Energy Retrofit Systems Market Size (2024 – 2030)

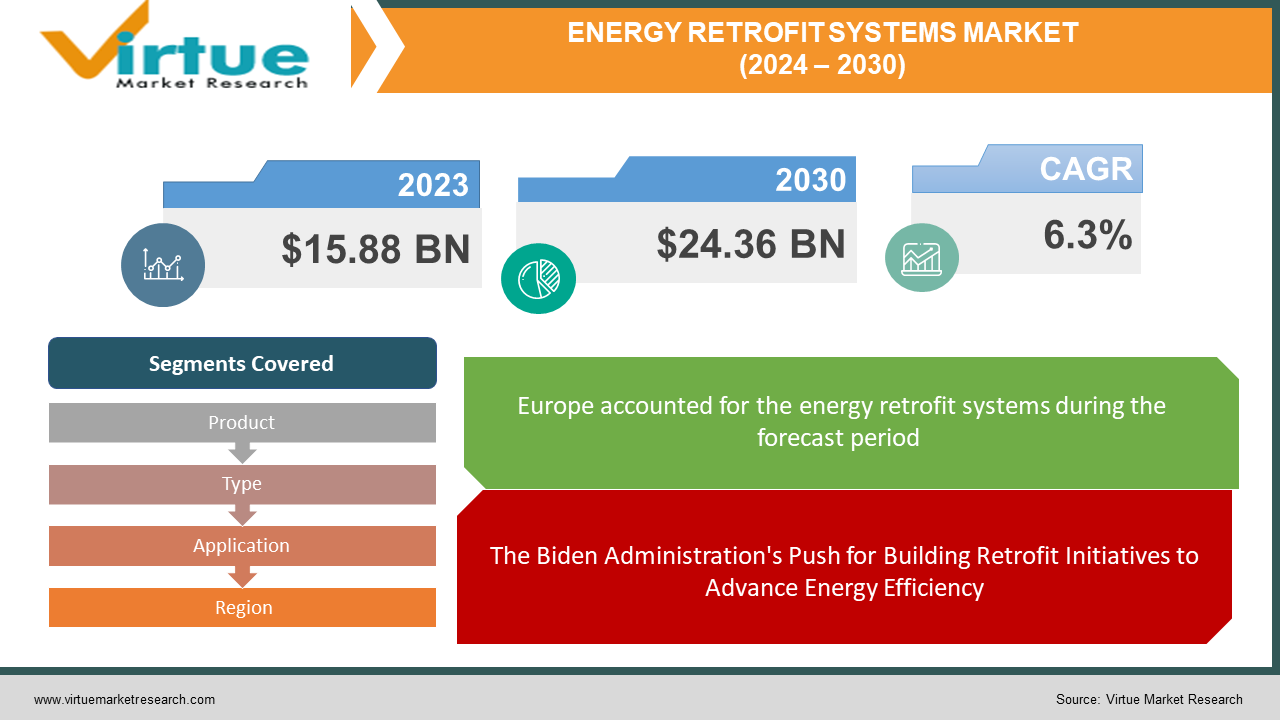

The Global Market was valued at USD 15.88 Billion and is projected to reach a market size of USD 24.36 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% between 2024 and 2030.

Growing worries about greenhouse gas (GHG) emissions and strict legislation to reduce carbon footprint are projected to be the main drivers of the expansion. It is anticipated that the growing use of HVAC appliances in a variety of industries will increase demand for the products. The majority of lighting and HVAC technology needs to be updated after 25 years since they are deemed outdated. Energy costs for homes and businesses are significantly reduced by retrofitting these systems. Due to extensive building projects and the adoption of retrofit systems to replace outdated, energy- and money-guzzling systems, the U.S. market is anticipated to increase significantly over the projected period. Following the United States Federal Government's decision to withdraw from the Paris Climate Accord, conjecture has been raised over non-renewable energy corporations' potential to profit from the situation. Additionally, it is anticipated that the financial incentives provided by government agencies would contribute to the rapid growth in public awareness of the use of renewable energy. These parts require constant technical advancements to improve the performance of energy retrofit system modules.

