Emergency Lightning Testing, Inspection and Certification Testing Services Market Size (2024-2030)

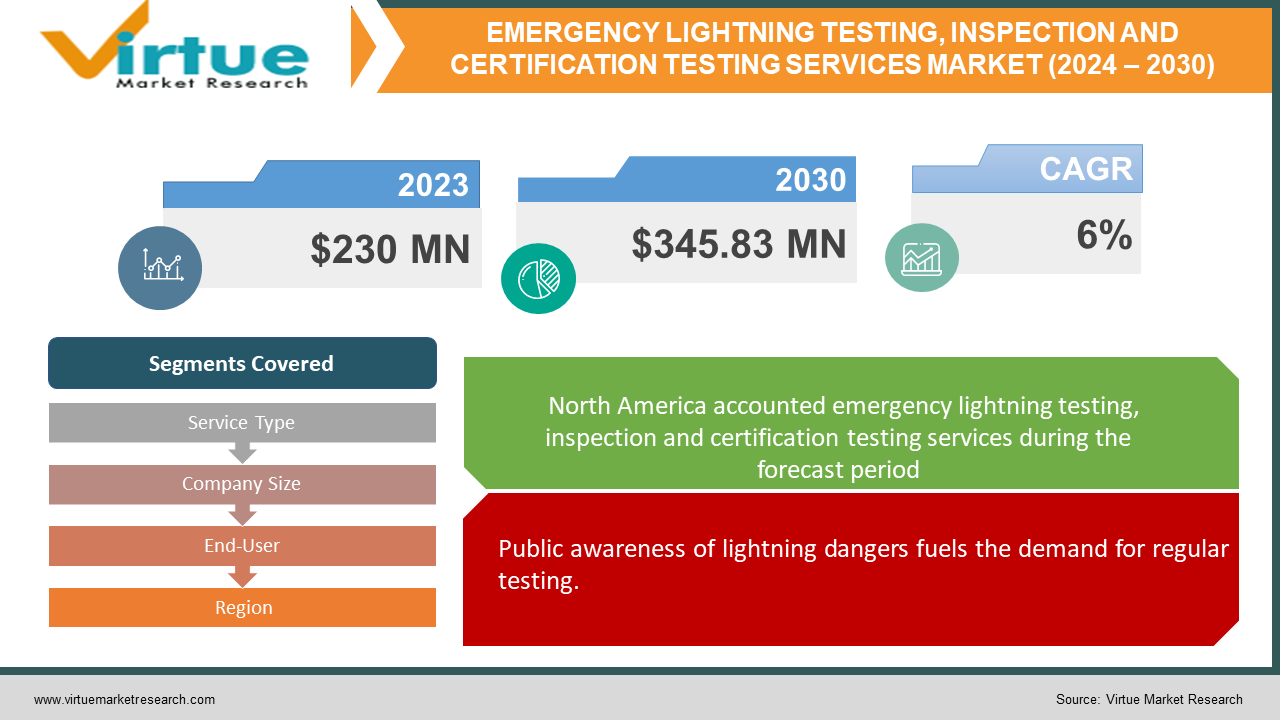

The Emergency Lightning Testing, Inspection, and Certification Testing Services Market was valued at USD 230 million in 2023 and is projected to reach a market size of USD 345.83 million by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6%.

The Emergency Lightning Testing, Inspection, and Certification market plays a crucial role in safeguarding buildings and their occupants from the dangers of lightning strikes. This industry ensures that lightning protection systems function properly by offering a range of services. Technicians conduct tests to evaluate the conductivity and continuity of the system's components. Visual inspections identify any signs of damage or deterioration. Finally, certifications are issued to confirm that the system meets the required safety standards.

Key Market Insights:

The Emergency Lightning Testing, Inspection, and Certification market safeguards buildings from the dangers of lightning strikes. Traditionally, this industry reacted to lightning incidents with repairs. However, a crucial shift is happening. The focus is now on proactive maintenance through regular testing and inspections. This ensures lightning protection systems are always functional, minimizing the risk of damage from strikes. Additionally, technology is playing a part. Drones offer faster and more efficient inspections, especially for areas that are difficult to reach with traditional methods.

