Energy and Power Automation Market Size (2023 – 2030)

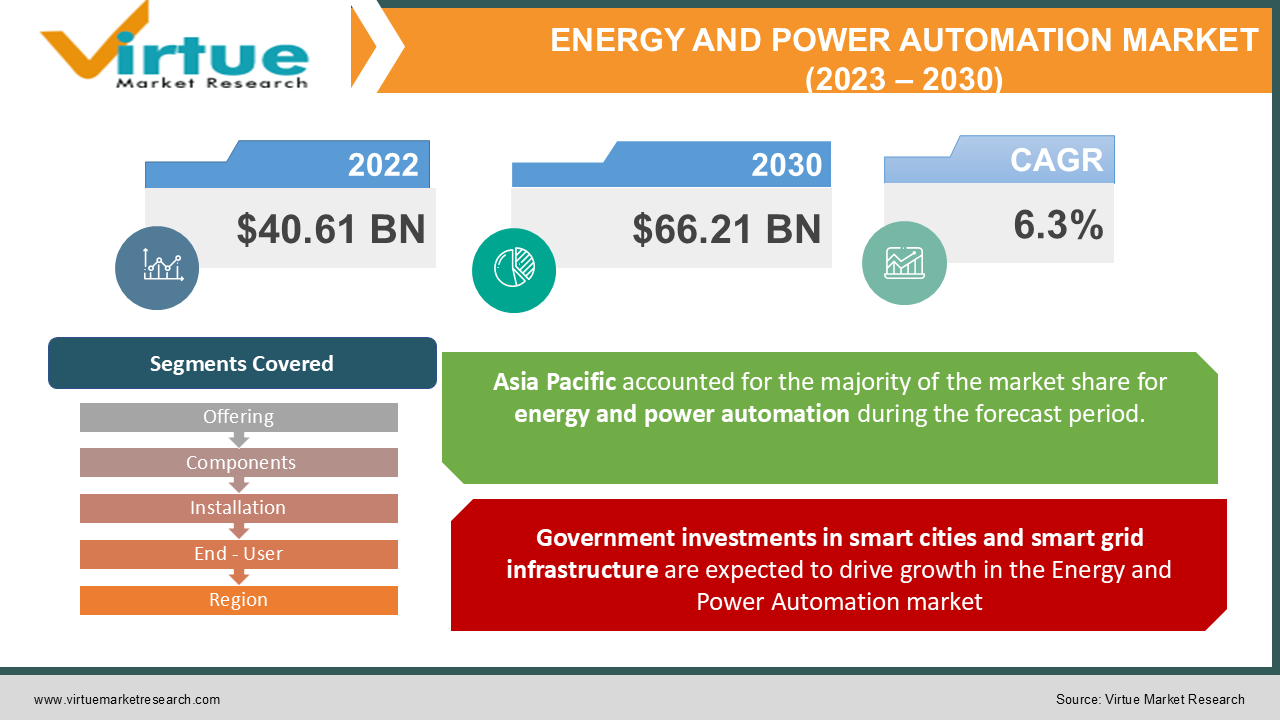

The Energy and Power Automation Market was worth USD 40.61 billion in 2022 and is set to reach USD 66.21 billion in 2030. The market is projected to grow at a CAGR of 6.3% over the forecast period of 2022 – 2030. The surge in demand for retrofitting traditional substations, soaring use of digital tools to enhance grid performance in smart cities, growing adoption of electric and hybrid vehicles, and increased focus on upgrading the IEC 61850 standard to resolve interoperability issues among intelligent electronic devices deployed in substations are all driving the growth of the Energy and Power Automation Market.

INDUSTRY OVERVIEW

The increased demand for stable and uninterrupted energy supply among users has prompted an urgent need for grid infrastructure modernization. The rapid expansion of the population has caused significant congestion and stress on the current system, resulting in an imbalanced and inefficient supply of energy to customers, with the majority of them experiencing power outages.

Energy and Power Automations systems allow power companies to remotely monitor, regulate, and safeguard the substation's transmission components, ensuring a more dependable and enhanced power supply while adhering to stricter safety rules. The technology employs real-time system data to discover major defects across the energy network, analyze and control the problems, and ultimately display the data. Energy and power automation systems have transformed how substations were previously regulated and gathered crucial data. The market has grown in response to the growing need for high productivity and grid dependability. Decreased capital investment has also contributed to the market's positive outlook. The global electric power substation automation market is being driven by a growing need for smart grid solutions. The capacity to cut transmission and distribution losses would ensure the market's long-term viability.

