Enterprise Manufacturing Intelligence Market Size (2024 – 2030)

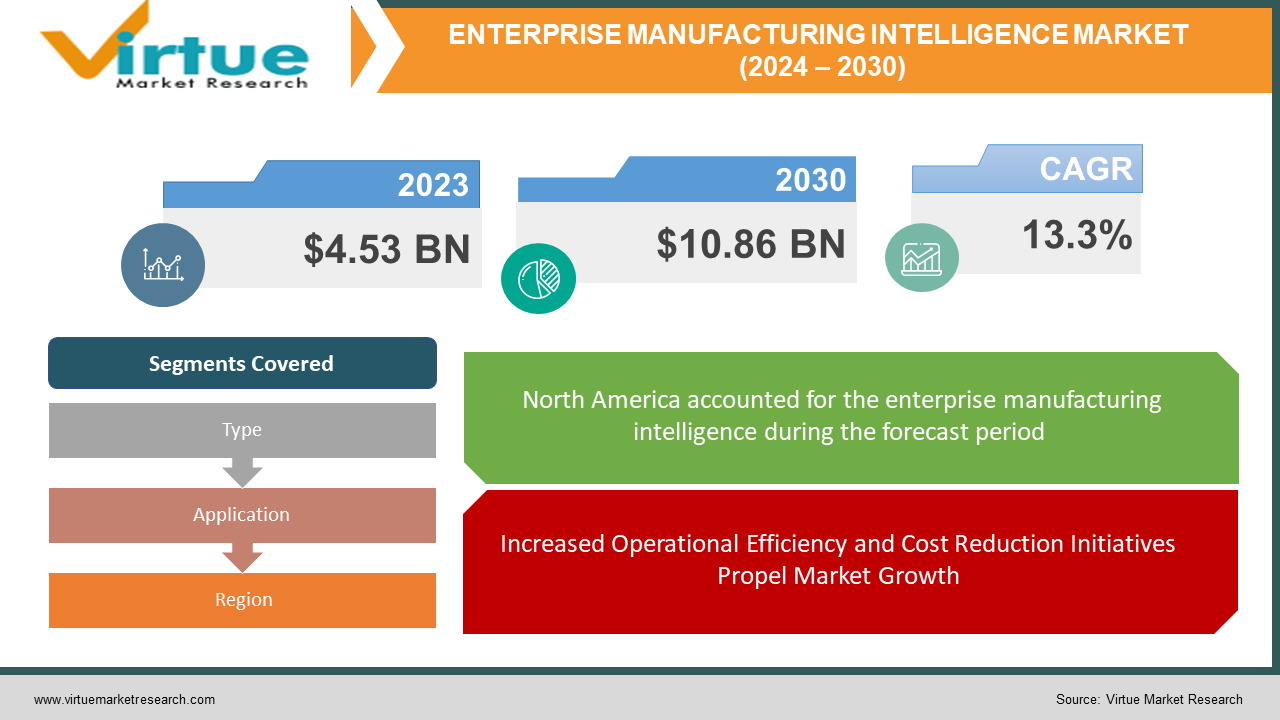

The Global Enterprise Manufacturing Intelligence Market size was exhibited at USD 4.53 billion in 2023 and is projected to hit around USD 10.86 billion by 2030, growing at a CAGR of 13.3% during the forecast period from 2024 to 2030.

Enterprise Manufacturing Intelligence (EMI) represents a strategic methodology for overseeing and enhancing manufacturing operations, achieved through the integration and analysis of data derived from diverse sources throughout an organization's production processes. This comprehensive approach acts as a vital link between the shop floor and the executive suite, delivering instantaneous visibility into manufacturing operations and facilitating data-informed decision-making. EMI systems collate information from disparate sources like manufacturing execution systems (MES), enterprise resource planning (ERP) systems, sensors, machines, and other pertinent outlets. Through the aggregation and contextualization of this data, EMI empowers organizations to glean insights into crucial performance indicators (KPIs) such as production efficiency, equipment downtime, quality metrics, and overall process effectiveness. This holistic perspective of manufacturing operations enables the timely identification of inefficiencies, bottlenecks, and quality issues, fostering proactive intervention and continual improvement. Additionally, EMI facilitates historical data analysis, trend prediction, and benchmarking, thereby supporting strategic planning and performance assessment.

