Energy Storage Systems Market Size (2024–2030)

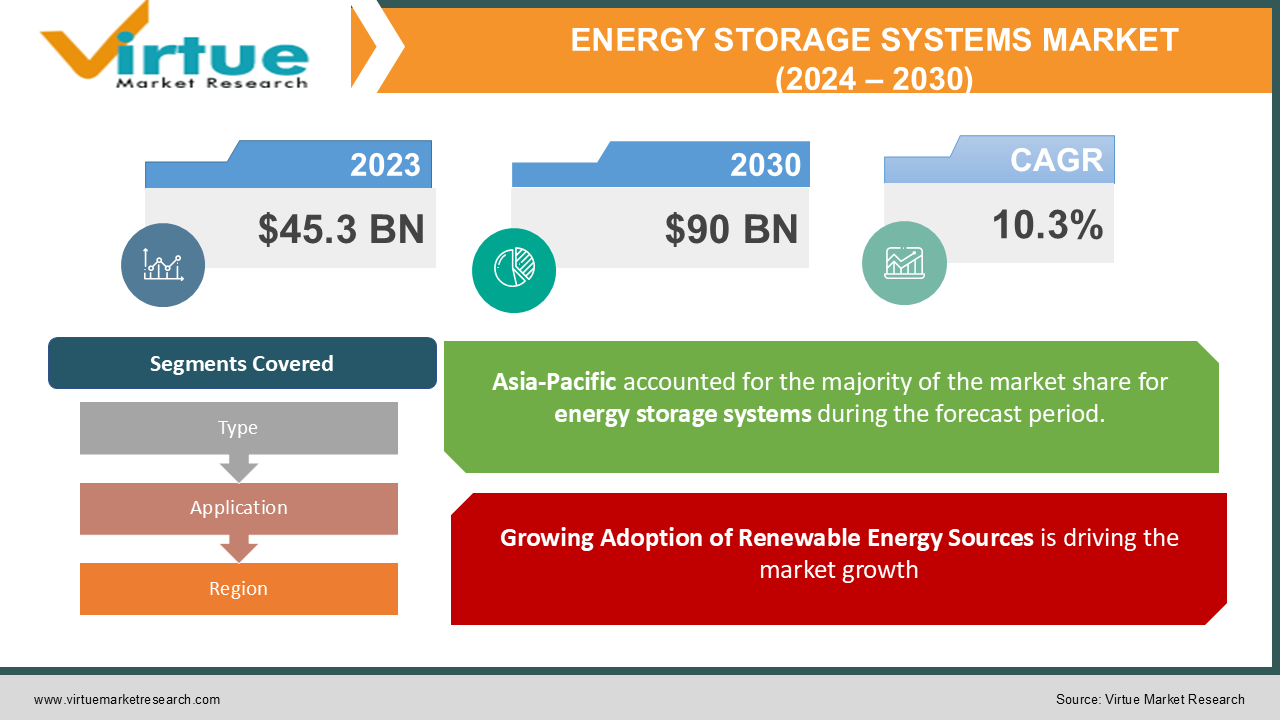

The Global Energy Storage Systems Market was valued at USD 45.3 billion in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2030, reaching approximately USD 90 billion by 2030.

Energy storage systems (ESS) play a critical role in managing power demand, enhancing grid stability, and integrating renewable energy sources like solar and wind. The market for ESS is expanding due to increased investments in renewable energy, the global transition to sustainable power solutions, and the need for efficient energy management in various sectors.

Rapid advancements in battery technology, particularly in lithium-ion storage systems, along with government initiatives to develop and adopt clean energy solutions, are driving significant growth in this market. Applications for ESS have diversified, from electric vehicles (EVs) and grid storage to industrial, commercial, and residential power management solutions. The global push for carbon neutrality and increasing energy demand have positioned energy storage systems as vital to future energy infrastructure.

Key Market Insights:

Lithium-ion batteries hold the largest market share, accounting for 60% of the total market in 2023, due to their high energy density, long cycle life, and scalability for multiple applications.

Grid storage is a leading application, contributing over 40% of the market revenue, as ESS is integral to stabilizing and balancing the grid, especially with renewable energy integration.

The transportation sector, particularly EVs, is anticipated to grow rapidly, with the sector expected to represent 25% of the market by 2030.

Asia-Pacific leads the market with a 35% share, driven by the expanding EV industry and substantial investments in renewable energy projects, especially in China, Japan, and South Korea.