The rising need for efficient energy consumption increased acceptance of renewable energy, and the requirement for optimal grid infrastructure are driving the Energy and Power Automation market. Energy and Power Automations are in more demand as the need for sustainable energy delivery grows. These systems are especially important to deploy in rural places and off-grid sites since they can provide real-time notification alerts during circuit outages, allowing the power company to respond quickly. The increasing adoption of sustainable power has supplemented the development of the Energy and Power Automation market. The technology is required for effective surveillance and real-time renewable energy supply to customers. Substation automation is considered to be a crucial solution for outdated energy infrastructure since it may minimize the strain on current utilities by monitoring and managing important faults throughout the network. However, the market's expansion has been hampered to a larger extent by an absence of skilled professionals and expensive installation costs. The absence of global interoperability regulations has also hampered business expansion.

MARKET DRIVERS:

Government investments in smart cities and smart grid infrastructure are expected to drive growth in the Energy and Power Automation market

With the use of advanced technology, energy, and power automation solutions may assist in minimizing operating and maintenance costs while also aiding in increasing the plat or utility output. It also assures the electrical power network's superior efficiency, stability, and safety by executing interlocking and intelligent load shedding operations. Smart grids in a power plant can decrease energy losses during transmission and distribution, enhance reliability and productivity, and proactively and cost-effectively manage energy demand. Because of all of these advantages, smart grid development is attracting major funding across the world and which in turn is propelling the energy and power automation industry towards growth.

Massive prospects for Energy and Power automation market due to increasing investments in renewable energy projects to meet growing energy demand

Solar and wind energy are presently the most common power generation choices, with most nations generating more than 20% of their electricity from these natural sources. As per the International Energy Agency (IEA), renewable energy sources accounted for 25% of global power output in 2019 and this is projected to grow up to 86% by 2050. Companies all across the world are investing their money into renewable energy infrastructure rather than fossil fuels. Countries all around the world are attempting to develop new renewable energy plants. They're also putting money into solar and wind projects to accommodate rising electricity demand and reduce the environmental effects and thus are also adopting energy and powerful automation solutions for enhanced maintenance and monitoring purposes which are influencing the market towards positive growth.

MARKET RESTRAINTS:

The high initial installation cost of the power automation solution is hampering the market expansion

The initial capital investment in energy and power automation is high, which may limit the worldwide energy and power automation market's growth. The expanding demand to integrate numerous IEDs, as well as the increasing usage of modern technologies like microcontrollers and service-oriented architecture (SOA), has raised the cost of the automation process. Energy and power automation solution implementation also necessitates strong collaboration beyond traditional organizational boundaries, major process change, and strict governance. High expenditures on smart substation deployment might add to the government's financial burden. Utility suppliers are also concerned about high operating and maintenance expenses following the implementation of automation solutions which is limiting the market growth.

The slowdown in the power generation industry with the outbreak of COVID-19 has also hampered the market growth

The outbreak of the COVID-19 pandemic has hindered the power-generating industry's expansion in 2020. During periods of complete lockdown in some nations, electricity usage has been reduced by 20% as major industries, offices, and organizations were closed. Industries have made very few investments in substation automation in 2020 due to the decline in power consumption. Furthermore, the lockdown disruptions hampered component and device production, causing item costs to rise and, as a result, diminishing market demand. Governments throughout the globe have reduced investment in a variety of sectors to focus more on upgrading healthcare systems; as a result, demand for energy and power automation products and solutions from national grid projects is likely to decline.

ENERGY AND POWER AUTOMATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Offering, Components, By Installation, By End - User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

G&W Electric Co., Mitsubishi Electric, Hitachi, Schneider Electric, S&C Electric Company, General Electric, Cisco Systems, Siemens AG, Alstom S.A., Schweitzer Engg Lab |

This research report IoT in IoT in Mobility Market has been segmented and sub-segmented based on Offering, Components, By Installation, By End - User, and By Region.