In recent years, the Enterprise Manufacturing Intelligence (EMI) market has witnessed substantial growth and evolution. It is characterized by a comprehensive approach that integrates data from various sources within the manufacturing process to provide real-time insights and analytics, ultimately enhancing decision-making and operational efficiency. The market's trajectory is marked by technological advancements, a rising embrace of Industry 4.0 practices, and the increasing significance of data-driven decision-making in the manufacturing sector.

Key Market Insights:

A primary driver influencing the enterprise manufacturing intelligence market is the escalating shift towards lean manufacturing practices. Manufacturers are increasingly embracing lean manufacturing to optimize resources, reduce production costs, and address operational challenges. This shift entails minimizing wastage in the supply chain process. The adoption of industrial automation software enables organizations to gain a comprehensive understanding of their status quo, leading to decisions that enhance productivity and product quality. Consequently, the demand for EMI software is projected to witness growth during the forecast period.

A notable trend in the enterprise manufacturing intelligence market is the surging demand for integrated solutions on a unified platform. This demand arises from the convergence of various applications, including product lifecycle management, product data management, and enterprise resource planning, to enhance organizational functionality. Integrated solutions play a crucial role in deploying lean manufacturing practices by monitoring each department and generating real-time data. The advantages offered by integrated solutions on a unified platform are anticipated to drive the global EMI market's growth in the foreseeable future.

Global Enterprise Manufacturing Intelligence Market Drivers:

Increased Operational Efficiency and Cost Reduction Initiatives Propel Market Growth

One of the primary catalysts driving the acceptance of Enterprise Manufacturing Intelligence solutions is the pursuit of heightened operational efficiency and cost reduction. EMI platforms empower manufacturers to collect real-time data from diverse production processes, analyze it, and extract actionable insights. This data-centric approach empowers manufacturers to pinpoint inefficiencies, streamline workflows, minimize downtime, and optimize resource allocation. By making informed decisions based on precise and current information, manufacturers can substantially enhance their operational efficiency, leading to significant cost reductions over time.

Growing Demand for Immediate Visibility and Decision-Making Drives Market Advancement

In the contemporary and competitive manufacturing environment, the ability to make well-informed decisions in real time is paramount. Enterprise Manufacturing Intelligence solutions provide manufacturers with the capability to monitor their entire production process in real time, spanning from raw material acquisition to the distribution of finished products. This immediate visibility facilitates the swift identification of issues, prompt responses to disruptions, and proactive decision-making. Manufacturers can address production bottlenecks, adjust schedules, and ensure product quality, effectively meeting customer demands and maintaining a competitive edge.

Global Enterprise Manufacturing Intelligence Market Restraints and Challenges:

Data Security and Privacy Concerns Pose Barriers to Market Growth

While the incorporation of Enterprise Manufacturing Intelligence brings forth numerous advantages, it is not without challenges, and notable among them are concerns related to data security and privacy. The manufacturing processes generate substantial volumes of sensitive and proprietary data that require secure collection, storage, and analysis. Ensuring the confidentiality, integrity, and availability of data is imperative to thwart unauthorized access, cyber threats, and potential breaches. Manufacturers must implement robust cybersecurity measures, encryption protocols, and access controls to safeguard their invaluable data assets and maintain trust among stakeholders.

Organizational Insufficiency in Training and Execution Hampers Market Growth

Organizations may possess well-defined specifications, a coherent EMI strategy, and a potent tool solution, yet they might lack technological proficiency in areas such as designing, building, maintaining, and supporting EMI applications. This deficiency can result in EMI systems running sluggishly, experiencing frequent breakdowns, yielding unpredictable results, and ultimately contributing to escalated EMI solution costs. Organizations should prioritize supporting their personnel in comprehending the necessity and benefits of an EMI solution. Resources need alignment with executives regarding the advantages of their newly adopted EMI technology. Organizations should invest judiciously in consistent training to ensure users are adept at utilizing the system effectively.

Global Enterprise Manufacturing Intelligence Market Opportunities:

Surging Demand in Automotive Sector

The Global Enterprise Manufacturing Intelligence (EMI) market is witnessing heightened demand in the automotive industry, creating lucrative prospects. With the automotive sector undergoing rapid technological advancements and transitioning towards Industry 4.0, there is an increasing requirement for EMI solutions to streamline manufacturing processes. EMI facilitates real-time data analytics, predictive maintenance, and overall operational efficiency, aligning seamlessly with the automotive industry's pursuit of enhanced productivity and cost-effectiveness. Given the escalating complexity in automotive manufacturing, EMI provides actionable insights, empowering improved decision-making and process optimization. As electric vehicles and smart technologies become integral components of the automotive landscape, the demand for EMI in the industry is poised for expansion, establishing a robust market landscape for innovative solutions and fostering continuous improvements in manufacturing intelligence.

