Enterprise Data Catalog Market Size (2024 – 2030)

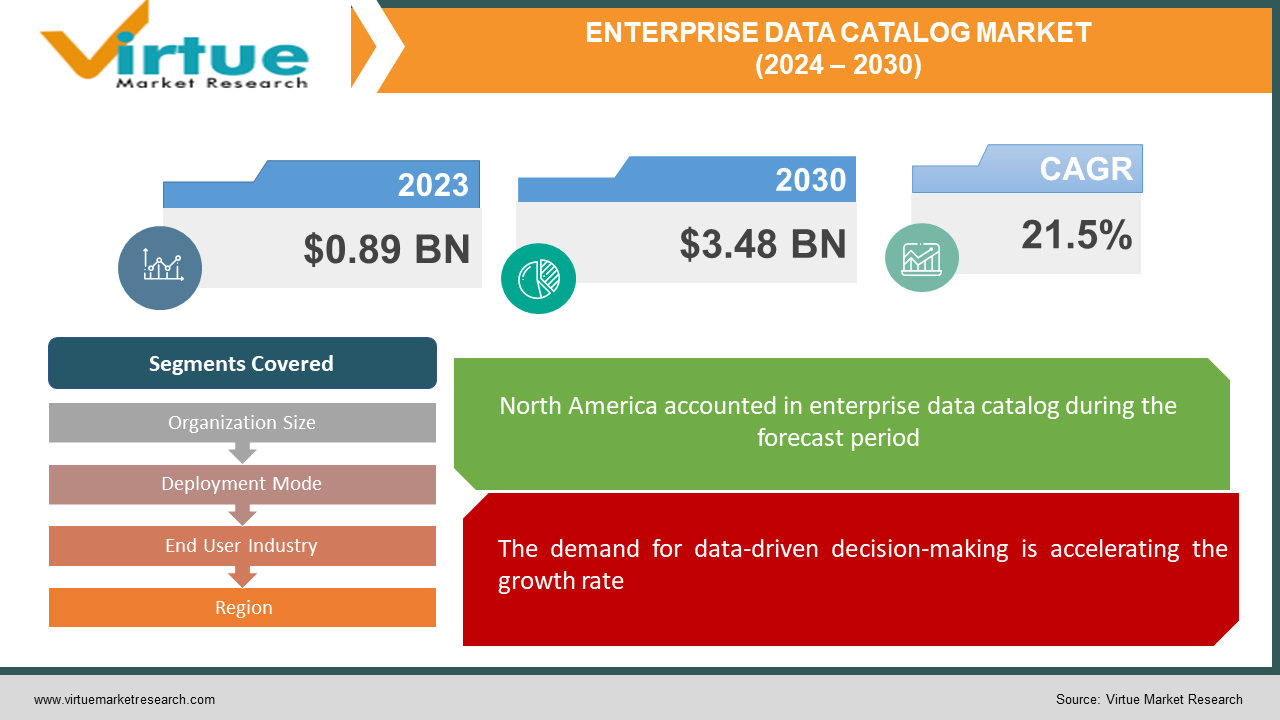

The market for enterprise data catalog at the global level is expanding quickly; it was estimated to be worth 0.89 USD billion in 2023 and is expected to increase to 3.48 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 21.5% from 2024 to 2030.

Due to the increasing demand for efficient data management solutions across numerous industries, the market for enterprise data catalogs, or EDCs, is rising quickly. Because of the ever-increasing volume and complexity of data that organizations must deal with, the EDC market is now crucial to achieving their digital transformation objectives. EDC solutions assist companies in enhancing their data governance, analytics, and compliance capabilities by locating, organizing, and managing massive data sources. The market is growing due to multiple factors, including the proliferation of data-driven decision-making, regulatory regulations necessitating complex data management procedures, and the growing usage of cloud-based technology. Additionally, as companies recognize the intrinsic worth of their data, they are searching for advanced cataloging solutions to unlock insights, increase operational effectiveness, and foster innovation.

Key Market Insights:

The need for strong security measures like encryption and access restrictions is highlighted by rising concerns about data security and privacy, which present substantial obstacles to market development. Promising potential arises from the integration of machine learning (ML) and artificial intelligence (AI) technologies, which enable automated data classification, discovery, and metadata enrichment for improved accuracy and efficiency in data cataloging operations.

North America is the market leader because of its strong legal systems and early adoption of cutting-edge data management technologies, which have significantly fueled industry expansion. As a result of its developing digital economy and rising use of data analytics tools across a range of industries, the Asia-Pacific region is showing the quickest growth rate, indicating enormous potential for market expansion in the area.

Global Enterprise Data Catalog Market Drivers:

The demand for data-driven decision-making is accelerating the growth rate.