This market faces a challenge in the lack of standardized global regulations for lightning protection systems. This inconsistency creates hurdles for companies operating internationally. To address this and improve overall safety, efforts towards standardization are needed. Another key trend is the rise of third-party service providers. Building owners are increasingly outsourcing lightning protection system maintenance to specialists. This allows them to leverage the expertise and resources of these companies.

The Emergency Lightning Testing, Inspection, and Certification market is poised for growth by adapting to these trends. As green building practices gain traction, there's a growing need for testing and certification of eco-friendly lightning protection systems. By embracing these changes, this market can ensure continued growth while playing a vital role in safeguarding structures from lightning strikes.

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Drivers:

Public awareness of lightning dangers fuels the demand for regular testing.

Public awareness of the dangers posed by lightning strikes is on the rise. This increased focus on safety translates to a greater demand for regular testing and maintenance of lightning protection systems. Building owners and occupants are becoming more proactive in safeguarding their structures and themselves from potential lightning damage.

Stricter building codes mandate proper lightning protection system maintenance.

Governments around the world are implementing stricter building codes and safety standards that mandate the proper installation and maintenance of lightning protection systems. This regulatory push creates a legal requirement for regular testing and certification, driving market growth.

The green building movement creates opportunities for sustainable system testing.

The growing popularity of green building practices emphasizes the integration of sustainable lightning protection systems. These eco-friendly systems often require specialized testing and certification procedures, creating opportunities for service providers in this market.

Increased electronics use necessitates robust lightning protection and testing.

The proliferation of electronic equipment in buildings has significantly increased the potential damage caused by lightning strikes. Since this equipment is highly susceptible to power surges and electrical disruptions, there's a growing need for robust lightning protection systems and the regular testing and certification that ensures their functionality.

The rise of third-party service providers streamlines maintenance for building owners.

Building owners and managers are increasingly outsourcing the maintenance of their lightning protection systems to specialized service providers. This trend benefits from the expertise and resources these companies offer, ensuring proper testing, inspection, and certification. As building complexity grows, this outsourcing trend is likely to continue.

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Restraints and Challenges:

The Emergency Lightning Testing, Inspection, and Certification market isn't without its hurdles. Despite growing public awareness of lightning dangers, some building owners might still underestimate the importance of regular maintenance. This limited understanding can translate to a reluctance to invest in these services. Additionally, the cost of testing, inspection, and certification can be a barrier, especially for smaller buildings. Finding cost-effective solutions or tiered service packages could be crucial for wider market adoption.

Furthermore, the lack of standardized global regulations for lightning protection systems can create complications. Companies operating internationally might face inconsistencies in regulations across different regions. This necessitates efforts toward standardization to streamline the market and improve overall safety. Another challenge lies in the potential shortage of skilled professionals. Proper maintenance requires qualified technicians and a lack of manpower in this field could limit the market's ability to meet growing demand.

Finally, the market itself is fragmented. Numerous service providers offer varying levels of expertise and experience. This can make it difficult for building owners to identify the most qualified company for their needs. As the market matures, efforts to improve transparency and establish clear benchmarks for service quality could be beneficial for both service providers and building owners.

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Opportunities:

The Emergency Lightning Testing, Inspection, and Certification market isn't just about overcoming challenges, it's brimming with opportunities. Technology advancements like drone inspections offer faster, more affordable ways to conduct visual examinations, particularly in hard-to-reach areas. Data analysis can further optimize maintenance schedules and proactively identify potential problems. The burgeoning green building movement presents a lucrative opportunity for service providers to specialize in testing and certifying eco-friendly lightning protection systems. Beyond core services, companies can expand their offerings to include lightning risk assessments, design consultations, and educational workshops, fostering client relationships and raising awareness. New customer segments like data centers, telecom companies, and renewable energy facilities – with their critical equipment vulnerable to lightning damage – offer fertile ground for market growth. As international regulations for lightning protection systems evolve, companies can explore opportunities in emerging markets. Collaboration is key; partnerships between service providers, building material manufacturers, and insurance companies can lead to standardized testing protocols, bundled service packages, and incentive programs that encourage building owners to prioritize lightning protection. By embracing these opportunities, the Emergency Lightning Testing, Inspection, and Certification market can solidify its role as a guardian of safety while experiencing significant growth in the years to come.

