Enrollment Management Solution Market Size (2024 – 2030)

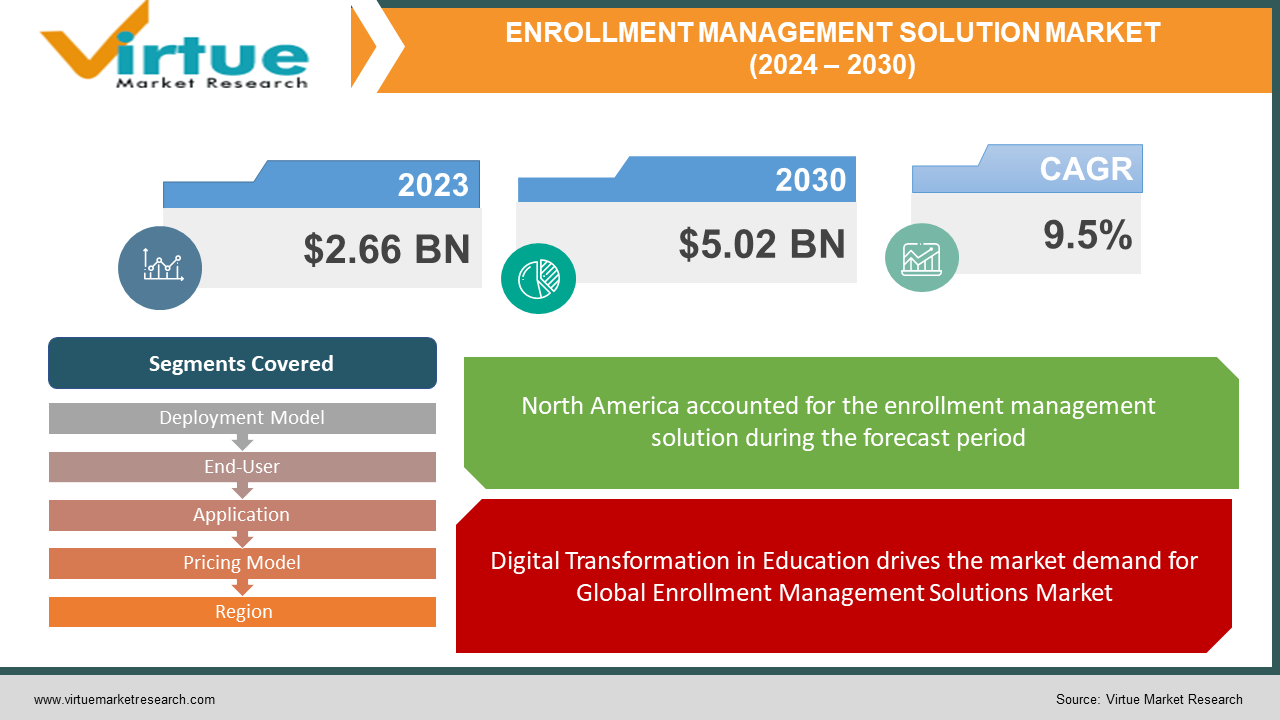

The Global Enrollment Management Solution Market is valued at USD 2.66 billion and is projected to reach a market size of USD 5.02 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.5%.

The global enrollment management solution market is characterized by long-term drivers such as digitization and automation, which have been further accelerated by the COVID-19 pandemic. In the short term, increasing competition among educational institutions presents opportunities for solution providers to innovate and differentiate their offerings. Additionally, the integration of AI and predictive analytics represents a notable trend in the industry, signaling a shift towards data-driven decision-making and personalized student engagement strategies. By staying abreast of these market dynamics and embracing technological advancements, stakeholders in the enrollment management solution market can navigate challenges, seize opportunities, and drive innovation to meet the evolving needs of educational institutions and students worldwide.

Key Market Insights:

As educational institutions strive to modernize their operations and adapt to changing student expectations, there has been a growing demand for comprehensive enrollment management solutions that can automate admissions, registration, and student data management processes. The COVID-19 pandemic further accelerated this trend, as institutions faced challenges in conducting traditional in-person enrollment activities. The shift towards remote learning and virtual engagement prompted educational institutions to invest in digital solutions to facilitate online admissions, virtual tours, and remote student support services. This increased reliance on digital enrollment management solutions is expected to persist even beyond the pandemic, driving sustained growth in the market.

As the global education market becomes more competitive, institutions are seeking ways to differentiate themselves and enhance the student experience. This presents an opportunity for enrollment management solution providers to offer innovative features and functionalities that address the specific needs and preferences of both students and institutions. One emerging trend observed in the industry is the integration of artificial intelligence (AI) and predictive analytics capabilities into enrollment management solutions. AI-powered tools can analyze vast amounts of data to predict enrollment trends, identify at-risk students, and personalize communication and outreach efforts. This trend reflects the industry's shift towards data-driven decision-making and proactive student engagement strategies, enabling institutions to optimize their enrollment processes and improve student outcomes.

