Emergency Lighting Market Size (2025 – 2030)

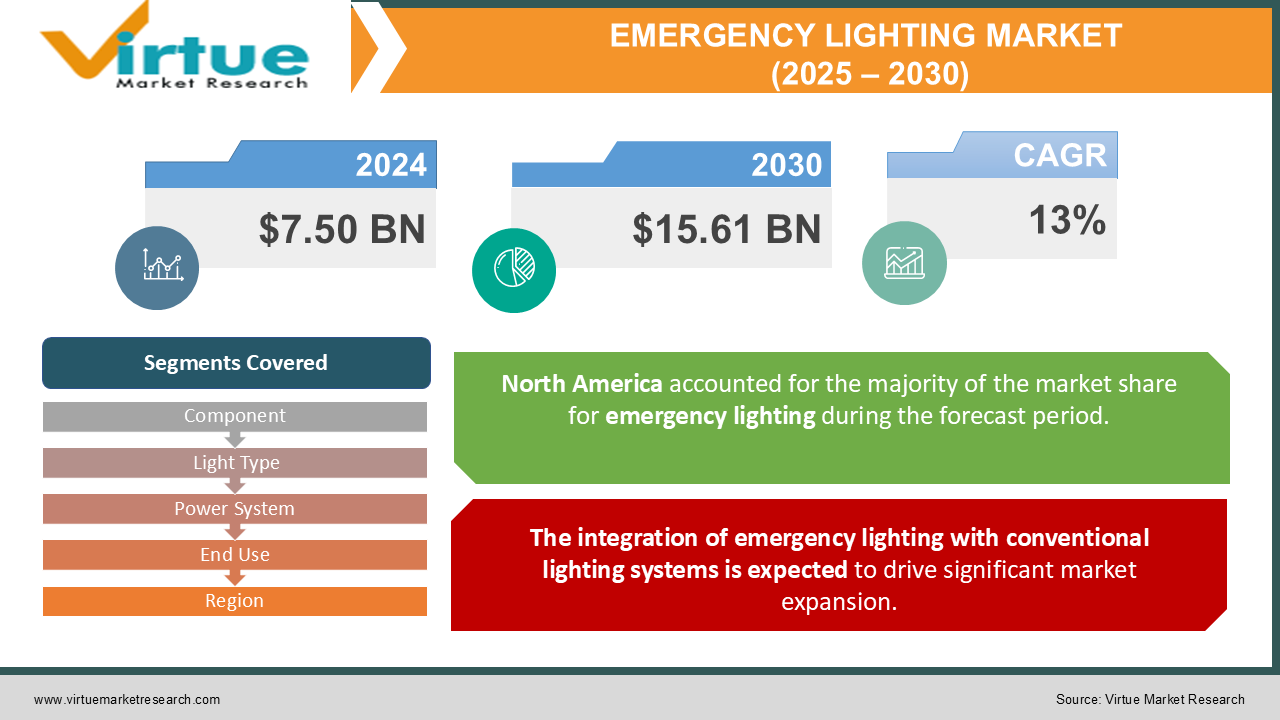

The Emergency Lighting Market was valued at USD 7.50 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 15.61 billion by 2030, growing at a CAGR of 13%.

Emergency lighting systems are designed to enhance personal safety and facilitate the safe evacuation of occupants in the event of an emergency. As global environments become increasingly urbanized and complex, the risk of safety hazards grows. High-density, high-risk, or intricate environments, such as railway stations, shopping malls, airports, and government buildings, require enhanced safety measures. In these settings, emergency lighting serves as a critical component for ensuring safety during emergencies. It is essential in enabling a safe, swift, and effective evacuation of individuals from buildings and spaces. Moreover, a well-designed emergency lighting system provides guidance to people navigating both enclosed and open spaces and helps them identify emergency safety equipment.

Emergency lighting systems are instrumental in ensuring that individuals can exit buildings quickly and safely during emergencies. They clearly mark exit routes, reducing the risk of obstacles, accidents, or panic. These systems also ensure that safety equipment such as fire alarms, extinguishers, and first-aid kits are easily visible, which plays a significant role in preventing accidents in hazardous environments. Collectively, these factors contribute to the growth of the emergency lighting market.

