Endocrine Testing for Infertility Market Size (2023-2030)

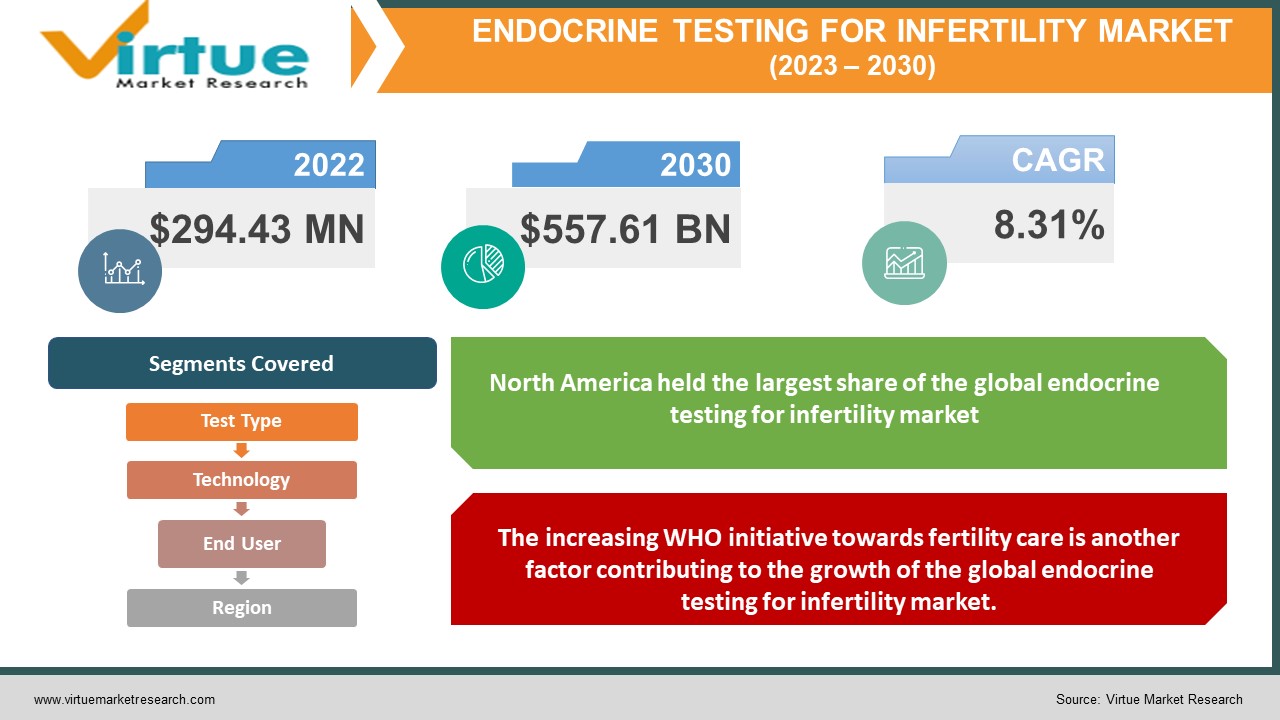

Global Endocrine Testing for Infertility Market is estimated to be worth USD 294.43 Million in 2022 and is projected to reach a value of USD 557.61 Billion by 2030, growing at a CAGR of 8.31% during the forecast period 2023-2030.

Endocrine tests are medical procedures performed by endocrinologists to assess hormone levels and detect issues with organs related to the endocrine system. They help determine hormone levels, evaluate gland function, identify underlying causes of endocrine problems, and confirm diagnoses. These tests can diagnose specialized fields and hormonal diseases involving various glands and tumors. They include urine and blood tests, imaging scans, and specialized procedures like bone density tests and thyroid scans. Endocrine tests assess hormone functioning, which affects secondary sexual characteristics, fertility, growth, metabolism, and sleep. They are conducted for reasons such as addressing symptoms of endocrine disorders or fatigue.

Before an endocrine test, preparation typically involves fasting, consuming only specified beverages, and following medication instructions. Patients are advised not to smoke and to remain physically active within the designated area during the test. The expectations of an endocrine test vary depending on the type of test being conducted. Hormone levels are assessed through urine and blood tests, while imaging tests help identify abnormalities or tumors affecting the endocrine glands. Treating endocrine disorders can be complex due to the interconnected nature of hormone levels. Regular blood work may be required to monitor progress, adjust treatment plans, or modify medications. Diabetes, adrenal insufficiency, Cushing's disease, growth hormone issues, hyperthyroidism, hypopituitarism, multiple endocrine neoplasia, polycystic ovary syndrome (PCOS), and precocious puberty can all be identified by abnormal endocrine test findings. The interpretation of abnormal results depends on the specific testing method utilized.

Global Endocrine Testing for Infertility Market Drivers:

The declining fertility rate is fueling the growth of the global endocrine testing for infertility market.