ENTERPRISE MANUFACTURING INTELLIGENCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Aspen Technology Inc., Dassault Systems SA, Emerson Electric Co., General Electric Co., SAP SE, Yokogawa Electric Corporation |

Global Enterprise Manufacturing Intelligence Market Segmentation: By Type

-

Discrete Type

-

Process Manufacturing Type

Enterprise Manufacturing Intelligence (EMI) is a software solution designed to offer real-time insights into manufacturing operations, enhancing efficiency, productivity, and decision-making. The market can be categorized by type into Discrete Type and Process Manufacturing Type, with Discrete Type leading in terms of market segmentation. The discrete type market utilizes EMI in industries such as automotive and electronics, where products undergo assembly through distinct steps. In the process manufacturing type market, EMI finds application in industries like chemical and food, involved in continuous processes, and is anticipated to experience substantial growth over the forecast period. Both segments benefit from EMI's capacity to collect and analyze data, monitor performance, identify issues, and optimize production processes for improved outcomes.

Global Enterprise Manufacturing Intelligence Market Segmentation: By Application

-

Chemical

-

Energy & Power

-

Food & Beverages

-

Oil & Gas

-

Pharmaceutical

-

Automotive

-

Aerospace & Defense

-

Electronics

-

Others

The chemical segment has established dominance in the global enterprise manufacturing intelligence market, contributing over 30.0% to the overall revenue. This growth is attributed to the increasing demand for chemicals across diverse end-use industries and the escalating research and development expenditure in developing new processes and products within this sector.

The pharmaceutical segment is poised for significant growth during the forecast period due to factors such as heightened healthcare spending, technological advancements, innovations, and rising employment rates globally. These factors contribute to an increased demand for medicines developed using advanced technologies, supported by insights derived from data collected in manufacturing processes across pharmaceutical companies worldwide.

Global Enterprise Manufacturing Intelligence Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America emerges as a frontrunner in adopting Enterprise Manufacturing Intelligence (EMI) solutions, driven by various factors that make it conducive to technological advancement and industrial innovation. The region's manufacturing sector has long been a cornerstone of its economy, encompassing diverse industries such as automotive, aerospace, electronics, pharmaceuticals, and more. This robust manufacturing landscape necessitates sophisticated tools and strategies for optimizing production processes and maintaining a competitive edge globally. The adoption of Industry 4.0 practices has played a pivotal role in North America's embrace of EMI solutions. The integration of advanced technologies like the Internet of Things (IoT), big data analytics, artificial intelligence (AI), and cloud computing has reshaped the manufacturing landscape. North American manufacturers recognize that thriving in the era of digital transformation requires harnessing real-time data insights to enhance operational efficiency, minimize downtime, and drive continuous improvement.

The Asia-Pacific region has emerged as a dynamic and rapidly evolving hub for the adoption of Enterprise Manufacturing Intelligence (EMI). This growth is underpinned by a wave of industrialization, technological innovation, and a relentless pursuit of excellence in manufacturing processes. Countries like China, Japan, and South Korea have spearheaded this transformative journey, showcasing a remarkable commitment to modernizing their manufacturing sectors through cutting-edge technologies. China, as the world's manufacturing epicenter, has played a pivotal role in driving EMI adoption in the Asia-Pacific. The ambitious "Made in China 2025" initiative, focused on transforming China into a high-tech manufacturing powerhouse, has accelerated the implementation of EMI technologies. The seamless integration of IoT, AI, and data analytics in manufacturing operations has enabled Chinese industries to achieve unprecedented levels of efficiency, productivity, and quality control.

COVID-19 Impact on the Global Enterprise Manufacturing Intelligence Market:

The Global Enterprise Manufacturing Intelligence (EMI) market underwent substantial transformations during the COVID-19 pandemic. The global supply chains were disrupted, leading to production halts and logistical challenges for manufacturers. Consequently, there was an increased emphasis on resilient, agile, and data-driven operations, driving the demand for EMI solutions. Companies prioritized technologies providing real-time insights, predictive analytics, and remote monitoring to navigate uncertainties and optimize production. The pandemic-induced acceleration of digitalization initiatives resulted in heightened investments in smart manufacturing, IoT, and advanced analytics. EMI emerged as a pivotal tool for enhancing efficiency and adapting to the evolving manufacturing landscape. The post-COVID era witnessed a paradigm shift, with organizations acknowledging the crucial role of EMI in fostering adaptability, innovation, and long-term sustainability.