Global Enrollment Management Solution Market Drivers:

Digital Transformation in Education drives the market demand for Global Enrollment Management Solutions Market.

The increasing adoption of digital technologies in education is a significant driver of the enrollment management solution market. Educational institutions worldwide are embracing digital transformation to enhance operational efficiency, improve student engagement, and streamline enrollment processes. Enrollment management solutions leverage technology to automate admissions, registration, and other enrollment-related tasks, enabling institutions to optimize their operations and provide a seamless experience for students.

Rising Demand for Higher Education has boosted the market for Global Enrollment Management Solutions Market.

The growing demand for higher education, driven by factors such as population growth, rising income levels, and increasing awareness about the importance of education, fuels the need for enrollment management solutions. Educational institutions face pressure to attract and retain students in a competitive landscape. Enrollment management solutions help institutions effectively manage the enrollment process, enhance student recruitment efforts, and improve retention rates by providing personalized experiences and tailored communication strategies.

Increasing Focus on Student Success drives the market demand for the Global Enrollment Management Solution Market.

There is a growing emphasis on student success and retention in higher education institutions. Institutions are prioritizing initiatives aimed at improving student outcomes, enhancing academic support services, and increasing student engagement. Enrollment management solutions contribute to student success efforts by providing institutions with tools to identify at-risk students, implement targeted interventions, and monitor student progress throughout their academic journey, thereby improving retention rates and enhancing overall student satisfaction.

Regulatory Compliance and Reporting Requirements have boosted the market for Global Enrollment Management Solutions Market.

Educational institutions must comply with regulatory requirements and reporting standards related to enrollment, accreditation, and student data management. Enrollment management solutions help institutions streamline compliance processes by providing tools for data collection, analysis, and reporting. These solutions enable institutions to maintain accurate records, ensure data security and privacy, and demonstrate compliance with regulatory mandates, enhancing institutional reputation and credibility.

Global Enrollment Management Solution Market Restraints and Challenges:

One of the primary restraints in the adoption of enrollment management solutions is the cost associated with implementing and maintaining these systems. Educational institutions, particularly smaller colleges and universities with limited budgets, may find it challenging to invest in expensive software solutions. Additionally, the ongoing costs of software licenses, upgrades, and maintenance can strain institutional finances, making it difficult for some institutions to justify the investment in enrollment management solutions.

Educational institutions often have existing systems and processes in place for managing admissions, student records, and other enrollment-related activities. Integrating new enrollment management solutions with legacy systems can be complex and time-consuming. Compatibility issues, data migration challenges, and interoperability concerns may arise during the integration process, leading to delays and disruptions in operations. Overcoming integration barriers requires careful planning, resources, and collaboration between technology vendors and institutional stakeholders

Management Solution Market Opportunities:

There is a growing demand for personalized experiences among students throughout their academic journey. Enrollment management solutions offer opportunities to customize interactions with prospective and current students, providing tailored communications, personalized recommendations, and targeted support services. By leveraging data analytics, artificial intelligence (AI), and machine learning (ML) algorithms, institutions can gain insights into student preferences, behaviors, and needs, enabling them to deliver personalized experiences that enhance student satisfaction and engagement.

Enrollment management solutions enable educational institutions to develop and implement more effective recruitment and retention strategies. By leveraging data-driven insights and predictive analytics, institutions can identify prospective students who are likely to succeed academically and fit well with the institution's culture and values. Furthermore, enrollment management solutions can support targeted outreach efforts, personalized communications, and proactive interventions to recruit and retain students, thereby improving enrollment yields and retention rates.

ENROLLMENT MANAGEMENT SOLUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.5% |

|

Segments Covered |

By Deployment Model, End-User, Application, Pricing Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ellucian, Oracle Corporation, Salesforce, Campus Management Corp., Blackbaud, Inc., PowerSchool Group LLC, AdmitHub, Technolutions, TargetX, Jenzabar, Inc. |

Global Enrollment Management Solution Market Segmentation: By Deployment Model

-

On-Premises Deployment

-

Cloud-Based Deployment

In the realm of enrollment management solutions, how these systems are deployed plays a crucial role in their effectiveness and accessibility. Two primary deployment models dominate the landscape: on-premises deployment and cloud-based deployment. Among these, the largest segment in the global enrollment management solution market is cloud-based deployment. Cloud-based deployment offers institutions greater flexibility, scalability, and accessibility compared to traditional on-premises solutions. Institutions can access cloud-based enrollment management systems from anywhere with an internet connection, eliminating the need for physical infrastructure and reducing maintenance costs. Additionally, cloud-based deployment enables seamless updates and upgrades, ensuring institutions always have access to the latest features and functionalities.