The global industry for endocrine testing for infertility is experiencing growth primarily due to a decrease in fertility rates worldwide. This decrease in infertility can be ascribed to a variety of factors, including a rising tendency of individuals to wedding at a later age, an ascent in age-related infertility, the incidence of obesity, and the existence of chronic conditions such as diabetes. As per United Nations, the worldwide fertility rate is projected to fall to 2.4 children per woman by 2030 and 2.2 children per woman by 2050. This drop in fertility rates on a global scale is anticipated to drive the demand for endocrine testing services for infertility.

The increasing WHO initiative towards fertility care is another factor contributing to the growth of the global endocrine testing for infertility market.

The acknowledgment and efforts of the World Health Organization (WHO) to improve fertility care and address infertility serve as a market driver for global endocrine testing for the infertility market. WHO's initiatives include conducting global research, developing guidelines, updating normative products, collaborating with stakeholders, and providing technical support at the country level. These initiatives aspire to boost access to high-quality family planning services, including fertility care, as well as to establish worldwide reproductive health norms and standards. The WHO's focus on policy dialogue, data collection, and resource allocation contributes to the growth of the market by creating an enabling environment, raising awareness, and strengthening health systems. Overall, WHO's efforts drive the expansion and advancement of the fertility care market worldwide.

Global Endocrine Testing for Infertility Market Challenges:

The global endocrine testing for infertility market is encountering challenges, primarily in terms of the costly development of accurate endocrine tests for infertility. Devising technologies for endocrine testing can be costly due to the intricate nature of the endocrine system and the need to measure numerous hormones and biomarkers. Creating tests that are accurate and dependable takes considerable time and involves extensive research and development efforts. Moreover, meeting regulatory standards and obtaining approval for new endocrine tests in clinical settings adds to the overall expenses. These various factors collectively contribute to the high cost associated with the development of endocrine testing technologies. Thus, these challenges inhibit the growth of the global endocrine testing for infertility market.

Global Endocrine Testing for Infertility Market Opportunities:

Market expansion strategies present a lucrative opportunity in the global endocrine testing for infertility market. Given the rising demand for endocrine testing for infertility owing to the rising infertility rates, a higher prevalence of conditions like PCOS and obesity, and increased awareness about fertility, businesses specializing in endocrine testing services for infertility can stand to gain significantly from this opportunity by expanding their services to emerging markets, including China, India, and Brazil. This development will help companies to increase their customer base and boost their overall revenue.

COVID-19 Impact on the Global Endocrine Testing for Infertility Market:

The outbreak of the COVID-19 pandemic substantially impacted the global endocrine testing for infertility market. The pandemic caused disruptions in supply chains and distribution of goods and services, which highly affected the provision of endocrine testing services. Moreover, the shifted focus of healthcare infrastructure resources and personnel to COVID-19 testing and treatment further declined the demand for endocrine testing services. These factors negatively impacted the growth of the global endocrine testing for infertility market. Despite these challenges, the global endocrine testing for infertility market is projected to recover and grow in the coming years.

Global Endocrine Testing for Infertility Market Recent Developments:

- In February 2023, Reproductive Medicine Associates (RMA) expanded its presence by opening a fertility center in Houston, Texas. Located at 888 Westheimer Road, Suite 200 in the Montrose area, the new clinic offers comprehensive and patient-centered fertility assessment and treatment services. With a focus on convenience, RMA aims to help individuals and couples achieve their family-building goals in one accessible location. Intrauterine insemination (IUI), in vitro fertilization (IVF), preimplantation genetic testing (PGT), and egg freezing are among the treatments available at the center. RMA is committed to supporting diverse family types, offering resources and options for LGBTQ+ individuals and single individuals to start their family-building journeys.

- In August 2022, Mira Fertility unveiled the Ovum Wand, a novel product catering to women aged 35 and above, to predict menopause and monitor fertility status. This innovative offering by Mira Fertility measures the levels of follicle-stimulating hormone (FSH) in urine. FSH is responsible for stimulating follicle growth and triggering ovulation.

- In August 2020, DiaSorin received CE marking for its Liaison Testosterone xt test, allowing it to be launched in European countries and other regions that accept the CE designation. The test precisely identifies reproductive abnormalities including hypogonadism in males and hyperandrogenism in females by measuring testosterone levels in both genders. This approval expands DiaSorin's existing portfolio of fertility and endocrinology tests available on the Liaison XL instrument. The Liaison Testosterone xt test provides valuable diagnostic information and assists healthcare professionals in diagnosing and monitoring reproductive system-related disorders.

ENDOCRINE TESTING FOR INFERTILITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.31% |

|

Segments Covered |

By Test Type, Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies (United States), Abbott Laboratories (United States), LabCorp (United States), Roche Holding AG (Switzerland), AB Sciex LLC (United States), Tosoh Bioscience, Inc. (United States)), Diazyme Laboratories, Inc. (United States), MilliporeSigma (United States), Endogenetic Life Sciences Private Limited (India), Quest Diagnostics Incorporated (United States) |

Global Endocrine Testing for Infertility Market Segmentation:

Global Endocrine Testing for Infertility Market Segmentation: By Test Type

- Estradiol Test

- Human Chorionic Gonadotropin (hCG) Hormone Test

- Luteinizing Hormone (LH) Test

- Progesterone Test

- Prolactin Test

- Testosterone Test

- Thyroid Stimulating Hormone (TSH) Test

- Others

In 2022, the human chorionic gonadotropin (hCG) test segment held the highest market share. The growth can be attributed to the widespread availability of user-friendly self-test pregnancy kits and the need for quantitative measurement of hCG in hospitals and laboratories. Additionally, the use of hCG level determination for detecting abnormalities during different stages of pregnancy, coupled with the increasing number of women of reproductive age, has further fueled the revenue generation in this segment. The utilization of hCG in infertility therapy for both men and women is also projected to propel the growth of the infertility endocrine testing market.