EMERGENCY LIGHTNING TESTING, INSPECTION AND CERTIFICATION TESTING SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Service Type, Company Size, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SGS, Bureau Veritas, TÜV SÜD, TÜV Rheinland, Intertek Group, Eurofins Scientific, Applus+ Group, DNV GL, DEKRA |

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Segmentation: By Service Type

-

Testing

-

Inspection

-

Certification

The dominant segment by service type in the Emergency Lightning Testing, Inspection, and Certification market is likely Inspection. Regular inspections to identify damage or deterioration are crucial for maintaining system functionality. Testing, while essential, might be conducted less frequently. The fastest-growing segment is expected to be Testing. Rising awareness of lightning safety and the need for proactive maintenance could lead to more frequent testing to ensure optimal system performance.

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Segmentation: By Company Size

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

The Emergency Lightning Testing, Inspection, and Certification market is segmented by company size, with two key players: Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large Enterprises, with their vast resources and expertise, solidify their market leadership, currently dominating the segment. However, SMEs are the fastest-growing segment. Their ability to offer specialized services or cater to niche markets makes them strong contenders in this growing market.

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Segmentation: By End-User

-

Residential Buildings

-

Commercial Buildings

-

Industrial Facilities

-

Government Buildings

-

Data Centres & Telecom Facilities

The most dominant segment in the Emergency Lightning Testing, Inspection, and Certification market by the End-User sector is likely Commercial Buildings. This is due to the widespread presence of commercial buildings across the globe and the emphasis on safety regulations in these structures. However, the fastest-growing segment is anticipated to be Asia Pacific. This region's rapid infrastructure development is creating a surge in demand for lightning protection systems and their subsequent testing and certification.

Emergency Lightning Testing, Inspection, and Certification Testing Services Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: This region boasts a mature market with well-established regulations and a high level of public awareness regarding lightning safety. This translates to a strong demand for testing and certification services. Here, large, well-resourced companies dominate the market landscape.

Europe: Europe presents a similar picture to North America. It's a mature market characterized by stringent safety standards for lightning protection systems. Large enterprises with extensive experience and resources hold a strong presence, ensuring a high level of service quality.

Asia Pacific: This region is the current growth champion. Rapid infrastructure development across the continent is creating a surge in demand for lightning protection systems, and consequently, their testing and certification. This booming market attracts both established players from other regions and new entrants looking to capitalize on the opportunity.

Latin America: Latin America is an emerging market with exciting potential. As the focus on lightning safety and infrastructure development intensifies, the demand for testing and certification services is on the rise. This presents a significant opportunity for companies willing to cater to these evolving needs and adapt their services to the specific requirements of the region.

Middle East and Africa: The Middle East and Africa hold promise for future growth. These regions are experiencing increasing investments in infrastructure development, which necessitates robust lightning protection systems. Additionally, stricter regulations regarding lightning safety are being implemented, further fueling the demand for testing and certification services. Early movers willing to enter these markets and establish a presence can capitalize on this emerging demand.

COVID-19 Impact Analysis on the Emergency Lightning Testing, Inspection, and Certification Testing Services Market:

The COVID-19 pandemic undeniably impacted the Emergency Lightning Testing, Inspection, and Certification market. Lockdowns and social distancing measures disrupted construction, leading to delays or postponements in new building projects. This meant a decrease in demand for new lightning protection systems, and consequently, a dip in testing and certification needs. Supply chain disruptions further complicated matters by limiting the availability of equipment needed for installations and maintenance. Additionally, during the initial stages, some building owners might have prioritized essential maintenance over routine lightning protection checkups.

However, there were some silver linings. The pandemic's emphasis on hygiene and safety could lead to a long-term benefit for this market. Heightened awareness of the importance of proper lightning protection system maintenance could result in a future rise in demand for testing and certification services. Furthermore, the pandemic accelerated the adoption of remote inspection technologies like drones. This allowed service providers to continue some operations during lockdowns by offering virtual inspections, minimizing the need for physical visits.