Key Market Insights:

The increasing adoption of improved safety standards and the integration of smart technologies are key drivers of market growth. As global safety regulations become more stringent, there is a growing demand for advanced emergency lighting systems that meet these higher standards. These systems are crucial for ensuring enhanced safety and reliability during power outages and emergencies.

Emergency Lighting Market Drivers:

The integration of emergency lighting with conventional lighting systems is expected to drive significant market expansion.

Emergency lighting plays a critical role in both personal and professional settings, serving as an essential lighting solution across a wide range of applications. As technological advancements continue, emergency lighting systems are increasingly being integrated with standard lighting setups to ensure seamless operation in emergency situations. Emergency lighting functions as a backup power source that activates automatically when the primary lighting circuit fails. Properly incorporating this into regular lighting designs offers benefits for both consumers and manufacturers alike.

As the economy stabilizes and businesses reopen, ensuring that battery backups and emergency lighting systems are functioning properly becomes crucial for safeguarding employees and customers during potential emergencies. Additionally, manufacturers are exploring ways to integrate regular lighting with emergency lighting solutions to reduce the costs associated with additional, standalone emergency fixtures.

For example, in April 2023, Hochiki Europe, a leading manufacturer of life safety solutions, introduced its highly anticipated new emergency lighting system, "Firescape Nepto," at the fire safety event, showcasing the latest innovation in this field.

Emergency Lighting Market Restraints and Challenges:

The establishment of new manufacturing hubs presents significant challenges that are currently restraining market growth.

Manufacturers and investors encounter significant challenges in various countries, primarily due to stringent government policies, including environmental regulations. In addition, during the initial stages of designing an emergency lighting system, it is essential to gather accurate information about the premises, either from drawings or a site survey. Inaccurate or incomplete data collection can lead to suboptimal emergency lighting designs, which can compromise safety and effectiveness. These challenges are particularly inhibiting market growth in developing countries.

Furthermore, the increasing variety of emergency lighting products being introduced across different applications is prompting governments to establish more comprehensive guidelines for companies operating within their borders. The time required to establish new manufacturing facilities, combined with regulatory complexities, is expected to slow the market's growth in the coming years.

Emergency Lighting Market Opportunities:

The development of new technologies presents significant growth opportunities for the emergency lighting market.

Technological advancements are driving the development of more sophisticated emergency lighting solutions. LED technology, in particular, offers several advantages, including enhanced energy efficiency, a longer lifespan, and improved brightness compared to traditional lighting sources.

IoT-enabled sensors and devices provide real-time monitoring of the status and performance of emergency lighting systems, allowing for proactive maintenance and better resource management. Moreover, the integration of emergency lighting with broader building automation systems creates additional opportunities for system integrators and solution providers, further driving growth in the market.

EMERGENCY LIGHTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13% |

|

Segments Covered |

By Component, Light Type, Power System, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ACUITY BRANDS, INC., Emerson Electric Co., Eaton, Honeywell International Inc. , General Electric, Legrand , Hubbell, Schneider Electric , Signify Holding, Panasonic Corporation |

Emergency Lighting Market Segmentation: By Component

-

Hardware

-

Software

-

Service

The hardware segment currently holds the largest share of the market, driven by increasing awareness of safety and emergency preparedness across commercial, industrial, and residential sectors. This growing awareness is significantly contributing to the demand for emergency lighting systems. Moreover, regulatory requirements and strict building codes are mandating the installation of emergency lighting systems, further boosting the demand for hardware components such as LED lighting fixtures, control systems, and backup batteries.

On the other hand, the software segment is projected to experience the fastest growth in terms of compound annual growth rate (CAGR) during the forecast period. This growth is primarily driven by the rising adoption of smart technologies and the growing demand for energy-efficient solutions. The software segment includes systems designed to manage, monitor, and control emergency lighting, ensuring optimal performance during power outages or emergencies. Technological advancements in the Internet of Things (IoT) have enabled real-time monitoring and control of lighting systems through connected devices, further accelerating the growth of the software segment.