Key Market Insights:

New business models in the electrical industry are starting to develop as a result of the growing installation of energy infrastructure and the spread of smart devices. An increase in energy demand worldwide in the commercial, industrial, and residential sectors is the driving force behind this development. The introduction of smart home appliances, especially for domestic use, allows for real-time power consumption optimisation and monitoring. Customers are looking for methods to reduce waste and increase efficiency as they become more aware of how much energy they use. They can monitor and control how much electricity they use thanks to smart gadgets, which can result in better decisions and possibly large cost savings. Furthermore, by making it easier to incorporate renewable energy sources into residential energy systems, these technologies advance sustainability initiatives. The proliferation of smart devices and the growing installation of energy systems have made it easier for creative business models to emerge in the electrical industry. The global increase in energy demand in the commercial, industrial, and residential sectors is driving this trend. The introduction of smart home gadgets allows for real-time power usage optimisation and monitoring, especially in the residential market. As consumers become more aware of how much energy they use, they look for ways to reduce waste and increase efficiency. With the help of smart gadgets, they can monitor and control how much electricity they use, which can result in better decisions and possibly large cost savings. Further advancing sustainability efforts, these technologies make it easier to incorporate renewable energy sources into residential energy systems.

Global Energy Retrofit Systems Market Drivers:

The Biden Administration's Push for Building Retrofit Initiatives to Advance Energy Efficiency.

The construction industry is expected to rapidly embrace energy retrofit systems due to their ability to maximise energy efficiency, minimise land energy usage, and lessen the need for new building construction. These systems have many advantages; they prolong the life of current buildings and guarantee the best possible thermal comfort for inhabitants, which raises productivity. Specifically, the Biden Administration stepped up efforts to modernise and upgrade residential and commercial structures in the United States with an emphasis on energy efficiency, affordability, accessibility, resilience, and electrification. In order to support 44 projects that cut energy costs and move the country closer to reaching net-zero carbon emissions, the U.S. Department of Energy (DOE) provided financing totalling USD 82.6 million as part of this effort. Among these initiatives, the New Jersey Institute of Technology will design, prototype, install, test, and assess a high-performance residential wall retrofit that should save at least 30% of energy for heating and cooling. This coordinated effort demonstrates a dedication to using cutting-edge technologies and building techniques to promote sustainable and energy-efficient building solutions across the country.

Government Policies and Procedures for Putting Energy-Improving Projects Into Action to Drive Growth

Retrofitting systems, which can save energy to the tune of 10% to 40%, are frequently installed in both commercial and residential buildings. Several government rules, financial models, and regulatory frameworks are frequently used in conjunction with this adoption to increase the coverage of energy retrofit systems and improve the energy performance of buildings. As an example, the Mayor's Energy of Londoner programme has accelerated efforts to reach carbon neutrality by 2030 by introducing a retrofit accelerator for houses and buildings. This programme is also supported by the European Regional Development Fund, which makes it easier to solve the climate emergency and lower energy costs by using low-carbon heating and electricity solutions and insulation. The Dutch government's strict law, which mandates that office buildings reach performance level C by 2023 and performance level A by 2030, is another noteworthy example. As of right now, about 15,000 residences or buildings are required to achieve the 2023 standards. By providing money or income to encourage private investments in building restoration, the EU Emissions Trading System improves the state of the market for energy retrofit solutions.

Global Energy Retrofit Systems Market Restraints and Challenges:

The residential sector is responsible for around 27.2% of energy consumption and 24% of CO2 emissions, according to the European Union (EU). To fully modernise the residential stack by 2050, the European Union has set long-term investment strategies and energy policies. In the home sector, obtaining efficient energy levels is not an easy feat, though. The current disparity in energy efficiency can be attributed to the illogical habits of residential users. Numerous research has looked into how the energy efficiency difference between potential investments and real implementations is impeding the growth of the energy retrofit systems market. Moreover, behavioural justifications, inaccurate model measurements, and a lack of knowledge of the advantages and range of options associated with energy efficiency all impede market expansion. Furthermore, the energy retrofit sector faces pressures from other reasons like structural changes. Energy retrofit systems have the potential to damage cultural and archaeological treasures due to the employment of untested technology or methodologies.