Moreover, the fastest-growing segment in the market is cloud-based deployment. As educational institutions increasingly embrace digital transformation and remote learning, there is a growing demand for cloud-based enrollment management solutions. The COVID-19 pandemic has further accelerated this trend, prompting institutions to prioritize cloud-based solutions to support remote admissions, virtual campus tours, and online enrollment processes. With the advantages of flexibility, accessibility, and scalability offered by cloud-based deployment, it is poised to continue its rapid growth and dominance in the global enrollment management solution market.

Global Enrollment Management Solution Market Segmentation: By End-User

-

Higher Education Institutions

-

K-12 Schools

-

Vocational Training Institutes

-

Others

When it comes to enrollment management solutions, identifying the primary users is essential for understanding market dynamics. End-users of these solutions encompass a variety of educational institutions, including higher education institutions, K-12 schools, vocational training institutes, and others. Among these, the largest segment in the global enrollment management solution market is higher education institutions. These institutions, which include colleges and universities, have a significant need for enrollment management solutions to manage admissions, registration, financial aid, and student records efficiently.

However, the fastest-growing segment in the market is K-12 schools. With the increasing emphasis on student enrollment, retention, and academic success in primary and secondary education, K-12 schools are increasingly adopting enrollment management solutions to streamline enrollment processes, improve student engagement, and enhance parent communication. As K-12 schools prioritize digital transformation and data-driven decision-making, the demand for enrollment management solutions tailored to their specific needs is expected to continue growing rapidly.

Global Enrollment Management Solution Market Segmentation: By Application

-

Admissions Management

-

Student Information Systems

-

Financial Aid Management

-

Academic Advising

-

Student Engagement and Retention

In the realm of enrollment management solutions, various applications cater to different aspects of the enrollment process and student lifecycle. These applications include admissions management, student information systems, financial aid management, academic advising, and student engagement and retention. Among these, the largest segment in the global enrollment management solution market is admissions management. Admissions management solutions help educational institutions streamline the admissions process, manage applicant information, and make data-driven decisions to optimize enrollment.

However, the fastest-growing segment in the market is student engagement and retention. As educational institutions focus more on student success and retention, there is a growing demand for solutions that can enhance student engagement, provide personalized support, and identify at-risk students. Student engagement and retention solutions leverage data analytics and predictive modeling to identify patterns and trends in student behavior, enabling institutions to implement targeted interventions and support services to improve student retention rates. As institutions prioritize student engagement and retention initiatives, the demand for enrollment management solutions that can support these efforts is expected to continue growing rapidly.

Global Enrollment Management Solution Market Segmentation: By Pricing Model

-

Subscription-Based

-

Perpetual License

-

Pay-Per-Use

In the realm of enrollment management solutions, how these systems are priced plays a vital role in their accessibility and affordability. There are various pricing models available, including subscription-based, perpetual license, and pay-per-use. Among these, the largest segment in the global enrollment management solution market is subscription-based pricing. Subscription-based models offer institutions the flexibility to pay for the software regularly, typically monthly or annually, rather than making a one-time upfront payment. This allows institutions to spread out the cost over time and budget more effectively. Additionally, subscription-based pricing often includes ongoing updates, support, and maintenance, ensuring that institutions have access to the latest features and support services.

On the other hand, the fastest-growing segment in the market is also subscription-based pricing. With the increasing adoption of cloud-based enrollment management solutions and the shift towards recurring revenue models, subscription-based pricing is experiencing rapid growth. Institutions appreciate the predictability and scalability offered by subscription-based models, as well as the ability to align costs with usage and scale up or down as needed. As a result, subscription-based pricing is expected to continue its momentum as the preferred pricing model in the global enrollment management solution market.

Global Enrollment Management Solution Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

When examining the global enrollment management solution market, understanding regional trends and preferences is crucial. The market is segmented into different regions, including North America, Asia-Pacific, Europe, South America, and the Middle East and Africa. Among these regions, the largest segment in the market is North America. North America boasts a robust education sector with a high demand for enrollment management solutions. Educational institutions in this region prioritize efficiency, innovation, and technology adoption, driving the demand for advanced enrollment management solutions.