In the contemporary digital era, organizations are leaning more and more on data to guide their strategic decision-making processes. The need for businesses to make effective use of their data resources is what is driving the market for enterprise data catalogs, or EDCs. Businesses may organize and catalog massive volumes of data from numerous sources with the use of EDC solutions, providing a coherent picture that aids in well-informed decision-making. Through the ability to identify trends, anticipate future occurrences, and unearth significant insights, EDC solutions help businesses gain a competitive edge in the global economy and enhance their business intelligence skills.

The increasing need for data governance solutions is facilitating the expansion.

Because data privacy regulations and compliance requirements are becoming more widespread worldwide, businesses are under increasing pressure to ensure the security and integrity of their data assets. The need for robust data governance solutions that support companies in adhering to legal requirements while maintaining operational efficacy is what's propelling the enterprise data catalog, or EDC, market. Businesses may adhere to data governance policies and reduce the likelihood of breaking the law with the aid of EDC systems' access control mechanisms, metadata management, and data lineage tracking features. As regulatory scrutiny grows, there is an increasing requirement for EDC solutions that prioritize data governance and compliance capabilities.

The shift to agile and scalable data management solutions through cloud adoption is enabling their development.

The growing adoption of cloud computing is reshaping the market for enterprise data catalogs (EDCs) as companies seek scalable and adaptable solutions to manage their expanding data ecosystems. Cloud-based EDC platforms offer several advantages, including elastic scalability, reduced infrastructure expenses, and expedited implementation. Using the scalability and flexibility of cloud infrastructures, businesses may easily expand their data cataloging capabilities to suit growing data volumes and shifting business needs. Additionally, cloud-based EDC systems provide seamless integration with other cloud services and data analytics tools, maximizing the value of data assets for enterprises while cutting down on overhead. As more businesses use cloud-native technology, it is projected that demand for cloud-based EDC solutions will increase.

Global Enterprise Data Catalog Market Restraints and Challenges:

Data security is a major concern.

One of the primary challenges confronting the global enterprise data catalog (EDC) market is the growing concern over data security and privacy. Organizations that collect and catalog vast amounts of data are more susceptible to data breaches, cyberattacks, and illegal access. The decentralized nature of data cataloging, which spreads information over multiple platforms and systems, makes security measures more challenging. Strong security measures, like encryption, access controls, and data masking strategies, are required to solve these issues and shield private information from possible attackers. If data security issues are not appropriately addressed, organizations run the risk of suffering financial loss, damage to their brand, and noncompliance with rules, among other major consequences.

Data quality is another barrier.

The global enterprise data catalog (EDC) industry is beset with numerous data quality concerns, including errors, duplication, and inconsistencies. Poor data quality can undermine the success of data categorization initiatives by resulting in inaccurate conclusions, poor judgment, and decreased operational efficiency. To maintain data accuracy and consistency, data cataloging solutions need to incorporate procedures for data cleansing, deduplication, and normalization. Organizations must set up procedures and structures for data governance to maintain standards for data quality and carry out regular evaluations of data integrity. Businesses may increase the dependability and usefulness of their data cataloging efforts and the value they derive from their data assets by proactively addressing data quality issues.

Interoperability difficulties in diverse data ecosystems create complexities.

Due to the difficulty of integrating Enterprise Data Catalogue (EDC) systems with existing IT infrastructures, organizations seeking to effectively leverage data cataloging capabilities face significant challenges. System integration is challenging because businesses usually operate in disparate contexts with a variety of data sources, formats, and technologies. Integration problems caused by disparate data silos, outdated systems, and incompatible data formats can impair the scalability and interoperability of EDC solutions. To solve these problems, facilitate data exchange, and expedite the data cataloging process, organizations need to invest in integration technologies like connectors, APIs, and middleware. By negotiating the difficulties of integrating EDC solutions into their current infrastructure, organizations may also maximize the value of their data.

Global Enterprise Data Catalog Market Opportunities:

AI and ML have been providing the market with many possibilities.

In the worldwide enterprise data catalog (EDC) market, combining machine learning (ML) and artificial intelligence (AI) technologies has a lot of potential. By automating tasks linked to data discovery, classification, and metadata enrichment, EDC platforms may improve accuracy and efficiency with the use of these advanced features. By employing AI and ML technology, organizations can discover hidden insights in their data, automate data governance procedures, and discover connections across many datasets. AI-driven data cataloging systems may also adapt and develop over time, which will increase their value and efficacy in dynamic data environments. By applying AI and ML, organizations may enhance their data cataloging capabilities, streamline data management processes, and gain insightful knowledge to drive business growth.

Increasing the use of data governance and compliance while meeting industry standards and regulatory requirements has been beneficial.