Global Energy Retrofit Systems Market Opportunities:

One of the market trends for any country's environmentally, socially, and economically sustainable development is energy efficiency. But the best way to support long-term environmental sustainability and get over the world's energy crisis is to use less energy. The building and construction sector is highly dependent on energy and contributes significantly to sustainability and energy conservation. Approximately 50% of all energy use is attributed to the building sector. Energy retrofit systems offer a chance to enhance any business building's assets for the duration of their life while also lowering energy consumption or increasing energy efficiency. Distributed generation installation in a building is also a great possibility provided by energy retrofit systems. To put things in perspective, the Dutch government has committed to paying subsidies for rental properties ranging from EUR 150 million to EUR 600 million, as well as funds for local governments to build energy-efficient housing. Targets for the energy-saving agreement include long-term energy savings and nearly zero energy levels, as well as the usage of one million retrofit systems by 2020 and associated market development initiatives. Thus, the rise in energy retrofit systems is driven by an increased emphasis on energy efficiency.

ENERGY RETROFIT SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Product, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DAIKIN INDUSTRIES, Ltd., Ameresco, Eaton, AECOM, Johnson Controls, Orion Energy Systems, Inc., Siemens, Trane, Signify Holding, General Electric, Schneider Electric |

Global Energy Retrofit Systems Market Segmentation: By Type

-

Quick Wins Retrofit

-

Deep Retrofit

The Global Energy Retrofit Systems Market Segmented by Type, Deep Retrofit held the largest market share last year and is poised to maintain its dominance throughout the forecast period. A sizeable chunk of the market was occupied by the deep retrofit category. Except for HVAC system replacements, deep retrofits need investments of over $10,000 and usually involve revamping 50–60% of energy-saving measures, including critical energy loads like air conditioning, hot water supply, lighting, and appliances. On the other hand, quick wins are a class of energy retrofit system that provides quick returns with cheap investment, with marginal capital costs of less than $10,000. These quick wins have a great deal of potential benefits, are easy to implement, and need little in the way of resources. Furthermore, since they are simple to execute and need little in the way of human resources, they encourage the natural adoption of best practices that result in large energy savings.

Global Energy Retrofit Systems Market Segmentation: By Product

-

Envelope

-

HVAC

-

LED Lighting

-

Appliances

The Global Energy Retrofit Systems Market Segmented by Product, Envelope held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Users of envelope retrofit systems have the chance to improve thermal comfort and minimise drafts by insulating and air-sealing buildings. By reducing heat loss, these upgrades not only make interior spaces cosier, but they also give residents the opportunity to lower their energy usage, carbon footprint, and power costs. HVAC retrofits optimise functioning while upgrading current systems with customised parts, offering a more affordable option than replacing entire units. Retrofitting old fixtures with LED lighting is known as LED lighting. LED lighting is becoming more and more popular in commercial and industrial settings because of its improved illumination quality, increased safety, and cheaper maintenance costs. In a similar vein, appliance retrofits provide an easy and affordable way to save energy by improving the efficiency and compatibility of older appliances.

Global Energy Retrofit Systems Market Segmentation: By Application

-

Residential

-

Commercial

-

Institutional

The Global Energy Retrofit Systems Market Segmented by Application, Residential held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Government organisations are specifically focusing on retrofitting residential buildings to improve their efficiency and convert them into affordable buildings. Energy retrofit systems are installed in existing homes, such as mobile homes, 2+ unit buildings, and single-family homes, to increase the energy efficiency of these buildings. Another significant industry that accounts for a sizable portion of energy usage is the commercial end-user. According to the MDPI Energies article, 30% of energy use is attributed to commercial buildings. This means that there are ample prospects for energy retrofit systems to lower energy use, energy prices, and greenhouse gas emissions. Energy retrofit systems are utilised in buildings related to education, healthcare, public order and safety, and worship in the institutional sector. Applications that use a lot of energy in the institutional sector include lighting, auxiliary heating, space cooling and heating, water heating, and other applications. This creates the potential for these systems.