Global Energy Storage Systems Market Drivers:

Growing Adoption of Renewable Energy Sources is driving the market growth:

The global drive to reduce carbon emissions and transition to sustainable energy sources is a significant driver of the ESS market. Renewable energy sources such as solar and wind power are intermittent, requiring efficient energy storage solutions to stabilize the power grid and ensure a reliable supply. As countries commit to carbon neutrality, the integration of renewable energy sources into national grids has become a top priority. Energy storage systems, particularly large-scale grid storage solutions, play a crucial role in managing renewable energy. They store excess energy during peak production periods and release it when demand is high or generation is low, balancing the grid and minimizing energy wastage. According to recent data, renewable energy accounted for nearly 30% of global power generation in 2023, and this figure is expected to grow. The increased share of renewables in the energy mix drives the demand for ESS, as they are essential to overcoming the variability and reliability issues associated with renewable energy.

Rising Demand for Electric Vehicles (EVs) is driving the market growth:

The growing adoption of electric vehicles has significantly boosted demand for energy storage systems, particularly lithium-ion batteries. As the automotive industry shifts toward electrification to reduce greenhouse gas emissions, demand for EVs is surging globally. In 2023, EVs represented approximately 12% of total global vehicle sales, and this percentage is expected to increase rapidly over the coming years. Energy storage technology is critical to the EV industry, as it directly impacts vehicle range, efficiency, and performance. The development of high-capacity, fast-charging lithium-ion batteries is central to meeting the needs of the expanding EV market. Furthermore, government incentives, including tax rebates, subsidies, and stricter emission regulations, are propelling EV adoption, creating substantial growth opportunities for ESS providers. The integration of renewable energy with EV charging infrastructure further amplifies the importance of ESS in achieving a sustainable transportation ecosystem.

Government Policies and Incentives Supporting Energy Storage is driving the market growth:

Governments worldwide are implementing policies, subsidies, and incentives to encourage the development and deployment of energy storage systems. These initiatives are part of broader strategies to meet renewable energy targets, enhance energy security, and address environmental challenges. In the United States, for example, the Investment Tax Credit (ITC) supports energy storage projects, providing significant tax benefits for developers and encouraging private investment in ESS. In Europe, the European Green Deal and the Renewable Energy Directive have set ambitious targets for renewable energy and energy storage. These policies mandate that member states invest in energy storage infrastructure to facilitate the integration of renewable energy sources. Additionally, countries in the Asia-Pacific region, such as China, Japan, and South Korea, have implemented programs to support the ESS market, including subsidies for EV battery manufacturers and energy storage providers. Such supportive policies and incentives are crucial drivers of the ESS market, accelerating its growth and encouraging technological innovation.

Global Energy Storage Systems Market Challenges and Restraints:

High Cost of Energy Storage Systems is restricting the market growth:

Despite significant technological advancements, the high cost of energy storage systems remains a barrier to their widespread adoption. Lithium-ion batteries, which dominate the ESS market, are costly to manufacture due to expensive raw materials like lithium, cobalt, and nickel. The initial capital investment required for large-scale ESS projects, such as grid storage, can be prohibitive for many companies and governments, especially in emerging markets. The high cost of ESS affects its affordability for residential and commercial consumers, limiting the adoption of off-grid and energy independence solutions. Although ongoing research aims to reduce costs through material innovation and improved manufacturing processes, cost remains a key constraint. Furthermore, fluctuations in raw material prices can impact the affordability of ESS, creating challenges for long-term planning and budget allocation.

Concerns over Battery Recycling and Environmental Impact is restricting the market growth:

The environmental impact of ESS, particularly regarding battery recycling and disposal, poses a challenge to market growth. Lithium-ion batteries, commonly used in ESS, contain metals that are difficult to recycle, including cobalt, nickel, and lithium. The improper disposal of these batteries can lead to environmental hazards, including soil and water contamination. Battery recycling infrastructure is still underdeveloped in many regions, and the recycling process is costly and energy-intensive, further complicating efforts to create a sustainable ESS lifecycle. Environmental regulations are expected to tighten as governments become more aware of the ecological risks associated with ESS waste. This regulatory environment may increase compliance costs for ESS manufacturers and encourage the development of alternative, more sustainable battery chemistries. Addressing these environmental concerns is essential to achieving the sustainability goals of the ESS market.

Market Opportunities:

The energy storage systems market offers substantial opportunities, particularly with the growth of renewable energy projects, the expansion of smart grids, and the development of innovative battery technologies. With the rapid expansion of renewable energy infrastructure worldwide, there is a rising need for ESS to support grid stability and energy management. Renewable energy projects, such as large solar and wind farms, require ESS to mitigate the variability of energy production, ensuring a stable power supply. Additionally, the evolution of smart grids, which integrate renewable energy sources, ESS, and advanced grid management solutions, presents new growth avenues for ESS providers. Smart grids enhance grid resilience and optimize power distribution, creating demand for distributed ESS installations. In the residential sector, the rising interest in home energy storage systems, combined with rooftop solar, supports energy independence and resilience, especially in areas prone to power outages. Technological advancements in battery storage, including solid-state batteries and sodium-ion batteries, represent promising opportunities for the market. These alternatives to lithium-ion technology offer advantages such as increased safety, improved energy density, and reduced reliance on expensive and environmentally challenging raw materials. With continued research and investment, these innovations have the potential to transform the ESS market, expanding accessibility and sustainability.