Global Endocrine Testing for Infertility Market Segmentation: By Technology

- Chromatography

- Immunoassay

- Mass Spectroscopy

- Others

In 2022, the immunoassay segment held the highest market share. The growth can be attributed to the availability of a variety of instruments and analyzers that utilize different immunoassay technologies for detection purposes. Additionally, many key players in the market offer a panel of immunoassay-based tests for assessing endocrine and reproductive function, which further contributes to the segment's high revenue generation.

Global Endocrine Testing for Infertility Market Segmentation: By End User

- Clinical Laboratories

- Diagnostic Centers

- Hospitals

- Others

In 2022, the clinical laboratories segment held the highest market share. The growth can be attributed to the availability of specialized and effective diagnostic procedures, as well as growing awareness of endocrine disorders. The expansion of clinical laboratory chains with advanced infrastructure and a diverse range of testing services for various diseases is anticipated to fuel further revenue growth in this segment. Moreover, the use of advanced screening methods in clinical laboratories enhances patient preference for these services.

Global Endocrine Testing for Infertility Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The region of North America held the largest share of the global endocrine testing for infertility market in the year 2022. The rising incidence of infertility cases, the presence of well-established healthcare infrastructure in nations, such as the United States and Canada, and the increasing government funding initiatives aimed at improving healthcare settings are some of the factors propelling the region's growth. Additionally, North America is home to several significant market players, including Agilent Technologies, Abbott Laboratories, LabCorp, AB Sciex LLC, Tosoh Bioscience, Inc., and Diazyme Laboratories, Inc.

Due to the rising development of the medical and diagnostics industry in nations, such as China and India, improvements in healthcare systems, and an increase in personal healthcare expenditure, the region of Asia-Pacific is anticipated to expand at the fastest rate over the forecast period.

Global Endocrine Testing for Infertility Market Key Players:

- Agilent Technologies (United States)

- Abbott Laboratories (United States)

- LabCorp (United States)

- Roche Holding AG (Switzerland)

- AB Sciex LLC (United States)

- Tosoh Bioscience, Inc. (United States))

- Diazyme Laboratories, Inc. (United States)

- MilliporeSigma (United States)

- Endogenetic Life Sciences Private Limited (India)

- Quest Diagnostics Incorporated (United States)

Chapter 1. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-110 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET – By Product & Service

6.1 Reagents & Kits

6.2. Instruments

6.3. Data Management Software

6.4. Service

Chapter 7. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET– By Technology

7.1. Clinical Microbiology

7.2. DNA Microassay

7.3. Immunoassay

7.4. Isothermal Nucleic Acid Amplification Technology (INAAT)

7.5. Polymerize Chain Reaction (PCR)

7.6. Others

Chapter 8. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET - By Application

8.1. Academic & Research Institutions

8.2. Diagnostic Centers

8.3. Hospitals & Clinical Laboratories

8.4. Others

Chapter 9. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET – By Region

9.1. North America

9.2. Europe

9.3.The Asia Pacific

9.4.Latin America

9.5. Middle-East and Africa

Chapter 10. INFECTIOUS DISEASE RAPID DIAGNOSTIC TESTING FOR HPV MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. QIAGEN (Germany)

10.2. Abbott Laboratories (United States)

10.3. Becton, Dickinson, and Company (United States)

10.4. Fast Track Diagnostics (Luxembourg)

10.5. Thermo Fisher Scientific Inc. (United States)

10.6. Bio-Rad Laboratories, Inc. (United States)

10.7. Cepheid Inc. (United States)

10.8. Roche Holding AG (Switzerland)

10.9. Hologic, Inc. (United States)

10.10. GenMark Diagnostics, Inc. (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Endocrine Testing for Infertility Market is estimated to be worth USD 294.43 Million in 2022 and is projected to reach a value of USD 557.61 Billion by 2030, growing at a CAGR of 8.31% during the forecast period 2023-2030.

The Global Endocrine Testing for Infertility Market Drivers is the declining fertility rate and the increasing WHO initiative towards fertility care.

Based on the Test Type, the Global Endocrine Testing for Infertility Market is segmented into Estradiol Test, Human Chorionic Gonadotropin (hCG) Hormone Test, Luteinizing Hormone (LH) Test, Progesterone Test, Prolactin Test, Testosterone Test, Thyroid Stimulating Hormone (TSH) Test, and Others.

The United States is the most dominating country in the region of North America for the Global Endocrine Testing for Infertility Market.

Agilent Technologies, Abbott Laboratories, and LabCorp are the leading players in the Global Endocrine Testing for Infertility Market.