ENERGY AND POWER AUTOMATION MARKET- BY OFFERING

-

Hardware

-

Software

-

Services

Based on Offering, the Energy and Power automation market is segmented into Hardware, Software, and Services. Among these, the hardware segment contributed the maximum to the Energy and Power automation market share. The development of the IEC 61850 standard for substations, which allows the integration of all management, assessment, and surveillance functions into a single protocol and improves compatibility between smart electronic equipment, is credited for the market's rise. The rising need to upgrade traditional substations with modern-day monitoring and control capabilities is also driving the demand for energy and power automation systems. SCADA systems are being installed in power stations across the world by government agencies and businesses. Utilities and heavy industries are rapidly implementing SCADA systems to get better control and a full picture of power stations, resulting in increased operational efficiency.

ENERGY AND POWER AUTOMATION MARKET- BY COMPONENTS

-

IEDs

-

Communication Networks

-

SCADA Systems

-

Others

Based on Components, the Energy and Power automation market is segmented into IEDs (Intelligent Electronic Devices), SCADA Systems, and Communication Networks among others. Among these, the IED, (Intelligent Electronic Device) dominated the Energy and power automation market. Microprocessor-based controllers of power system equipment are referred to as Intelligent Electronic Devices (IEDs) in the power generation sector. IEDs take data from sensors and power equipment and can automatically send orders, such as activating circuit breakers if the voltage, current, or frequency abnormalities are detected, or raising/lowering voltage levels to the optimum level. The intelligent electronic devices market was worth USD 12.5 billion in 2021 and is anticipated to reach USD 19.3 billion by 2030. The IEDs market is anticipated to witness a CAGR of 6.2% over the forecast period. The market growth can be attributed to the increase in up-gradation and modernization of the devices as they increase the efficiency of the system and reduces human interventions.

The SCADA segment is also poised to contribute significantly to the market growth. The SCADA system was valued at USD 1.7 billion in 2021 and is projected to reach USD 2.5 billion by 2030, experiencing a CAGR of 7.6% over the forecast period. The growing adoption of Industry 4.0 is a major driver propelling the power SCADA market forward.

ENERGY AND POWER AUTOMATION MARKET- BY INSTALLATION

-

New Installations

-

Retrofit Installations

Based on Installation, the Energy and Power automation market is segmented into New Installation and Retrofit Installation. Among these, the new installation category is projected to contribute maximum to the market development over the forecast period. The energy and power automation for new installations is anticipated to grow at a high CAGR. The growth is credited to the rise in new power stations and smart grid infrastructures in numerous industries that are growing swiftly. Moreover, the need for automation, IEDs, SCADA systems, and the latest and advanced communication systems is also propelling the market expansion. New installations also provide a higher level of functional safety and dependability, as well as fewer maintenance requirements. In the energy and power automation market, businesses have launched various new installation projects to increase power flow, promote electric dependability, enhance energy supply quality, and modernize electrical infrastructure.

ENERGY AND POWER AUTOMATION MARKET- BY END-USER

-

Utilities

-

Steel Industry

-

Oil & Gas Industry

-

Mining Industry

-

Transportation Industry

-

Others

Based on End-user, the Energy and Power automation market is segmented into Utilities, Steel, Oil & Gas, Mining, and Transportation industries among others. The utility category emerged as the dominant segment for the energy and power automation segment and is projected to continue with this trend over the forecast period. The market's expansion may be linked to rising government programs aimed at modernizing power systems and increasing investments in renewable energy generation. As per World International Energy Agency (IEA), total investment in renewable resources grew from USD 226 billion in 2019 to USD 259 billion by 2050. In the current situation, the demand for energy and power automation is driven by the wind energy industry. Governments across the world are partnering with power generation firms to bring automation to the wind farm sector which is propelling the market growth.

ENERGY AND POWER AUTOMATION MARKET- BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

Based on region, the Energy and Power automation market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. The Asia Pacific region was valued at USD 4.7 billion in 2021 and is projected to grow with a CAGR of over 6% during the forecast period. Various governments in APAC nations have taken numerous measures to strengthen the power and energy sector, which has fueled the expansion of the energy and power automation market. Due to increased expenditures on smart grid initiatives, the area is projected to witness significant demand for Energy and Power automation solutions. Countries like Japan, China, and Australia are driving the region's growth. Furthermore, factors such as fast industrialization and a growing shift toward clean energy to fulfill rising energy demands are likely to boost the region's market growth.