For example, in February 2023, ABB, a Switzerland-based technology company, launched the NaveoPro Wireless solution, which allows users to manage entire emergency lighting systems via a user-friendly mobile app. This fully automated system provides real-time status updates for all monitored buildings, displayed on a digital floorplan, thereby enhancing safety and improving maintenance planning.

Emergency Lighting Market Segmentation: By Light Type

-

Fluorescent

-

LED

-

Incandescent

The fluorescent segment currently holds the largest market share, driven by ongoing urbanization and infrastructure development across various regions. As cities grow and new commercial complexes, residential buildings, and industrial facilities are constructed, the demand for reliable emergency lighting systems rises. Fluorescent lights, renowned for their energy efficiency and long lifespan, are commonly chosen for these installations, thereby bolstering the market for fluorescent emergency lighting.

The LED segment, however, is expected to experience the fastest growth in terms of compound annual growth rate (CAGR) during the forecast period. LEDs consume significantly less power than traditional incandescent and fluorescent bulbs, which has contributed to their widespread adoption across both residential and commercial sectors. Additionally, advancements in LED technology have led to enhanced brightness, longer lifespan, and reduced costs, making them a more cost-effective and attractive option for a larger customer base.

Emergency Lighting Market Segmentation: By Power System

-

Self-Contained Power System

-

Hybrid Power System

-

Central Power System

The self-contained power system segment currently dominates the market, driven by innovations in battery technology and advancements in LED lighting. The development of long-lasting, energy-efficient lithium-ion batteries has significantly improved the reliability and performance of these systems. Additionally, improvements in LED lighting technology have enhanced the overall efficiency and lifespan of emergency lighting solutions, making self-contained systems increasingly valuable to end-users seeking reliable and cost-effective emergency lighting options. Meanwhile, the hybrid power system segment is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period. The rising frequency of power outages, along with the growing need for reliable emergency lighting in both residential and commercial buildings, has fueled demand for hybrid power systems. These systems combine traditional power sources with renewable energy options, such as solar and wind, offering greater reliability and sustainability. By ensuring that emergency lighting remains operational even during power failures, hybrid power systems are becoming an increasingly attractive solution for modern infrastructure.

Emergency Lighting Market Segmentation: By End Use

-

Residential

-

Industrial

-

Commercial

-

Others

The commercial segment currently holds the largest market share, driven by the increasing emphasis on workplace safety and compliance with fire safety regulations. Additionally, technological innovations, such as the development of energy-efficient LED lights and smart lighting solutions, are enhancing the performance and appeal of emergency lighting products. The growing adoption of green building practices and energy-efficient solutions further contributes to market growth, as businesses seek to lower operational costs and minimize their environmental impact.

The industrial segment, on the other hand, is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period. As new industrial facilities are established, the need for comprehensive safety measures, including emergency lighting, becomes increasingly crucial. There is a growing awareness among industrial operators about the importance of workplace safety, which is prompting greater investments in emergency lighting systems to ensure safe evacuation routes for employees during emergencies.

Emergency Lighting Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The North American market currently holds the largest share of the emergency lighting market and is expected to continue growing at a significant rate. This growth is attributed to the presence of several large companies in the region, as well as a number of unregistered market participants. As a result, North America is poised to maintain its dominance in the emergency lighting market in the coming years.

In the Asia Pacific region, China holds the largest market share, driven by the presence of numerous large suppliers and the country's evolution as a major exporter of emergency lighting products to other nations. China's growing population further contributes to the increasing demand for emergency lighting solutions, bolstering the regional market's growth.

In the Middle East and Africa, countries like Saudi Arabia, the United Arab Emirates, and Qatar are making substantial investments in infrastructure development. These governments' favorable policies, including tax rebates and incentives, are enabling companies to offer emergency lighting products at competitive prices, thus stimulating market growth in the region.

In Latin America, while the adoption of new technologies has been slower compared to other regions, the market is expected to grow significantly in the coming years. The relatively small number of lighting manufacturers in the region presents both challenges and opportunities, with market growth being influenced by the region's capacity to integrate advanced lighting solutions and the increasing demand for safety and energy-efficient products.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly affected the construction industry, much like many other sectors. During the pandemic, funding for public projects was reduced, and delays in ongoing construction projects occurred due to economic uncertainty and supply chain disruptions. However, the construction industry is expected to recover in the post-pandemic period, which is likely to positively impact the emergency lighting market as well.