ENERGY STORAGE SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla, Inc., LG Energy Solution, Samsung SDI Co., Ltd., BYD Company Ltd., Contemporary Amperex Technology Co., Limited (CATL), Fluence Energy, Inc., ABB Ltd., Siemens AG, Panasonic Corporation, EnerSys |

Energy Storage Systems Market Segmentation: By Type

-

Lithium-Ion Batteries

-

Lead-Acid Batteries

-

Flow Batteries

-

Thermal Storage

-

Mechanical Storage

The lithium-ion batteries segment dominates the market, accounting for 60% of the market share in 2023. Lithium-ion batteries are widely used across multiple ESS applications due to their high energy density, longevity, and declining costs.

Energy Storage Systems Market Segmentation: By Application

-

Transportation

-

Grid Storage

-

Residential

-

Commercial

-

Industrial

Grid storage holds the largest share in the application segment, representing over 40% of the total revenue in 2023. Grid storage is critical to supporting renewable energy integration, balancing electricity supply and demand, and enhancing grid stability.

Energy Storage Systems Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The Asia-Pacific region is the dominant market, with a 35% share of global ESS revenue in 2023. This region’s dominance is attributed to substantial investments in renewable energy and ESS infrastructure, particularly in China, Japan, and South Korea, alongside the rapid growth of the EV industry.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the energy storage systems market. While supply chain disruptions led to delays in ESS deployment and increased material costs, the demand for resilient energy infrastructure highlighted the importance of ESS, particularly in regions with high renewable energy penetration. The pandemic accelerated the adoption of decentralized energy solutions, including residential ESS, as businesses and households sought backup power to mitigate power disruptions. The renewable energy sector, although initially impacted, rebounded as governments prioritized green recovery initiatives. These efforts included investments in ESS to support the expansion of renewable energy. The heightened awareness of the need for reliable power storage solutions has continued to drive ESS demand in the post-pandemic period, particularly for grid storage and backup solutions in residential and commercial applications.

Latest Trends/Developments:

Recent developments in the ESS market include advancements in solid-state and sodium-ion battery technologies, increased focus on residential storage solutions, and smart grid integration. Solid-state batteries, which offer improved energy density and safety, are emerging as a promising alternative to lithium-ion batteries. The demand for home energy storage systems is also growing as residential customers seek energy independence and resilience, often pairing ESS with solar PV systems. Furthermore, ESS integration with smart grid technology is advancing grid management capabilities, enabling real-time response to power demand fluctuations and improving grid efficiency. These trends are shaping the ESS market toward a more sustainable, resilient, and versatile future.

Key Players:

-

Tesla, Inc.

-

LG Energy Solution

-

Samsung SDI Co., Ltd.

-

BYD Company Ltd.

-

Contemporary Amperex Technology Co., Limited (CATL)

-

Fluence Energy, Inc.

-

ABB Ltd.

-

Siemens AG

-

Panasonic Corporation

-

EnerSys

Chapter 1. Energy Storage Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Energy Storage Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Energy Storage Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Energy Storage Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Energy Storage Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Energy Storage Systems Market – By Type

6.1 Introduction/Key Findings

6.2 Lithium-Ion Batteries

6.3 Lead-Acid Batteries

6.4 Flow Batteries

6.5 Thermal Storage

6.6 Mechanical Storage

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Energy Storage Systems Market – By Application

7.1 Introduction/Key Findings

7.2 Transportation

7.3 Grid Storage

7.4 Residential

7.5 Commercial

7.6 Industrial

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Energy Storage Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Energy Storage Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Tesla, Inc.

9.2 LG Energy Solution

9.3 Samsung SDI Co., Ltd.

9.4 BYD Company Ltd.

9.5 Contemporary Amperex Technology Co., Limited (CATL)

9.6 Fluence Energy, Inc.

9.7 ABB Ltd.

9.8 Siemens AG

9.9 Panasonic Corporation

9.10 EnerSys

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 45.3 billion in 2023 and is projected to reach USD 90 billion by 2030, growing at a CAGR of 10.3%.

Key drivers include the adoption of renewable energy, rising demand for electric vehicles, and supportive government policies for energy storage infrastructure

The market is segmented by type (lithium-ion batteries, lead-acid batteries, flow batteries, etc.) and application (transportation, grid storage, residential, commercial, and industrial).

Asia-Pacific dominates, with a 35% share of the global market in 2023.

Leading players include Tesla, Inc., LG Energy Solution, Samsung SDI Co., Ltd., BYD Company Ltd., and Fluence Energy, Inc.