures during virtual events. Another notable trend is the growing emphasis on sustainability and environmental responsibility in the entertainment industry. Event organizers and production companies are adopting eco-friendly practices, and insurers are responding by offering coverage options that promote sustainability and address environmental risks. Additionally, advancements in technology are transforming the entertainment insurance landscape. The use of blockchain technology is enhancing transparency and efficiency in policy management and claims processing. Artificial intelligence and data analytics are being leveraged to improve risk assessment, underwriting, and fraud detection. The adoption of these technologies is streamlining insurance processes and improving customer experience. Furthermore, the increasing globalization of the entertainment industry is driving the demand for international insurance coverage.

Key Players:

-

Allianz Global Corporate & Specialty

-

Chubb

-

AXA XL

-

Hiscox

-

Marsh

-

Aon

-

Gallagher

-

Tokio Marine HCC

-

Berkshire Hathaway Specialty Insurance

-

Zurich Insurance Group

Chapter 1. Entertainment Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Entertainment Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Entertainment Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Entertainment Insurance Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Entertainment Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Entertainment Insurance Market – By Application

6.1 Introduction/Key Findings

6.2 Film Production

6.3 Music Concerts

6.4 Sports Events

6.5 Theatrical Productions

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Entertainment Insurance Market – By Type

7.1 Introduction/Key Findings

7.2 Production Insurance

7.3 Event Insurance

7.4 Liability Insurance

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Entertainment Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Entertainment Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Allianz Global Corporate & Specialty

9.2 Chubb

9.3 AXA XL

9.4 Hiscox

9.5 Marsh

9.6 Aon

9.7 Gallagher

9.8 Tokio Marine HCC

9.9 Berkshire Hathaway Specialty Insurance

9.10 Zurich Insurance Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Entertainment Insurance Market was valued at USD 4.5 billion in 2023 and is projected to reach USD 7.8 billion by 2030, growing at a CAGR of 8.17% from 2024 to 2030.

The market is driven by the rising number of live events, increasing investments in film production, and the growing complexity of media projects.

The market is segmented by type into production insurance, event insurance, and liability insurance. It is also segmented by application into film production, music concerts, sports events, theatrical productions, and others.

North America is the most dominant region due to its well-established entertainment industry and the high frequency of live events and productions.

Leading players in the market include Allianz Global Corporate & Specialty, Chubb, AXA XL, Hiscox, Marsh, Aon, Gallagher, Tokio Marine HCC, Berkshire Hathaway Specialty Insurance, and Zurich Insurance Group.