As a result of the pandemic, there has been a heightened awareness of the importance of emergency lighting systems, which is expected to drive demand in the coming years. A notable emerging trend is the growing demand for nickel-metal hydride (NiMH) batteries, which are increasingly being used in pathway emergency lights and exit signs due to their reliability and efficiency. Additionally, there is a rising need for software solutions that allow for effective monitoring and control of emergency lighting systems, enhancing their functionality and performance in critical situations. This shift towards advanced, energy-efficient technologies is further supporting the growth of the emergency lighting market.

Latest Trends/ Developments:

In July 2024, Signify Holding launched a new over-the-counter lighting brand, Ecolink, which offers a competitively priced range of LED luminaires. Designed in the UK, Ecolink caters specifically to the needs of electrical professionals by providing high-quality, energy-efficient lighting solutions. This brand capitalizes on Signify's innovation and expertise in lighting, offering reliable products to meet market demand for cost-effective yet high-performance lighting options.

In October 2023, Emerson introduced the Appleton HEX LED Series, a comprehensive range of emergency lighting solutions that includes exit signs, exit sign/emergency light combinations, and lamps-only emergency systems. These systems feature a 90-minute battery backup, ensuring compliance with OSHA, NFPA, and NEC regulations. Specifically designed for use in demanding industrial environments such as oil refineries, LNG plants, chemical processing areas, and water treatment facilities, the robust Appleton HEX LED Series provides critical illumination during evacuations, helping employees safely navigate and exit hazardous situations.

Key Players:

These are top 10 players in the Emergency Lighting Market :-

-

ACUITY BRANDS, INC.

-

Emerson Electric Co.

-

Eaton

-

Honeywell International Inc.

-

General Electric

-

Legrand

-

Hubbell

-

Schneider Electric

-

Signify Holding

-

Panasonic Corporation

Chapter 1. Emergency Lighting Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Emergency Lighting Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Emergency Lighting Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Emergency Lighting Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Emergency Lighting Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Emergency Lighting Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Service

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Emergency Lighting Market – By Light Type

7.1 Introduction/Key Findings

7.2 Fluorescent

7.3 LED

7.4 Incandescent

7.5 Y-O-Y Growth trend Analysis By Light Type

7.6 Absolute $ Opportunity Analysis By Light Type, 2024-2030

Chapter 8. Emergency Lighting Market – By Power System

8.1 Introduction/Key Findings

8.2 Self-Contained Power System

8.3 Hybrid Power System

8.4 Central Power System

8.5 Y-O-Y Growth trend Analysis By Power System

8.6 Absolute $ Opportunity Analysis By Power System, 2024-2030

Chapter 9. Emergency Lighting Market – By End Use

9.1 Introduction/Key Findings

9.2 Residential

9.3 Industrial

9.4 Commercial

9.5 Others

9.6 Y-O-Y Growth trend Analysis By End Use

9.7 Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 10. Emergency Lighting Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Light Type

10.1.3 By Power System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Light Type

10.2.4 By Power System

10.2.5 By By End Use

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Light Type

10.3.4 By Power System

10.3.5 By By End Use

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Light Type

10.4.4 By Power System

10.4.5 By By End Use

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Light Type

10.5.4 By Power System

10.5.5 By By End Use

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Emergency Lighting Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 ACUITY BRANDS, INC.

11.2 Emerson Electric Co.

11.3 Eaton

11.4 Honeywell International Inc.

11.5 General Electric

11.6 Legrand

11.7 Hubbell

11.8 Schneider Electric

11.9 Signify Holding

11.10 Panasonic Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing adoption of improved safety standards and the integration of smart technologies are key drivers of market growth.

The top players operating in the Emergency Lighting Market are - ACUITY BRANDS, INC., Emerson Electric Co., Eaton, Honeywell International Inc., General Electric and Legrand.

The COVID-19 pandemic significantly affected the construction industry, much like many other sectors.

The integration of emergency lighting with broader building automation systems creates opportunities for system integrators and solution providers, further driving growth in the market.

Latin America is the fastest-growing region in the Emergency Lighting Market.