Global Energy Retrofit Systems Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Energy Retrofit Systems Market Segmented by Region, Europe held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The Renovation Wave Strategy was introduced by the European Commission to reduce energy poverty, enhance quality of life, and lowering emissions by speeding up house improvements throughout the EU. Additionally, because inefficient structures make people more susceptible to heat waves and cold spells, the remodelling wave technique will enhance people's health and general well-being. In the following ten years, the strategy aims to triple the rates of energy renovation, which will result in even greater resource and energy efficiency. According to the Commission, 35 million structures could undergo renovations by 2030. Given that the U.S. Department of Energy (DOE) launched the Commercial Buildings Integration Programme and financing from the Solution to Improve the Energy Efficiency of Small and Medium Buildings, the North American market is expected to develop exponentially throughout the projection period. Upon completion, the project showed a yearly reduction in GHG emissions of 190 298, an average of USD 4008 in utility savings per building, and an annual energy savings of 103 166 MMBtu. China, South Korea, India, and the Asia-Pacific region all push energy-efficient products. For instance, the Indian government started the UJALA programme in 2015 to give local customers access to LED bulbs. It aimed to swap out 770 million incandescent lightbulbs for LED ones. A total of 47 million kilowatt-hours (kWh) were produced by replacing about 360 million incandescent bulbs. About 360 million incandescent light bulbs were changed, saving 30 million tonnes of CO2 emissions annually in addition to 47 million kWh of electricity. Under the programme, LEDs may be purchased by low-income homes for USD 0.154 per unit at first, with the remaining amount to be paid off in convenient instalments from their electricity bills. As a result of lower energy consumption from lighting end users, the programme has not only helped domestic consumers adopt efficient lighting equipment at reasonable prices, but it has also assisted the nation's distribution corporations in managing peak energy demand.

COVID-19 Impact Analysis on the Global Energy Retrofit Systems Market:

The abrupt COVID-19 epidemic that created a global health emergency has had a substantial impact on the landscape of energy efficiency advancement. Businesses and consumers have delayed investing in more efficient technologies due to the present economic crisis. Market behaviour has changed as a result of the crisis, adding to the unpredictability around advancements in energy efficiency. For instance, the record drop in demand for air travel could change the energy intensity of international travel and freight, depending on how the aviation sector recovers from the epidemic. Energy efficiency's socioeconomic advantages are now well acknowledged. With the announcement of billions of dollars in stimulus funding to increase energy efficiency, particularly in buildings and transport, governments are starting to rise to the challenge of 'building better' in the wake of the crisis.

Latest Trends/ Developments:

A growing emphasis on sustainability, government initiatives, and technology breakthroughs are driving key trends and developments in the worldwide energy retrofit systems market. AI algorithms and IoT integration are two technological advancements that are optimising energy efficiency and cutting costs. To attain net-zero energy use and lower carbon emissions, governments everywhere are enacting strict laws and providing incentives to encourage energy retrofitting. The demand for retrofit projects is being driven by a trend towards sustainable construction techniques and an emphasis on building resilience, while the availability of green financing options is making investment in these projects easier. Particularly active emerging markets are those where the demand for energy-efficient solutions is being driven by increased urbanisation. All things considered, these patterns point to a bright future for the energy retrofit systems industry, one that is open to expansion and innovation.

Key players:

-

DAIKIN INDUSTRIES, Ltd.

-

Ameresco

-

Eaton

-

AECOM

-

Johnson Controls

-

Orion Energy Systems, Inc.

-

Siemens

-

Trane

-

Signify Holding

-

General Electric

-

Schneider Electric

Chapter 1. Energy Retrofit Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Energy Retrofit Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Energy Retrofit Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Energy Retrofit Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Energy Retrofit Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Energy Retrofit Systems Market – By Product

6.1 Introduction/Key Findings

6.2 Envelope

6.3 HVAC

6.4 LED Lighting

6.5 Appliances

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Energy Retrofit Systems Market – By Type

7.1 Introduction/Key Findings

7.2 Quick Wins Retrofit

7.3 Deep Retrofit

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Energy Retrofit Systems Market – By Application

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Institutional

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Energy Retrofit Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Type

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Energy Retrofit Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 DAIKIN INDUSTRIES, Ltd.

10.2 Ameresco

10.3 Eaton

10.4 AECOM

10.5 Johnson Controls

10.6 Orion Energy Systems, Inc.

10.7 Siemens

10.8 Trane

10.9 Signify Holding

10.10 General Electric

10.11 Schneider Electric

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Energy Retrofit Systems market is expected to grow at a 6.3% CAGR through 2030.

The Energy Retrofit Systems market is expected to reach USD 24.36 Billion by 2030.

The Deep Retrofit sector drives the Global Energy Retrofit Systems market.

By 2023, the Global market is expected to be valued at USD 15.88 Billion.

Europe dominates the Global Energy Retrofit Systems market.