However, the fastest-growing segment in the market is Asia-Pacific. The Asia-Pacific region is experiencing rapid economic growth and a surge in demand for higher education. As educational institutions in Asia-Pacific countries invest in expanding their offerings, improving student experiences, and enhancing administrative processes, the demand for enrollment management solutions is on the rise. Additionally, the increasing adoption of digital technologies and online learning platforms in the region further fuels the growth of the enrollment management solution market in Asia-Pacific. As a result, the Asia-Pacific region presents significant opportunities for enrollment management solution providers looking to expand their presence and capitalize on the growing demand for innovative education technology solutions.

COVID-19 Impact Analysis on the Global Enrollment Management Solution Market:

The sharp decline in air travel demand during the pandemic has resulted in reduced airline operations and flight frequencies. With fewer flights and grounded fleets, the need for aircraft maintenance and repair services has decreased significantly. Airlines have scaled back their maintenance activities, deferred non-essential maintenance tasks, and postponed fleet expansion plans to conserve cash and mitigate financial losses.

The economic impact of the pandemic has intensified the focus on cost optimization and efficiency improvement within the aviation industry. Airlines and maintenance providers are seeking ways to reduce operating costs, streamline maintenance processes, and improve resource utilization. While smart maintenance solutions offer long-term benefits in terms of efficiency and reliability, the immediate priority for many organizations is to minimize expenses and preserve liquidity.

Latest Trends/ Developments:

One of the key impacts of COVID-19 on the enrollment management solution market has been the increased demand for digitalization and remote learning tools. With the sudden shift to online education, institutions have recognized the need for robust enrollment management solutions to support virtual admissions, remote student engagement, and online enrollment processes. As a result, there has been a surge in the adoption of cloud-based enrollment management solutions, which offer the flexibility and scalability needed to accommodate remote operations.

Additionally, the pandemic has underscored the importance of data-driven decision-making in enrollment management. Institutions are leveraging enrollment management solutions with advanced analytics capabilities to gain insights into shifting enrollment trends, student preferences, and retention challenges. By analyzing data from various sources, including online applications, student interactions, and academic performance, institutions can make informed decisions and develop targeted strategies to recruit and retain students effectively in the face of uncertainty.

Key Players:

-

Ellucian

-

Oracle Corporation

-

Salesforce

-

Campus Management Corp.

-

Blackbaud, Inc.

-

PowerSchool Group LLC

-

AdmitHub

-

Technolutions

-

TargetX

-

Jenzabar, Inc.

Chapter 1. Enrollment Management Solution Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Enrollment Management Solution Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Enrollment Management Solution Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Enrollment Management Solution Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Enrollment Management Solution Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Enrollment Management Solution Market – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-Premises Deployment

6.3 Cloud-Based Deployment

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. Enrollment Management Solution Market – By Application

7.1 Introduction/Key Findings

7.2 Admissions Management

7.3 Student Information Systems

7.4 Financial Aid Management

7.5 Academic Advising

7.6 Student Engagement and Retention

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Enrollment Management Solution Market – By Pricing Model

8.1 Introduction/Key Findings

8.2 Subscription-Based

8.3 Perpetual License

8.4 Pay-Per-Use

8.5 Y-O-Y Growth trend Analysis By Pricing Model

8.6 Absolute $ Opportunity Analysis By Pricing Model, 2024-2030

Chapter 9. Enrollment Management Solution Market – By End-User

9.1 Introduction/Key Findings

9.2 Higher Education Institutions

9.3 K-12 Schools

9.4 Vocational Training Institutes

9.5 Others

9.6 Y-O-Y Growth trend Analysis By End-User

9.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Enrollment Management Solution Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Model

10.1.2.1 By Application

10.1.3 By Pricing Model

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Model

10.2.3 By Application

10.2.4 By Pricing Model

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Model

10.3.3 By Application

10.3.4 By Pricing Model

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Model

10.4.3 By Application

10.4.4 By Pricing Model

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Model

10.5.3 By Application

10.5.4 By Pricing Model

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Enrollment Management Solution Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ellucian

11.2 Oracle Corporation

11.3 Salesforce

11.4 Campus Management Corp.

11.5 Blackbaud, Inc.

11.6 PowerSchool Group LLC

11.7 AdmitHub

11.8 Technolutions

11.9 TargetX

11.10 Jenzabar, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Enrollment Management Solution Market is valued at USD 2.66 billion and is projected to reach a market size of USD 5.05 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.5%.

Digital Transformation in Education, Rising Demand for Higher Education, Increasing Focus on Student Success, and Regulatory Compliance and Reporting Requirements are the market drivers of the Global Enrollment Management Solution Market.

On-premises deployment and Cloud-Based Deployment are the segments under the Global Enrollment Management Solution Market by Deployment Model.

North America is the most dominant region for the Global Enrollment Management Solution Market.

Asia-Pacific is the fastest-growing region in the Global Enrollment Management Solution Market.