The North American region is also set to contribute significantly to the growth of the energy and power automation market. Because of new technical innovations in IoT and communication systems, the North American market is likely to increase considerably throughout the forecast period. Furthermore, the region's market expansion is likely to be aided by the existence of numerous major competitors. Owing to increased industrialization in the area, Latin America is predicted to rise due to considerable demand from Brazil and Mexico. Brazil is the region's market leader, with a significant market share, followed by Canada.

The European market is poised to grow significantly in the coming years. The expanding investments in grid development, along with the increasing complexity of the electric supply infrastructure, have resulted in tremendous growth throughout Europe. Germany, France, and the United Kingdom are major countries contributing to the market growth. The region's growth is projected to expand due to the rising need for energy efficiency in the power supply.

ENERGY AND POWER AUTOMATION MARKET- BY COMPANIES

Some of the prominent players operating in the Energy and Power automation market include:

- G&W Electric Co.

- Mitsubishi Electric

- Hitachi

- Schneider Electric

- S&C Electric Company

- General Electric

- Cisco Systems

- Siemens AG

- Alstom S.A.

- Schweitzer Engg Lab

The Energy and Power automation market is concentrated and highly competitive with key players occupying market share. The major players are focusing on innovation, mergers, and product launches to capture market share and increase their product portfolio.

NOTABLE HAPPENING IN THE ENERGY AND POWER AUTOMATION MARKET

- PRODUCT LAUNCH- In January 2021, SEL introduced a new product, SEL – 3350 automation controllers. The controller can be used for applications that require midlevel I/O and computing. The SEL – 350 can endure harsh environments in industrial control systems and utility substations.

- PRODUCT LAUNCH- in December 2020, Hitachi ABB Power grids launched a new Remote Terminal Unit 530. The new RTU aids in extending the life of existing power distribution automation solutions and also facilitates the transition to newer technologies with increased security features such as secure communication, encryption, and security logging.

- ACQUISITION- In November 2020, Schneider Electric has procured a majority stake in ETAP Automation Inc. (Dubai), the foremost software platform for electrical power systems modeling and simulation, to speed up and enhance the incorporation of renewables, microgrids, fuel cells, and battery storage technologies into the electric grid.

- PRODUCT LAUNCH- In March 2020, ABB Switzerland has unveiled the latest of its REX640 protection relay, which improves communication security and versatility in the power generating and distribution industries.

COVD-19 IMPACT ON ENERGY AND POWER AUTOMATION MARKET

The COVID-19 outbreak wreaked havoc on the energy and power automation industries, resulting in massive financial losses. Procuring raw materials and components essential for manufacturing, recruiting personnel from quarantines, and delivering finished goods to markets were all issues that automation technology suppliers and device makers encountered. Due to severe lockdown restrictions, installation and replacements were postponed, further affecting manufacturing facilities and putting the market to a standstill. Furthermore, the lockdown disruptions hampered component and device production, causing item costs to rise and, as a result, diminishing market demand. Governments throughout the globe have reduced investment in a variety of sectors to focus more on upgrading healthcare systems; as a result, demand for energy and power automation products and solutions from national grid projects is likely to decline. Moreover, as the commercial spaces in most regions of the world are functioning at a massively reduced capacity, power consumption is predicted to drop dramatically, and electric utilities may face a delay in modernizing their grid infrastructure. All of these reasons are projected to have a negative influence on the market growth.

Chapter 1. Energy and Power Automation Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Energy and Power Automation Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Energy and Power Automation Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Energy and Power Automation Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Energy and Power Automation Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Energy and Power Automation Market – By Offering

6.1. Hardware

6.2. Software

6.3. Services

Chapter 7. Energy and Power Automation Market – By Components

7.1. IEDs

7.2. Communication Networks

7.3. SCADA Systems

7.4. Others

Chapter 8. Energy and Power Automation Market – By Installation

8.1. New Installations

8.2. Retrofit Installations

Chapter 9. Energy and Power Automation Market – By End-User

9.1. Utilities

9.2. Steel Industry

9.3. Oil & Gas Industry

9.4. Mining Industry

9.5. Transportation Industry

9.6. Others

Chapter10. Energy and Power Automation Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. Energy and Power Automation Market – key players

11.1 G&W Electric Co.

11.2 Mitsubishi Electric

11.3 Hitachi

11.4 Schneider Electric

11.5 S&C Electric Company

11.6 General Electric

11.7 Cisco Systems

11.8 Siemens AG

11.9 Alstom S.A.

11.10 Schweitzer Engg Lab

Download Sample

Choose License Type

2500

4250

5250

6900