Recent Trends and Innovations in the Global Enterprise Manufacturing Intelligence Market:

-

In September 2022, Verizon Business unveiled its latest enterprise intelligence initiative, aiming to showcase the transformative impact of 5G, 5G edge, and proprietary 5G infrastructure on some of the world's most innovative businesses. The company will highlight practical examples from leading companies in entertainment and sports, automotive, retail, manufacturing, and logistics that leverage Verizon's applications.

-

In September 2022, Intellicus Technologies, a startup specializing in data analytics, introduced Flow. This omnichannel workforce management solution seamlessly integrates cloud, artificial intelligence, and automated machine learning technologies with traditional business process management. The purpose of Flow is to optimize, plan, and predict workforces.

-

Verizon Business disclosed its latest enterprise intelligence initiative in September 2022, with the objective of illustrating how 5G, 5G edge, and distinctive 5G infrastructure are revolutionizing forward-thinking organizations worldwide. The company will exemplify real-world instances of prominent firms utilizing Verizon's applications across various sectors, including entertainment and sports, automotive, retail, manufacturing, and logistics.

-

In September 2022, Intellicus Technologies, a data analytics startup, introduced Flow, an omnichannel workforce management solution. Combining cloud, artificial intelligence, and automated machine learning technologies with conventional business process management, Flow is designed to optimize, plan, and predict workforces.

Key Players:

-

Honeywell International Inc.

-

Rockwell Automation Inc.

-

Schneider Electric SE

-

Siemens AG

-

Aspen Technology Inc.

-

Dassault Systems SA

-

Emerson Electric Co.

-

General Electric Co.

-

SAP SE

-

Yokogawa Electric Corporation

Chapter 1. Enterprise Manufacturing Intelligence Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Enterprise Manufacturing Intelligence Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Enterprise Manufacturing Intelligence Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Enterprise Manufacturing Intelligence Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Enterprise Manufacturing Intelligence Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Enterprise Manufacturing Intelligence Market – By Type

6.1 Introduction/Key Findings

6.2 Discrete Type

6.3 Process Manufacturing Type

6.4 Y-O-Y Growth trend Analysis By Type-

6.5 Absolute $ Opportunity Analysis By Type-, 2024-2030

Chapter 7. Enterprise Manufacturing Intelligence Market – By Application

7.1 Introduction/Key Findings

7.2 Chemical

7.3 Energy & Power

7.4 Food & Beverages

7.5 Oil & Gas

7.6 Pharmaceutical

7.7 Automotive

7.8 Aerospace & Defense

7.9 Electronics

7.10 Others

7.11 Y-O-Y Growth trend Analysis By Application

7.12 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Enterprise Manufacturing Intelligence Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Enterprise Manufacturing Intelligence Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International Inc.

9.2 Rockwell Automation Inc.

9.3 Schneider Electric SE

9.4 Siemens AG

9.5 Aspen Technology Inc.

9.6 Dassault Systems SA

9.7 Emerson Electric Co.

9.8 General Electric Co.

9.9 SAP SE

9.10 Yokogawa Electric Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Enterprise Manufacturing Intelligence Market size is valued at USD 4.53 billion in 2023.

The worldwide Global Enterprise Manufacturing Intelligence Market growth is estimated to be 13.3% from 2024 to 2030.

The Global Enterprise Manufacturing Intelligence Market is segmented By Type (Discrete Type, Process Manufacturing Type), By Application (Chemical, Energy & Power, Food & Beverages, Oil & Gas, Pharmaceutical, Automotive, Aerospace & Defense, Electronics, Others).

The Global Enterprise Manufacturing Intelligence Market anticipates future growth through trends like increased adoption of Industry 4.0, integration of advanced technologies (IoT, AI), enhanced cybersecurity measures, and rising demand in sectors like pharmaceuticals and automotive. Opportunities lie in optimizing operations, ensuring data security, and leveraging real-time insights for sustainable advancements.

The COVID-19 pandemic significantly impacted the Global Enterprise Manufacturing Intelligence Market, triggering a demand surge for resilient, data-driven solutions. Manufacturers prioritized EMI for real-time insights, predictive analytics, and remote monitoring to navigate disruptions, accelerating digitalization initiatives and emphasizing EMI's pivotal role in fostering adaptability and long-term sustainability.