Overall, the impact of COVID-19 on this market was likely a mixed bag. While project delays and supply chain disruptions caused a temporary setback, the long-term outlook appears positive. An increased focus on safety and the potential for wider adoption of remote inspection technologies could contribute to market recovery and growth in the coming years.

Latest Trends/ Developments:

The Emergency Lightning Testing, Inspection, and Certification market is embracing innovation to enhance service efficiency and safety. Drone technology is taking flight, offering faster, more affordable inspections, particularly for hard-to-reach areas. This can revolutionize inspections, improving technician safety and reducing time spent on-site. Sustainability is another key trend, with a growing demand for testing and certification of eco-friendly lightning protection systems. Service providers who specialize in this area can gain a strategic advantage. Data analytics is also playing a role, with advancements paving the way for predictive maintenance. By analyzing historical data, targeted inspections can identify potential problems before they escalate, minimizing downtime and repair costs. Standardization efforts are underway to address the challenge of inconsistent global regulations. Companies that participate in or adapt to these efforts can position themselves as industry leaders. Finally, the rise of smart lightning protection systems with real-time monitoring capabilities is a trend to watch. Service providers who can offer testing, inspection, and maintenance services for these advanced systems can gain a competitive edge. By embracing these latest trends and developments, companies in this market can ensure they're offering the most advanced and efficient services, not only contributing to market growth but also playing a vital role in keeping structures safe from lightning strikes.

Key Players:

-

SGS

-

Bureau Veritas

-

TÜV SÜD

-

TÜV Rheinland

-

Intertek Group

-

Eurofins Scientific

-

Applus+ Group

-

DNV GL

-

DEKRA

Chapter 1. Emergency Lightning Testing, Inspection and Certification Testing Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Emergency Lightning Testing, Inspection and Certification Testing Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Emergency Lightning Testing, Inspection and Certification Testing Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Emergency Lightning Testing, Inspection and Certification Testing Services Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Emergency Lightning Testing, Inspection and Certification Testing Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Emergency Lightning Testing, Inspection and Certification Testing Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Testing

6.3 Inspection

6.4 Certification

6.5 Y-O-Y Growth trend Analysis By Service Type

6.6 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Emergency Lightning Testing, Inspection and Certification Testing Services Market – By Company Size

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 Small and Medium-sized Enterprises (SMEs)

7.4 Y-O-Y Growth trend Analysis By Company Size

7.5 Absolute $ Opportunity Analysis By Company Size, 2024-2030

Chapter 8. Emergency Lightning Testing, Inspection and Certification Testing Services Market – By End-User

8.1 Introduction/Key Findings

8.2 Residential Buildings

8.3 Commercial Buildings

8.4 Industrial Facilities

8.5 Government Buildings

8.6 Data Centres & Telecom Facilities

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Emergency Lightning Testing, Inspection and Certification Testing Services Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Service Type

9.1.3 By Company Size

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Service Type

9.2.3 By Company Size

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Service Type

9.3.3 By Company Size

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Service Type

9.4.3 By Company Size

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Service Type

9.5.3 By Company Size

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Emergency Lightning Testing, Inspection and Certification Testing Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 SGS

10.2 Bureau Veritas

10.3 TÜV SÜD

10.4 TÜV Rheinland

10.5 Intertek Group

10.6 Eurofins Scientific

10.7 Applus+ Group

10.8 DNV GL

10.9 DEKRA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Emergency Lightning Testing, Inspection, and Certification Testing Services Market was valued at USD 230 million in 2023 and is projected to reach a market size of USD 345.83 million by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6%.

Heightened Awareness of Lightning Safety, Stringent Building Codes and Safety Regulations, Green Building Movement and Sustainable Systems, Increased Use of Vulnerable Electronic Equipment, and Rise of Third-Party Service Providers.

Residential Buildings, Commercial Buildings, Industrial Facilities, Government Buildings, Data Centers & Telecom Facilities.

The most dominant region for the Emergency Lightning Testing, Inspection, and Certification market is likely North America, due to established infrastructure, strong regulations, and high awareness of lightning safety.

SGS, Bureau Veritas, TÜV SÜD, TÜV Rheinland, Intertek Group, Eurofins Scientific, Applus+ Group, DNV GL, DEKRA.