Because industry norms and laws are changing, there is a significant opening in the market for global enterprise data catalogs or EDCs. There is growing demand for businesses across several industries to comply with industry-specific norms and regulations, in addition to stringent data privacy laws such as HIPAA, CCPA, and GDPR. EDC solutions offer robust data governance and compliance features, like metadata management, data lineage tracing, and access restrictions, to help businesses achieve regulatory compliance and risk reduction. Through the centralization of data cataloging processes and the enforcement of governance standards, EDC solutions assist businesses in maintaining data integrity, ensuring accountability, and demonstrating regulatory compliance to stakeholders and regulatory bodies. Data governance and compliance features are projected to become more and more important in EDC solutions as regulatory requirements continue to

Unlocking unstructured data's potential is augmenting market growth.

Because there is a wealth of unstructured data, the worldwide enterprise data catalog (EDC) market has a tremendous opportunity for innovation and growth. The majority of data generated by organizations is unstructured and consists of textual records, multimedia files, and social media posts. EDC systems with advanced text mining, natural language processing (NLP), and content analysis tools enable businesses to catalog, categorize, and analyze unstructured data alongside structured datasets. By utilizing insights from a range of data sources, organizations may gain a thorough awareness of their data environment, uncover hidden patterns, and derive actionable insights to inform decisions and advance business objectives.

ENTERPRISE DATA CATALOG MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.5% |

|

Segments Covered |

By Organization Size, Deployment Mode, End User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Collibra, Alation, Informatica, IBM, Microsoft, SAP, Waterline Data, TIBCO Software, Talend, Denodo |

Enterprise Data Catalog Market Segmentation: By Organization Size

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

Large enterprises are the largest growing organization size. Strong data management solutions are required for these organizations since they handle enormous amounts of data from many sources and business divisions. Enterprise data catalogs enable large enterprises to accomplish regulatory compliance, foster cross-team cooperation, and accomplish full data governance. SMEs are the fastest-growing category. This is because SMEs are realising how important data management solutions are to boosting productivity and competitiveness. SMEs use business data catalogs to improve decision-making processes, expedite data discovery, and increase data quality despite their smaller size. SMEs use data to drive development and innovation through affordable, scalable solutions that are customized to meet their needs. This allows them to quickly respond to changing market conditions and take advantage of new possibilities.

Enterprise Data Catalog Market Segmentation: By Deployment Mode

-

On-Premises

-

Loud Based

Cloud-based solutions emerge as the largest and fastest-growing deployment mode. Businesses all over the world are growing more and more interested in cloud-based deployment due to its unparalleled advantages, which include scalability, agility, and cost-effectiveness. Unlike traditional on-premises solutions, cloud-based EDC platforms do not require ongoing maintenance or upfront infrastructure investments, allowing businesses to swiftly extend their data cataloging capabilities as needed. In today's fast-paced corporate environment, where businesses must deal with shifting workloads and data management requirements, this adaptability is very helpful.

Enterprise Data Catalog Market Segmentation: By End User Industry

-

BFSI

-

Healthcare

-

Retail & eCommerce

-

IT & Telecommunication

-

Manufacturing

-

Others

The BFSI sector is the largest growing. BFSI organizations give regulatory compliance, risk management, and data governance top priority since they have access to enormous volumes of sensitive financial data. Because they offer a centralized platform for lineage tracking, metadata management, and data discovery, enterprise data catalogs are essential in this field. BFSI companies may improve regulatory reporting capabilities, guarantee data integrity, and boost operational efficiency by utilizing modern data catalog solutions. Furthermore, BFSI institutions use enterprise data catalogs to extract actionable insights from their data assets in response to the growing demand for individualized financial services and the rise of fintech disruptors. This allows them to provide better customer experiences, reduce risks, and stay ahead of the competition in the quickly changing financial landscape. The retail & e-commerce sector is the fastest-growing end-user. With the use of EDC systems, these companies can effectively handle and analyze massive volumes of customer data, transactional records, inventory information, and marketing analytics. By implementing EDC platforms made especially for the retail sector, including supply chain optimization, personalized product recommendations, and consumer behavior research, retailers may increase their competitiveness and enhance customer experiences.

Enterprise Data Catalog Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the largest growing market. Strong legislative frameworks, the presence of leading technology companies, and the region's early adoption of cutting-edge data management solutions all contribute to its leadership position. North America is positioned as a major engine for market development and innovation due to the region's thriving ecosystem of technology suppliers and strong demand for advanced data analytics solutions, which further drive the adoption of corporate data catalogs. Asia-Pacific is expanding at the fastest rate due to the region's growing digital economy and rising use of data analytics tools. Businesses in industries including banking, telecommunications, and e-commerce use business data catalogs to make better decisions, increase operational efficiency, and extract insights from massive amounts of data. Additionally, as big data and cloud computing become more widespread, businesses in Asia-Pacific are embracing data catalog solutions to use their data assets for competitive advantage and market differentiation.

COVID-19 Impact Analysis on the Enterprise Data Catalog Market:

The COVID-19 epidemic has had a major impact on the sector, presenting both opportunities and challenges. On the one hand, the sudden shift to remote work and digital operations has accelerated the adoption of cloud-based EDC solutions as businesses search for adaptable and scalable data management solutions to support distant teams and ensure business continuity. The pandemic has also brought attention to how important it is to make choices on data, which has led to increased investments in EDC platforms to improve data governance, boost analytics capabilities, and foster operational efficiencies. However, due to budgetary constraints and economic worries, several organizations have chosen to postpone or scale back their IT investments, which has impacted the pace at which EDC adoption is happening in some cases. Furthermore, because of the disruption to supply chains and worker dynamics, which has increased the importance of data security and privacy, businesses are giving priority to EDC solutions that offer robust security features and compliance capabilities. All things considered, the COVID-19 pandemic has caused challenges for the EDC sector, but it has also presented an opportunity for suppliers to exercise creativity and adjust to the ever-changing demands of their customers in the rapidly evolving business landscape.

Latest Trends/ Developments:

Due to several recent developments that are altering the analytics and data management landscape, the market for enterprise data catalogs (EDCs) is growing swiftly. One noteworthy trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies in EDC platforms. Organizations that use AI and ML algorithms to automate data discovery, classification, and metadata tagging processes can expedite data cataloging efforts and more efficiently extract pertinent insights from their data assets.

This trend reflects both the increasing complexity of modern IT settings and the need for flexible and interoperable data management solutions. Furthermore, businesses are discovering they can extract valuable intelligence and insightful information from their data catalogs by combining advanced analytics and visualization tools with EDC platforms. Taken together, these latest developments and trends demonstrate how the EDC sector is constantly evolving and how data management strategies are constantly altering to become more creative, effective, and adaptable.

Key Players:

-

Collibra

-

Alation

-

Informatica

-

IBM

-

Microsoft

-

SAP

-

Waterline Data

-

TIBCO Software

-

Talend

-

Denodo

Chapter 1. ENTERPRISE DATA CATALOG MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ENTERPRISE DATA CATALOG MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ENTERPRISE DATA CATALOG MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ENTERPRISE DATA CATALOG MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ENTERPRISE DATA CATALOG MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ENTERPRISE DATA CATALOG MARKET – By Organization Size

6.1 Introduction/Key Findings

6.2 Small and Medium Enterprises (SMEs)

6.3 Large Enterprises

6.4 Y-O-Y Growth trend Analysis By Organization Size

6.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 7. ENTERPRISE DATA CATALOG MARKET – By End User

7.1 Introduction/Key Findings

7.2 BFSI

7.3 Healthcare

7.4 Retail & eCommerce

7.5 IT & Telecommunication

7.6 Manufacturing

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End User

7.9 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. ENTERPRISE DATA CATALOG MARKET – By Deployment Mode

8.1 Introduction/Key Findings

8.2 On-Premises

8.3 Loud Based

8.4 Y-O-Y Growth trend Analysis By Deployment Mode

8.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 9. ENTERPRISE DATA CATALOG MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Organization Size

9.1.3 By End User

9.1.4 By Deployment Mode

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Organization Size

9.2.3 By End User

9.2.4 By Deployment Mode

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Organization Size

9.3.3 By End User

9.3.4 By Deployment Mode

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Organization Size

9.4.3 By End User

9.4.4 By Deployment Mode

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Organization Size

9.5.3 By End User

9.5.4 By Deployment Mode

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. ENTERPRISE DATA CATALOG MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Collibra

10.2 Alation

10.3 Informatica

10.4 IBM

10.5 Microsoft

10.6 SAP

10.7 Waterline Data

10.8 TIBCO Software

10.9 Talend

10.10 Denodo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global market for enterprise data catalogs is growing rapidly; it is forecast to reach 3.48 billion USD by 2030, with a compound annual growth rate (CAGR) of 21.5% from 2024 to 2030. In 2023, the market was valued at 0.89 billion USD.

The need for effective data management solutions is being driven primarily by the growing volume and complexity of data in organizations, which is driving the global enterprise data catalog market.

The primary challenge facing the worldwide enterprise data catalog market is the prevalence of data quality issues, including errors, duplicates, and inconsistencies.

In 2023, North America held the largest share of the global enterprise data catalog market.

The major participants in the global enterprise data catalog market are Colibra, Alignment, Informatica, IBM, Microsoft, SAP, Waterline Data, TIBCO Software, Talend, Denodo, Zaloni, and Astacama.